Barclays US Credit Cards App Reviews

Barclays US Credit Cards App Description & Overview

What is barclays us credit cards app? Access your account anywhere, anytime with the Barclays US App. With biometric login, customized notifications, and mobile wallets, using your card is faster and easier.

If you already have a Barclays online account, you can use the same online credentials. If not, you can set up an online account through the app.

Faster

•Digital wallet: pay with just a tap. Add your card to Apple Pay® and replace your cards and cash

•Biometric login: skip the password. Log in quickly and securely with Face ID

•Rewards: all your rewards at your fingertips

Easier

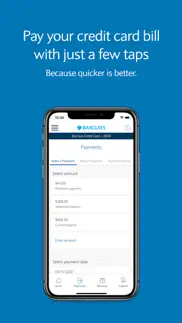

•Quick and easy payments

•View all your accounts in one place

•Spend Analyzer: get a big picture view of your spending with our handy tool

•Free online access to your FICO® Credit Score

Safer

•Card control: lost card? Not a problem. Lock your card instantly

•Notifications: personalized alerts and push notifications

•Replace your card: get a new card in just a few easy steps

Most capabilities are also available on the iPad and Apple Watch apps. iPhone, Apple Watch, and iPad are registered trademarks of Apple Inc. FICO is registered trademark Of Fair Isaac Corporation in the United States and other countries.

Please wait! Barclays US Credit Cards app comments loading...

Barclays US Credit Cards 8.2.4 Tips, Tricks, Cheats and Rules

What do you think of the Barclays US Credit Cards app? Can you share your complaints, experiences, or thoughts about the application with Barclays Bank Delaware and other users?

Barclays US Credit Cards 8.2.4 Apps Screenshots & Images

Barclays US Credit Cards iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 8.2.4 |

| Play Store | com.barclaycardus.iphonesvc |

| Compatibility | iOS 15.0 or later |

Barclays US Credit Cards (Versiyon 8.2.4) Install & Download

The application Barclays US Credit Cards was published in the category Finance on 29 March 2011, Tuesday and was developed by Barclays Bank Delaware [Developer ID: 425199402]. This program file size is 115.8 MB. This app has been rated by 206,499 users and has a rating of 4.8 out of 5. Barclays US Credit Cards - Finance app posted on 15 February 2024, Thursday current version is 8.2.4 and works well on iOS 15.0 and higher versions. Google Play ID: com.barclaycardus.iphonesvc. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

| Barclays US Savings Reviews | 3.2 | 1,091 | Free |

Thank you for using the Barclays US App. New in this release: - Minor bug fixes and improvements

| App Name | Released |

| Wells Fargo Mobile | 18 May 2009 |

| Zelle | 12 September 2017 |

| Providers EBT by Propel | 12 May 2016 |

| Klover - Instant Cash Advance | 30 July 2019 |

| Western Union Send Money Now | 09 May 2011 |

Find on this site the customer service details of Barclays US Credit Cards. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Receipts Pro | 04 December 2013 |

| 10BII Calc HD | 20 September 2010 |

| WalletApp | 21 September 2015 |

| Easy Stock Profit Calculator | 11 December 2017 |

| CalcTape Paper Tape Calculator | 16 May 2012 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| SHEIN - Online Fashion | 19 May 2014 |

| Hive Social | 18 October 2019 |

| Cash App | 16 October 2013 |

| WhatsApp Messenger | 03 May 2009 |

| Wizz - Make new friends | 24 February 2019 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Stardew Valley | 24 October 2018 |

| Purple Place - Classic Games | 17 May 2019 |

| Bloons TD 5 | 15 November 2012 |

| Geometry Dash | 13 August 2013 |

| Monash FODMAP Diet | 17 December 2012 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Barclays US Credit Cards Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Good app, annoying security “features”. The app itself is good for your mobile banking needs, it’s pretty easy to use. The reason for the 1 star is solely on the security policies that are implemented on this app. For whatever reason after a certain amount of time, I think 3 months. The app forces you to log in with your password which isn’t saved instead of using Face ID. Once you log in, if you remember your password without having to reset it, you have to go into the settings section and then Face ID back on because for whatever reason it gets disabled on it’s own as well. You have to type in your password again to get Face ID reactivated. It’s an incredibly annoying “feature”, no other banking/credit card app does this except for Barclays. Please change this, there’s no reason to have to use your password if Face ID is already activated by your own accord.

Card gets a worse wrap than it deserves. Ok, the app is far from perfect, but if you: a) have a decent limit b) don’t max out your card regularly c) pay on time OR contact them before any missed payments It does everything needed, and a different FICO score than my BoA app which is useful. Since main complaints seem to be about the card.. Idk what people have, but without perfect credit I got a 9.08% APR. Perhaps you have a rewards card if yours is much higher? This alone makes Barclays worthwhile. If you miss payments or even stay maxed, yes, they’ll reduce your limit. If you want idiotic lenders, then deal with higher APRs. There’s a trade off. People seem to think Barclay can’t move your credit as they want - mine has been raised, lowered, and raised at their discretion, and any request for a raise was denied barring my first one. I quickly saw they like to see 50% or less revolving balance. That’s reasonable. If you can’t keep that up, you’re spending yourself into debt you can’t get out of, and they see it coming. They’re reducing their liability by reducing your limit. Use it wisely and it will only ever be raised. With 20% + being normal, idk how anyone can complain. Also, yes there’s a payment turnaround for available funds.. it’s their money after all, I’m borrowing it, seems reasonable unless they have a bigger relationship with me (not my main bank so I don’t expect it).

Pretty good. Update: I increase the stars on my review. I was able to figure out how to pay in VoiceOver mode. So everything appears is VoiceOver accessible and nothing needs to be fixed. This app is very voiceover accessible, however, when I try to make a payment I’m unable to enter in an amount. It says amount and then next to it it says expandable button but it never brings up my keyboard for me to enter in the information. I believe this is a voiceover issue since my wife who is cited was able to make a payment and get the amount in there when I was not. I will update my review and increase the stars if this is fixed.

Worst company ever!!!!. Call center is in India. Zero help whatsoever!! Hung up on me after I yelled at them, I was supposed to be enrolled in auto payments, they never set it up. Weird how when I went into the app to set up auto pay myself after that conversation where they hung up on me, my checking account info was in there already, how did they get my checking and routing info... weird! I was sending additional amount every month to pay principal down, that amount just so happened to be above my minimum payment but when minimum payment went up, the additional amount I was sending in didn’t cover the minimum anymore. 30 day late on my credit. This is the 2nd 30 day late I’ve ever had in my life, guess who my 1st 30 day late was with? This same company! Lol. The reason I set up the auto pay. Granted that one was my fault. I had a balance of like 15k, I calculated what I needed to pay card off in 12 months. Was sending in that amount every month. I miscalculated by $20... 30 day late. F this company!!!!

Horrible and virtually inaccessible. Keep your laptop handy.. Update Feb 2020: still terrible. App will not use Face ID to log in, even though I set it up to do so. I have to enter my password first. What’s the point? So frustrating. UpdateJan 2020: Still the worst most frustrating cc app. Every other bank and cc app i have is secure AND lets me log in, imagine that. Once you get into the app things are fine, nothing special. I really can’t say because i can’t get into the app to refresh my memory of what the app offers. It constantly is asking for my password. If I remembered my password, i wouldnt use biometric access. What’s the point?! Horrible and pisses me off everytime i want to open the app bc i have to go find my computer to reset the password. You can’t even reset your password through the app. Security through denial of service to the authorized user. Worst App that has not gotten better in the years that I’ve had it.

