Fidelity Investments App Reviews

Fidelity Investments App Description & Overview

What is fidelity investments app? Invest at a firm invested in you. Fidelity’s secure and easy-to-use award-winning app gives you access to a broad choice of investments, expert insights, and investing tools—helping you make smart decisions with your money.

Secure: Fidelity is committed to your security with 2-factor authentication, voice biometrics, security text alerts, and money transfer lockdowns.

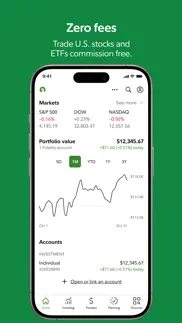

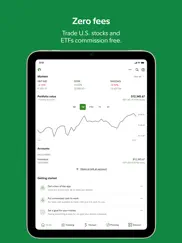

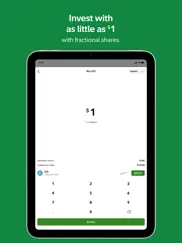

Easy: Get started with no account fees or minimums when you open a retail brokerage account. Plus, get commission-free trades for US stocks, ETFs, and fractional shares for as little as $1.

All-in-one app: Deposit checks, pay bills, track spending, trade stocks, and more, all backed by 75 years of Fidelity’s financial expertise.

Here’s how it works:

• Create an account

• Add funds

• Make your first investment

What’s inside the Fidelity app:

Powerful trading tools

• Trade stocks, ETFs, and mutual funds using industry-leading research and market analysis.

• Trade smarter with advanced charts and on-the-go technical analysis.

• Monitor markets and trading with real-time quotes.

Cash management

• Trade, transfer, deposit checks, and pay bills.

• Schedule transfers and automate investments.

Financial learning at its best

• Build your confidence in investing with podcasts, articles, videos, and more.

• From small classes and coaching sessions to large multi-session webinars, we have something to help you take your knowledge to the next level.

Alerts and notifications

• Receive timely, customizable alerts to help you manage your stock trading.

• Set price triggers so you never miss an entry or exit on your investments.

24/7 customer support

• Get state-of-the-art security in 2-factor authentication and voice biometrics.

• Tap to chat with a Virtual Assistant 24/7.

Accessibility

• Use enhanced voiceover and dynamic type.

To learn more, go to https://www.fidelity.com/mobile/overview.

Looking to manage your workplace benefits like a 401(k) or HSA? Download our NetBenefits® app in the “More by Fidelity Investments” section below.

762430.45.0

Please wait! Fidelity Investments app comments loading...

Fidelity Investments 3.89 Tips, Tricks, Cheats and Rules

What do you think of the Fidelity Investments app? Can you share your complaints, experiences, or thoughts about the application with Fidelity Investments and other users?

Fidelity Investments 3.89 Apps Screenshots & Images

Fidelity Investments iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 3.89 |

| Play Store | com.fidelity.watchlist |

| Compatibility | iOS 16.0 or later |

Fidelity Investments (Versiyon 3.89) Install & Download

The application Fidelity Investments was published in the category Finance on 22 February 2010, Monday and was developed by Fidelity Investments [Developer ID: 348177456]. This program file size is 677.62 MB. This app has been rated by 2,269,773 users and has a rating of 4.7 out of 5. Fidelity Investments - Finance app posted on 26 January 2024, Friday current version is 3.89 and works well on iOS 16.0 and higher versions. Google Play ID: com.fidelity.watchlist. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

| Fidelity Charitable Reviews | 2.8 | 43 | Free |

| NetBenefits Reviews | 4.6 | 24,199 | Free |

Thank you for using the Fidelity® mobile app. The latest version includes: • Accessibility-related upgrades: Continually improving usability to increase compatibility with assistive technologies • Bug fixes and enhancements Help shape future versions of the app by writing a review and sharing your feedback!

| App Name | Released |

| Crypto.com - Buy Bitcoin, SOL | 31 August 2017 |

| Splitwise | 24 August 2011 |

| Zelle | 12 September 2017 |

| PayPal - Send, Shop, Manage | 03 February 2019 |

| MySynchrony | 03 October 2017 |

Find on this site the customer service details of Fidelity Investments. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| CalcTape Paper Tape Calculator | 16 May 2012 |

| Debt Manager | 08 December 2011 |

| BA Financial Calculator Pro | 20 November 2009 |

| Quick Checkbook Pro | 02 January 2013 |

| MoneyStats - Expense Tracker | 14 January 2018 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Gmail - Email by Google | 02 November 2011 |

| WhatsApp Messenger | 03 May 2009 |

| 09 October 2009 | |

| Google Chrome | 28 June 2012 |

| YouTube TV | 05 April 2017 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Slay the Spire | 13 June 2020 |

| The Past Within | 02 November 2022 |

| Terraria | 28 August 2013 |

| Minecraft | 17 November 2011 |

| 75 Hard | 19 June 2020 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Fidelity Investments Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Thoughtless App “Upgrade”. The bank is great and the app in general is robust, especially compared to others. However as is often typical of “upgrades” this latest ones seems to have been done by a team that doesn’t actually use the app. As someone who interacts with the app a few times a day, it’s a flaw that now only 2 columns can be seen at one time (versus it used to be 3). Makes a huge difference in an already tiny screen trying to maximize data. Also, it shouldn’t now take 3 taps to see account history. By the 3rd tap (after the unnecessary step of having already selected which account), the user is prompted to do so again but this time with rotary option—just present that option to begin with. But speaking of account history, lumping that in with “activities and orders” is not intuitive. Seeing a list of historic dividends and payouts is an obvious goal for investors—should be a stand-alone option not needing 3 clicks to access and more buried in a sub-menu of “transactions”. Tech teams seem obsessed with constantly tweaking websites and apps but mostly for sport (do they secretly compete to just tally up high counts of random changes??) and not necessarily with the end user in mind. Changes should be improvements and not just for the heck of it. They should maybe beta test changes with actual users and fans before broadly releasing. Otherwise the result is “upgrades” that are really downgrades in useability .

Excellent platform. First and foremost I can easily buy and sell shares of stocks using the Fidelity platform and now there is no charge to trade . I also appreciate whatever money that is on hold waiting to be invested is automatically placed in an interest earning account that is significantly higher than what I can receive from my regular savings account in my bank . Everything has been very easy and clear from trading to moving money into my brokerage accounts with Fidelity. I use my Fidelity credit card frequently because 2% of that amount automatically goes right into my brokerage accounts at Fidelity per my instructions . There is always personal assistance I can speak to directly if I desire to do so . And lastly there are all kinds of webinars to further my knowledge about trading in general that I can take whenever I have the time to do so. I trust this platform and consider it excellent in executing my trades . I am really a beginner in my second year of trading myself and I love it .

Fidelity just ruined the app.... Fidelity just removed all content from the “Feed” tab (which could be scrolled through without logging in). This was an invaluable feature of the app because it displayed a global map of world market states (up/down), futures and open market values, equity quotes that related to your holdings and watchlists, and market news briefs/links relative to each equity displayed (including quick charts and instant quotes). Additionally, some brainiac actually decided to post a message in place of all that highly relevant content which states “To help you navigate...we’ve streamlined your client experience for the things you do most”. Umm, you mean like knowing where the markets are, where are they headed, what are my holdings doing, etc.?..Why in the world would any client want that kind of stuff immediately available?? Users of the Fidelity app are now forced to use competitors’ mobile apps for that quick access to comparable info throughout the trading day, and I sincerely hope one or more of those competitors offers a workable replacement so that we can take our trading accounts else where.

