Navy Federal Credit Union App Reviews

Navy Federal Credit Union App Description & Overview

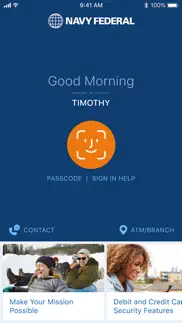

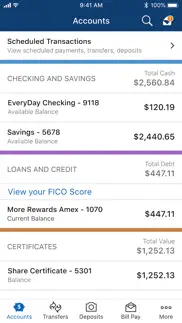

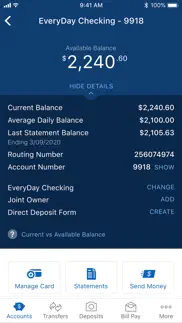

What is navy federal credit union app? Bank easy with the Navy Federal mobile app! With a great look and feel, we’ve made the mobile app easier to find information on your accounts and transactions. Breeze through payments, transfers, and check deposits with just a few taps. Quickly sign-in using Touch ID®, Face ID®. Apply for new accounts, become a member, or find your closest ATM or branch.

Features:

• Safe and Secure. Access your accounts 24 hours a day.

• View balances without signing in using our widget.

• Pay people using Zelle® or member to member transfers.

• Move money between your accounts.

• Deposit checks without visiting a branch or ATM.

• View scheduled transactions, including pending deposits, upcoming transfers, and bill payments.

• Make payments to Navy Federal consumer loans, mortgages and credit cards, or to other companies via Bill Pay.

• Apply for new credit cards, auto loans or personal loans, or become a Navy Federal member.

• View and manage statements.

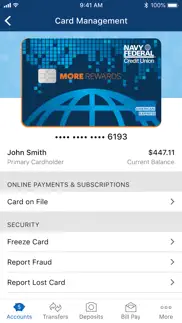

• Manage your credit or debit cards, including activating cards, signing up for purchase notifications, or freezing misplaced cards.

• Security tips and management of your username and password.

• Find the nearest branch or ATM.

• View rates and info on our loans and savings products, or estimate a payment with a calculator.

• Read timely articles to help educate and plan your financial life.

To sign in to mobile banking, use your Navy Federal username and password. If you are not a member, apply now using the app or call us at 1-888-842-6328 or 1-703-255-8837.

As always, if you have any issues with our app, you can call us at 1-888-842-6328 or 1-703-255-8837, or reach us via Twitter at @NavyFederalHelp.

Federally insured by NCUA.

iPhone®, iPod Touch® and iPad® are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Message and data rates may apply.

Continued use of GPS running in the background can dramatically decrease battery life.

Please wait! Navy Federal Credit Union app comments loading...

Navy Federal Credit Union 6.22.1 Tips, Tricks, Cheats and Rules

What do you think of the Navy Federal Credit Union app? Can you share your complaints, experiences, or thoughts about the application with Navy Federal Credit Union and other users?

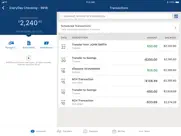

Navy Federal Credit Union 6.22.1 Apps Screenshots & Images

Navy Federal Credit Union iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 6.22.1 |

| Play Store | org.navyfederal.nfcuforiphone |

| Compatibility | iOS 13.0 or later |

Navy Federal Credit Union (Versiyon 6.22.1) Install & Download

The application Navy Federal Credit Union was published in the category Finance on 07 May 2010, Friday and was developed by Navy Federal Credit Union [Developer ID: 370652021]. This program file size is 105.37 MB. This app has been rated by 700,027 users and has a rating of 4.9 out of 5. Navy Federal Credit Union - Finance app posted on 29 January 2024, Monday current version is 6.22.1 and works well on iOS 13.0 and higher versions. Google Play ID: org.navyfederal.nfcuforiphone. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

| Navy Federal GO Prepaid Reviews | 1.6 | 135 | Free |

We addressed an issue impacting date selection when scheduling a transfer, resolved an issue impacting some members ability to Add Member to Member Accounts within Transfers, and made an update to ensure our products were always displaying the most up-to-date rates.

| App Name | Released |

| Discover Mobile | 17 November 2009 |

| Crypto.com Buy BTC, ETH | 31 August 2017 |

| Venmo | 02 April 2010 |

| Splitwise | 24 August 2011 |

| SoFi - Banking and Investing | 10 April 2017 |

Find on this site the customer service details of Navy Federal Credit Union. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| IVelopes | 13 January 2010 |

| Simple Budget- Track spendings | 30 May 2012 |

| Adding Machine 10Key Universal | 26 November 2012 |

| IXpenseIt Pro | 12 February 2019 |

| BA Finance Plus | 06 August 2010 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Snapchat | 13 July 2011 |

| CapCut - Video Editor | 14 April 2020 |

| Google Maps | 12 December 2012 |

| SHEIN - Shopping Online | 19 May 2014 |

| Telegram Messenger | 14 August 2013 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| AutoSleep Track Sleep on Watch | 19 December 2016 |

| Papers, Please | 12 December 2014 |

| Potion Permit | 06 February 2024 |

| True Skate | 18 October 2012 |

| MONOPOLY | 04 December 2019 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Navy Federal Credit Union Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Missing Pending Checks & incorrect pay dates. Two points of feedback. 1, I usually love the NFCU app. However, so often there are missing pending checks and ACH transactions that clear either at random times during the day or during a processing period in the middle of the night. These checks do not show up in the app until they fully clear. Solution: please include checks and other electronic pending transactions shown as grouped and show how this relates to the “available balance.” Often it is not calculated in the available balance, which causes headaches when budgeting. Maybe also show another number that subtracts these amounts and call it “effective available balance.” 2, the pay dates for early and active duty pay were shown as January 12 and 13 for most of the time this month leading up to these dates. Then at the last minute they changed to the 13th and 14th. It made budgeting a bit difficult when that extra day occurred, not getting paid until a day later. Solution: somehow verify the dates are correct for the rest of the year and on an ongoing basis, please.

Love the Bank, Hate the App. I’ve been a customer of NFCU for around 3 decades. Great credit union. Very happy. Wouldn’t leave them for anything. But this app has issues. The auto-capture for Mobile Deposit hasn’t worked in almost a year. No matter how steady I hold my iPhone, no matter if I’m too close or too far, it simply will NOT capture. And then 1 out of 10 times it’ll give an error like “Sign the back of your check” when I clearly SIGNED IT! I usually just retake the photo and it often works then, without changing anything! In comparison, my mom uses US Bank and their app works beautifully. Auto-captures the check before you even stop moving the camera. And never an issue or errors. It just works. Next is reliability. Again, 1 out of 10 times, the app just doesn’t want to work right. “Technical Difficulty” messages, “Try Again”, or sometimes it will just fail to load an account. And yes, app is up to date. Lastly, I travel A LOT. And even though I enter my travel plans into the app, my NFCU Visa fails to get approved on my trip about 1/4 to 1/2 of the time. I appreciate the caution and safety NFCU is trying to exercise, but I already SAID I’d be in XYZ country. Why is my card getting declined almost half the time? My Fidelity Visa ALWAYS work while traveling and I don’t even inform them I’m leaving home. Hire some new IT guys and fix the app. See who US Bank uses.