Love the app but looks like an update is needed. I prefer using the app over the website. The website forces me to log in twice as the website just hangs on my first login, then I have to refresh and login again. That needs to be fixed but this review is supposed to be for the app so I gave it 4 stars because I can easily manage both my Barclay cards and logging in with FaceID works great. The only issue currently is since updating to iOS 14 when opening the app it says I have a jailbroken device which from seeing other recent reviews I’m not the only one experiencing that error message. I just ignored the message and logged in with FaceID but it is concerning if the app believes my device is not running what the app believes it should be and might be making the app less secure. Looking forward to an update hopefully soon.

Can’t paste password. I use a password manager. The app occasionally disables Touch ID and requires you to enter your password manually. But it’s not possible to paste a password in the field in the Barclay app after copying from the password manager. And to add to the frustration, the app clears any text you enter if you try to view any other apps by double tapping the home button. So now when I have to log in, I either have to write my password down on a piece of paper, or if I’m out and about I get my girlfriend to type it into her phone so I can copy. That totally negates whatever security measures Barclay is seemingly trying to employ by disabling copy/paste. It’s been a while since I’ve had such a bad user experience with an app, and I’m an app developer so I come across a lot of bad UI/UX.

I’ve really enjoyed this card. Second card I received to rebuild my credit after they bought the original card company I was with - Orchard Bank. I was rewarded on a regular basis for my on-time payments and wise use of credit line. They have increased my credit limit a few times in the last 5 years and at times the extra support cushion has been necessary. I love that I can track my credit score and they help you see how you can improve your credit as well. So far a great company and excellent card. Thank you for taking a chance on me those years ago and helping me get back to my 730 score!

Needs to get with the times. I can deal with a lot of annoyances; delayed postings, no notifications, click after click to get answers to questions, but for heavens sake the login process is painful!!!! Every time the app updates it dumps the Touch ID. Which for me means resetting the password since I never remember it (hence working from a device with Touch ID!). The process to reset from the phone is at the least arduous. Go get your wallet, get your card out since you need your acct. number and enter other personal ID info to reset. All I want to do is make a payment from my couch, cafe, or work break room. Come on Barclays! People work from their phones 90% of the time these days - it would be nice if making payments was made as easy as possible!

I enjoy this app. I’ve had this card for about 5 years now and I’m happy with it so far. The app has had its challenges in the past, but it has been improving consistently for quite some time. I don’t use Touch ID or biometrics, only password, so maybe that’s why I haven’t had any issues. I can access anything from summary to credit score, make payments easily (latest update solved the problem of typing in your current balance - thank you for that), with overall pleasant experience. I have a few cards so my main criteria for this review is the ease or making payments and checking credit score - and this app excels at that.

Shockingly terrible bank. I thought Barclays was a reputable bank however I am now having huge concerns. I signed up for a card never received it went to the store because I needed to be able to make a payment they said I had to wait for the card to set up payment. Two months later and 2 late payments I then receive a statement but no card. Called them got a credit that never showed on the statement. Set up my online ability to pay the bill and minimum payment is more than my bill. Called again and everyone sees the credit bill n there end and can’t understand why it’s not updated online. Now I have 2 late payments on my credit report because of this bank. And I’m still on hold and they’re stating they are trying to push the credit through and don’t know if they will be able to. Wth Barclays? 2 calls to this company and their system is apparently freezing WHAT?! Yeah don’t trust them. The customer reps have all been polite no issues with them BUT their computer systems are horrible this makes me nervous because I have to be able to trust that they are running secure system. This is bad Barclays.

Ditto, Ditto, and Ditto. I have to echo many of the others’ comments, hoping the volume of like comments will eventually motivate you to actually listen to your app consumers and implement features that are pretty much standard for banking and credit card apps these days — 1. Able to schedule a payment for a pre-populated current (not statement) balance. I can’t stand balances on my cards so tend to pay as soon as they get put on balance. 2. Push notifications of user-selectable transactions (not just/only email) 3. FICO scores. Update them regularly (monthly) or drop the service. Sometimes it goes three months without an update. (And there are lots of FICO scores. Could you say which one you’re actually reporting? So, you lose three stars - one because your not up to the standards of other like apps (citi, cap1, discover) and two more because you’ve had these issues and these comments from day 1 and haven’t been responsive.

Easy to use and efficient. I also have a credit card with Discover and even though I love their app, some of the external features don’t always work like their widgets for the iPhone. Barclays got it functioning on the first try which is really great and saves me a lot of headache. This is an important function for me because it’s how I keep up to date with my spending and balances. Not to mention it took a few minutes to set the whole thing up. I’ll be updating my review as i continue to use the app but so far, I’m very pleased with what’s being offered here.

Horrible card, horrible app. This is the only card I’ve had over the past 22 years that randomly lowered my credit line (excellent credit) by $10,000 without a single late payment since owning the card for 2 years. Worst yet is this was done with no warning or notice. None whatsoever. I’ve read some complaints online about this but I figured it was happening with people that were late a lot, had bad credit, bad debt to income ratios, etc. I never thought it would happen to me but they lowered my credit line twice with no notice. The second time it was lowered to just barely above what my balance was on a business trip. Now imagine that you have to book a flight back home, go to pay but it’s declined due to your credit limit being lowered to just a few dollars above your current balance. That’s how shady this company is. If you’ve downloaded the app then you’ve already gotten the card so all I can recommend is keep a very close eye on this companies management of your credit and identity and cancel the card as soon as possible at a time that’s least impactful on your credit. If you don’t, I can confidently say that you’ll wish you had at some point.

Worst customer service. I wish i could give this much less than 1 star because of how i was treated. The main reason for applying for this card was for their 60,000 award miles which was applied if you used this card for any purchase in the first 3 months. For some weird reason i waited for almost 1 month and never received my card. Than i tried calling customer service and was asked to please update my address (it was always the right address but yet i went ahead and did it). After another month i went ahead and called again they came to the conclusion that they had to send me a new card. All this process took longer than 3 months for me, which meant that i never received my 60,000 award miles. I called again to fix this and was told that everything will be alright, to please give it a month or so until their head department received my complaint and help me with receiving my miles. I just finished talking with one of their managers and was told that my claimed had already reached a deadline and i will not received my award miles. I have never had such a bad experience with customer service as today. Now I cannot claim something that should be mine do to their fault for never sending my card. I really which i could gove less than 1 star which is what they deserve. Don’t recommend them to anyone.

This App needs lots of improvements. I’m new (second day using the app) to the Aviator Credit Card - Two things need to be updated to be at par with other banking apps: 1) Remove that one has to answer security questions on every login & 2) Notify when a new charge is made. Customer service supposedly corrected the issue of notifications when a charge is made. Made a charge today and no notification, either email or text. Called customer service second time and went through all the steps as previous day and this time they told me “no text message option available” But should get emails after a charge is made. We’ll see. If it does not work I will close this account because with all the bandits out there cloning cards, etc., charge notifications is extremely important to me.