Financial research GIANT! LOVE the data!. I have tried many other Investment companies over the last 20 plus years for quality research information. I ALWAYS go back to Fidelity Investments for my research on companies, businesses and industries. Fidelity puts technology at the forefront in their business (I know from my own personal experiences with Fidelity over the years). Fidelity is ALWAYS “that” company to spearhead their business with the new advancing technologies. Funny side note...I remember working at Fidelity a LONG TIME AGO when they were one of the first companies using email for their customer accounts before any other investment companies had heard or thought of implementing that new technology. I completely trust the research information you can find on the website or with a customer service agent. I currently like to attend Fidelity’s financial webinars like socially responsible investing to options. The website is a massive resource for those who are looking...

I can’t imagine a better financial service!😊. I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isn’t rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelity’s research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

So dissatisfied with the beta. As a previous fidelity intern, I first learned how to invest while working at the branches. I was so excited for my first real paychecks to be invested. I opened my first brokerage account and 401k with this company; and have been a credit card user since 2016. This app used to make investing and tracking my finances so easy until the most recent beta update. The interface has so much potential to simplify things, but some how makes it so inconvenient to do the basics like setting a trade on the close in my brokerage account. I can’t I’ve used this app so much less due to this inconvenience. If I am on my Roth 401k and want to check the balance detail, this instead shows a rollover 401k and each time I have to click on the drop down. I can’t click out of the credit card transactions without having to restart the app. I just switched back to classic and compare it to being on the desktop is how terrible this beta version is. The quote details alone, will make me stick with the classic for as long as I can.

Updated review: Thanks for listening, Fidelity.. Old review: “Fidelity has always felt customer-oriented and professional. Unfortunately, this apps User Interface (UI) fails to live up to that standard. In an increasingly digital age where attention spans are minimal and trading is readily accessible, Fidelity needs something with a greater focus on an active retail investor. Recent events have proved without a shadow of a doubt that the retail investor plays a large role in the marketplace today. This is unlikely to change. Fidelity’s current UI caters to an individual with multiple, minimally active accounts (accounts that may even be managed by Fidelity itself). Though this isn’t inherently bad, an overabundance of information can negate a customer’s ease of use. I would love to see a cleaner, quicker UI with much better access to brokerage.” Update: Recent UI and options level improvements have caused me to revisit this old review. Fidelity’s mobile app has finally made a shift to a cleaner, quicker UI that is more in line with other broker’s offerings. Though I feel the charting could still be improved upon, this new app is far superior to what was, and proves that Fidelity is listening to user feedback.

Worst treatment ever.. I had an investment account with Fidelity through my employer. After years, I opened checking and savings accounts. After that I cashed my unemployment check from the State of Pennsylvania. My account was immediately frozen on suspicion of fraud. I don’t understand why because the check had my name and clearly printed by PA. They then asked me to provide my details. First I faxed the documents but nothing was done for almost 3 weeks. Only to be told my documents are not in good order. I mailed the documents and delivered and signed for by one of Fidelity employees but they said they couldn’t locate them. At first they yelled at me and accused me of lying but I gave them the tracking which showed the signature of their agent. After that they requested me to fax again. I did as per their request but they said they can’t find the documents. Then a guy from fraud gave me a link to their Vault portal to upload the documents. I uploaded all the documents while I had him on the phone. All the documents were uploaded based on his request. The following day I was told the documents are not in good order I should mail them or fax them. This went on for a month and as of writing this I’m still struggling with them.

New App Experience is Bad. Your app has a 4.8 star rating. Why would you completely change the app experience? The new app overall is less intuitive and takes many more taps to do the same actions. For example, I especially don't like the multi-screen wizard style stock order process. The wizard process may be easier for absolute novice investors, but it is so much slower and harder to adjust stock purchase parameters on the fly in a fast moving market. It takes so many more taps to perform these operations than it used to! Please give us a single page stock purchase/sale option in the new app experience. Also bring the tabs in the account view back when you are viewing an account. You've doubled the taps needed to switch between app views. With the tabs I could jump between balance details and activities with one tap of the tabbed navigation. Now you've doubled the taps where I have to click to see Activities then click back to account overview then click into Balance details then back to account overview.

They get it!. Fidelity fully understood UI visual flow when building this application. For me it seems that their design team also figured in swipe movement [finger] to screen. Most other financial institutions who offer investment mobility focuses on desktop to keyboard similarity rather than small screen finger gestures. Why is this a problem: hassle work flow. What’s visually on the screen that’s important, swiping/scrolling trying get to what I/We need can cost us profits or make us money. I also like Fidelity makes explanation notes available on current screen rather taking me to URL which creates navigational confusion. Everything I wrote above keeps me interested coming back to this app rather using other apps which over simplifies and take tools away. So I am getting best of everything with Fidelity and I do like some separation with FidelityGo. Quick view conduct business and done. Again most important transactions are on screen with less need for constant finger play.

Be careful!. I signed up for Fidelity a few months ago. Everything seemed to be working well at first. Then, I realized that over $500 had been taken out of my account as I was trading, claiming that it was taxes that were being withheld. I have never had this happen on any of the other apps I use (Webull, Robinhood, Ameritrade, etc.). So I called Fidelity. The person whom I first spoke with said that I just needed to fill out a tax form and then the money would be placed back in my account. He then sent me the tax form. I filled it out and uploaded it to my account. After about 10 days of not seeing the money placed back in my account, I called again. This time, the representative said that the first person whom I spoke with was not correct. The money cannot be placed back in my account. And in order to get the money back, I would need to go through the work of retrieving it from the government when I do my taxes next time. So just to warn people, if you are going to use Fidelity, realize that if you download the mobile app and link it to your bank account, this may very well happen to you. And there is no warning or notification that you even need to fill out this tax form. So I would personally use one of the other well known apps, which all seem to be immune to this problem. Or, if you do create a Fidelity account, make sure to figure out how to get their tax form and upload it to avoid this mess.

Ridiculous. Slow response time! I have voice verification and they even can tell me who I am when I call, but the system didn’t recognize my apple phone update, so they locked out my account and made me physically drive to a branch office and present my ID, before they would unlock my mobile phone access spent 1/2 hour on the phone with two separate call centers then another our driving to and from their office presenting my drivers license to prove who I was. They didn’t accept my correctly answered security questions, I am a doctor and had to get this fixed during my busy day of patients. Not only this but it’s earnings season and I have over two million fully invested in the market with fidelity and took losses over $20,000 before they would simply unlock my access to trade. The totally absurd thing about their system is they said they would be happy to place a trade for me by telephone WITHOUT verifying my ID but would not unlock the phone I have been using for FOR weekly and daily trades over two years, in order to do the trades myself.

