Mint: Budget & Expense Manager App Reviews

Mint: Budget & Expense Manager App Description & Overview

What is mint: budget & expense manager app? Experience a fresh way to manage money. Reach your goals with personalized insights, custom budgets, spend tracking, and subscription monitoring—all for free. Easily see your monthly bills, set goals, and build stronger financial habits. Get the #1 personal finance and budgeting app now*.

Mint is the money management app that brings together all of your finances. From balances and budgets to credit health and financial goals, your money essentials are now in one place. Join the 24 million users that trust Mint to help them reach their goals.

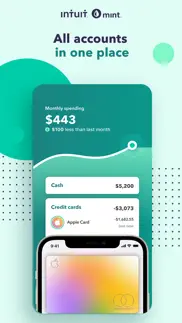

ALL YOUR MONEY IN ONE APP

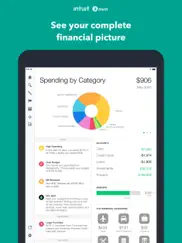

Your spending and financial accounts all in one place. Mint gives you a more complete picture of your financial health by bringing everything together: account balances, monthly expenses, spending, your free credit score, net worth, and more. Connect your cash, credit cards, loans, investments, and more.

MONITOR YOUR CASH FLOW

Mint helps track your transactions, budgets, expenses, and subscriptions. We bring together all your numbers to show your net worth and spending trends. Get alerted when you’re close to going over budget and before you overdraft from an account. We’ll notify you when subscription prices go up and uncover old ones you don’t use.

START SAVING WITH BILLSHARK BILL NEGOTIATION

A new and exciting feature that could help you save on your monthly bills**.

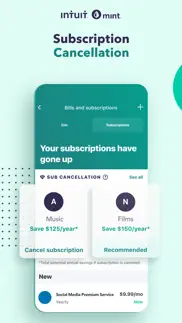

NEW PREMIUM FEATURE ENABLING SUBSCRIPTION CANCELLATION

Mint can now cancel subscriptions directly from our App. Get notified when subscriptions have gone up and let us do the work for you!

A new and exciting feature that could help you save on your monthly bills**.

SPEND SMARTER AND SAVE MORE WITH PERSONALIZED MINTSIGHTS™

Mintsights will take a deep dive into your accounts and uncover new ways to make every dollar count. Use our money tracker to get a quick view of your financial health.

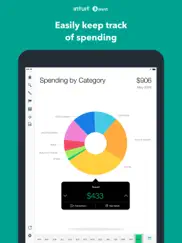

BETTER BUDGETING AND EXPENSE MONITORING

Make every dollar count with our budgeting feature. Get a smart budget based on your spending on day 1 and keep tabs on your balances with our budget tracker.

SEE YOUR BILLS LIKE NEVER BEFORE

Track bills right alongside your account balances. Our bill tracker makes it easy to manage your expenses, helping you keep tabs on your debt. Plus, get bill reminders so you can put an end to late fees. Expense tracking can help you reach your goals sooner.

FILE and TRACK YOUR IRS TAX REFUND

File and track your taxes directly in Mint with TurboTax. Check your refund status and date estimate in Mint when you file with TurboTax. We’ll notify you when it arrives in your account.

STAY FOCUSED ON YOUR FINANCIAL GOALS

Set custom financial goals in our budgeting app and get actionable tips tailored to you. With our money management advice, you can see and celebrate your progress. We’ll help you make the most of your money.

GET YOUR FREE CREDIT SCORE & CREDIT REPORT

See your free credit score & credit report whenever you sign in. Get fraud and identity alerts and updates to your score in one money management app.

STAY SECURE

Protecting your data is our top priority. We’re serious about keeping your account safe and are constantly improving our security measures. See more here: https://www.mint.com/how-mint-works/security#toc

*based on all-time app downloads

**additional terms and conditions apply

FROM INTUIT INC.

Mint is part of a suite of financial tools that include TurboTax®, QuickBooks®, QuickBooks Self-Employed™, and ProConnect™.

To learn how Intuit works to protect your privacy, please visit https://security.intuit.com/index.php/privacy

By installing or using Mint, you agree to our Terms: https://www.mint.com/terms.

Mint currently connects to US and Canadian financial institutions only.

Please wait! Mint: Budget & Expense Manager app comments loading...

Mint: Budget & Expense Manager 150.81.0 Tips, Tricks, Cheats and Rules

What do you think of the Mint: Budget & Expense Manager app? Can you share your complaints, experiences, or thoughts about the application with Mint.com and other users?