Terrible App and Website Design. Shady with fee charging and not letting you log in. I can log in with app completely fine but to change the bank account connected I have to use online website. I log in on my laptop and they say my user or password is wrong even though i checked it on my phone app and it works. Asked me for my social and phone number or my bday and my social and kept saying that info was incorrect. How tf do i get my social or phone number of birthday wrong? Then they lock your account with no choice but to call customer service and this happens literally every time I try to log into the website. Just add the option to change my payment option on the app already because you’re charging me interest fees for not paying the last month yet the bank account I have connected to this isn’t even active any more. PLUS their customer service is only available monday-Friday til 8pm so good luck reaching them if you work two jobs full day. Been weeks and they lock my account every time I try to log in. Terrible app without being able to change payment option and terrible website with bad verification locking

Deceit. When I applied for the JetBlue credit card, I was very excited. During the process it offered a balance transfer, but I was unaware of the fee that I’m charged. I’m sure the website displays it, but it’s displayed in such a manner that it’s easily missed. As a consumer, I’m very mindful of how my money is spent but when I transfer the balance from another credit card, I was doing it so that I can push out my due date. Unbeknownst to me I signed up to be charged $500 for the statement balance transfer. I am disgusted with how this relationship with JetBlue credit card started. I would never recommend this card to anyone because the website is deceitful. I think it should be made clear that customers will be charged such a high percentage to transfer a balance. There is no incentive to transfer a balance. What made it worse is customer service was not able to help with my innocent error. I have great credit but unfortunately they didn’t value me enough to credit me the $500 I was charged.

Pretty good but it would be nice if the current balance was an easy payment option. In general, I find this to be a pretty good app. My only issue with it, and the reason that I gave it four instead of five stars, is that when you pay your credit card, the current balance is not an option that you can select. So I pay my credit card multiple times per month to avoid debt. However, to pay my current balance, as opposed to the statement balance or the minimum payment, which are the only pre-filled options, I have to remember the balance and type it in in the other amount field. I know that it may seem weird that somebody would pay their balance off before it was due, but if I do this, I’m probably not the only one. All my other credit cards offer a choice to pay the current balance, where the current balance is already filled in. It would be great if you could add this feature, as it would save a lot of time and hassle.

Payment options. Your payment option is totally confusing. I previously selected to make balance payments, not preselected amounts. You enroll me in preselected payments and it was never enough to pay the balance so I changed it to balance payments and you canceled my entire payment plan. Now I am late for a payment and you are making me pay a penalty fee. You messed it up for me. I should not have to pay any fee because of your error on my account. I just finished going through your website and changing my payment to be for the balance, not a selected amount. BALANCE is my selection.

The WORST - 0 Stars!. This has GOT to be the worst finance company. They took over the GAP/Old Navy credit card and since DAY 1, I’ve had issues. Every single month, I have the hardest time logging in to pay my bill. Every. Single. Month. I have a password manager on my phone, so it’s not like I forget my information… I’ve changed my password multiple times. I tried logging in today and the exact same issue I’ve been having is STILL an issue!!! I don’t understand how a company that makes millions every single day cannot have a working app/system. How ghetto! If you use “forgot password” you need last 4 of SSN, DOB, and the 16-digit account number on the card. I don’t carry that card and frankly don’t even know where it’s at! If I have my personal information, why can’t that be enough??? PLEASE FIX THIS ISSUE SO I CAN PAY IT OFF AND CANCEL MY ACCOUNT. I am more than FED up. I’ve had multiple credit cards from different companies last and present and I’ve never had an issue like this. Get it together Barclays! I’ll avoid your company like the black plague.

This app needs to be fixed. This app is slow in terms of transactions for instance let’s say I make a purchase and it cost 50 dollars, it will take like a few days like 5 days before I can pay it off. Why?? It doesn’t need to be this way, my Bank of America app lets me pay off my balance immediately after I make a purchase or at least like a day or two TOPS. It seems like to reason for this is to get people to unknowingly rack up a bill higher than they can pay off so that they end up paying the high interest. It’s shady. The only reason I have not cancelled this card yet is because I want to use Hawaiian miles card but guess what? Southwest is in Hawaii now, so I think I’m gonna just get a credit card with them now. Your reign is over. Make some changes to your set up or you’re gonna lose a lot of customers in Hawaii. You have some really bad reviews, think it’s time you make some changes.

Wrong math. Barclays approved me for a certain amount, then they proceed to do a Balance transfer for more than the available credit, which put me $555 over the limit. No Senior manager was able to help me, nor did they accept it was the bank’s fault that my balance went over the limit, yet I was very upset because that could negatively impact my credit score. They gave no solutions as to how to fix the issue, they just said to make a payment that will bring the balance down to, or below the credit limit. I think it’s very irresponsible on their behalf to have transferred more than my available credit, if I would have done it manually, I would have done the math, and transfer a lesser amount. Very disappointed with their decision, and with Senior management!

Push Notifications are junk!. This app used to be okay. A couple years ago it would not send single transaction notifications at all, and customer service is useless if you call and tell them that. Then about a year ago push notifications started to work finally for single transactions, BUT I would get an email for every transaction and every posted transaction on top of the push. I didn’t have the app even set to email me or ever want a second email and notification for a posted transaction. Now the past month or so push notifications and emails on single transactions have stopped completely again. I cannot get the app to send them no matter what I do. I’ve never seen such a poorly designed financial services app. Well, outside of the Empower retirement app… How can Barclays have such a crap app in 2022? My Amex app has easily and no issue sent me push notifications for single transactions for years! Barclays, hire some Amex tech engineers!

Notifications Anyone??. This app needs a lot of improvement. The UI could have been designed by a 5 year old. It's stuck in the minor leagues... while the other banks are playing in the major leagues. I am thankful that it is fully accessible to the blind. Easy to navigate, but not feature enriched. Many people are complaining about the login, and I get the frustration. Although, I haven't had any issues with TouchID with my iPhone 8. It has worked every time I've logged in. I've not been asked to constantly reaffirm credentials. Barclays... Please improve on this app. I'm pleased with my customer service. User experience with website and app, not so much. The biggest security issues... Where are my notifications? It doesn’t protect me after the fact. Notifications should occur at point of activity, not when sale posts.

I have been very happy with the APP. Overall this app is quite useful. I do all my banking on it and rarely have found a reason to log onto the main site. I have found that I am able to make payments, view balances, schedule travel notifications and even lock the card if I misplace it. I have read all the negative one star reviews but it seems those are specific to a credit product offered by Barclay not necessarily the app itself. The app is very useful. My only suggestion would be to make it easier to redeem points in app. It’s possible it just takes a few steps and a little patience.

Multiple Flaws. Barclays took over Gap credit card and in just the set up of my account I came across multiple errors. First of all at some point during the set up it asks you to select a primary number for text from a drop down box but the only thing in the drop down box is “select.” This app also does not allow you to get alerts for purchases and security by text only by email. I big step down from the previous bank that had the Gap card. My career doesn’t afford me the option of sitting in front a computer to check my email, so it would be a good 12 hours minimum before I realized that someone was using my card. The app also asks you to answer security questions when you are setting up the alerts, not sure where these questions came from but clearly they don’t know my life as well as me because it kept telling me there was an error and I could not complete the set up. That’s question we’re not the ones set up earlier in the process but either way if I chose the actual correct answers it while not let me move forward. Very disappointed as the previous company was so much better. WHO DOESN’T ALLOW TEXT NOTIFICATIONS.