UX is Getting worst and worst with every new update.. I’ve been using the Fidelity IPad app and Desktop view for years. I use to use it without much frustration other than limited column sorting. However, lately it’s getting more and more frustrating to use. Many of the most important features are hidden while unimportant summaries are splashed all the place to the point I have to navigate around them like obstacles. The table listing all of my investments with the columns of performance metrics should be available on the front page and clearly labeled if it is going to be hidden. Instead it’s buried 3 pages down with no clear button or call to action. I have to poke around every time I visit this app, to find the most fundamental tools. The buy button use to work good. You press the buy button, and you get all the fields you need to find the ticker and set the parameters. Now it’s broken out in to separate screens and if you want to change something you have to go back and forth loosing choices you already made. Plus there are buy features that are now missing in the process. If they are not missing I can find them. There isn’t enough room to go into all of it here but I’m very unhappy with the direction Fidelity is going in regards to the user Experience. I’m Getting the sense the designers are all inexperienced interns. Now I need to open my computer and see if I can still make a simple trade.

iPad Pro - Makes me rotate my screen to trade. Really?. I have been with fidelity for years. I am really surprised by this app. I don't use it mainly because when I trade, the beautiful full screen makes me rotate my iPad Pro 13” sideways to read the screen. When I have it connected to my keyboard, I have to read sideways to place a trade. Do the programmers realize how ridiculous this is? You’re a multi million dollar financial company and you write an app that make you rotate your screen because it turns into an iPhone to make a trade? I only use my phone becuase of the pain the iPad create. Who is in charge? IT leadership needs a new head. Also, making a trades could be easier. We need a quick trade now button. Like click your lot and say sell now. Something without all the keystrokes. Lastly, when making a limit order, put the time of trade before the limit price so you can only go back one screen to make a quick change to price before executing. Instead you have to go back 2 screens and forward 2 screens to change the price. Not well thought out. I also agree with everything Bakutraders said about general trading with fidelity. Not sure why there are no premarket quotes on the apps, premarket hours, trading premarket qqq, etc. Come on fidelity get with the times.

Ok I guess. I decided to open an account and put $1k into it just to see how it is, because I feel more comfortable with a company like this as opposed to Webull for example. TD is merging with Schwaub so I decided not to get involved there for now. I don’t like the layout at all to be honest. It’s hard to navigate and it’s not intuitive or logical when compared to something like Webull. The charts are not good at all. I also can’t even find the quote book showing the bids and asks on the mobile app. Honestly I will probably continue using Webull, unless I decide to use the desktop version (I never do, I trade when I’m at work usually, on mobile) and it’s better. Perhaps I will keep some longer term stuff here eventually, maybe an IRA or something, but it’s doubtful since I don’t want to have multiple accounts tbh. I’ll keep playing around with it and see what I’m going to do next week when the market is open (also can’t check crypto prices on here afaik). I likely will just transfer the $1k back into my bank.

New software. Really hard to navigate. Making a limit trade is not at all self evident. System architect did not do a great job. The test for any writing or software is- “is the writing self containedly meaningful “. Answer-your guy gets an “F”. If I am forced to use the new system all the money will go to Schwab where I have another account. I don’t know what you guys were thinking. I made my living writing software and what is better for you, needs to subjugated to what is best for client. Opening screen should be all your investments. You should not have to dance around through a bunch of screens. Buy and sell screen is totally opaque to place a buy order that is not a market order. Getting other service information, transfer of funds, data on forced withdrawals from IRA is also unfindable. Phone number for representatives should be on every page- you are dealing with big money here- help should be your PRIMARY concern. I constantly get offers from JP to switch with incentives. You guys need to get it together. Kurt Widstrand

Terrible customer support. I had a terrible experience with fidelity and their customer service. Long story short.. the New York State Child Support Department accidentally levied my account and sent notice to fidelity. I called fidelity and they notified that nothing was going to happen with my money after me asking multiple times for reassurance. 3 weeks later I get a notification that my positions were closed on my BEST stocks. I called again, dealt with people who tried to rush me of the phone to just be directed to their law and operations office, which I had to wait for a returned phone call. I received my return call and I spoke with an absurd and extremely rude representative by the name of Krissa. She told me “it was a courtesy that she was even calling me back and wasn’t obligated to do so.” She even told me that they didn’t even need to notify me that New York State was placing a levy!!! What??????!!! A courtesy?? After investing thousands with them it’s a courtesy that they call me about someone trying to take money out of my account when it’s their fiduciary responsibility to protect my assets and they failed to do so and now I’m waiting 3 weeks later for money still from New York State!!! I was just about to transfer $25,000 from Robinhood to them, but now I’m looking to cancel my account with fidelity and also report them to the Better Business Bureau.

Terrible new splash screen. I’ve been a Fidelity investor for years and I specifically arranged my screens so I could see the market indexes without having to log in. Now, the first thing I see is a childish animation and a forced login experience. Shame on you Fidelity for moving in this direction. I’ve already switched to a friendlier app so I can take a quick glance at the market overview without having to log into something. Fidelity, you moved the usability needle backwards with that update. [Update Dec 2022] While I know you can’t please everyone, it’s not hard to get the little things right. Respecting a user’s personalization settings is one of those areas. Although I have the market overview set as my default splash screen, the app is stuck showing my portfolio. I don’t want to see that as soon as the app clears the splash screen, and I ESPECIALLY don’t want anyone nearby to see it if they are shoulder surfing. I love Fidelity as an investment house, but please put better people in charge of curating the customer experience. For an institution with as much prestige as Fidelity, I can’t understand how the digital side of the house is allowed to continue offering a product that’s really amateur hour. I’ll change my review when the quality and customer experience rises to a par with your competitors.

mr.. Every representative of Fidelity that I have ever had the privilege of being helped by has been very friendly, very willing to explain, help, and see to it that I understand the answer that is given me to the question I have asked. Bottom line, the Representatives of Fidelity are honorable, class act employees. Also, even though I read little of it, a library of helps for Fidelity clients is sent out several times a month. I am new at all of this and what I have written is likely very elementary to the Giants who regularly attend this field of knowledge. I'm just very thankful to have been advised to join what to me seems to be a solid and trustworthy business organization that believes that doing right makes right and ends right. Leadership, in my view is often the real difference between success and failure; leadership is most often the whole difference. So, there must be great leadership running Fidelity. Again, at least in my view, leadership is the difference. Especially when God is intentionally and purposefully at the Top in the hearts and minds of those at the helm! Hopefully, that's the case at Fidelity. God bless!!! Tino Huggins

Limit orders don’t execute; dollar amount sells. I’ve had multiple instances where my limit order won’t execute if the market opens below my limit price. Fidelity would automatically “move the goal post” by reducing my limit price. This has been frustrating and not how most people understand limit orders to work. One huge pet peeve of mine with this app is that you can’t place market orders in dollar amounts after hours. That means you can’t sell all your fractional shares unless you wait til the trading day to actually put in the order. I don’t have time to be entering orders during the day which is why I use these apps to begin with. This has led to so many times where I would forget to put in an order during the trading day and miss opportunities to minimize loss or maximize profit. I wish they’d never rolled out this “fractional share” feature that’s only half complete and actually creates more problems than it solves. That said, I can tell they are putting an effort towards modernizing their app to stay competitive.

Good app for monitoring your IRA account. I just chose Fidelity to roll my 401k over from a previous employer and they made everything every easy. There’s even a Fidelity Banking center 10 minutes away from where I live so getting to them were easy. I currently am invested in their Fidelity GO option because I don’t have $25k for it to be managed by a broker. Their app is easy to use and they are just a phone call away. You can also deposit your funds into their account via their website or via banking center. I choose them because my some of my previous employers used them for a 401k account and they’ve always been very helpful. However, when it comes to the tools of day trading they lack in this area because they don’t provide you with a detailed chart like td ameritrade but that fine because I don’t say trade with fidelity. I haven’t found a flaw in the app yet and the results have been positive so I have nothing to complain about. Keep up the good job!