Mint: Budget & Expense Manager 150.81.0 Apps Screenshots & Images

Mint: Budget & Expense Manager iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 150.81.0 |

| Play Store | com.mint.internal |

| Compatibility | iOS 15.0 or later |

Mint: Budget & Expense Manager (Versiyon 150.81.0) Install & Download

The application Mint: Budget & Expense Manager was published in the category Finance on 19 December 2008, Friday and was developed by Mint.com [Developer ID: 300238553]. This program file size is 456.23 MB. This app has been rated by 793,698 users and has a rating of 4.7 out of 5. Mint: Budget & Expense Manager - Finance app posted on 04 February 2024, Sunday current version is 150.81.0 and works well on iOS 15.0 and higher versions. Google Play ID: com.mint.internal. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

Bugfixes and enhancements

| App Name | Released |

| Credit One Bank Mobile | 21 September 2016 |

| Schwab Mobile | 14 December 2010 |

| Testerup - earn money | 21 December 2017 |

| PayPal - Send, Shop, Manage | 03 February 2019 |

| Crypto.com - Buy Bitcoin, SOL | 31 August 2017 |

Find on this site the customer service details of Mint: Budget & Expense Manager. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Mortgage Payment Calculator | 12 April 2013 |

| Debt Manager | 08 December 2011 |

| MoneyStats - Expense Tracker | 14 January 2018 |

| 10BII Calc HD | 20 September 2010 |

| Accounts 3 Checkbook | 20 August 2022 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| 06 October 2010 | |

| BeReal. Your friends for real. | 08 January 2020 |

| CapCut - Video Editor | 14 April 2020 |

| Amazon Shopping | 03 December 2008 |

| Target | 24 November 2008 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| AnkiMobile Flashcards | 26 May 2010 |

| Minecraft | 17 November 2011 |

| Bloons TD 5 | 15 November 2012 |

| Terraria | 28 August 2013 |

| Suika Game-Aladdin X | 06 March 2024 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Mint: Budget & Expense Manager Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Love this app but has a couple flaws. As a recent college grad learning to budget independently for the first time this app has been a lifesaver!! It takes some time to set everything up but is SO worth it- I can track how much I’m spending each month across various accounts and two credit cards. The big negative is that you can’t link a venmo account, so being paid or paying someone through your venmo balance doesn’t register unless you transfer the balance to your bank (or pull funds directly from the bank). This is for me the biggest flaw of the app because I use venmo constantly for splitting restaurant/bar bills and paying utilities, so the monthly tracker frequently doesn’t accurately track that spending/reimbursement. I also wish there was a feature that let you automatically override the spending category, and I REALLY wish spending not in a budgeted category still counted towards your monthly budget- for instance, there have been so many times I didn’t notice a charge at CVS that was automatically labeled “Pharmacy”; since I don’t have a separate “pharmacy” budget, the spending didn’t show up as pulling from my budget until I manually changed the category. If these things were fixed the app would be perfect!!

Getting Progressively Worse. I started using this app in college (10 years ago) and it was great. Loved the budgets and charts and seeing where I was spending. However the longer I continue to use Mint the worse it gets. Mint is particularly bad with investments. I’m constantly having linking issues with my accounts, for 6+ months I was unable to refresh my link with one account causing my balances and investment numbers to be completely off. Cash held in investment accounts is not accounted for, and every time I make a stock purchase, it treats the purchase value as income. For example, if I had $10k in an investment account, with $7k in stocks and $3k in cash. My account total would only show $7k under the investments tab and nothing under the cash tab, so $3k was just missing from my net worth. When I made a stock purchase of $1k, it appeared as income and then a stock buy in transactions. So both my income and spending numbers are elevated for the month, even though I was just investing money that was already in an account. This is really frustrating when trying to track savings and investments over time and terrible for budgeting as everything is thrown off. And if I make a transfer to an investment account, until the cash is invested it appears as if I’ve spend X amount of money. I wish mint would fix this, or at least allow us to add an offline account with a balance to offset the missing cash. It’s very frustrating, but I’m considering finding an alternative.

Used to be great, constantly adds and subtracts 5k off my Robinhood investments. I was obsessed with Mint years ago. It kept tabs on me better than a therapist. I constantly told friends about how it gave me a clear picture of my finances and how satisfying the interface was, to the point where I had to assure them I wasn’t a spokesperson or affiliated in any way. Well, not sure if I want to be affiliated even as a consumer anymore. I have around $5k in investments in Robinhood, and about $300 that hasn’t been invested. Several times a month, the app will refresh and forget that that $5k even exists. The first time I saw my net worth drop by $5k, I completely flipped out. Now it’s incredibly inconvenient and defeats the purpose of the tracking since it will account for the $5k one day, and it’s gone the next. I tried adding the approximate amount in cash on the browser version as property, hoping that would fix it. Nope. A few days later, it will catch the $5k and suddenly I’ve inflated my net worth. Either way it’s pretty useless having it track my money that way with the data all skewed. I’m honestly bummed because I loved the interface of this app so much, and the convenience to see all my finances at once. I loved having a browser version and app, but now I’ll have to find something else. Incredibly disappointed.