Hello Developers. NFCU is an outstanding financial institution, but this app is aggressively bad. It cannot remember or process login credentials even after many months of this problem being known and pointed out. This seems like a very basic function to have down. How does this even get messed up and approved for release in the first place? Is there no function test? Work-around for fellow users: Touch ID, etc., is useless because the app won’t remember you. If you close the app and immediately reopen and try to use Touch ID it will tell you that you haven’t signed in for a long time and that your password is needed. Literally 1 second after you just closed the app. It will also reject your password as being wrong. Your password is not wrong; you need to navigate the menu and select the option to sign in as a different user. From there, and only there, you can log in with your credentials. Pardon the pointedness, but this is a stupid problem to have. And to have gone on for so long. Nobody cares about the color scheme. Listen to the first-hand user experience and fix the actual problems.

I need to go back to keeping a paper register. We can argue that I SHOULD have always kept a paper register detailing all my transactions and running balances, but the fact of the matter is I didn’t need to. With the previous layout, I had all my transactions detailed out with a running balance all in one spot. It looked just like the paper register I use to keep. Now I have to look at the transaction detail on the right hand side then look to the top left for a my current balance. If you asked me what my balance was at the end of last mo th, I’d need to do the math. I do not see where removing this detail presents a value add for members. The App also has a lot of unused space on the left hand side below where it shows my current balance. Out side of that, and a few buttons, the remainder of the page shows no information. In my opinion, the programmers have this a feel, similar to a credit card app. But the fact is, this is a banking app, and with the layout changes you made to the part of the app I use most, it’s now a terrible banking app!

Could be improved. I came here from PNC upon referral from my sister. With the PNC application, you can use the calendar to add in preauthorized payments you made outside of bill pay (like if you went to a credit card app and made a payment to them, it’s posted to your credit card and you can add the authorization amount and who paid to into the calendar), checks you wrote, etc so you can see a real-time balance and not have to mess with a checkbook at all. It was very beneficial in that I could see all my accounts, what the balances were after the deductions scheduled to come out. If there is a way to do this on Navy Federal app that I’m not seeing, would appreciate if someone could advise. If that isn’t an option, perhaps someone could look into making it an option? I’ve tried different apps to link my accounts and haven’t been successful in linking them all and showing correct balances. Updating and such have been a pain. I’d just like to be able to add things on my app.

Scheduled payments disappears. I had set up recurring payments for my credit card. A few days before the April payment is due, I go into my account on the app, and there’s no scheduled payments showing. I didn’t receive any notification that anything was canceled. So I scheduled payments on a month-by-month basis. Today, when I went into the app to see if my payment for April was processed, the scheduled payment I made a few days before for my April payment was gone and no payment applied. So I called customer service, At this time, I had the app open to a scheduled payment screen for May, and I didn’t even touch the screen when a pop-up box appeared asking if I wanted to cancel the transfer. If I wanted to cancel the transfer, I would have pressed the big orange button- NOT some tiny pop-up box with tiny print. There is something definitely wrong with the app. I will wait to see if my scheduled payment for May disappears also. Terrible app when you set up payments, and they disappear. And a tiny pop-up appears asking if you want to cancel when the screen isn’t even touched. Makes me distrust NFCU if the app is this problematic. A very bad user experience.

Good app but. I know I’m not the first person to PCS to Guam. I’ve had to call customer service 5 times for issues with what they keep telling me is localized to the app; I tend to believe them because their fix was for me to delete the app and reinstall it. The issue comes into play when I’m “asked” to update my security questions; “asked” is in quotations because you don’t have a choice but to update them or get kicked off. So I go thru the process of selecting and answering 5 questions and then hit save... only to be followed up with “update” your contact number so we can call you if there’s an issue with your account. I input my Guam number, since that’s where I’m stationed now, only to be ticked off haven spent all that time selecting questions relevant to me and that I’ll actually remember, then the information DOES NOT SAVE BECAUSE THE SYSTEM REFUSES TO RECOGNIZE MY ONLY CONTACT NUMBER. It will not allow you to continue leaving you with the only available option; cancel. Then you get kicked out with your work with the security questions deleted.

Won’t log in with correct info on first try. Have had this app for a long time. For about the last month or two I fail to log in on my first attempt every time. I have gone out of my way to make sure my information is correct and it will not work the first time but will always work the second time. This make me uncomfortable using the app because it makes me suspect malware and I fear my accounts being at risk. Since I have had this problem ongoing for a while now and have had no issues with my account I have concluded that this is not an error but instead an attempt by the app to get me to change my password. If that is true I feel it is a dishonest practice. I am quite sure, however, that if this is purposeful, the apps creator will not admit it.

Frustrating to use and inaccurate information. Updating this after reading other reviews. The balance IS NOT ACCURATE!!! After nearly two decades as an NFCU member, and believing in the accuracy of my balance and posted transactions, I got hit with two overdraft fees when an amount that allegedly “posted” to my account had not. This is the first time this had ever happened to me, due to paying off a fairly large bill that was listed as paid before I paid other bills. I saw when reading the one-star reviews of the new update that this has happened to others. You CANNOT TRUST THE INFORMATION CONTAINED IN THE APP, including balance. In addition, the app has lost functionality. It’s now very frustrating. Tried to add a biller and it tells me it can’t find the biller and suggests I enter it manually. But it no longer has the option to enter the biller manually if it can’t find the biller. So Catch-22. Tried to enter the bill as a person instead and when I had to enter the phone number I mis-typed the first digit. The system would not let me backspace over the mis-typed first digit. Had to completely cancel everything and re-enter all the information before I could save the biller. Plus since it would only allow me to manually enter the biller as a person instead of a company, there is no field for account number.

Behind the times. The mechanics behind the app is truly outdated. I don’t feel as though I have to keep checking this app and my balance to see if a charge actually posted or when it posted. I’ve been overdrawn twice already because they can’t post charges when they actually happen. And I’m saying to myself, “I know this charge is going to appear out of nowhere” and it did, and it overdrew me. And it wasn’t a charge where one price is shown and then it updates to a final price, the charge simply wasn’t there for 2-3 days and I’m going into the app to check periodically.. it’s 2022 I shouldn’t have to worry about things like this. This makes people move on to fintechs because they think about things like that. Truly frustrating that this app can’t update me on my spending, no form of notification from having a negative account, no text alerts, nothing. If I make a payment with this card on Tuesday, why doesn’t my balance change until Friday?? Confusing.

Running balance is not accurate!. I love being able to bank with an app on my phone, but one feature in this app is driving me crazy! When you pay your bills through bill pay the running balance is not accurate. Up until the day of the bill payment you can see the amount of your bill payments in Bill Pay. But once you get to the day of payment, the list of what bills are being paid disappears completely until then payment clears the bank at midnight! It is NOT in Bill Pay or as a pending transaction in your account! If you pay multiple bills all on the same day and can’t remember exactly how must they totalled you could very easily overdraw your account! This needs to be fixed. Immediately either keep the pending payments in Bill Pay for an extra day, or show them as pending in the account the same way you would with a debit card payment. This should not be a difficult thing to do and the only reason I can think of for NFCU not doing this is so that they can collect overdraft fees. Note: I have NOT overdrawn my account. I just see the potential for it to happen to many people and I want it to be fixed. Pronto.

One step from a 5 star. This is an honest review. I currently belong to two credit unions - The one I grew up using and then most recently Navy Federal. We will just say a couple things non app related but are essential to say. Navy federal’s customer service far surpasses all my and my wife’s expectations. That goes for app support as well. There have been times where we have needed help and just being able to call in and talk to an actual human being goes a long long way. This app is loaded with resources that help you in the app as well as redirect you to their website for more information. But the amount of things you can do in this app is incredible. The UI is intuitive and is fairly easy to maneuver around in. My only complaint (and its really not a big deal because you can do it from the website but it should be a feature in the app in a future update) is the ability to transfer a $ amount directly towards principle when it comes to the mortgage. On the website this is an option which obviously is helpful - I think that the user experience could greatly benefit from having this ability. Thanks Navy Fed, keep up the great work!