Beware. Had this card for over 4 years now, never missed a payment, kept below half my credit limit (below 30% is better) one day out of the blue I get a letter saying that they took over 3k credit limit away from me. This messed up my credit score and caused me problems and for what? I called to ask about what the reason was and they said if I have a problem I can send in a dispute but nothing else can be done unless I want to agree to them giving me a hard inquiry on my credit to check to see where I’m at now and possibly give me a little more credit back. I said NO! Needless to say I’m done with this creditor and moving to a better one. Don’t waste your time with these people. Your not gonna get anywhere with them. I had to find out the hard way unfortunately.

Good App. Could be Improved. The pending activity view needs improvement. A pending transaction and a pending payment are treated the same when totaling pending activity. If I have pending payment of 100 and a pending charge of 100 the total pending activity shows 200, when really activity nets to 0.00. This is the primary card I use so it makes it difficult to track actual rolling balance when I have large volume of pending activity. It would be nice if rolling balance would be included in pending activity as well.

Inaccurate Balances Reflected. Avoid frustration and wasted time. DO NOT GIVE THIS BANK YOUR BUSINESS. I used this bank to finance my computer purchase and carefully tracked my payments to pay the card in full before interest free period ended, so that I wouldn’t be charged full interest for missing a payment. Even though the app is underwhelming, I still expected it to reflect an accurate account balance. Even that was too much to expect! I thought I had payed off my card and even payed extra after forgetting to discontinue the automatic payments. I made a couple of purchases to redeem the money I overpaid. Long story short, after hours on the phone with their substandard customer service reps, we find that the app had inaccurately reflected my account balance but I am still expected to pay the remaining balance. If you’re looking for transparency in your financial records and the support of a good team of customer service representatives, this app and bank is not for you...

Password Input is awful. The app, like many other apps with sensitive information, periodically logs you out and disables Touch ID requiring you to put your password in again for security purposes. That’s all well and good, however many people now use password managers to keep up with their passwords and therefore it is nearly impossible to type out this password. Copy paste would be the solution here...if it worked. The app recently broke the paste functionality so I cannot paste my password into the app. Oh, so just swap back and forth between your password manager app and the Barclay app typing in 4 letters at a time that you read and memorize. That would technically work too...if the Barclay app didn’t reset your typed characters each time you changed what app you have active. This app is pretty bad for multiple reasons but it was at least somewhat functional. As of now it is LITERALLY unusable for me without having a way to login.

Good idea at the time. I locked my card after I paid my card off so I wouldn’t have any problems with someone using and getting my card number. So I go and try to unlock from the app so I can make a purchase, and it won’t unlock. Try to do it over the phone and that didn’t work either. I call customer service to unlock my card and they can’t do it with either. Then they send me to someone so they can help and they are talking about they are doing maintenance services at the time so it can’t be unlocked. I said the other rep never said anything about this as long as I’ve been on the phone. I asked since when because I haven’t been notified? Did you send out a notification? The lady says no ma’am I’m sorry! So how the hell are you doing maintenance without notifying your customers? I am sooo done with these people. I always have problems with them and at this point I’m done!!!

Some things fixed, others need fixing. I find that Face ID works fine, as well as most things in the app which is good because it seems those things were broken before and Barclays fixed it. My biggest complaint is I haven’t been able to activate the push notification for all transactions. I always get an error message. Also the interface and lag time is sub-par. They should look at Chase’s app, it’s not perfect but WAAAAY better. If they don’t make improvements I will close my account because it’s not worth not being to access my info and customize things the way I need them. It’s my hard earned money we’re talking about, and whomever lets me manage it as easily as possible is who I’m sticking with.

Poor chip quality. I have the Barclay Uber VISA card, I’ve had transactions declined at major retailers like CVS and Walmart, when I called customer service they have no record of an authorization attempt, there is also no security hold on my card, I have my Barclays card also tied to my Apple wallet so I was able to complete the transaction using the card reader via my iPhone, so the Barclays network is working, but the card machines can’t read the chip when I physically insert the card into the machine, so it’s either a cheap chip or an issue with the hardware at CVS and Walmart which is unlikely since everyone else is able to use their credit cards, so must be a Barclays issue, frustrating to have a credit card that only works some of the times, I’ve already had my card replaced twice this year and the issue is still recurring, most of the time the card works but not always, never had this issue with my Chase or Amex cards

Constant connectivity problems. Nine out of ten times I try to open this app, it can’t log on. And then when I’m finally on, the basic functions of the app will inevitably be so slow that they time out. I’ll be on WiFi, great connectivity, every other app on my phone works just fine - and yet mysteriously, I just get stuck on an endless loading/sign in screen every time. This is not a review of the banking, which has been fine, just this horrendous app that has constant, mysterious, pathetic connectivity problems that have never been improved from update to update. I love having to sign in 10 times over 20 minutes to finally get it to stay working long enough to pay my credit card. (Literally the only thing I use this app for is paying my credit card - do they not want me to be able to quickly and easily give them my money??)

Real time. This app needs to be real time. I pay my bill or make a purchase and it can take up to two days for either of those transactions to show up in the app. It makes deciphering your actual balance impossible. I actually saw a negative number show up as my balance as my charges hadn’t as yet caught up with the payments. And because of the built in restrictions you can’t pay when you have a positive balance even though the app shows you pending charges coming in but not yet applied. The payments form will still show you an amount you can pay, but it won’t let you pay it. They need to fix this. If I can get an email instantly indicating that I’ve setup a payment, they can show the payment as pending immediately, not two days later - linger if you make it on a Friday after 3PM EST. The same is true for changes. Show them pending immediately and subtract them from the balance unless something subsequently goes wrong. You can always reverse it. If Starbucks can finally make their app payments and charges instantaneous, so can Barclays. Thank goodness you have extremely patient and kind representatives to talk us off the ledge when confronted with the shortcomings of the app. You might have another revenue stream as a call-in therapy help center. ;)

There are better cards. I must agree with the one ⭐️ reviews. I just put in my password 3 days ago. I opened the app and I did the Touch ID. Then it asked for my password again!!!! Really???? Also there are no push notifications when using the card. I've signed up for everything. Sometimes, not always, I'll get an email message a day or so later of a charge. So let me get this straight. You pester me with endless passwords and questions to use the app, but you won't give me the info so I can see if there's actual fraud going on??? My wife buys gas, charges things and nothing ever comes across. I might as well turn off the notification. Other cards are instant. Pretty simple. I'm actively looking for a better card now. I've waited a year for these guys to clear up their nonsense but it's futile. It's easier to just move on. I originally got this card because they said it was a true chip and PIN card outside the US. Not! Every time it spits out a receipt to sign. So outside the US where they don't check the signature, there's no security. You lose the card, they'll be on a spending spree.

Only one major issue. Ok, so I like this app, and find it convenient. Ever since they fixed the two step authentication issue, it’s been even better. One thing I’d like to see, though, is a running total of my balance for each purchase. So far it’s just a list of how much I’ve spent or paid and at the top it states my current balance but that number never makes sense and I have to go back and add everything individually to make sure it’s all correct and no errors have been made. It would be much better if at each purchase I can see the running total so at a glance I can make sure it’s on track. Thank you.