Not accurate. I would not recommend this application. Every month random transactions don’t upload to my Mint account. Because of this I go over budget. On top of that, the customer service is extremely bad. I have chatted with multiple customer service reps starting back in August. They all keep telling me to keep waiting and that I can’t submit another ticket to get my account looked at. It’s now December and I recently chatted again asking if my problem is fixed. They said it wasn’t and that I would have to keep waiting. At this point I am giving up on the application. This problem where random transactions have not been uploading to my mint account is very tricky since most people would not notice. You have to pay very close attention to figure out you are missing things. The main reason I found out was because I was missing a transaction that was $150 which is much more noticeable. Also, sometimes transaction would show and then they would be gone 2 weeks later. If you use this application for your monthly budget I would be very carful and make sure the app is accounting for all of your transactions. In the end, it’s not worth it for me to keep adding up everything and comparing it to my mint application. The app was supposed to be doing that for me. I do not recommend this for anyone.

Eliminating bill pay?!?!. Intuit acquired a bill pay app approximately one year ago only to force its customers onto the Mint platform, requiring a complete reconfiguration/reconnecting of all accounts. This was an EXTREMELY lengthy and inconvenient process wrought with bugs, inconsistent or missing connections, missing institutions that were previously available, etc, causing several late or missed bills over several months. The Mint bill pay feature was inferior to the previous billpay app, but it improved over time and finally stabilized around November 2017. Now in April 2018 we get notification that the feature is going away?! Intuit, you acquired a company, forced all of its customers onto your inferior platform requiring months of careful monitoring on the part of the customer, and then, when it is finally stabilizes you discontinue the service completely?! I apologize for the rant, but this is simply unacceptable. I now have to find another service and go through the same painful process with less than 2 months notice?? This will cause huge issues with financial implications for your customers. Intuit Leadership, your poor choices and incompetence has hemorrhaged my trust and faith in your company. You’ve totally screwed your customers. Who wants to go near a company like that?

Bought premium immediate regret constant crashing. I’ve used the free version for years on and off and had no problems other than the normal random account won’t link or sync but it was keeping track of the main things I wanted it to and worked for the accounts I cared about. Recent couple months have been paying closer attention and felt like I wanted to join the premium version so I decided to get the premium tonight. Immediately after the purchase I regretted it. Selecting anything that came with the premium version would cause the app to crash. Even some of the free features like the monthly expenses when I click on the lower area the app will crash. I have looked at the reviews and I am not the only one dealing with this and every time the moderator/help bot says to message them on Facebook or Instagram or another app. Honestly just out of principle if I get that response I will most likely unsubscribe and uninstall the app. Date of first review (January 14th 2023) If you have made it this far thru the review I will rate it 5 stars at the beginning because it has been great but if I get the same response or no response at all I will rate it a 1 star so later down the road you will be able to understand what happened or why it is fully rated long term.

Making a Mint with Mint. Mint helps me track all of my expenses in real time, allowing me to track my mortgage, household expenses and car payments as well as insurance, assets and investments so that I can see how everything is faring comparatively and in the big picture. It warns me if I’m spending more than usual or more than what I’ve budgeted in specific areas. It allows me to set goals for increasing savings or investments or reducing debt. It also reports my net worth in real time based on all of my assets and liabilities. It charts the growth of assets or the decline of debt over time, so that you can see your progress which is very rewarding and reinforcing. You’re motivated to watch your financial picture improve and to make small changes in spending or savings so that you can see that improvement. It also reminds me to pay bills, or cancel unused subscriptions. It tracks every penny, so you always know exactly where you stand. I’ve never had a problem with security of my information or data. I love Mint and credit this app for my financial standing today. It’s easy to use, intuitive and allows me to see my financial picture at any moment in time right from my phone. I highly recommend Mint without reservation.

Overall pretty good, some complaints. The app is very streamlined and easy to use. I like it a lot. However, there are some issues. First, and I know this is in progress, you can’t edit subscriptions (or remove them?) once you’ve added them. It also automatically capitalizes the name, so I entered my iCloud sub as “iCloud” and the system changed it to “Icloud”, which I now can’t change. Secondly, and something that is turning me off from the app, is the fact that some tags are hidden for no apparent reason, and this varies between web and iPhone. On my phone, looking at my account history, I can add the “Loan Payment” tag under the “Loan” category to a transaction. That whole category does not show up when trying to do the same thing on the web. If I try to add that tag, I’m told it already exists, but it’s not there. Then, when I go to create my budget on both phone and web, the Loan category is missing. I’d like to be able to include my loan payments in my budget. The Investments category is also missing, both in the budgeting section on all platforms and in the transaction history section on the web. This is largely what’s preventing me from regularly using the app. I got it specifically to track my payments, including my loan, and I can’t do that.