Wish I joined a long time ago. My brother has been telling me for years to bank with NFCU but for some reason I was hesitant. The “no local branch” thing scared me. I finally gave in after another hellish experience with a major branch bank. And man oh man was this the biggest case of I told you so. My banking experience has been nothing short of a breeze. The customer service is fast the people are polite, they answer all of my questions and don’t make me feel like an idiot. There’s no unnecessary fees they refund ATM fees, so don’t worry about not having a branch near you. Mobile deposit is painless. Seriously I have no negative comments that’s far been with them about eight months. Open to cards with them low interest, no nonsense. Don’t be like me!! Join if you can!!

Have always been a fan until this!. Since I joined NFCU, I’ve never felt at home with so much welcoming features for its customers, including its customers’ Sevices. That was the dream until the nightmare fell. I woke up one day and saw out of nowhere my Zelle services restricted for security reasons as they claimed. I called the given number on the error message (about 4 to 10 times) to question the decision and resolve the issue but all that without success. After hours of conversation and phone calls, been bounced around between departments, NFCU simply told me they can’t do anything about it. So here I am been punished without me knowing for a crime I didn’t commit, guilty till proven innocent without a chance of proving innocence. Till this day I cannot use Zelle services with NFCU. That same issue happened to my mom and sister as well. My brother’s even weird as he cannot Zelle me money to my phone number which is associated with my other bank. That slap on the face leaves me extremely disappointed and heartbroken. I would not recommend NFCU to my peers. I’m exploring completely switch to USAA or other great credit unions.

One Of The Best Banking Apps & Banks In The US. My name is Sage Pitre better known as YouTuber, Boxer, Motivational Speaker, & Public Figure: Lit Wichi. I love this app & Navy Federal so much , they make banking as easy & accessible as possible. Everything you need is literally a few clicks away, the also makes sure you are doing well & finding everything fine , or need any further help. The only thing I want that’ll make Navy Federal & their app better is quicker deposit when turning in funds, or accepting funds. This would make the app better because I won’t have to worry about stressing if I’ll have all the money to pay my bills, finical needs, & wants in the time that they need it. Other than that I love Navy Federal & all the different offers they have , and the process for signing up is quick, easy, & very understandable. If you want a great bank & banking app download the Navy Federal app & bank with Navy Federal! , Sincerely Sage Pitre aka Lit Wichi

Mobile Deposit. First let me say I have never written a review in my life. Love everything about the app, but because I’m 2 hours away from my nearest Navy Federal Branch, I have to resort to mobile deposits. Every. Single. Time. I try to deposit any amount of check I am constantly hindered and bombarded with the error of “the numbers at the bottom are blurry”. Every single time I try it as instructed. Every time I try at every single angle, background, lighting, and any other type of condition you can think of in order to deposit. These deposits generally take anywhere between 15 mins to 2 hours or the next day or two because I give up on trying to deposit via this feature. Please all I ask is that this is looked into, this is the most irritant most hassle I have ever gone through to make a deposit each time. (And every single photo is as clear as day, the most legible HD photo you can get, a photo that can be read and understood microscopically by the human eye, but apparently not a digital program/computer)

Inaccurate readings on accounts. I too have been banking with Navy Federal for years. There are no branches near where I live, so the app is my go to! This year I have had to really keep my eye on the app. Twice this year I had return check fees for payments not going through. The app has been taking dayS to update withdrawals from bill payments. Everything else seems to be instant, expect bill payments which is most important to me! I’ve been building a new business, and my first large payment while building my business credit was returned. Not only does that hurt my score, but I was also charged a fee! Sometimes things move a little fast. I should be able to trust what my account says and not have to calculate the true balance before making transactions. In the past when transactions would be delayed it would post as pending until cleared. I’m not a fan of what is happening now. Years ago this was a huge issue with Hunnington Bank and a class action lawsuit was issued. I hope this doesn’t get that far!

Pretty annoying!. This dumb app keeps telling to enter my password because “it has been a while since you logged in.” Or something like that. Two days is a while, really? I get that message way too often and it’s getting annoying. Combined with the fact that when you try to put gas at a gas station and pay using your card as a debit card, they automatically put a hold on your card for 150 bucks (I was told a couple of times over the phone). I’ve had many banks in my lifetime, and no other bank has done that. With my other two credit unions if you have 15, 10, 5, or whatever other amount you have in your account, the pump stops when you reach that amount. With Navy Federal I have to go inside and pay if I have less than 150. I was told to pay selecting credit card, but I always get declined. And in some gas stations, such as Arco, if you pay with debit you get charge the same price as cash, but if you pay with credit they charge you ten cents more per gallon. But seriously, about 10 years ago it was estimated that above 78% of the people in this country live from paycheck to paycheck. I imagine that now the number is higher. These are some of the reasons that I really don’t use Navy Federal anymore but rather use other credit unions.

Sign-in STILL BROKEN!!!. Yet another update (v6.9.1) and STILL the sign-in process is broken. After deleting the app then reinstalling it I can sign in. But if i sign out or close the app out and try signing back in again it says my password doesn’t match records. If I try turning on passcode or face/Touch ID when I signed on the first time, that also fails and says “password has changed and you must log on with passcode again”. The password did not change though and I STILL get that my CORRECT password doesn’t match when I try to log in again!!! The only way to log into this app is to delete it and reinstall it EVERY TIME I WANT TO USE IT!!! This issue has been a problem for MONTHS now across MULTIPLE VERSIONS and they still have NOT FIXED IT!!! And I’m not the only one either! Just look through these reviews, the majority of the bad one are because of this issue. It’s like the developers just don’t care and only want to work on new features instead of big that keep their users from even USING the app!!!

Suggestion. Love the app, it serves its purpose, not too excited about the recent updates, I thought it was just fine before but I do have a suggestion, i'm always wondering how much money I’ve spent in a certain period of time but to do that I have to pull up a calculator and bounce back and forth between the app and the calculator and it’s inconvenient, I would like to see an in app calculator where I could possibly click on certain expenses on my statement and it would add them together in real time based on whether they are a negative or a positive transaction and then maybe an algorithm that breaks those expenses down into a daily, weekly, or monthly average, it would give me view on how much money I am spending on certain things in certain time periods, I think it would greatly help myself and others budget finances and get an outlook on spending habits... hope this gets through to someone i’m pretty sure I made this suggestion a few years back as well Update: Navy federal has responded by email to my suggestion above and stated they’ve shared this with their technical team, I’ll probably keep my rating at 4 stars until they add this feature but it would be pretty awesome if they did

Best banking mobile application. The Navy Federal mobile app is the absolute best and incomparable. I can honestly say I boast about the features and functionality of the application. It’s extremely easy to use, the home page shows all your funds, you can apply for credit cards on the spot and transfer money easily. When I ask non navy federal users about transferring money, they cant do it using their mobile banking app or it cost money to wire funds to other banks. I love this app and customer to the full extent. I can make 1 suggestion, I have a prepaid Navy Federal Go card to provide money to my siblings, and that site is a blast from the past. I would like to see that incorporated into the navy federal mobile app. Thank you navy federal for providing excellent service.