FEELING SCAMMED. First off, literally every other app I utilize for banking purposes has face scan login capabilities. Pretty much a leading factor in not using my Barclays credit card as much as any of my other cards. Oh and not to mention, the only reason I signed up for a Barclays credit card in the first place was because the original offer was for a card backed by Uber in which you could get 5% cash back on dining out expenses and other misc. Uber related benefits. That only lasted for a year, maybe two, until they switched the card to a ‘Barclays View’ card that doesn’t have any of the same offers that the Uber credit card had. Feels pretty slimey if you ask me, because I wouldn’t have ever signed up for a ‘Barclays View’ credit card with its current perks. At the end of the day, I feel pretty cheated because everyone knows what happens when you cancel a credit card that you’ve used for a while.

Worst app || bank full of malpractices. 1. If your card expires, then they will turn off the auto payment “automatically”, but will let you use your card. Eventually, if you don’t check your account every two weeks or so, then you will realize that you are being charged late fees and interest. But the bank wouldn’t inform you. 2. The app wouldn’t let you sign in until you have your full card number in front of you. So if you are generally trying to check your balance, you cannot unless you first activate the reissued card. So you will continue to pay late fee (“quietly”) but you wouldn’t know. 3. In the end, they will inform the bureau about your delinquency. You will learn about the delinquency when you have your credit alert turned-on. Luckily, I had. But it badly impacted my credit, right before I was about to apply for home loan. 4. After calling, they admitted the technical issue and waived the interest but dost waive the fee. They didn’t communicate to the bureau either. So now I have to carry the burden of their malpractices and poor app interface until my credit score comes back. 5. If you login, you will realize how poorly designed app this is. A college graduate can make a better app than this!

Best Credit Card App!!. I have several cards with apps that stink, this app by far is so easy to use. I can check transactions, make payments, transfer account balances all from the app. Very secure with fingerprint login. Barclay Bank is so-so, but this app is great. I use it with Wyndham Rewards, so I pay everything with the card, and pay off transactions promptly. AND it is one of the few apps that is iPad friendly, meaning I can use it with my favorite landscape position. I do not understand why it gets so many bad reviews! Other finance companies should use the app developers!

Barclays, have you ever tried to use your own app?. Basically have the same complaint as everyone else. I enabled Touch ID for a reason. I appreciate you trying to do me a favor by making me sign in with my password almost every time I use the app but what favor are you actually trying to do? Enable Touch ID....period. Stop logging me out. Also, what possible reason could you have for not allowing the paste function into the password form? My password is some random long string of garbage because I use an encrypted password app and just cut and paste my passwords in. Another favor I guess? To sign into your app, I literally need to find a pen and paper, write down my password, open your app and then plug it in and hope I don’t have a typo. Seriously, just, so, awful. You guys are light years behind your competitors.

Can’t pay bill w/app. Or so I thought...over the last three months I’ve attempted to pay my balance on the app each time I have received an error message that either tells me that I can’t pay more that the balance due (when I am selecting “pay balance due” or the other error that tells me something isn’t working now, please try again later. Each tome I have had to call customer service for help (so much for the convenience of mobile). The first month I was told that a) my payment was received - which meant that the payment I submitted through the app actually went through even though I got an error msg and b) I was told there were some problems with the app “right now” so just use the web. The second month - same exact story. Third month, today, after scheduling a payment last Friday but getting an error msg and trying it again 2x today, i again looked at the app to see that I had 3 payments (totaling 3x my balance!) pending. I called and customer service, they adjusted my payments and told me to delete and reinstall the app, or just use a desktop...ugh!

App works great. I was wary after seeing all the 1 star reviews but this app works great for me! I can see my recent transactions and current balance on the main screen. There’s an option to lock the card there as well. The login process is easy, it does face id as i open the app and has a nice animation saying good morning/afternoon/evening. I havent had any issue with having to enter a password or security questions multiple times like other users have said. Knocked one star because it isn’t super easy to see all your previous transaction history. There’s usually maintenance and i can’t login if i try to login around 7am EST but that’s understandable, the app always works if i try it a couple hours later. Overall, good app, does it’s job.

App on iPhone needs to fail gracefully, or better yet, work!. This app auto-upgraded on my iPhone from Version 6.25.7 to 6.25.8, which boasts “Minor app improvements”, but the actual effect of the change was that the app no longer works. Specifically, it attempts to load, then disappears, crashes. I can see the Peek features (long-hold on App icon), so I know the App has my correct information. I uninstalled the app, rebooted iPhone (iOS 13.5.1, which is up-to-date, lest someone claim it’s an iPhone issue), then reinstalled the app, to no avail. Ok. I get it: an App update didn’t go as planned! I know: let me submit a ticket to report the issue, and hopefully revert to older version of working App. Ah, those are not things the App Developers or this bank value, apparently: the App Support link in the App Store takes you to the Barclays US website, which is lovely, except for the whole “missing the point about support” part. To be sure: the website has no mechanism to report App issues either. Hence my 1 star rating. An App should not take this much time from its users. It should work, allow for simple downgrades, and simpler means yo report issues.

3.5 hours later. After 3 1/2 hours of trying to purchase a train ticket in Spain online and speaking with six separate customer service representatives at Barclay MC and trying to purchase the ticket four times I finally gave up. During the process of trying to purchase the ticket I was informed Barclay had a mobile app where I could schedule by international travel by using the “Tools”. Since I was on hold with Barclay I thought I would give the app a try. The reviews did not look encouraging. I awarded a one star rating for a very simple reason. Nowhere on the homepage is there any indication of how to get to the tools menu. Absolutely nothing indicated where or what to click to go to the tools menu. The fifth customer service rep I was transferred to was the web specialist. She had no idea how the mobile app worked and could not help me find the tools menu. She and the previous representative offered to schedule my travel. I understand they will do that for me but if they’re going to have an app that they advertise in anyway whatsoever has the capability, it should work. I gave up trying to make the purchase on the Barclay MasterCard. It’s a mystery to me but why my personal bank Visa card worked without an issue is beyond me. I had my ticket within five minutes after using the visa card and I don’t understand what the difference was. I entered everything the same way.

When auto-pay isn’t actually auto-pay. First of all, this app is clunky, slow, and hard to look at. Second, Barclaycard failed to make it clear that auto-pay takes a billing cycle or so to actually get going (why? Nobody could tell me), which it mentions in tiny print on the last page of setting it up. So off I go, thinking I’m being a responsible customer who doesn’t have to think about manually making payments every month (oh, and on the front page of my account is a big banner that says “ENROLLED IN REPEAT PAYMENTS”). They don’t even attempt to contact me to inform of a missed payment or late fee. I just happen to go online to check something and see that I have a missed payment alert. Ridiculous. And when I called in to fix it, the agent wasn’t sure if my auto-pay would be “ready” for next month, so I should call in and confirm. Absolutely outrageous. Be very cautious when setting up your convenient, responsible auto-pay - Barclaycard might not be able to ha handle it.

If i could give a 0 star i would. I have been a member for over 8 years, i have never missed a payment, i always pay on time but when it comes to costumer service horrible, i made an on time payment for the bill of march, days later i made another payment for over $1600 for the bill of april, it counted as a march payment when i already paid the bill of march days before, i called and asked them they said yes because i paid it on march, i told them i had never had this problem if they could help me because i made a huge payment, got told no there policy change they can’t change the payment for april and if i didnt pay the “april bill “ ( that i already paid) they were going to charge me interest and non payment penalty. I made 2 payment on march but the second one was for the month of april, they solve nothing, so disappointed.