This is the best app ever!. This is the only app I use for finances and it’s all I need! This has helped me to be on top of budgets, account balances, bills and my credit score. This app would be great for anyone, even if you are starting out with you first savings account. It’s easy and can only be opened with your thumbprint or passcode if you wish. It sends you alerts if you have high spending or if your account balance gets to low. On the budgets you can use their categories and subcategories or create your own. I have only found a way to create them on the website, not on the app but they may have updated since, not sure. Basically everything about this app is customizable as for as organization goes. You can rename your accounts and when transactions come through under a category that may not make sense, you can change the category to fit in with where it goes in your budget. You can even hide transactions from your budgets and trends (there are trends a graphs for everything)!! I use this If say... I bought something for a friend who was going to pay me back with cash, but I didn’t want to take the cash back to the bank to balance the account. I could use this feature to just hide the transaction.

Terrible customer service experience. Have been trying to log back into my account for literally over a year. Any time I get in touch with their customer service I’ve been given the run around. They send a password reset that never gets to me. They make tickets to help and never get back to me. The last time I reached customer service they told me I have to contact turbo tax, which I can log into with no issues, along with my intuit account. I have deleted the app, will never use it again and will actively tell anyone possible not to use their service. I wish I can delete my account but I know it’ll be no use. This has been one of the worst customer experiences in my life, and coming from hospitality and understanding what it’s like to be on the other side of customer issues. I have patience with these types of issues. But this by far is the worst. Again, have been tryin to log in for over a year, possibly even two years, that’s how long it’s been since I was able to get into my own account. I have reached out many, many times and still no one can actually help me. This is garbage. Their customer service is garbage. Do yourselves a favor and use another app, because if you have any “suspicious behavior” on your account you will never be able to use the app again. Even after proving that it’s you and are able to use every other intuit product.

The Ads Are Taking Over. As a longtime Mint user (6+years), I've watched this app go from helpful to becoming something that is so riddled with ads that it's practically useless. The most recent update solidified this in my book. Several of the displays are half taken up by ads. It's so difficult to even see where your money is going since many of the pages are screaming "apply for this credit card (that's paying us for ad space)" or "invest your money here (again, paid ad space)." It's so disheartening to watch this app go from something I trusted for my every budgeting need to being something that's practically useless. I've mentioned many times before (during the repeated in-app "rate our app" requests) that I'd love to see a paid version so I could ditch the ads, but that hasn't happened. I'm actually willing to PAY for this app to ditch the ads, but they seem to think that half of their screen space sold to other companies is a better way to do business. It's disheartening, frustrating, and downright greedy. I'd love to see a response from Mint (which I've requested before), but they're too busy cooking up ways for additional profit to actually respond to loyal customers. And right after I submitted this, I noticed that their screenshot previews in the App Store didn't even show the most recent, janky version of this app! Instead, it showed the previous, actually useful version of the app...where I knew where my money was actually going.

The Best. I have been using this app for several years now and I believe it's the best app for keeping track of bank accounts and credit cards. It has several new features that I am interested in using-investments . I really enjoy the fact that all I have to do is enter my password and I can see all the details of my checking account and my credit card. In my opinion this is the greatest app for controlling my budget. All I need now is a little will power. Thanks for this app. I really miss the ability to make additional payments on my credit card. I wish I had used it more often. If you want to improve your credit score, use this app to easily keep track of your money on a moment to moment basis. Having tried a few other apps, I am happy to say that this app is the BEST. UPDATE!!! Oct 29, 2018: I have just experienced a second password failure. This same failure happened 2 years ago. (Nov 13,2016). Their system just drops the password and there's nothing you can do but establish a new password. It's the only complaint I have ever had with system. They send a message through your email so now I have to start all over again. Other than this problem, it's a great way of keeping track of your money.

Good app, but it’s lost some focus. With the development priority seeming to go towards monetization, the mobile app has become less useful/intuitive. They’ve gotten much better on the back-end integration with financial service providers, and I’ve noticed fewer data feed outages in the past year or two, and they tend to be resolved faster. Kudos for that, dev team. But the app UI has suffered, with more advertising of card referrals and less utility in the dashboard. Budget line items are sorted alphabetically, rather than by overall category as they are in the web interface. Why default to alphabetical (why not largest budgeted amount, or dynamically based on most recent transaction) and if it’s static why can’t I drag and drop the display order like I can with most other apps adhering to the iOS design language? The widget is set to show upcoming Bills, which is odd given that Mint has deprecated Bill pay. I would much rather have recent transactions available in the widget view, or better yet a choice of what the widget will display (but seriously, transactions please). Overall solid effort, but a handful of tweaks would get me recommending this app again.