By far the best mobile financial app!. I have several financial accounts at various institutions and can say hands down that the NFCU mobile app is far superior to all others. Very intuitive UI and supports most banking functions so you never have to resort to signing in with a web browser. Supports biometric authentication making signing in a breeze. The only knock I have is that they should simplify the process for placing a travel notifications on multiple cards (e.g. credit & debit) at once. At one point the UI supported this but was modified to require setting the notification of each card independently. This is cumbersome because you have to re-enter the same travel dates and destinations for each card separately which is time consuming and in most cases each card will be traveling to same destination on same schedule as the card holder so allowing users to select multiple cards for the same trip would be nice. That said, I still really love this app and wish other financial institutions had as comprehensive and polished a mobile app as NFCU.

I wish there were better features. I love NFCU but I wish the app had better features that would make banking via the app more user-friendly. For example, in the ‘view biller’ section, it would be great if the most recent scheduled pending payment was displayed. Sometimes I have to go back and forth from the view billers section to scheduled payments section to recall if I had already scheduled a payment for a biller. Another feature that would really enhance the banking experience would be to allow for the customer to make withdrawal or deposit reminders in the account transactions section. There are times when I have automatic recurring ACH withdrawals that I forget about or if I wrote a check, or am expecting a ACH deposit even, it would be great if I could enter a reminder or self schedule a withdrawal or deposit that serves as a reminder of some sort, that I can then delete once the transaction clears my account. I’ve used other banking apps that even allows you to set recurring reminders so that you can recall the payee/payer, amount, and anticipated date.

Great company infuriating decisions.. I was trying to deal with an urgent financial situation and the app forced me to fill out several detailed security questions to “protect me” some of which I wasn’t 100% sure on my answer and wouldn’t be sure I would type the exact same thing next time it asked. Worse yet I was not in a position to write down or type up these answers for later review. In the event I need them I will likely have trouble. While I got through the situation it was a huge inconvenience at the moment and it made me so much more mad when I tried to sign in online via the web browser on my phone and it forced through the same process there too! Thanks for trying to make me safe but don’t ever withhold someone’s ability to move their funds without performing functions that easily could have waited until next time they signed in. Huge hit to your credibility on this one. How long until I am locked out of my account again until I perform some other tasks you want for “my protection?” I’ve already got two factor authentication turned on and facial recognition enabled. Why the hell is it so urgent to know what my mothers maiden name is. It could have waited Navy. It could have waited.

Good CU, horrible app.. NFCU is good, but not great. Customer service and efficiency are the strengths of this bank. Want a card ? Get it right away. Something seems wrong ? Almost always someone nice and competent on the line without having to wait for very long. However, the app is a huge weakness. It is not ergonomic, frankly ugly, a little buggy. All in all: it’s far from being kept simple and there is *a lot* room for improvement. Also, as a software engineer, I can tell that the backend has serious issues as well. Balance takes days to get updated, but it’s just a value written in a database, updating it takes milliseconds. This means that it’s more of an architecture/design issue rather than a technical issue. You guys are working around problems instead of just fixing them. Efficient solution have to be disruptive and wether you like it or not, you will have to let your process evolve with your tech to offer a quality service to your clients. According to glassdoor you guys pay your engineers 50k. Well, don’t expect great solutions for such a low pay. NFCU will keep offering poor tech to it’s customers if it does not spend the money required by great people for great work. You guys need to hire a visionnary CTO to allow technological transition to happen in your CU. If you don’t, you will stay behind, and maybe die because a whole generation born with smartphones in their hands will prefer online banking rather than dealing with you guys.

Reversed fraudulent transactions. I don’t know what i would have done without everyone from navy fed that helped me during this time. On 8/21 a fraudulent charge was made on my PayPal account. Paypal REFUSED to give me a refund even after multiple inquiries. So i had to contact navy federal. Every person i talked to was doing everything they could to help me. When i called they couldn’t see the transaction because it had not posted from paypal to my account. So they asked if i wanted to create a new checking account (because my paypal was connected to my checking) and they said it would possibly stop the transaction from posting and you wont have to worry about someone having access to that information. I did so. They transferred everything from one account to the other. During all this, they were kind to ease my worries. They reassured me that if it did process that they would get my money back. Unfortunately, i had a pending paycheck coming in on my old checking account and right when it posted to my account... PayPal processed the transaction. Literally within seconds of each other. This happened at 10pm last night 8/24. I immediately called nfcu and they sent me an unauthorized transaction form. I filled it out and sent it right back a few minutes later. This morning i had checked my account and my funds were BACK in my account! If it wasn’t for everyone that helped me at nfcu i would’ve lost my money. I learned a good lesson and I will NEVER use PayPal again.

Mobile Deposits Don’t Work. This app is fantastic for checking balances, making transfers, finding ATMs, and finding contact information. Unfortunately, the most useful feature, mobile deposit, is nearly useless on the most recent version of the app. Nearly every time I try to make a deposit, I get an error saying that I forgot to sign the back of the check even though my signature and the “for Mobile Deposit only at NFCU” endorsement are clearly visible on the check. I’ve tried everything… different backgrounds, lighting, check orientation, I even rigged a stand for my phone so that I could ensure the phone was perfectly still while taking the picture. It often takes 20-30 tries to get the app to accept a check. Customer service just advises going to a branch or depositing the check via ATM or mail. This had been an issue 5+ years ago but was eventually resolved; unfortunately the newest releases of the app have this issue again. I would happily give the app 5 stars if NFCU could make mobile deposits work properly!

Great credit union, mediocre mobile app. I'm overseas and love the local base branch office. But the mobile app can be frustrating! Right now, I'm trying to get on...and like it often does on our Sundays...the app is undergoing maintenance. And a few other things, when bills are paid with the online banking feature, why can't it just show the amount already reduced in the charges under the checking account? Instead I have to look at the recent charge history, and then in a day or two...wham, here comes the charges applied! Like other banking apps, it would be nice to show how the charges are being processed but still reflected in what your current running balance is. And 3rd, when I get a zero dollar balance bill, why can't I just make the bill go away by selecting "zero balance, already paid"? It's found on the website, full version, but not on the mobile app. Why? Anyway, just wanted to give some constructive feedback. Thanks.

Speechless - Navy Fed is THAT GOOD!. I have been in the banking and finance field for 20+ yrs., worked for small/regional/large financial institutions, and hands down Navy Fed. is not even in the realm of other institutions, they should be your credit union if you truly believe in service, great products, and hands down, the best service I have received (even with some of the banks I worked for as an employee). I was visiting family in AZ, found something I wanted, made an application for a loan (very easy) online, and almost fell to the floor when 5mins later the funds were in my account! Thinking to myself, “let’s see what you have for a solid credit card”, well like the first, DONE! And even handled my balance transfer. This isn’t something you’ll ever see, or what I have seen in my long career in Banking! You want the best CU - Go NAVY FED! Stunned and overwhelmed with how great EVERYONE from service to loans, to just a call! Bravo! CRS

Failing. NFCU has some stand up workers until you deal with their online messages. They lack the knowledge to address issues with payment processing or forms. They used to be very quick at processing payments but over the past 6 months or so my credit card payments, account balance, and available balance do not match for days after being processed. Making a payment that was pending should show as such in your available balance and account balance. It makes no sense for one to update immediately but not the other. I.e. my account with show I have a credit because I paid my amount in advance. Then, I purchase a $250 item. It would show I owed $250 on the available balance and in turn be reported to a credit company if on reporting day even though the account has the $800 credit that should've been taken down to $550 rather than showing I owed $250. They are denying that anything has changed but this never used to be an issue.