Fine… but makes you log into the website to make lots of basic changes. If you just wanna check a balance, or make a payment the app works well, but they’re all kinds of basic things like setting up notifications for unusual transactions over letting you know when payments have been made and received, which show toy the options but that don’t actually function and until you open up a “more info” icon and read a bunch of jargon, do they tell you that you have to log in to the website to make those changes. There’s no reason at this point to have annoying restrictions in that kind.

Buggy. This app is terrible. There’s no option to do autopay and even tho I have it set up to send a push notification when my bill is due I know for a fact I don’t get that notification. I’ve forgotten about payments because of this. When you make a payment and submit it, you are rerouted to the same screen which makes it seem like it didn’t go through. I’ve made double payments because of this before. Your balance doesn’t update instantaneously either which also makes it seem like the payment submission failed. I was just using it and there was even html showing on the page which never should have made it through QA. If they’re missing simple html in the UI, how can I be confident that your security practices meet privacy standards. USbank by far has the best financial app I’ve used.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Worst card ever!. Crap card and service, card was paid off, it was then hacked 3 different charges and they will not remove charges because they need to investigate individually and each month when my bill is due I call for update. They keep me on hold for an hour and then my account is in failure to pay and is charged fees. I have to go through the whole process all over again. They tell me it will be handled and it never is. Absolutely the worst customer service. I hate ever getting this card!! Zero stars if I could. Also they close at 5 which is 2pm California time. They kept me on hold until they closed and left me on hold.

Alerts. It’s just silly that this day and age this bank doesn’t have instant transaction alerts did all transactions by either text or push. They only have email alerts AFTER a transaction has posted. This means these could be fraud for days until you are made aware. I realize they have push and texts for payment reminders but come on, I have eleven other cards and they all have instant transaction alerts. Also, I’ve been waiting over two weeks and I still have not received a text enrollment confirmation after I replied to confirmation text. This stuff should be instant

Only missing push notifications!. Overall its a good app, however the one thing other apps like Chase and Discover have that this one doesnt is push notifications as soon as the card is used, with discover i get a push notification as soon as i use the card, with chase it takes a few seconds, with barclay i only can get an email a few days later when a purchase is posted so i have to check the app often to make sure there are no shady purchases

Issues with the app. I have been a customer with Barclay Jetblue for about 10 years. Unfortunately recently I have had some very bad experiences with the app. I constantly get the same error message. Previously I could easily check my account balance and make payments when necessary. Now for over a month I keep getting the same error message. I have called the 800 number and changed my password to no avail. The app has gone from very good to horrible. Someone has to rectify this issue ASAP. My time is too valuable to have to call constantly because your app works poorly. I use my fingerprint to go on the phone app so I don’t know what the issue is. Adolfo.

Excellent service. I really like the payment option on Barclays. I think that having the App is great and very easy to do what I need to accomplish. I like the fact that I can make a payment in advance and also set up repeat payments, so as not to take the burden to know that I won’t need to call and make my payment each month. Thank you Barclays for making this such an easy task. Sincerely A very satisfied customer

Worst service ever. I Gotta say that this car has the worst service ever. Their security questions are coming from some sort of a service that doesn’t make sense for the user. I tried to validate my service and security for five times and all the questions that they choose had nothing to do with me. I called three times in a month of service to validate my identity. I understand that you need to have security, but this is incredible frustrating. Some of their security questions were asking for individuals or family members that I did not recognize at all I never had to do that for a credit card this is frustrating. I cancel my account in less than a month from opening I will suggest to go and find all their credit card company.

Not Listening to the reviews. This is now my second review. Why are you the only card that doesn’t give purchase notifications other then emails or text messages. Push notifications would be very useful, helpful and more convenient to the consumer. UPDATE: I stand corrected you can get push notifications for every purchase. It unfortunately isn’t located under “notifications” but it is possible by going to “tools” then “control your card.”

Password handling is bad. TouchID worse.. How on earth do you make an app in this era refuse to enable copy/paste? The fact that password managers are a must in today’s world mean that the inability to paste in a password is absurd. Add to that the fact TouchID becomes unusable when you don’t like in for more than a day due to “security concerns” makes this app dead on arrival. The app used to at LEAST allow you to paste in your password, but that has been broken sometime in the past few updates. I seriously cannot believe Barclays would have such a terrible app on the App Store. For these two reasons this is THE WORST banking app I’ve used of all the major and a few regional banking institutions. Come on Barclays. Get your act together.

Face recognize(auto log in) doesnt work well. This is credit card app, unlike any other apps that are being used everyday. I barely check it once a week or twice a week max. It has face recognizing feature but it doesnt work as it should. It wont ask for password for few times then all off a sudden it ask for password. When you ger used to auto recognition feature u slowly start to forget ur password. Its frustrating when you really need to log in, you forgot your password, and face recognition feature wont work. And after a try or two of guessing ur password, app will lock you out. To unlock yourself in, 4 digit of ssc, account number, and bunch of stuffs requires. Overall, its frustrating.

Amongst the worst banking apps I have used. I can’t believe a trusted financial institution has an app that has this poor of a user experience. My biggest gripe is that this app makes paying my credit card difficult. In order to pay my balance, it takes 8 more “clicks” than my CapitalOne card. Want to make a payment? You have to click on “View Payments”. Then you have to click on the “Amount” toggle switch when it should be the default option. Most frustratingly, then there isn’t even an option to select your actual current balance. My bank account - the only source for payments - is not selected by default; the list goes on. Who designed the UX and did the QA testing on this app?

Will NOT let me talk to a manager.. I have called him multiple times and spoke to many people overseas I have about three different reference numbers. No one will let me talk to a manager I have done my part and I have paid my bills and they are making a ton of interest on me and I cannot get my airline miles which was promised to me when I signed up for this card. And they still want me to pay a yearly fee. They want me to do the right thing but they won’t even give me the common courtesy of doing what they said they would do. They are the ones gaining here they are the ones getting interest. I would strongly suggest no one open a card with him because they will not do the right thing.

THE REVIEWS ARE TRUE!!. This is a HORRIBLE financial institution. They charged me fraudulently for a transaction and after more than a month in dispute, I managed the issue myself with the company who charged me (I did Barclays job for them). Aside from that, they’ve just lowered my credit limit from 5500 to 1400 without notice - my credit score is over 700 and I updated my income recently because I’ve had a decent increase. Their reps over the phone are the WORST people to talk to. They either have no clue what you’re talking about and are NOT financially educated or CLEARLY don’t want to do their job of taking calls. Haven’t closed the card because it’s going to further impact my credit but not dealing with this “bank” may be worth it.

Crashes Voiceover upon launch. I am blind and use apple voiceover on my iPhone to access my phone. Upon launching this app, starting at some point during the iOS 13 release cycle, the phone freezes and voiceover becomes unresponsive. Eventually, voiceover restarts and I can interact with the app for a little bit, but is soon as I try to start typing my account password to login, voiceover becomes unresponsive. Basically, the app is unusable. This issue exists with several apps that I use and I am in contact with all of their developers as well. Thanks for your attention to this matter.