Love the App!. This app and the desktop companion have helped me organize my household finances very effectively. Lately, however, I’ve had a couple issues. 1. No description of where I made a purchase is being downloaded into the app from my bank. Everything used to come in clearly but now it just says the day it was made and the last 4 digits of the debit card used. It makes it hard to remember how to categorize because most are default categorized to restaurants. Weird. I’m running a household with 5 busy kids and I don’t always remember what was spent where. 2. There’s a glitch that sometimes erases all the categorization and notes I’ve made to transactions. So I have to go back and redo it all. It doesn’t happen a lot, and it’s not to every transaction, but it’s hard to recover when it does. Other than this it works great and has helped me keep track of all the financial comings and goings of a busy household. One suggestion would be to add a way to keep track of receipts. I’d love to scan in my receipts and track online receipts for tax purposes. All the apps online for this purpose are for small businesses, so they charge way too much and offer lots of features I won’t ever use. They just aren’t realistic for someone running a household.

Great budget app. I love Mint to help me track my spending this is way better for me than the Bank of America tools because the bank site used different categories on different page sections, and I couldn’t create a cohesive easy to understand view. Mint lets me pull in several accounts and credit cards and see everything all together. There are 2 things that bother me. First, it has a great feature for budgeting that allows you to carry over unused funds from month to month. This is great if you want to save up or reward yourself for behaving, but the app can’t tell the difference between overspending and underspending. For example, if your clothing budget is $50 a month and you only spend $25 in one month, the extra $25 will carry over to give my $75 for next month (yay!) but the app shows the budget item as red as if I have overspent and tells me I’m -$25 over budget (boo!). That makes NO sense and throws off my ability to quickly look for the red/yellow/green bars to see if I’m ok on spending and see how much I have available to spend. Also, I wish Mint would “learn” better. There is one restaurant I frequent that always seems to get categorized as a hotel. I have changed the categorization about 200 times. I would like the app to either figure it out or to let me set up an automatic override rule so I don’t have to keep changing the same charge over and over. If they would fix these 2 small things, the app would be perfect for me.

Has potential but not quite there. This app definitely does what I wanted it to. However there are a few things that make it very hard to use. First the UX is way off for the tabs, the common actions from the overview tab should be spread out into the other tabs because I see myself only using this one tab 95% of the time and scrolling up and down for the common actions is a pain. Maybe add a side menu to make it much easier to select these. Second, it feels like it’s lacking the historical overview and analysis that I want with an app like this. I can add a budget for the current month for something new like bills but this new budget does not get applied to the previous month so I’m unable to see it. This budget should also allow a view to see your trends on it. Another pain is the [Month] Spending section. I can’t view previous months only the current one and when a new month comes You are stuck to only seeing those couple days of transactions. This is very troubling given that the graphs and info provided in this section are very well made yet under utilized. Please update these things and I will consider increasing my rating TL:DR This app is great for looking at your spending habits yet lacks several features to look into trends and historical data, this restricts it to really only working as a budget tool and makes it nearly impossible to make new analysis on spending habits that haven’t been predefined

Almost perfect. I've been using Mint for years and recently started using it consistently. There's a lot to love about this program! I won't go into all of its great features because with this kind of rating, it's obvious that there are many! Instead, I want to bring up a few minor nits that keep this from being perfect for me. First, there's differences between what you can do on the web version, the iPad version and the iPhone version. For instance, you can only create new tags on the web version. The reports are slightly different. The way you set date ranges are different. It's not intuitively obvious how to do the same function on a different platform. I can manage it, but trying to help my not-quite-as-tech-savvy wife understand why the capabilities and functionality is different on each platform is hard. The second nit is that across all the platforms, I don't see a way to do multiple filters. For instance, if I want to see all my fuel purchases at king soopers for the last two months, I have to either search for the fuel category and look manually (or export to csv) or by merchant and look manually or... But there's no way to specifically look for all three criteria. Similarly, when I get a list of transactions in the little pop up window on the web version, there's no way to export just those transactions. I have to copy and paste them out to transfer to a spreadsheet. Besides these nits, I love the program. I use it daily and am mostly very happy with it!