Good bank, app needs improvement. I am satisfied with fidelity as a bank and the interface of the app is clean and navigable, but there are things that need to be changed. For one, I’m unable to see a single performance chart for any security. No matter the ticker or time horizon, I get the message “chart not available for this security” every single time without exception. This seems like a pretty glaring problem for an investment app where I’m curious about past performance. Right now I have to switch back and forth between fidelity and my Apple stocks app to find information which is a bit bothersome. Also, every time I exit out of a security’s page from the investments tab, the whole page reloads and brings me back up to the top. I assume this is to keep price information as current as possible, but it just makes navigation much slower if I want to check more than one security without scrolling through all my investments again. Again, I’m happy with the financial side of things, but these issues should be fixed.

Now improving. I have investments with several brokerages (“don’t put all your eggs in one basket”) and so I have experience with apps from various companies. Right now Fidelity has the best app. It might seem a bit complex, but the organization is good and BEST OF ALL, the app doesn’t limit what transactions are possible. Too many brokerage apps provide limited information and functionality, which necessitates going to computer, browser-based access. Not so with Fidelity. So far I haven’t encountered any limits to what transactions I can do in the app compared to working on a computer. Thank you Fidelity. Nice job! Keep it up and I just might start shifting the larger chunk I have at another brokerage to Fidelity. One really big problem however. When you select an investment in an account to buy more, rather than the purchase defaulting to the account you’re working in, the purchase occurs in whichever account is listed first in your list of accounts. It’s frustrating. I’ve accidentally made purchases in the wrong account several times. The purchase should default to the account you were working in.

Someone please explain. As far as I can tell this anti-user friendly app is 100% useless. I have a page and a half of zero balance accounts on my homepage I have never known existed previously (including a stock option for a company I worked for for a summer in high school 20+ years ago). I cannot hide them or close them or even choose how the screen is viewed. So I must scroll through endless nonsense to see the 2 accounts I care at all about. Next, I switched companies about a year ago. I would like to change the elections in both the old and new retirement accounts and, ideally, merge the two. Hours of clicking on everything I can find, no idea how to anything. I then used ~ten dollars to open a personal investment just to see if that would be any more straightforward. Perhaps there are more limited options for a company-driven retirement plan than a personal investment account ? Nope! 10$ I may as well have set fire to in a can. This app is the most aggravating garbage I have ever encountered. I must delete before it causes me to chuck my phone out of a moving car.

Funds available in checking but not getting paid. Two months in a row I have waited for a check to clear my checking account. When my account shows the balance available, I pay my bills, only to get a flood of emails from Fidelity that these payments were not sent through due to insufficient funds in the account. Meanwhile, the funds are clearly showing in the account as available balance. It’s infuriating. I then have to keep track of each individual payment to watch and see whether the payee will resubmit the payment automatically after a couple of days. Some accounts do and some don’t. But I don’t dare pay again in case the auto re-submission is also pending. I am also charged fees on some account. I don’t know what the deal is with showing funds as available, then declining payments; but the programming needs to be adjusted to show checks in pending status until the are truly cleared (just like every other bank I work with. I have never had this problem with another bank. This literally causes me weeks of continual frustration before it is resolved. Please change something so whatever restriction on allowing funds to be used is clearly indicated to the account balance owner.

It’s alright. I’ve used Fidelity for a couple years now, and it’s not the greatest but it isn’t the worst. My main issue is that everything I invest in do not pay dividends and every stock that I’ve looked at, even popular companies, don’t pay dividends either which I feel like is a little unfair to put my money in something, and know that I’m not gonna get some kind of dividend back. In reality, I wouldn’t call it a “trading” app as much as a “saving up” app. It’s like a savings account, rather than actual trading in my opinion. I really wish every company on Fidelity would pay dividends, because I feel like that’s what makes investing and trading so interesting to many people, including myself. However, it’s a great app nonetheless, and it was my first ever introduction into the market and I’d definitely recommend it to anybody who’s trying to get involved with any kind of financial hobbies/careers.

Disappointed in Fidelity. I think there is this false perception that because brokerages like Fidelity have been around for decades they’re great and that because brokerages like Robinhood are new they’re trash. In my experience that has not been the case. In the 3 years I had Robinhood I never once had to call them because everything went so smoothly. The app is fast, intuitive, everything is perfect. Somewhere along the way I bought into this story that Fidelity was better and I couldn’t have been more wrong. I full heartedly regret leaving Robinhood for Fidelity. This app is slow and clunky in comparison. Everything takes forever. I’ve been waiting two weeks to have my funds available to invest, meanwhile missing out on the growth the market has been having recently. I’ve had to call Fidelity 4 times already because of issues. Again, never had any issues with Robinhood. Ever. I gave Fidelity 2 stars because the customer service people are awesome. The app and the painfully slow transfer process on the other hand deserves 1 star. As soon as I have funds available I’m withdrawing, closing my account and never coming back.

Good but not great. Its one of the best I have come across so far but it has its flaws as well. First and most importantly theres no after-hours quoting on the app. Their IT department disregarded the most important feature? Anyways, also you have to sign a lot of paperwork to start trading normally. Any type of trade needs to be applied for and authorized pretty much. Many leveraged ETF's are not available. Pre-markets orders start from 7am whereas even a crappy online brokerage running from garage such as Webull allows 4am trading. Last but not least it would be nice of they gave credit in certain amount to start trading right away when you make a deposit. What I do like about Fidelity is that I know my money is safe with them and they have live customer service although sometimes you have to wait a lot to talk to a representatives. Still better than the crappy customer service Webull ( over-messaging ) or Ameritrade ( rude) or Interactive Brokers ( INDIA outsourced) provided. The app is great with customized news feed and detailed info of your stocks. The HEAT MAP is probably the best feature! I love it! The streaming is also smooth. Oh, I have to say the execution of the trades are FLAWLESS! The best trade executions I have seen so far. Like I said in the beginning one of the best brokerages out there.

Fidelity Chart issue. Fidelity chart issue : I do like the fidelity IOS app, the Information is comprehensive and effective to an extent. However, when it comes to the deciphering chart on iOS fidelity app, it is frustrating and outright exasperating. Problem with the chart is , data, it is not spread out at a glance, it is slow, and needs to be colorful. For example when the stock is down amber color is preferred amongst stock traders, green when stock price is rising. Recommendation is Please update the chart section. In addition, FaceTime login also seems to be lagging comparable to the other platform (Robinhood). As a new young investors, iPhone apps is highly preferred and is always with us. Thus, making the fidelity app faster and easy to read chart highly recommended. Lastly, when transferring money to fidelity brokerage account, there is no way knowing when exactly the money will be available. Only expects indication is (2-4 days). Which often takes more days. Exact available date for transfer would be exceptional . It is annoying and having to check account weather the money has arrived or not . In the transfer section adding a status of transfer and exact available date update would be highly appreciated. Please fix aforementioned issues next update . Thanks .