Great app but........ This app is awesome and allows you to control and do almost any and everything related to your account. You can even freeze and unfreeze your debit card if you lose it and find it later or until you have it replaced. I only have two complaints: 1) Sometimes the app and website show different info. Although my balance is the same, the scheduled transactions that show on my computer through the website aren’t showing up in the app on my phone. 2) In-process and pending transactions should show in the scheduled transactions list on the account page so you’ll know to deduct them from your available balance. Today I noticed my in-process transaction wasn’t showing up in the scheduled transaction list. This could be a major issue because if you forget about it and if you don’t check the bill paying tab you could think you have more than what’s available to spend.

Great app with even better service. I use both Bank of America and NFCU, and NFCU’s mobile app and overall customer support combined with integration with the app is completely seamless and eons ahead of BoA. The NFCU app has an extremely user friendly interface, and I love that it has direct links to customer service chat and call. Overall its security and banking-tech integration is fantastic. There was an example of a time I forgot my PIN to my card and after speaking with a representative she informed me that I was actually able to reset my PIN directly through the app. In comparison for BoA I can only reset my PIN by going in person to the bank during their working hours, which obviously poises a challenge for customers with 9-5 workdays. I am so impressed with the apps’ highly secure, detailed and user friendly interface. Even today when I went to make multiple payments to my credit card, it prompted me with a screen checking if I knew I was making multiple payments. I really appreciate developers’ high attention to detail and clear care to make NFCU customers’ experience using the app as positive, secure, accurate and responsive as possible. Thanks NFCU! Amazing service as always.

This App was great but now Zelle doesn’t work. I normally really like this app, five stars if it went back to working like it’s supposed to. For months now, the Zelle portion of this app has been glitching when I try to send money to certain numbers. If I try to add contacts, whether it’s from my phone or from memory, it somehow locks up that contact and nothing happens when I try to tap on it to send that person money. I had to text them and ask them to send a request. So ridiculous. A review from 4yrs ago had this same complaint about the Zelle app itself. For the past few weeks, I haven't been able to access Zelle at all. It just goes to a blank page and does nothing when I try to access it. I’ve tried going around it every way I can and even the Zelle app sends me back to this glitchy mess. As a volunteer treasurer for a few organizations, this is not a good look and I will no longer list Zelle as a payment option. Well send our business elsewhere....unless it’s fixed and given prompt attention.

Auto capture for mobile deposit not working after latest update. So incredibly frustrated right now! I used my brand new iPhone, my iPad Pro Air, and even my old iPhone (because it used to work on there) to attempt a mobile deposit, but your latest update will *not* “auto capture” a mobile deposit check. Blurry pics, check wouldn’t fit in the auto capture window when it used to auto capture almost instantaneously. What is happening??? After literally 20+ tries on three separate devices, I turned off the feature so I could take a picture of the check and I did get a message stating it was accepted only to then get a message 15 minutes later saying it wasn’t and to do it again. Never, not once, have I ever had this issue before so I had already written VOID on the check! I’m sure you can imagine the headache that caused. Sooo not happy with your latest “fix.” Saw another review with the same problem so it’s not just me or my mobile devices…

Simple App. Works well, does what it’s supposed to do and accurate. You can’t blame where you bank for overdraft fees and a poor accounting of your money. If you operate that close to the edge I might suggest keeping a paper ledger so you don’t cut yourself short. As a former USAA customer, Navy Federal is HANDS DOWN superior in customer service. This app, while it has less overall features than USAA, it simple and easier to navigate. An added benefit to banking with Navy Federal is if you have a problem, whether it be with the app, a debit or credit card, or whatever... you can walk into one of their many branches and speak to a HUMAN and get your problem resolved. USAA got too big for their britches... and Navy Federal hasn’t forgotten about their customers like USAA seems to have. I should have switched years ago.

Clean and Usable; Needs To Implement Multiple Accounts Better. For users who have multiple different logins, such as multiple personal accounts or personal and business accounts, it’s very tedious to have to constantly sign in and back out to manage different accounts all owned by the same person. Especially when two-factor authentication is on and required every time you login. Other banks I’ve worked with allowed for all business and personal accounts under the same login and it made it much easier to manage accounts and transfers. If not having everything under one login, at least having a way to quickly switch between logins after they’ve been authenticated and stored on the device/app would really speed things up. Also, as of 2016 the government recommended one-time passwords no longer be sent via text or email because of how easily they can be stolen. This app and the Navy Federal website need to switch to two-factor authentication that uses device push notifications, authenticator apps like Microsoft/Google authenticator, and Yubikeys for more security.

Absolutely Frustrating. Newest update introduced the problem of asking me to complete a software update for my phone that DOES. NOT. EXIST (after restarting multiple times my phone is fully up to date). Apparently someone thought it was a good idea to update the application to completely brick itself and become unusable. Great change! Uninstalling and reinstalling fixed the issue, but then I had to go through the added hassle of reconfirming my device and re-doing all security measures, as well as face-id. Then I tried to make a deposit. Asked for all my security questions, put in the CORRECT ANSWERS I REMEMBERED TYPING EXACTLY into the text box and I was locked out of my account. For someone that gets very anxious when funds are not settled quickly this is utterly maddening. The convenience of being able to deposit from home and not drive a ludicrous distance is abundantly useful, but causing this much stress over something as simple as sending two images is ridiculous.

Mobile Deposits Sometimes Don't Work. Overall, the app does what I mostly expect it to. I can see my bank account and transfer money between checking and savings which is fine. The big two issues I have are 1) About 50% of the time, I cannot open messages in the app from NFCU so even though they are quick to respond, it doesn't matter because I can't read the response anyway, 2) Mobile Deposits sometimes work and sometimes don't and because you have to write "For eDeposit only at NFCU" on the back of the check, if it doesn't work, then you're stuck with essentially a void check. The issue is that the app can't read all types of checks and therefore it states the writing on the check is unreadable. I know it's not my phone because in one instance where I attempted to deposit three checks back to back, one was unreadable while the other two worked. NFCU is a great institution, but their app doesn't always work when you need it to.

Having sign-in issues. For the most part I have no problems with this app but it has started to have several issues in the past week that did not exist before. All the issues I’m experiencing are related to the sign-in process. Even though I have Touch ID enabled and have been using it for months it suddenly no longer offers this option when I launch the app. I tried to disable and re-enable the Touch ID feature to see if I could get it back but it will not allow me to disable Touch ID. When I go to manually enter my password the app automatically remembers my user name but says that either my user name or password is incorrect. After a 45 minute call with tech support I was told to try logging in as an alternate user. Magically the app now accepts my user name and password when I go through this extra step. This is now the only way I can login to the app. This is not a satisfactory solution to the problem. Please get these bugs fixed ASAP!

40 Year Happy Member. Great credit union, great service, great APP! One suggestion; on APP mobile deposit, checks must be endorsed using specific wording. Yet, there is no indication of that until it is time to photograph the back of the check. At that time they show a checklist, and first indicate the required endorsement wording. However, by then I’ve already endorsed the check using the standard “For deposit only”. (Why else would I think it’s ready for submitting?) There is never enough room to cross out and correct that phrase, and I don’t do enough mobile deposits to remember the requirement. I’ve had to drive an hour each way to do counter deposits after the mobile deposits were rejected. Please, modify the APP to let members know up front the specific things required for mobile deposits.