Latest Update. The latest update basically renders this app unusable. To preface all of this, I have been a huge proponent of this service and have recommended it to countless friends and family members over the last three years. It has been profoundly helpful for me as a young adult learning how to budget, manage, and invest in ways that work for my income in a user-friendly and accessible way. With the latest update, though, those functions have been nullified or broken in such a way that they are unrecognizable. Another reviewer stated that the developers have essentially rendered a clunkier version of our bank apps, which I fully agree with. I appreciate the attempts to “streamline” the product interface, but cramming everything onto one text-filled page is the opposite of intuitive. If users want a list of randomized expenses in an unreliable chronological order, they can easily find that with their personal banking app. The budgeting and visualization functions are unusable now, with many of the graphs being inaccurate or difficult to access. Removing the tabs/pages took away the user’s ability to compartmentalize their spending habits, which has (for years) been the true benefit of this service. If there is not marked improvement within the next update to patch some of these issues noted in the *numerous* reviews below, Mint has dug its own grave in abandoning longtime users and made it nearly impossible to attract new ones.

Mint user since 2012. Mint is the perfect tool to keep track of 100% of your finances. Want to track your net worth and credit for free Mint is perfect. Saving goals, monthly budgets, pay bills, get reminded about bills. It's customizable and intuitive. It has gotten better over time. It used to be that you struggled to keep all your accounts synced, mint has improved the reliability. Of 20+ accounts, maybe one or two need to be fixed a year. Even your Lowe's card now syncs with Mint. I only give it 4 stars because I wish I could pay to remove recommendations but that really isn't that annoying, it's less like a ad and more like an adviser showing you tools on how to save money. One thing I wish the app could do that you can do on the web version is reset the monthly rollover budget for a category. Like if you went over on groceries last month and you need headroom this month, I have to go to the web version to reset the budget to zero without the overage carrying over from last month. Good job mint team! Can't wait to see how you integrate mint and turbo tax in the future. One more request, add net worth to the trends within the App, web version has it app does not. Important to ensure it always is going up!

Categorizing via mobile needs improvement. I’ve used Mint for four or five years now because it’s the budgeting system that works for me, starting in college and moving into adult life. But the major problem I continue to have is Mint’s interface continues to refresh the categories I set for particular reoccurring charges - for instance, one monthly payment plan charge continues to be set by Mint as “doctor”, instead of the payment plan budget category. So in order to see how my over budget is doing each month, I have to go into individual purchases and reset each category every time I open the app. I have reset categories both by mobile phone (which is my main contact with Mint) and by desktop browser, and neither platform fixes the issue. This is also a weird problem with payment app charges like PayPal, which all show up as “shopping” by Mint. I can go in and manually designate one charge as “groceries” “rent” or “gift” and the next say it will refresh the category as “shopping.” This is a pain. It factors into my decision to recommend to others, and if I were running more than a 1-person household it would be nearly unusable for the amount of time it’s supposed to take. Highly recommend Mint addresses categories so I can permanently “set and forget” reoccurring charges in budgets, as well as permanently recategorize individual purchases without affecting future charges by the same payment platform.

Need’s a new feature option for a more comprehensive understanding of your wealth of information. There's not a transaction deletion feature available. You can't remove transactions once they are placed on your accounts. Now, you need this when for example, you take money from one bank account and put it in another, it will show up as a negative when in reality you're just moving money around, resulting in an ”expense” that in reality has not left your pocket. And in the end, it will show up as an expense, that at the end of the year will show inaccurate results. An example of it is the following, I paid my insurance company with my credit card and then I decided to move to another company so I received a full refund of the money that I spent on a paycheck, so although I got the money back and deposited it, it still shows up as a credit card transaction and income transaction, when in reality is the saw amount of money. If I would have the option to delete those two transactions then my monthly expenses don't have to show up wildly as it shows with these transactions that you can't delete for an accurate reading of your expenses.

No more bill pay-useless. What the heck Mint? I’ve had this app since it was Mint Bills and it was great. You took away that app and merged it with Mint, which wasn’t as great and had a lot of features I wasn’t looking for. I kept Mint and learned to deal with the busy screens and finicky updating of accounts and waited while all the glitches worked themselves out, but I started looking for an alternative app for paying bills that functioned like the old Bill app because you guys ruined that feature and that is the only reason I used the app. I used Mint alongside another app over the last year or so, I only kept Mint because it had more of my billers set up and that made paying them easier than the new app. Well now that you are taking away the bill paying feature, I’ve deleted the app altogether and am using my alternate app, despite it not having the ability to connect to a couple of my billers. You left us no choice, no one wants to go to each biller’s website and pay anymore, and most online banking bill pay lacks the features this app and the Mint Bills app had that I wanted, like being able to see the bill amounts broken up by biller in order by due date, especially on a tablet or phone. Thanks a lot for forcing us to convert to Mint from Bills and then ruining this app too. There are so many apps like Mint that don’t feature bill pay, you’re making a mistake. I hope you bring it back someday. Or even better, bring back the Mint Bills app.