A dumbed down version of the website. I want to like the app, since that is what Fidelity seems to push. However, before I can love it, it needs to be much better. On the website, with a click of a button, I can see all of the details of a security, from earnings to dividends to analyst rating and news. On the app, I need to hunt that information, and I can’t perform the same depth of research or at least not easily. Of course, then there is everything else: closed positions, tax forms, the exit strategy view, rich visualizations, etc. If they are here at all, they are laid out differently and buried. If this is THE app, then THE app needs to recognizably duplicate all of the features of the website for me to prefer its use. At the moment, I only see this as a dumbed down version of the website. It is such a missed opportunity, too. iOS should be more feature rich than a browser, not less. They could have designed something more real time that more closely resembles Active Trader Pro. Instead, they went to the opposite end of the spectrum and gave us a crippled app.

CUSTOMER NO SERVICE !!!. been withFidelity for over30 years. called customer service because I have to restart all my devices multiple times a day because screens don’t load data properly and the differing apps across my connected devices for mac, ipad, iphone and watch all freeze up and don’t work. continually have to shut down and restart because their programming is so buggy. they don’t even have a ios compatible software. they layer it on top o another incompatible software making it very slow and error ridden. fidelity admitted to the problems. called customer no service and spent 2 days of my life on the phone with multiple holds and long wait times. last call was to specifically complain and was sent to 7 different people costing me at least 2 hours on one call. not treated well by some customer service people. rude and belligerent . bottom line they took my error logs and said they MAY call me back with a resolution. They didn’t even seem concerned when i said i will be leaving Fidelity Investments. I all ready worry about my money, and now I DON’T TRUST FIDELITY as a fiduciary.

So close!. I was really looking for a company to handle all of our investments, savings, and our life insurance. I really liked the investment side so I decided to apply for their life insurance and found out that Fidelity is ONE OF THOSE COMPANIES. You know what I’m talking about. It’s run by and overrun with Regan Era fans that still think science is magic and that medical marijuana patches that don’t get you high and definitely are not smoked…are smoked. No one smokes plastic patches geniuses. Now I have to start the whole process of transferring my accounts to another company all because Fidelity is stuck in the 80s and can’t be bothered with verifiable facts. I can’t wait for that generation to reach the downside of The Hill. Don’t worry, we won’t let your wheelchairs roll into traffic or anything. It would be laughable for a 35 year old marathon runner with impeccable blood pressure, lab work, and a flawless physical exam to get offered “tobacco use” rates if it wasn’t just a drop in the bucket of hurdles, obstacles, and flat out traps that are set to make it impossible for younger generations to build any real wealth. My only comfort is in knowing that they’re getting older every day and no matter how hard they pray, they can’t take their money with them. Avoid Fidelity like the plague (or stinky smokers) if giving your business to progressive companies matters to you. And if it doesn’t, then it should.

Fidelity is where everyone should start.. Before opening a brokerage account and giving up your personal information, it’s important to do your research to find out what your looking for. Fidelity is a popular choice for 401Ks, IRAs, and other retirement accounts. And thus, their platform is suited for that. Fidelity is best for the long term investor: one who does fundamental and technical analysis, is in tune with current economic and political implications, and reads analyst reports. It’s for the investor who has the big picture. If you’re looking to be an active trader, choose a different platform. What I will say about trading, however, is that long-term investing will help you to be an amazing trader. Being able to hold your positions during corrections and recessions will build the stomach needed to become a successful trader. If you’re looking for a bank for a checking or savings account you’re better off at a regular bank like Chase, BOA, or TD. But if you’re interested in saving or investing for the long term, Fidelity is the answer.

Wash sale for stock that has not been sold for years. Fidelity marked wash sale for a stock that I have not sold any for years but adding shares. There was no such sale in the automatic confirmation received after buy/sell activities. They did not response (supposed to be in 24-48 hours) my first inquiry until I sent a second one. However, they did not respond to the second inquiry asking whether it was because my shares was loaned to someone else and caused a sale with a record in my account. I sent a follow up a week ago pointing out the my record showed no such sale and whether it was mixed with someone else account (by reviewing their response). The wash sale sign (supposed to be made in Dec. as they claim) just appeared recently beside the stock position. Not only have they responded to any of the further inquiries, but also the inquiries have all disappeared from the communication center, and their only response could not be reviewed . It appears to be a dead end.

Getting Better - Improvements Can Be Made. As a young investor my first stock trading app was RH. After some fickle things happened earlier this year I made the swap to Fidelity. I do miss RH’s ease of navigating around, but Fidelity came out with their Beta app on iPhone, and it’s pretty good so far for basic buy/selling etc. I can’t say for certain about anything else because I don’t do anything else other than buy/hold/sell. Some things that I would love to see for iPhone is an increase in customizing widgets from Fidelity. I’m given the option to either watch the top market makers or my overall balance for an account . One thing that I enjoyed about RH is they have widgets to watch specific markers from your watchlist or positions that you specifically hold. It’d be nice to be able to casually glance to see how X position is doing without needing to open the entire app. To lastly echo sentiment i’ve heard from other people, an update in the charting to make it more mainstream would also be appreciated. Overall moving in a great direction!

Terrible Choice for Active Traders. This release leaves much to be desired for the active trader. It's fine for those who hold long and strong, but for swing and daytraders it's functionality is rudimentary at best. Fidelity really needs to put out a mobile version of their desktop Active Trader Pro software, which in itself is quite cumbersome. This mobile app lacks any serious charting functions, and what they call "advanced charts" are extremely limited in any sort of analytic tools, and don't even update in real time. Anybody planning on using Fidelity's very stable platform for active trading is therefore forced to use third-party applications to do the actual charting and everyday work required of the successful trader. I personally use TD Ameritrade's Think or Swim mobile application for charting across multiple time frames, and use this app to execute trades. In addition, it is impossible to place conditional orders within this app, which is ridiculous. In other words, one cannot place both a stop loss and sell limit order on the same security/option. This severely limits the speed at which one can execute trades. Seems like most of the other online brokerage houses have apps much more sophisticated when it comes to charting and chart analysis. This app only allows one lower analysis tool at a time, and the choices of tools are EXTREMELY limited. IMO, fidelity is falling way behind in regards to the sophistication of their mobile applications.

Worst brokerage ever - all lies. Really mystified as to how they have such good ratings. I have several accounts in different places and wanted to consolidate. I called fidelity (surprisingly had a long wait despite looking to open account - not even customer service) and they assured me that there were no fees to move accounts. I started by moving my smallest account first. After one week the transfer went through minus a $75 transfer fee. I tried calling but after an hour on the phone between two representatives and multiple long holds was told I’d have to call back in 20 minutes. I gave up. Also I should say that the platform itself is not as seamless or enjoyable to use. The other accounts I’ve used have been E*TRADE, Robinhood and TD Ameritrade (along with their sinkorswim platform). Each of those has a feature or two that I really like over the other. Fidelity has nothing over any of those. Needless to say I will not be transferring over any other accounts and hope this review helps someone else who may be considering making a similar move.