Unparalleled customer service. Day or night no matter what time NFCU is always available to help. I had a credit placed on a card that I no longer use and wanted to move the credit to my checking account. The rep was able to take care of this in 6 minutes and was so polite and welcoming during our call. I had another instance once of a string of fraudulent activity on my card that started happening late at night. I called around midnight and the rep was able to freeze my card, cancel it, issue a new one, and reassure me that the fraudulent transactions would be refunded when they posted to my account. Again in little time and with such professionalism. I cannot more highly recommend NFCU as a bank. Since this review is supposed to be about the app, I’ll just say that the app is amazing as well. I can do so much on the app without needing to call (I can even request a cashiers check & sign loan documents right on my phone!). Balances are right where I’d expect them so I can quickly check whenever I’m wondering. The thing I love the most about the app though is a bit of an Easter egg. If you pull down on the accounts screen and you keep pulling down it says thanks for being a member in the middle of their globe. It’s the little things that count & continue to make me a happy customer. Thanks Navy Federal 😊

Everything is great except one thing. This app is awesome and has almost everything I need in life except one thing. Unfortunately, that thing is something they could have simply had there the whole time like other apps. The balance that is left in account after each transaction. That would be great to see along side how much I or my spouse spent. My spouse is a visual person and needs to see that type of thing in order to be a better financial person. They have ADHD and therefore doesn’t like doing the extra work of calculating on paper how much they have spent and left behind after every transaction. Now I know it shows in the app, the balance left all together in the checking account. However, once money is added to the account, it is hard to tell how much was left after spending before the money was deposited from our jobs. Which is something I desperately need my spouse to see since they think they are not the ones spending most of the money in the account. If navy federal could make things easier for spouses married to those with ADHD and ADD, that would be amazing.

Unprofessional Customer Service support at duty yesterday and tonight. It was a very bad experience for me with a female Unprofessional Customer Service support at duty yesterday and tonight, they just talked to you like somewhat!!. I had an issue on one of my ACH payments client account which I requested a proper review on it as for the client was claiming most payments was on hold by my bank but Navy already deducted those payments from my account. To my surprise when explaining to this customer service representative, she wasn’t sure of what information was on the account but only to accused me of talking over her and she rejected my request for a supervisor on duty! Not only that, she went farther to put a note on my account so that no other representative person would assist me at anytime. Tonight I called again to confirm same account status and the representative that picked up call was just so rude that she didn’t want to talk to me and did mention that there was a note on my account that she had to reject my request due to the note… but at the end, she accepted my request after asking her so many why questions and i thought she later realized that she was doing the wrong thing by behaving inappropriately to me as a customer of Navy Federal.

Beyond Expectations. This Credit Union will take care of You and has your back All the way through. PNC, Chase, Bank of AMERICA, TD, I've had them. And they tend to be a jumbled mess and treat you like the same, from what their perspective is, as a ”Peasant” limping in off the streets. They make there hundreds to thousands of dollars off of you through Late fees and Interest and wait for the next $20,000 a year Annual earning man or women who walks through there Billion dollar a year earning double-doors. Navy Federal, seems to actually Treat you like you matter. Your Worthy of at least a Chance to have a and reliable and comfortable financial existence for your Service and Hardship that you’ve done for this country. And the App is downright Silk and Butter. Open, 4 digit password, Pay, see ALL activity within less then 30 seconds slight of one hand. And the customer service is amazing. They seem to treat you like your apart of a family. And you honestly are. We all cried, bleed, hurt during our times in the Uniform and Navy federal understands that. Navy Federal Credit cards, Loans, all are given to your person with a Very generous Amount and Very low Interest. I will be with this Credit Union until the end. Thank you Navy federal! I recommend this Union to ANY in-service or veteran!

App Won’t Total-up Pending Transactions!. We live in an automated world now: we expect our banking applications to do the simple task of telling us, at a glance, in real time, how much of our credit we are using or how much money remains in our debit accounts. …Not on this app. On this app, transactions in the “Pending” category can take days to clear, with little consistency as to how many days, and yet the “pending” category comes with no automatic display of its sum! Other banks may may tell you your “projected balance” which incorporates “pending” commitments you have made on your card. The absence of this basic service requires users to tediously tally their litany of pending transactions by hand, constantly, if they want to avoid either going over budget or, worse, incurring an overdraw fee on a debit account. This is especially a nuisance when traveling - as NFCU’s military clientele often do - because travelers must make many frequent transactions over a period of days. This missing aspect of the user-interface is so basic and so inconvenient that customers may be tempted to think that it is deliberate: a design to get NFCU’s less careful bankers into a financial pinch, racking up overdraw fees and credit card interest for their profits Without a simple automatic Talley and Sum to show user’s their true, pending balance, customers on this app might as well carry a ledger book in their pocket and pretend it s still 1993.

Missing Standard Banking App Features. The NFCU app allows customers to access the basics but there are a few features that need to be updated. -When the app sends notifications to your cell phone there is no indication of the reason for the notification. When users click on the alert and the app opens up, it doesn’t take you to the reason for the notification (ie. withdrawal, paperless bill ready for view, etc.) Users have to look at each account and try to figure out why they are receiving a notification. -Bill pay only allows payments to be made using the checking account. Other banking apps allow users to pay bills using checking and savings account funds. NFCU forces users to transfer to checking and then pay bills. -Transfers between the users own NFCU accounts are not immediate. This includes low dollar amounts. Moving money from one account to another takes 24 hours before the account reflects the change. The $ is being moved in house and shouldn’t take that long.

Update to 6.4 caused app to crash. I have been using the app for some time and have been happy with it. Just updated to version 6.4 and that caused the app to “crash”. When trying to open it after the update, it showed the opening screen for 2-3 seconds, then jumped back into the background without completing opening. If you bring it back forward again, same thing. I power cycled the phone, same thing. I deleted and re-installed the app, same thing. Kind of hard to like an app that you can no longer use. iPhone 5, but shouldn’t make a difference. Update: I guess that the developers actually do read these reviews and take them in to consideration. A further update to version 6.4.3 has been made and my iPhone 5 is “back to happiness” with the app. Thanks, glad to be using the app again as I want and need. Back up to 4 stars now...

Latest update is a step backwards in usability. The 6.9 update follows the annoying trend of adding empty vertical white space to the information presented. Now, instead of seeing 4-5 transactions when I first open my checking account, I see only two. Scrolling to fill the screen with transactions presents far fewer than were visible previously, meaning it takes longer to find what I was looking for. This is not only not an improvement, it is a big step backwards in the usefulness of the app. I’d like to see the polling numbers on how many requests you had to present less information on the screen, because I have a hard time imaging that a significant number of users requested that fewer transactions be visible at a time. Just because something is trendy in UI/UX design doesn’t mean it is what users want or need. Users like large screens because it allows more stuff to be on screen at a time, not because they like to look at empty spaces.

Profits are their mission. Been with this bank for decades. Have relentlessly had issues with them. You’ll never get their advertised rates and they’ll never match the competitions rates. Navy federal has all the same little asterisks next to anything as any other bank. Financed multiple cars with them and there’s always a problem. They lost the title and suddenly it’s my problem. When the State title agency says only the legal owner can request a replacement title that is again my problem. Since they lost the title they’ll convert the loan to a consumer loan at credit card interest rates. Dealership I bought the car from supplied me with copies showing that the title was mailed and filled out as per Navy feds instructions. Last time shopping around for a car a local bank with whom I had never done buisness with before beat their rates so bad they called them (TTCU) a scam bank. Mortgage’s are the exact same. Only reason I still have an account with them is for the length of credit history. I will never again use navy federal for anything.