Great general overview. This is really lovely for people who want just a monthly overview and to kind of watch their money as it flows in and out of your bank account. I however have been budgeting check to check instead of an entire month. I find that it’s just easier for me to focus that way. When I’ve done the entire month all at once I’ve made mistakes in My finances that I tend to not make when I zoom in closer. However budgets are only set up by month and as far as I can tell you can only go up to the month you’re in whereas I plan my budget a month in advance… so that would be nice to be able to continue to do. Since I’ve been doing that I’ve never missed a payment or over-drafted an account like I used to when I would clump all my finances together. It would also be cool to be able to add paydays into the calendar to see which bills could come out of which checks. I also don’t like that I linked my credit cards and now my alerts just say credit card is due without saying which one and then it gives the total balance as what’s due instead of the minimum payment. So it would be nice to at least see both of those in the actual alerts.

Great app but some bugs to be aware of. I’ve been using this app and the website for many years, and it’s very good, particularly since it is free. I have recently reported an issue with the app incorrectly including income categories as expense when viewing prior month budget history. And if you exceeded your Income budget, earning more than planned, it shows it in Red like it is a bad thing. So that is confusing, and it’s hard to go back and see what your budget was previously if you are a person who adjusts your budget categories each month. (It appears your total monthly budget was double what you had planned to spend. You will need to use the full website version to see the correct number.) Also, I often get advertisements for credit cards I already have, so the targeted ads could be better. Sometimes an account will stop syncing, so you have to keep a close eye on that. Also, pending charges can sometimes remain after they have gone through, so your budget can get hit twice for the same transaction. You just need to change the category of the duplicate pending charge to ‘Hide from budgets and trends’ to fix that.

Great app, couple issues. This is the best budgeting app I’ve had. I’ve tried a few others and nothing compares. I like that I can link my accounts (recurring bills, investments, credit card, checking and saving), set personal budgeting goals, and watch where my money goes each week and month. The app sends alerts to my email when I’ve exceeded a budget. My issues however started a few weeks ago. For whatever reason, the app has the hardest time syncing my checking and savings account, which I hold thru a small, local bank. I sometimes have to log out, log back in, and sync it a few times before it corrects itself. So my transactions aren’t loading, I’m not getting alerts, and the overall data isn’t correct. The app used to sync on its own before May 2019 started. I’m not sure if it’s a new update that’s causing a glitch, but it sure is annoying. I check the app to monitor my progress a few times a week, and I edit my budgets monthly, so it’s not like I hardly mess with the app. Additionally, the app doesn’t provided any tips or tricks for how to spend less/save more. Some apps I’ve tried had those but didn’t have the personalized budgets, so I switched to this one. Can’t have everything apparently. Ultimately, I won’t ever leave this app because it provides the bulk of what I’m looking for in the app. I’m just annoyed that the app stopped syncing my accounts without me forcing it to every few days.

Almost as much work as doing it analog. Only useful for seeing your overall assets in one place. For actual budgeting, I’m finding it very cumbersome. You can’t modify category for pending transactions. There’s no options to add a “savings” category to your budget. They automatically count credit card payments as a transfer, so it shows up as a debit and a credit in your budget, rather than the debt repayment it is. It’s a pain to recategorize and “hide” categories to try to get an accurate representation of what’s coming out of your funds. Also tedious to recategorize every single purchase to fit it into our simple budget - if their automatic coding doesn’t fit in your designated budget categories, they hide in “unbudgeted spending” and then you have to manually add the category they chose for it to your budget, open up that category, recode that purchase, then delete the category from your budget again. Or you can sift through your purchase list and try to find any wrong categories. I am going back to an analog spreadsheet. at least I won’t be staring at full screen credit card ads while fighting to pull down the tiny drop down menu where all the budgeting tools hide. (P.S. I am under 30, this just is not an easy to use app for strict budgeting)

Don’t Buy Premium. Mint is a wonderful tool to help with budgeting and tracking expenses but I’m not sure if the premium version is worth the extra monthly charge. The “money spotlights” is really buggy. When I try to use this tool, there is a large X in the “money spotlights” title and it doesn’t even allow me to close the tool. Plus I have to tap “go to budgets” several times just to get out of the tool and sometimes that doesn’t even work. Most of the time I have to close the app to get back to the overview page. I recently updated the app and the “money spotlights” tool doesn’t even work, it just crashes the app whenever I try to open it. 😂 The other disappointing feature about the premium tool is that I can’t use the “compare spending with other Minters” and the “monthly spending projection” tools because I don’t have enough transaction history. BUT what does work flawlessly in the premium version are the arcade games. I think the arcade games are a neat add on but why did Mint execute this feature so well but not money spotlights? Overall, I highly recommend Mint and will continue to use it BUT do NOT buy the premium version yet. Looking forward to trying it again when they fix the bugs and I have more transactions history. Until then, I’ll go back to the ad-free version. :)