Meh. The app used to be decent enough to manage my card but now it not only disables Touch ID all the time but also is impossible to tap on anything. It took 5 minutes of tapping all over the password input box to finally get a keyboard to pop up that let me type in the password. (Since paste from my password manager still doesn't work.) Then when trying to look at Transactions tab again nothing works to tap on to bring up other menus. The arrow that I guess is supposed to be the back button doesn't do anything and I have swipe left from the side to pull up the main navigation just to start over again. I'm thinking of just deleting the app at this point and using the site login for all my account management instead..

Terrible for Travel. I seem to have endless problems with this account. Most recently buying flights with a domestic airline and booking a hotel in peru. The first I gave up with in the end and used PayPal and the second was initially denied, but after I called card security and resubmitted the payment while I was on the phone it went through and the hotel confirmed it. But then today I can't find any trace of the charge so I called the card yet again and they confirmed the charge. So there's a $700 charge on my account and record of it anywhere except in the difference between the available credit and the current balance. I'm so tired of this account. World Elite Mastercard is calling me back.

Love the new features!. New features, especially the payments section is great! Layout is very clear and the green icons clearly show when I completed the step correctly. I also appreciate the change where current balance is listed as a payment option, as I no longer need to remember the balance that is listed on the home screen/dashboard and enter that into the “other” payment option field.

Too many bugs for a simple banking app.. I have a savings account that I periodically like to check through the app but as many people have discussed the app either forgets your device every log in, or periodically resets your security preferences like facial recognition. The app then takes you through a labyrinth of security verification processes only to give an error on the last one...taking you to square one. While I enjoy the high interest savings account there’s really no excuse to have a horrible app in the year 2019. Would I be interested in other financial services through Barclays? Probably not if I can’t execute my business on the go like the millennial I am, or I’m forced to deal with clunky tech from the year 2005.

Difficult to use. This app is very hard to use. The print and text is so light I need a flashlight and magnifying glass to use the app on my phone. On my iPad the type is big enough but it is so light I still need a flashlight. Would you please consider black type. The repeat payment was difficult to set up and even after many tries I’m still not sure if I really have it set up to pay the balance in the account on the the same day each month. I hope I will grow into it or I’ll find another card.

Consistent Issue. There’s definitely a theme developing within these reviews… my only gripe is the fact that every now and then, I can’t use Face ID to unlock my account and I have to remember my password. I have all my passwords written down on my notepad, but what if I don’t have it with me (which happens often)? If Bank of America, AMEX, and other banks don’t require passwords intermittently to access my account, then why Barclays? I find it hard to believe that it’s because of “security reasons” — especially when Face ID is more secure than a password anyways. To be fair, the app layout is very easy to work with (for the most part) and it is designed more beautifully than other mobile banking apps, but the negatives outweigh the positives.

No push. Ironically the help screen says click to enable push notifications for any of the notifications. But the only options are email and sms. Common BC, may as well add carrier pigeon and telegram. Push has been around for years and is the gold standard for credit card activity awareness. Go get an account at Chase and see how it should be done. If I wasn’t a Lufthansa flier I’d be out of here so fast your head will spin. In fact the insane 26% may drive me to that anyhow on top of the whacko annual fee. So fix at least two of this, m’kay? Also, I’ve yet to see the supposed free annual ticket once and have been a cardholder for 10 years. After typing all this. I think it’s time to dine find a new travel card in fact.

I just got a survey .... .... from Barclays asking about how I use my card. I said I almost never use it because like most people in 2020, I manage things from my phone and since this app constantly disables fingerprint ID and has password issues, I don’t use the card. I’d be more understanding if this was something I thought was on Apple’s end or was common in other apps. But NONE of my other apps - including my bank, health insurer, two other major credit card issuers, or my auto loan financed (another big bank) which handle sensitive info have this problem with their apps. Biometric login works flawlessly on all of them with only very rare and always temporary glitches. I’m not holding my breath for them to fix, but maybe if enough people complain ...

Newest Download is Buggy. Downloaded newest update and the app is quite buggy. It asks me to activate my card which has been activated for over a year already. When I attempt to enter my current information to re-activate my current card it tells me that the information does not match what is on file. How can it verify what is on file when I go into my profile information and it is currently blank when I view it and lastly the chat function does not fully load when being transferred within the app to the chat relationship manager about these issues. What was a good app with 4-5 stars has dropped to 2-3 stars after this last update. Get it fixed DEVS.

improve content and transparency. I had the touch ID issues that everyone mentioned but that finally seems resolved now. What is most irritating about the app to me is the lack of important information up front. when you log into most banking apps, you can easily see your closing date. not here. You can navigate to one of your statements and then zoom in and look around to find it. why not put it right up front, instead of saying just “No payment needed” with no further information? I can see that you guys tried to make the design appealing, but please listen to the reviews about accurate and transparent content as well

???. I don’t know what all these bad reviews are because it took me two minutes to activate my account and it has everything you possibly could need I guess you all think that if you ignore your payment date that it will be taken care of I don’t think so but the app itself is good and easy Gotta be a moron if you can’t use his app or just a stupid phone And for those who say there’s no push notifications then they didn’t open up yet correctly reload the app and it will ask you if you want it on your phone phone

Great app if the year was still 1998. I’m the type with a ton of credit cards across most of the major US banks since I’m big into maximizing credit card points and benefits. As such I regularly use the Chase, Amex, Citi, Capital One, and BoA apps. All of these are slick, modern, state of the art apps that one would expect in 2021. Barclays meanwhile feels like 2 decades behind the rest. It is clunky, the interface is sloppy, it constantly asks for my password despite having Face ID active, and perhaps the biggest joke of all is that there’s NO way to get push notifications for transactions. The app is virtually incompatible with modern standards. It hasn’t changed in YEARS. Take a look at the difference between this app and the other major bank apps and ask yourself, who would YOU want to do business with?

Not intuitive - major lag in processing. This is the worst credit card app for those who like to keep a zero balance on their card. Payments and charges take multiple (3+) days to process. The current balance reflected is never accurate making it hard to budget and make accurate payments. You constantly feel like you are over-paying (or over-spending) because the balance is not updating in real-time. ***You never know how much you need to pay off unless you stop using your card for a few days to let the balance settle.*** My community bank has a better mobile experience. It’s hard to find the payments in the first place and then they block you from paying the full card balance if there are “pending” purchases aka if you have used your card in the past three days. It truly feels like they don’t want you to pay off your card so they make it impossible to make full payments and view a real time balance.

Buggy. App no longer shows transactions. Pretty lame No error codes. Just no longer shows transactions with the explanation "no billing periods" Will no longer load previous monthly statements Idiotic customer support people who say they have no support for mobile app. Disappointing Finally - weeks after I reported the issue, I did receive this note from the development team: Thanks for providing additional information. We are aware of this issue having resurfaced recently & would like to reassure you that we are working towards a fix on priority. Please ensure you are updating to the latest version of the app to avail of fixes and new features. Many Thanks.

Easy to use and efficient. I also have a credit card with Discover and even though I love their app, some of the external features don’t always work like their widgets for the iPhone. Barclays got it functioning on the first try which is really great and saves me a lot of headache. This is an important function for me because it’s how I keep up to date with my spending and balances. Not to mention it took a few minutes to set the whole thing up. I’ll be updating my review as i continue to use the app but so far, I’m very pleased with what’s being offered here.