Too Obfuscated. Initial account setup and bank linking was a nightmare. I ended up with two locked accounts that could not be deleted or have banks linked to them. Chat support was excellent and resolved my issue by manually deleting one of the accounts and guiding me to a page where I needed to submit additional documents. Not only was this not immediately clear to find on the desktop site, I believe it is not even an option on the app. And even on the desktop site, that singular page is the only indication that my account is locked. Nowhere else is this information apparent. The process needs to be way simpler or at least clear about account restrictions and why they are in place. Rather than saying “account is ineligible to link a bank account. Please create an eligible account,” the app should have given me a prompt saying my account is locked and cannot be linked with a bank account until additional documents are received and approved. To which then I should have been able to submit those documents within the app and have the status of that be at the top of the main page considering I literally cannot do anything with my account until that is resolved. The fact that this isn’t even in the app whatsoever and insanely hidden on the desktop site is unacceptable.

What’s the point!!!. I have been a customer for many years and am very close to changing to another firm. Every time the change there website I have to call customer service and spend an hour sorting out why it isn’t working. The last time was when I was using an app that did not work with my account anymore. They said the change had taken effect a year before but someone in IT decided to lock out all the non conforming accounts. They did not alert the users or the representatives that I called who waisted over an hour trying to log me in. Then today I was traveling and got on my iPad and was told that I needed change my password and that I could only do this on my desk top. I tried to call customer service and was informed that it be approximately 30 minutes to talk with someone. Have to catch my plane so I guess I will not accomplish what I need to today. Why don’t you leave what is working alone until you can get apps launched that actually work.

Not positive, but not bad.. I’ve been investing with Fidelity Go for a few years now. I’m in the process of buying rental property and wanted to pull funds from fidelity for this purpose. Not everything, but most of it. I planned on continuing to invest with them. Unfortunately, I hit a wall with the withdrawal and was told I couldn’t withdraw the amount I was requesting on the app, I had to call them. This is a huge nuisance for me, I work at sea and rarely have a cell signal. I rely on internet services for everything. Due to the fact that they will restrict what I do with my money, I called and closed my accounts. I’m afraid that that policy is just unacceptable. They’ll let me deposit any amount I want, but restrict withdrawals to the same account…no. I’m lucky that we’re close to a port still and I can get a cell signal for a few more hours, otherwise I might have been unable to use my funds when I need them. Bad decision Fidelity.

Deposits work 50% of the time. I loved this app. I only needed the deposit feature and being able to check my balance now and then. I deposited my checks twice a month. Now in the last few months it is hit and miss when I can get the deposit to go through. No different internet and no different phone. Same check look also. Something updated and now I have to attempt the checks to be updated at least a dozen times sometimes waiting till the next day because I don’t have the time to sit there. My checks are handwritten and the closest fidelity is not close. So I’m stuck begging it to not error on the picture and then go through and accept the deposit. Thankfully I only have to do this twice a month. I like the banking and the interest for my account which I’m not sure is worth the hassle of the deposits and no close bank to run it to when I don’t have the time to keep trying hoping it will accept it. :(

Great Customer Service and very efficient App. I have dealt with other brokerages that I will not name that have been pretty difficult regarding Customer Service. Fidelity has some of the best customer service I’ve ever experienced in my life and that includes for all businesses. I have called Customer Service many times with inquiries about trades and I have never once received a single employee that had a bad attitude and was hard to deal with, it’s actually been the opposite, Fidelity Customer Service employees go out of their way to help you understand whatever issue you have. On top of the Customer Service , the Fidelity app on my phone works great! I also enjoy the PC Fidelity website as well, both are very easy to navigate and make trading seamless. I utilize Fidelity active trader pro too, it works almost flawlessly and really helps me with my day treating. So grateful to be able to use this type of technology!

Needs UI/UX & Performance Improvements. I switched to Fidelity from Robinhood, and the user experience difference is pretty stark. Here's what I would improve: - FaceID login should be more streamlined. It should happen immediately, instead of prompting you to login and then doing it, and eliminating the screen glitching that occurs. - I'd like a way to more visually track the performance of my portfolio. Right now, the graph functions are buried or don't update frequently. Robinhood's app does this much better. - The feed is also not very scannable, with images that get in the way of quickly reading text to find valuable information. Individual stocks that appear there are very large but don't provide much info at a glance. - The visualization of portfolio performance isn't optimized for a mobile environment. Horizontal scrolling is not ideal. I would give high level metrics (perhaps these are customizable) for each stock in a single line, with an accordion drop-down to display further information. Leveraging more up-to-date information and graphic displays of data will help convey meaning more quickly too. - Overall app performance is sluggish. - Visually, a lot of the images have nothing to do with Fidelity. I'd recommend an overhaul of your design standards. With some of these changes, Fidelity could catch up to what competitors are doing more effectively and the app would match the good service you provide.

This app conveniently always fails right when the morning bell rings & the market is opening. Not only has it happened numerous times there’s always a delay when you want to purchase stock as soon as the bell rings. A lot of other times you buy stock and you literally typing a specific amount for a limit purchase yet without your permission you end up paying more!!! I don’t understand what the point is of putting in a limited purchase amount per share if it’s just gonna be disregarded!?!?!? Not everyone is an expert in trading so perhaps they should explain why they are allowed to do this instead of just doing it and expecting us to ask accept it with no explanation. There’s a lot of other times when it just fails and I simply can’t get log back in for 5 to 10 minutes most of the time but other times its inaccessible for 30 mins to an hour. One instance this year it was down for 3 days. Again it would’ve been nice had they sent an email out to their customers to let us know that their operating system was completely in operable instead no one sent any notification and we just had to wait and wait and wait. So I hope that never happens again because I know I received 3 good faith violations during that 3 day period resulting in a suspension of certain privileges...all because I couldn’t see any of my normal reminders or warnings!

Incorrect values. The app has worked fine for years. Now, numbers don’t match. For example, my daily change in summary says I am down a couple hundred bucks for the day, but the positions summary says I’m up for the day. Which daily gain/loss is correct? Some positions, with the same close value on the app versus desktop version, show different daily performance values. Which is correct? Desktop or app? I called support and they told me to just focus on current value to determine if my portfolio has increased or decreased. What is this 1982 and I need to keep a ledger of my positions? Really??? Don’t provide bells and whistles if the numbers are not correct? Don’t tell me it depends where there are pulling the information from. Pick one and stick with it. If I can’t trust a financial company to provide correct numbers, what good are they? Correct numbers is their job and telling me to do the math to track my portfolio is unacceptable in 2020.