Won’t let me log in.. I usually don’t write a lot of bad reviews, but my PIN number was the first thing. It was just randomly disabled one day, which isn't too big of a deal. I could still log on, but now they’re trying to add two factor authentication and whenever it asks to send an email to verify your account it says we’re having technical issues right now please call ***-**** for help. I called them and it’s over an hour wait to talk to someone. I actually started writing this review after being on wait with them for 47 minutes so far for what should be a simple problem to fix. Navy fed is a great bank, I’m just really disappointed with they’re technical division. Edit: I had that problem yesterday, but I am pleased to say that they tactfully explained the situation and while still frustrating it was understandable. They even sent an apology email which was a pleasant gesture and showed their understanding of my disappointment.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

I love Navy Federal!. I am 18 and I have been using Navy since I was 13 y’all are amazing!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Would be a great app if...... The main purpose of this app would be to check your balances, make transfers, credit card payments.....all fine if you have an iPhone. If you have an iPod touch or a Wi-Fi iPad the App is nothing more than an advertisement platform for rates and contact information. Once installed you are referred back to the Navy Fed webpage to setup mobile. This requires a verified mobile number with no options for Wi-Fi use. It is what is is....but the App Store download page states that it is iPod touch comparable and since there are no cell numbers for any type of iPod touch this is wrong. (Needs to clarify 3G iPad only comparability as well) Maybe one day they will make a change. At that point I'll give it a 5. Sent from my disrespected iPad Wi-Fi.

Awesome. Has everything the U.S. app has. This is the exact same app as the NFCU app from the US and has all the same functionality. I was hesitant to use it at first due to the low rating but those are old and if anything went wrong I know NFCU would have me covered anyway.. It’s good to have all my same banking needs met while in Canada!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Deposit process needs troubleshooting. I forgot how awful it is to try to deposit checks to NFCU. I usually just eDeposit to USAA and transfer as needed because of how terrible the app is for deposits. Even when I write clearly in black Sharpie, I always receive a “not signed” error and this most recent attempt, the entire app froze when the camera portion to take a picture of my check came up. I had to re-start the app six times. Six failed attempts. I wonder if USAA will accept the check with the “for eDeposit only at NFCU” endorsement written on the back? I’m angry and frustrated not to have access to my money because the app doesn’t function as it should! I have not had problems, generally, with accessing funds once in the account. Transferring funds and paying bills through the app are simple and effective processes.

I have use this app for years and have enjoyed it until recently..... I live in New York and there are few branches available to me. So I started using the app. I’ve used it to make deposits, to pay bills, to get loans, to keep up with my account balances, etc. Unfortunately, recently, the app stopped allowing me to view my checking account transactions. I contacted the call center and informed them of the problem. They said they looked into the account and didn’t see anything wrong. In the meantime, I cannot see any transactions. Today I opened the app only to find out that my checking account is no longer showing at all. So I don’t know what my balance is,?what transactions have occurred, nothing. This is very frustrating to me. I am on a fixed income And I need to have access to the limited funds that I have. Not to mention the fact that I need to make a payment on my Navy Federal credit card account. Not happy!

Updates. Awesome app-usually and a great bank. I just have a hard time wrapping my head around the idea that Apple publishes betas for their next iteration of iOS months prior to the release- even public betas and here we are on launch day for the iPhone 11 and Navy Federal is telling customers “the team that handles all updates hasn’t gotten around to it yet. So hopefully in the next few days they’ll update the app and you can use it on your new device”. So for that reason alone I give one star- who is to say since they can’t even update it to work with new phones in a timely manner- with months of preparation, that they update the app enough to be secure enough for online banking?

Unreliable app. The bank itself I love because it is bar none the best of the best for customer service, the reps always seem to go above and beyond to make you feel valued and cared for. Their app is top notch useful too when it works, which unfortunately is always a toss up. I don’t live near a branch and haven’t for years, so when this app doesn’t work it is always deeply inconvenient for me because then I have to pull down my laptop and log in on it. That’s if I even have my computer close by which is not often. I guess I just don’t understand why they don’t put more focus on this app; for some of us it is our only continual connection with the bank. When my one major connection is perennially unavailable as well as generally unreliable, it makes me question if my needs wouldn’t be better served elsewhere.

"Sneak Peek" for everyone to see! 😕. The latest update has taken the Sneak Peek off of the APP and put it on the WIDGET. How messed up is this?! So now, instead of signing on to my phone (securely) and viewing my NF app to quick check my balance, NF has decided that complete strangers (in essence) should be able to easily see how much is in my bank account just because they can swipe to the widget screen, while my phone is still locked, and see it plain as day. No need for personal security 🤷🏻♀️ I am very disappointed in this "new feature". Of course I can remove it from my widget but the point being is that I now have to sign ALL THE WAY IN to quick check my balance instead of clicking the magnifying glass 🔎 like before. Please fix it so we have the OPTION of seeing the Sneak Peek on the APP AND/OR on the widget!! What a downgrade to the update 😕

Love the bank, hate the app!. Let me get started with I absolutely love Navy Federal, but there application, and online needs some major work. One big thing I need to be able to do is check my account balances, and I feel as if its always down when I need to check it. I know you can always call but its not convenient considering you have to enter all your information, press the prompts, and wait. I never have any issues with chase, citi, capital one, or american express. Its 2018 where everyone has a smartphone, and they need a application that is reliable, not one that is always having server issues, or wont load. Everything else is perfect but they need to invest some time and money into their application.

Love NFCU. I’ve been so happy with NFCU in all aspects of my account. I’m so very happy to be a member thanks to my 2 US military sons and my son in law. There have been issues in the past when I had to transfer money to my oldest son and SIL, it was instant and so much appreciated. I love every aspect of being a NFCU. Customer service (on the phone and in a branch office) is always so friendly, kind, informative, knowledgeable and helpful! I live in Maine and wish we had a branch offices in Maine. I believe the closest is in Boston MA. If there were branches in Maine all of my banking would be done at NFCU. Thank you NFCU for always taking care of some of my banking needs. I value my NFCU accounts! Thank you!

Good app, bad design for Mobile Deposit. The design, features, and overall experience for most of the app is excellent. There have been some reliability problems lately with accounts being unavailable for several (at least once per week), but that isn’t the fault of the app. The weak point is definitely Mobile Deposit. Using an iPhone 7s the auto capture feature is useless. It always takes a blurry picture, and even when the picture looks clear the auto-crop feature typically cuts off part of the check forcing you to start over. Turning off auto-capture works much better, but the auto-crop still applies and cuts off part of the check in inconsistent ways. Additionally, there doesn’t appear to be image quality checking before Deposit submission like in other banking apps. Deposits can be submitted and then rejected by email over image quality or other reasons. The reason in Email given for the last rejection for me was “due to other”. Not exactly helpful and required me to call to figure out what went wrong. Create a better experience for MDC and it would be one of the best banking apps out there.

Mostly one problem.. Navy Fed first off, has been amazing for me. My biggest and maybe only complaint is constantly being forced to create five security questions and answers in order to login. If it was optional then I would have no issue however, when you are forced to fill out all five questions and three of them have questions that do not pertain to you, how in the world do you even use the app? I first stopped using it because I wanted to use my fingerprint to login but every time I would login (once every week or two) I’d have to use my password which made the fingerprint option useless. Now I’m thinking of not using it again because of the forced security which I can’t even setup. Other than that the layout and response time has been very good.