TruBlue points not visible. I have the JetBlue trublue rewards card. My frustration with this app relates to the trublue program. I haven’t used the program in a while so I must have accumulated points but I don’t see the sum of my trublue points. Nor can I easily find the total points I have. I can see the total I earned last statement and the points earned so far this statement but not the total. When I click on redeeming points I get general info about the program but not the actual ability to redeem. Seems like it’s obvious I would want to see my rewards total easily if I’m paying an annual fee for this card to have this program. I’ve decided 99 is too much. Canceling this week.

Payment functionality fix. I don’t normally review apps but wanted to suggest something since I’ve run into a few issues with the payment portion of the app. When I go to pay my bill I select all the right fields and submit but instead of perhaps returning back to the homepage or given a success page it reverts back to the payment page with the fields empty. It may confuse the user thinking perhaps their payment didn’t go through and there was an error. There was a time when I did do this and I ended up having the payment applied twice. Other than that the app works fine.

Annoying. Every time they update this app they turn off logging in by Touch ID. This absolutely infuriates me. I don’t know and don’t want to remember my password, I want to use the biometric log in feature built into my phone! The app should save my opt-in to Touch ID once and for all and never require me to elect it again, let alone do so every single time they update the app. To add insult to injury you can’t even use password recovery directly through this app, you have to log in to the website to do it. There are other stupid gaps in functionality too, like not having your current balance as an option on the payment screen. Barclays, make your app more user friendly for your customers!

The app is not my favorite. The way it shows your your statement balance is really not intuitive. If you’re trying to look at a purchase that is out of your current statement by 1 day, you have to search for it. When you pay off your balance I almost ALWAYS have to manually enter in the numbers because it doesn’t show you the current balance due. It has the last balance due instead. It would be a lot better if they took some advice from the MACU app. It’s extremely intuitive and helpful. Even Wellsfargo has a better app. Sorry to bash on you guys. I don’t mean to it’s just a little frustrating to use this app. Hope this helps the developers!

Not sure why this gets so many poor ratings. I love my Barclay card. As an Apple user, I get 1 point for every dollar I spend and 3 points for every dollar I spend on Apple. If you use the App Store or buy Apple products it is a very good deal. When I earn a certain amount of points, I receive gift cards for Apple, which I use to buy music or things for my apps. There is no yearly fee and as long as you keep up with your payments I have never experienced a problem. I find the App easy to use, get my info/transactions, and pay my bill. Which is really all I expect from a credit card App. Considering a lot of cards give you nothing for using their cards, I think the Barclay Apple Card is great. Particularly if you buy Apple and/or purchase things on an App. I don’t know if they have a similar Google Play Card but it would be worth looking into if you spend money on Apps from there.

Cannot pay entire balance. As mentioned by someone else, the app is great but payment is always a nightmare. I have to remember what the balance is so that when I navigate to the next screen I’ll remember. Also, it takes a while to update/sync up available credit with balance. Problem with that is if my due date is a couple days from now, I can’t pay off the balance - since a number of transactions stay pending for 2 days or longer. Then I have to keep checking for when the balance is updated to reflect the correct amount.

Garbage app. I have banking apps with other institutions that allow you to see your account info and easily set up automatic payments. This app does neither. The amount of “tools” it offers is garbage. Sure you can see your balance and make a one time payment, or view that you don’t have auto payments set up. But actually set it up so that you don’t miss payments and get charged the deferred interest per the terms and conditions is shady and a poor ethical banking decision. As soon as my balance is paid I will cancel this card altogether because Barclays is no longer worth the headache. Promotional APR is nice but I mean everyone gives you that. Step up your game or disappear, Barclays. Maybe this is why apple is launching its own card (because they don’t want to work with you either).

Slow notice. The Barclays card and its app are both very usable. The one drawback is that it takes days to receive a text notice of purchases. By comparison, capital one instantly notifies by text of purchases of all sorts. I consider that a great feature because then I know instantly if my card is misused or there are any questionable purchases. Barclays delay in notification is vexing when it is clear that the technology for instant notice is available.

No statement via mail or email. Last month I was one day late on my Barclay payment. The reason is that I did not receive any notification of balance or payment due. That’s ridiculous. It is the first instance I’ve ever had our credit card company not sending you either a paper statement or email. I find it very bad administrative practice on the part of Barclay. when I did get a notice, it was in the form of you failed to make your payment yesterday. Why didn’t Barclay send me a statement or email before the payment was due. I immediately made a payment many times and it required minimal. I would like Markus to acknowledge their error. Robert

Can’t add to Apple Pay. I have a Wyndham business card and it says your card isn’t support whenever I try to add to Apple Pay through the app. Zero support to request this gets fixed and I’m not calling a number where they just ignore me. All the rest of my credit cards for years has worked with Apple Pay but guess Barclays doesn’t care Update: the card was added so it works with Apple Pay today, I’m satisfied with it now

Dependable and accurate. I’ve had this card through Hawaiian Airlines for years and love it. Customer service is excellent and the mobile interface is easy to navigate. The only improvement I would want is a text field for notes for each charge. Since you cannot see the receipt, would be nice to have an area where I could describe the purchase, or make custom categories.

Jailbroken device message. I use the iPhone 7 plus sometime back in Sep 17, 2020 (I had a screenshot saved) and there was an unexpected message appearing at the log in screen. It read ''Jailbroken device detected: Your account information may not be secure by running the Barclays mobile app on a jailbroken device. For your protection, it is strongly recommended that you access your account on another device, or reset your device to its original settings'' The device was not modified in any way and I still have the receipt from Apple on the iPhone 7 plus device. Could this be an Barclays error?

Quit making me enter my password!!. Decent app, but the push notifications are freaking annoying I cannot turn them off and I’ve called in to support with no success, I’d rather have a text alert not a push alert but no they don’t offer that for transactions but they light my phone up with alerts without my consent. Also I’m routinely forced to enter my password to sign in even when setting up fingerprint in the past, what a joke. It doesn’t even let me paste my password, they would rather me have to manually type it in, which is more error prone and vulnerable to shoulder surfing.

Could be better. At least once a month I have to track down my password and log back into my account on my app. Seems great at first blush (for security reasons you know), but this thing is compatible with face scanning, and fingerprint scanning on my last phone. With this tech I shouldn’t have to remember a really long password with caps, special characters, etc. Mine is actually quite long and diverse, as it should be. But it has to all be typed in at once - no flipping to other apps to read a section and then type that in. And of course copy and paste is disabled. So I’m left with writing it down and reading from that. Not a very good way to stay secure. There’s a lot of good with this app, but this ruins all of it.

Security!?. 1. Website allows past 30 characters for password, but this app only supports up to 30. I must decrease the length of my password now to accommodate a less secure app :-/ 2. Requires security questions even if you have Face ID set up. Security questions are BY NO MEANS SECURE and are often references to laughably easy-to-locate personal information. So I instead use random characters for security questions. Even so, I find it hilarious that this app requires security questions any time you attempt to access it. WHY??! I can only think they don’t understand industry security practices. 3. Need support? They have a chat section in the app. That would be great if it worked. I registered a chat and was met with a totally blank page. For what it’s worth, I came there because everyone on the phones was busy, so perhaps the app just doesn’t have an indicator for “nobody is available right now but we’ll respond as soon as possible”. Kind of an obvious thing to miss, though... I will endure since the Uber Card has such an incredible reward rate.