Unwanted Alerts Continue. This has been a sporadic problem for a few months now. I have called a few times since, but no one has been able to solve the problem, which is interesting because for my two PMA accounts, none are enabled for alerts (the default setting), which makes sense because I don't need to know what your staff are doing on a play-by-play basis. Further, I also receive alerts the next trading day sometimes from the accounts I'm trading in. They tend to be alerts related to cancelled orders / replaced orders. I've been told this is / can be a latency issue, and that I can disable the push alerts feature. For that matter, I could not enable it on my phone to go through during the "Do Not Disturb" time, but if it were working properly I wouldn't mind a legitimate alert. I don't need to know I cancelled / replaced an order the day before, which is sometimes from a Friday (three days before). This occurred most recently this morning and yesterday morning at 5:20 am PDT

Can’t believe this is a 2023 app. My company uses fidelity to manage 401k, which encouraged me to open multiple saving and investing account here. No comment on their product and portfolio, but their online user portal is the worst among all financial institutes I’ve seen, both web portal and mobile app. To start with, the app always removes you Face ID setup every week or so, and requires you to re-enroll Face ID. The list of your portfolio looks horrible — I can’t even see the full name of the CD I purchased, no idea when it’s maturing or what interest rate it is. You can’t edit your CD ladder after purchasing. Fidelity GO never show you how your portfolio is performing — how much you’ve deposited, how much dividends you’ve got, how much fee you have paid, you have no idea of any of this basic info. Same thing applies to investment account and 401k account as well. The app doesn’t support lots of functions and you will have to visit the website, which is as horrible. The Spire app is slightly better. At least you can see more basic performance numbers and the full name of your CD. However, they’re abandoning that app.

investor. Have been with Fidelity for over forty years. We started investing when we had our first two thousand dollars to get started. We were very frugal and managed to get our savings increased until we have enough money to buy stocks. From then on, we patiently kept investing, spent less on material things and it still amazes us how we could have become this rich. Fidelity has been very good to us. All the personnel we dealt with were very knowledgeable, kind and treated us kindly even we never look like millionaires. I have recommended Fidelity time and time again to those who are willing to listen. I have always gone to your seminars. At one time I drove all the way to Dallas to listen to Mr Ned Johnson so I can meet him personally. Never got a chance to talk to him to let him know how I think highly of the campany. My husband and I are very blessed for having connected with Fidelity since we started investing. It was the best decision we ever did fur the family. Our children went to school using our lifelong savings, and set a trusts for them, and now we are doing the same thing for the grandchildren. Rosé Sulistio

Terrible UI that hasn't been updated!. I hate Robinhood but I wish Fidelity copied their app's user interface. This app looks like it was designed at least 10 years ago. It contains a lot of unnecessary/irrelevant information while leaving out vital features. For example, I trade a lot of options, and with options it's all about timing. But when you click on positions, you can't sort your options by expiration date. I mean come on! That's just wrong. Also, why not show your positions you already own when looking up a company? Placing orders on the Fidelity app is so clunky that it seems they must not have wanted you to do that. Otherwise it wouldn't make sense to design it the way it is. Again, as awful as Robinhood is, they keep adding customers. You want to know why? It's because their app is very user friendly. You don't have to reinvent the wheel so please copy Robinhood's app design language. Fidelity app gets 1 star, everything else 5 stars, hence 3 stars rating. I will update my review if Fidelity redesigns the app.

Stop with the constant redesigns!. The new experience obscures everything users are accustomed to and makes it very difficult to simply look at positions within an account and track performance. Noboby needs “gamification” or robinhood style interfaces to track important assets; but apparently the robinhooders who only have $5 to spend on fractional shares seem to be the new target audience for all these redesigns. Fidelity is known for their technology, data and accessibility, but these constant changes to “modernize” an already extremely functional and easily usable app is getting to be too much. Please leave the “classic” experience, which is very user friendly, intuitive, and rich with easy to access data. Please stop with all the pop-ups, intro screens, and clutter…your customers want direct access to the important data regarding their securities and other holdings. We don’t want to navigate 5 screens deep, get the latest fads on UI design shoved down our throats, or hunt for the specific tap, click, or swipe to get to the information they need. I’m in my 30s and these constant changes and frustrations are making me feel geriatric…stop with the constant updates or you are going to drive your customers away!

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Lip Service. No follow through and or feedback from Fidelity per my suggestion and numerous requests spanning several years. To wit…….. 1. To make a mobile deposit, one must omit a number from the account number imprinted on my Fidelity Check and substitute it with a numeric number. 2. To pay a bill online, one must lop off the First four (4) numbers from the account number imprinted on the bottom of the check and substitute with pre-determined eight (8) digits. Where are the written instructions? My phone conversations today with a Fidelity Customer Service personnel in Florida said there are none.. I don’t pay or deposit often and it is difficult for the lay person to remember let alone memorize the process and this is where Fidelity fails to service the needs of all clients. By this lack of procedure, Fidelity ASSUMES their clientele have full knowledge of its online tools and learning process. Please simply and have your brilliant programmers design written procedures like……”STEPS TO TAKE FOR A MOBILE DEPOSIT; STEPS TO TAKE FOR PAYING A BILL THROUGH DIRECT DEBIT FROM YOUR ACCOUNT. If time is money, I have wasted valuable time of Fidelity’s personnel who had to orally explain the two procedures listed above. Let’s reform and use some formative evaluation skills to right the above, but I have personal feelings that the status quo prevails and nothing gets done.. Take this as an angry constructive critics. Donald Mar

spending more $$. I would spend more money investing in stocks Fidelity would figure out how to make their website more like stash or Robin Hood. For example I might have five dollars in my account but I wanna invest in a share of Disney because it looks good, give me the option like in survey monkey to add more money to my account via a bank transfer. Why can’t they write an algorithm that goes hey man I want to buy some stock I want to share to Disney at the limit price or market price just make it happen? They don’t do that they lose market share but there’s so many people out there that just want to invest their money in some thing because we all know we’re doomed. That’s what I learned from stash, Robin Hood and public. Hire me. I want to show you how to make money for people to have a small amount of attention span and they want to make money really quickly because we are doomed

UI needs improvement. The app itself looks very old. The graphs aren’t very interactive and it would be great to see a better graph view of your holdings maybe daily or weekly and not an entire month. I hope Fidelity will take some time and money from the Robinhood masses that moved over to update their UI a little bit. Literally hours on the phone trying to get someone to talk. Ridiculous! I had an automatic investment set up for a week from today. Decided to cancel so I can deposit today. When I hit delete it said page is unavailable. Tried it again and hit delete again and same. Page unavailable. Checked the app and found out you just deposited it twice. How?? I tried to cancel and you literally deposited it twice. Plus the automatic is still not canceled and I don’t want to try it again otherwise you’ll deposit it again. What the heck Fidelity? Nobody answering calls and emails so not I have to move money around that the 3rd deposit will be covered, too. Shame on you!

Great customer support. So I just transferred money and I found out that it was literally instantly available to trade I was unsure of this because the money did not transfer from my bank account. So I called customer support and was instantly met within two minutes by an American agent which is so surprising dealing with customer service agencies over the years. She was extremely nice and told me that my funds were instantly available to trade however I would have to wait one to two days for the funds to actually clear before I could sell which makes sense. Great customer service!!!! my only issue with the app is the lack of charts and things like that I feel like they could have more advanced charts like WeBull does.

Fidelity is Amazing, App Needs Some Features. I would first like to say that Fidelity is an amazing company to invest with. The customer support is incredibly helpful, and you can trust them with your investments. The app, while it has all the essentials, could use some additional features. I recently received a Fidelity credit card, and have learned that all my notifications are sent either by text or email. It’s really annoying getting a text message every time you make a purchase, and it would be amazing if I could receive push notifications instead. Most other credit card apps have push notifications, and this is definitely something that Fidelity should consider adding to their app. I still 100% recommend using Fidelity, but a few things could make the user experience sooo much better.

It’s alright. I’ve used Fidelity for a couple years now, and it’s not the greatest but it isn’t the worst. My main issue is that everything I invest in do not pay dividends and every stock that I’ve looked at, even popular companies, don’t pay dividends either which I feel like is a little unfair to put my money in something, and know that I’m not gonna get some kind of dividend back. In reality, I wouldn’t call it a “trading” app as much as a “saving up” app. It’s like a savings account, rather than actual trading in my opinion. I really wish every company on Fidelity would pay dividends, because I feel like that’s what makes investing and trading so interesting to many people, including myself. However, it’s a great app nonetheless, and it was my first ever introduction into the market and I’d definitely recommend it to anybody who’s trying to get involved with any kind of financial hobbies/careers.