Annoyed with it switching banks. When i first opened my account it was wonderful and i enjoyed it. As of late all of those emotions have left the building. My app never accurately shows the amount of money in my account i had 12 dollars now I’m negative 15! Why you ask? The app always displays more than is in the account so even with the overdraft blocker on you’ll still find your way into a negative balance paying extra fees. Let’s not end there i work overnight and this particular night in January is 27 degrees and i have to sleep in my car at qt because they never ever tell you when they are doing a system update which means your card isn’t useful from 11/12 pm til 8 am which is ridiculously inconvenient for someone WHO WORKS OVER NIGHT! if anything they should send a mass email/notification letting it’s users know of this ahead of time! I can’t count how many people tell me to go with USAA instead and I’m definitely considering after this.

Latest Update Gets Stuck In A Loop. I loved being able to submit additional payments on my mortgage using the app. But with the latest update, I get stuck in a loop and can never submit the payment. After entering the necessary info about amount, date, etc, I click Submit Payment. Then a new section opens to confirm that I’ve read the terms and agreements. When I click the link to read them, they open within the app. When I click the back button in the app, I’m taken back to the section that’s like a dashboard about payment information versus the additional payment section I was just in. Click schedule additional payment and it’s the same thing over and over again. Previously, the terms and conditions opened in an Internet browser so you never lost your progress in the app. I guess it’s back to the Internet to pay my mortgage unless or until this glitch is fixed.

So far the best bank I’ve used yet!. I have had many banks, and out of every bank I have had I have always had issues of some kind with everyone of them. So far Navy Federal credit Union has been the best bank I have used to date. if you are considering a bank to get, this is a fantastic bank to start with. It comes with a checking account with no minimum balance, five dollars to open the account, a savings account, and you can also open a second savings account with a higher interest rate, if you have over a third of our money in my savings count.

Very Happy Customer. NFCU is by far my favorite to bank with. I have been a target of fraud twice already and both times, the customer support was amazing. They are easy to get a hold of, often times I have no wait times, no hold music, just a quick ring and a real person answers. Recently, I thought I had another case of someone stealing my card info but it was actually just a company charging me months after the fact, the fraud agent gave me the best advice and I didn’t have to get a whole new card thanks to her guidance. I also love how user-friendly the app is and how easy it is to manage my money how I please.

Hear me out. I love the credit union, the 24/7 customer service, and the unlimited ACH transfers. As for the app, I experience technical and bug problems weekly. (I.e., the app won’t recognize my face, issues with the connection on the application) I have a business account and a personal checking. Don’t get me wrong they are worth the bargain, i just simply wish I could navigate between the two accounts only using my primary account login. It is a bit tedious juggling between the two accounts. Also, the two-step authentication process can be a hassle. Although I do love the protection, I wish things were all in one place and smoother.

App works fine for me and NF is a good bank to have. So far the app loads fast enough, definitely faster than chases app. It also lets me do transfers easily enough. 2 issues I have had are when trying to login it will sometimes just show a “sorry were having technical difficulties” screen and I can’t see balance. It’s ridiculous and they should have a backup basic page you can view where you can at least see your money. Not just lock me out of my info. The other is just crashes that happen randomly. One example, and this was reproducible for me: go to scheduled transactions and click on the current day on the calander. It crashes the app to the home screen?? Stuff that like probably shouldn’t happen with a banking App.

I want to work for NFCU. I’m going to retire soon from education. I can retire this year if the opportunity allows it. I still love what I do. And I’m a proud member of NFCU. I would be great in a training setting. I can’t wait to apply. Every time I walk in the doors of the NFCU Branch in my town, in Winchester ironically, I share my pride and confidence in being a member. Check out my member number- it’s five characters long. I’ve been a member since I was about seven years old, or earlier…..My dad is an old Navy chief, with all the pride you can imagine. I love NFCU, and I will work for you! My name is Brad Moss, and I hope this review tells you all you need to know!

Missing scheduled transaction. 1. Cannot find Scheduled transactions on the scheduled date, and the transaction is not verifiable. Example: If I scheduled a payment to my credit card, let’s say on the 30th of the month, the scheduled transaction is missing on the scheduled date, but the payment is not posted on the credit card account (the credit card is also from NFCU). The question is, did I schedule the payment or not? At times I have to pay twice, just to make sure I did not miss the deadline. It should at least informed me that the transaction was completed/pending. 2. In the Events section - You cannot edit the events that applies to you.

Amazing Bank App. I love all the features that this app allows us to see and do especially with the credit score built in, fast easy transfers, and works pretty flawlessly. My recent issue is when I got a new phone and deleted every other phone on the easy 2 step verification settings except my current one and I still consistently get the 2 step verification every time I sign in on my only mobile device. It is very annoying and I’m not sure if I’m the only one experiencing this issue. This needs to be resolved because when I looked at the FAQ for the answer, went to the settings, nothing changed and there should be a button or something saying which device is the primary device to sign in or something along those lines.

Great app! Please let us add scheduled transactions too!. We switched to NavyFed from USAA and so far we love them. The app is great and customer service is awesome! There is just one thing that would make it even more user friendly: to let us add our own scheduled transactions. It will do it for you if they’re transfers you schedule with your accounts or payments to their credit card but if you would allow us to also add bills and other expenses so we could see our projected balance it would really simplify a lot of the mental math or reliance on other “budgeting” apps. Other than that it’s been great!

Phone activity. I’ve had my account for over two years I only use it here and there. I’m an independent contractor and I finally got paid money owed to me with back pay included. Navy federal waited until the check cleared to freeze my account and have me call security. That’s no problem. After being on hold for 45 minutes and answering numerous questions I was told my account is being deactivated for “Phone activity”. I have three I phones on different services for work and one for family, I explained that. The man then proceeded to tell me they’re closing my account and i can’t do a thing. Is it because I’m black or am I being punished for having the iPhones on the same iCloud? Either way I’ll never recommend this bank or return!! I’ll stick to using my Chase acct!! Now I have to suffer and wait even longer while bills go unpaid and my car sits in the shop! Thanks for nothing!!

My dad has problem to pay bills. I and my dad used the app to monitor the money coming in each end of the month because my dad disabled and retired veteran. But he tried to pay bills on his iPad the app shutdown and he have get back in using his passcode and tried again. I’m trying to add the same bills as him. When he goes to operation like in 2025, I will pay the bills for him while he recovers from the surgery. I’m acting as his caregiver after my mom passed away plus I’m the only child in my family and I trying to take care of him as long as I can. Is the a fix to his problem on the app so he can pay bills without the app shutdown on him. I used NFCU and BoA.

All my info at a glance!. I’ve been waiting to get my iPhone to download this app. I’m happy to report that it’s great so far. I’m trying to figure out how to get it to ask for my phone pin whenever I open the app. But once I get in it looks great and all info is available without having to dig through menus. There is some digging for some settings as it should be but as far as info that I need day to day it’s right there when the app opens or at most, two swipes away. I gave it 4 starts because I haven’t fully explored the app and the phone pin requirement on open (if available) should be on by default.(according to me anyway)

Unable to contact App Support. I would have rated this App 5 star until the most recent updatemmi spent 20 minutes trying to deposit a check. It kept freezing. It would not let me manually capture the check would not automatically take it either. I had to restart the app 7 times. Once it captured the front OK but then froze when I tried to capture the back. Normally I can contact app Support using the Ipad's App and going to "contact web developer". Instead that feature takes me to the iPad browser. I couldn't get logged in that way because I use a password manager and go through the browser in the PW Manager app. It kept cycling through login screens without letting me login. Hopefully the App developer will contact me through this review or at least find it and improve the ability to allow users to manually capture the check image without numerous restarts and screen freezes when the auto capture fails.