Ok for basic trades. Streaming data is unreliable / delayed. I’ve been using this app for almost a decade now. The release that updated from the “classic” interface to the “new” interface is unusable for more advanced trading involving options. The trading buttons are obnoxiously huge and navigating to see usable options data while trying to execute a trade is putting the trader at a disadvantage. The older version was honestly better in my option. Reliability on “streaming data” in this latest release is an issue and only works some of the time. I find myself refreshing the whole screen to see the latest pricing while entering parameters for my trade. My bandwidth here is 250mb/s. I’m sure the team works hard to make the app continually better but the last big release seems a step backwards. Hoping for upcoming improvements.

Worse investment application ever. I wonder how people can give 5 start for this app. I have been using Robinhood for few month and then I tried to open this app for my 2nd investment app. But compare with Robinhood, this app is a crap. Not user friendly at all. So much of unnecessary informations and instead of saying what is bad, I can say only 1 good thing which is , total gain/ losses info from this app which Robinhood doesn’t. Other than that this app is really complicated and never recommend for anyone. If a developer read this review, please install Robinhood and see how user friendly it is and try to get some idea of how a user friendly platform should be. Look like cheap paying developers develops this app. Can’t even remove items from watch list.

Website Review. The website seems to think that having 450 ways or options to look at each stock is advantageous. Trying to move investments from one thing to another is one of the most complicated endeavors one will ever undertake. The simple act of moving money from one fund to another (one would think) would be a fairly straightforward process. Not at this website. Every time I change investments I have to resort to calling a Fidelity representative to help me, and usually they run into a glitch while doing this as well. It is wildly over complicated I have mentioned this to them every time I have to call and get the cursory “We’re working on that and we strive to meet our customer needs and blah blah blah”. Meanwhile, it only becomes worse. Shouldn’t moving money from one investment to another within Fidelity’s framework be fairly simple and easy to accomplish? I am also aware that this note will not be taken seriously and there will be no followup or action taken.

Possible scam. Don’t use them This is the first time I’ve ever heard of fidelity and I wanted to start investing so I download the app and start making an account right after I put in my information it tells me that I made an account already so i tried to recover the account and it took me to a blank screen and only allowed me to call for assistance. I called the number for it to one out me on hold I waited 30 min to an hour to speak to someone and once they finagled answered I told him what my problem was and he told me it’s a pop up WHATTT!?! He then transferred me to another guy to help recover this so called account I have he told me that I had an account before I told him this is my very first time using them he read me back my information I put in along with my social security put me back on hold where it then hung up on me. I called back and it continued to go to voicemail. I tried to make another account with a fake social security and fake info and it says that it still was an account with that info already DONT USE THEM there a scam

Great redesign, connectivity with other apps broken. I love the new redesign and UI, feels much more modern and intuitive and makes information easier to digest. Recently tried Fidelity Full View with the impending loss of Mint and there were a couple major connectivity issues. My overall thoughts on Full View are still undecided. First, after I added external accounts to Fidelity Full View, I connected my Fidelity investment accounts to my checking account at another bank, which brought in all Fidelity investment accounts plus all my external accounts, showing them all as Fidelity. This seems highly problematic for obvious security reasons, since I only expected my investment accounts to link. Second, a couple weeks ago, Fidelity changed the way it connects to Mint and when I updated my connection, the entire history of my accounts disappeared in Mint. When I re-activated the older accounts to see trends and previous transactions, it duplicated my investment net worth. The timing is incredibly annoying considering the amount of transactions happening at the end of the year and trying to reconcile my accounts in order to prep my Mint history for export before having to switch to a new budgeting app. Please merge the two versions of the same accounts showing up in my mint history!

Phone ‘help’ terrible but in branch help was excellent. I needed to add my second last (given) name to my account to link my bank account and the woman at the help desk on the phone told me I could not update my name online and had to go to a branch to do it. She gave me some ridiculous explanation that made no sense, saying that its possible to update your married name online but not your given name. This was very annoying, and I later found out incorrect. When I went to the branch the woman there was very helpful and informed me that it’s actually slower to update it at the branch than online, making the inconvenience of having to go to the branch not only unnecessary, but detrimental to my goal of making a 2017 contribution before April 17. Luckily, the lady at the branch was extremely helpful and expedited my name update and then followed up with me when it went through in a couple hours. Please train your help phone staff as well as your in branch staff.

Needs a Lot of Improvement. Fidelity’s app is lagging in UX design, feature selection, uniform metrics, and desirable metrics that other asset management apps currently have as standard features. One account will display YTD return, another type of account will display daily returns and aggregate account balance. Why? Give me my returns across time horizons(D, W, Q, YTD). This is a basic thing and not difficult to deploy. Benchmark returns are always 1-yr returns. Meaningless since everything else is either daily, again depending on account type. Make this uniform so you know how you are performing vs beta. Mutual funds in an IRA will show performance by purchased tranche whereas mutual funds purchased in an individual account will display a dollar-cost average return with no journaling of tranche purchase price. What is this? Again make it uniform. Fidelity products are missing key information. Certain Vanguard products that directly compete with Fidelity products also have missing information. Why bother having institutional class shares listed or other mutual funds if you lack data and can’t purchase them. I expect far more from a company with the amount of resources and talent that Fidelity possesses. Get focus groups together. Have your customers help you with UX design. This app was made in a bubble because it would be better and cleaner if you had asked for user input. Step it up. You’re Fidelity...act like it.

App keeps crashing. I’ve been using the app for quite a while, and it performed very well until recently. After latest updates, when opening the app, the app will immediately crash and close after it goes through the login process. Also, a few weeks or even months ago, I noticed certain features on the app were not available and there was a message that would pop up saying data could not be loaded in regards to daily balance or change in balance. In other words, you couldn’t stay completely current and up to date with any changes in account history via the app. For these reasons, I’m giving a two star rating until the app is fixed and working like it used to previously. Then I would give it a 5 star rating if working properly.

Fidelity Investments very good service.. Good day to you. Since establishing My Individual Retirement Account with Fidelity Investments seven months ago I have experienced the highest quality service overall. The personnel, face-to-face at the Park Avenue, NYC location is very professional, knowledgeable, clear and helpful. The personnel over-the-phone, is also quite helpful in answering all questions I have as well as helping Me to favorably resolve My financial matters. Overall, I am very pleased to transact business with and have My finances grow and prosper with Fidelity which insures that I, as a person/client, am highly respected and valued. In My experience with various financial companies over the decades I must say, very low overall quality service is commonplace these days, I will even say that good customer service is absent. Clientele is an afterthought, and increasing profits is their singular concern which attributes to such deplorable service. Fidelity Investments outshines other companies because, in My experience, they maintain each person/client as the singular priority, thereby superb, long term profitability is assured. I am very pleased that for the many decades ahead, Fidelity is My choice for the financial advice and prosperity of Me with My wife and Our family. For all of your excellent service I thank you Fidelity Investments. Ray Nice Cruz Bronx, NY El