Best Finance app, but still needs more. Update: All my bills in which I use mostly this app for are all gone. Just disappeared. Not cool. Mint has worked wonders in managing my finances. No longer do I need registries, or keep up with my reciepts. If your a numbers geek, want to keep up your finances, or want to watch you banks grow. This is the app to do it. I find myself looking at trends and budgets. Tweaking and adjusting to my financial goals and needs. With out this app I would be truly clueless where all my money is going. Now I know where every penny goes. As a current college student recovering from credit card debt, watching my debts decrease and my net value increase has been addicting. Highly recommend. However I wish this app allowed to add estimated payday payouts to the calendar on bills, giving you a balance of what you'd receive and what would be left after bills of the following 2 weeks and month. That way customers will know how much money they can budget everymonth. Or simply just adding the ability to add expected income before and adjusting automatically to when the deposit comes in. Mint is great for tracking expenses, investments and property. Just not the best at income!

Unreliable connection to bank and useless customer service. It used to be a nice app, but this year they failed twice at connecting to bank accounts. Don't take me wrong! I mean constantly not refreshing the balance for days and two months (I canceled the first account while the second account hasn't been fixed by their tech team for more than 2 months now, and I'm still waiting). They must have bugs in the system especially if you try to connect with two account of the same bank, which I believe many married couples do. I have wasted at least 10 hours, literally, in total on tens of emails and live chatting. Yes, they don't have phone call service:( The email customer service representative only asks you questions you have answered many times as if they cannot access previous conversation. For example, I was asked whether the two accounts have the same credential for four time in each case of my two issues. They can also ask you to try something that has been tried many time. Apparently, they just don't want to solve your problem, because your reply will not go to the same person again but randomly someone else. So they just need to say something and their job is done. For the app design, I don't understand why they don't allow you set in-app alert off. For example, I know my backup checking has a low balance and I don't care! I don't need to see low-balance alert constantly. Lastly, if you want to refresh again 10 min after the last refreshing, it won't do it!

Terrible App- account connections routinely fail. I was really hopeful when I downloaded this app, but it’s more aggravating than anything. The remote account connections (the feature that’s supposed to allow mint to keep track of your accounts and balances and read your transactions for budgeting) routinely fails. For example, I just spent 20 minutes clicking back and forth between Capital One and Mint, because Mint reported that my permission for Capital One ended. No matter how many times I authorized the access (on Capital One), I got returned to the same screen (on Mint) where I was asked to go to Capital One to authorize Mint. Other accounts also intermittently do this. So if you’re hoping for a good way to track multiple accounts, this isn’t it. The other aggravating element of this app is its categorization of transactions. Every one of my paychecks is labeled a state tax return, and no matter how many of them I re-categorize, Mint doesn’t learn from my changes. My groceries are labeled “shopping”, and apparently I get a tax return every other week (according to Mint), so I have to go in and re-categorize transactions repeatedly. These categories are used for budgeting, so Mint reports I have “low cash flow” (because it doesn’t recognize my paycheck), or that I overspent on my “shopping” budget (I don’t have a “shopping budget- I bought some food). Between these two issues, I can’t track my balances nor create an actual tracked budget using Mint. Deleting.

Very good, just this close to perfect (see below). To track my net worth and expenses, have been a long time user of Personal Capital. However, noticing that it recently had several issues connecting with my 401k provider and refreshing properly RobinHood account data, I decided to try out Mint. So far, the experience has been great as both accounts linking and syncing has worked flawlessly. EXCEPT: 1- One issue... when linking RobinHood, despite correctly adding both my investment account value and the cash management account value, it computes the investment value incorrectly: since it adds to it the cash account balance. Basically, the cash management account balance is counted TWICE! 2- I was amazed by how flawlessly Mint shows me transaction history for stock purchases. So, why not computing this into a graph that shows progress of financial growth over time? Net worth data unfortunately only starts from the day I register my account and connect the institutions of relevance. And it would be just amazing if the app could pull past data and logging that too! Hoping for this to get fixed (item 1-) to update my review to 5/5 :)

Obsessed. I have been a Mint member since 2016. I think around January of this year (2021), Mint redesigned their app. I have been obsessed with it! My favorite is the weekly and monthly “story” styled recaps - seeing how my net worth has changed, what contributed to that change, and seeing what changes there were in my expenses. Also since 2016, I have been keeping track of my expenses on a daily, weekly, monthly, and annual basis - all hand written in my planners! While I still do this, I love using Mint for my overall financial management. The user interface is 10/10 for me. Using this app brings me joy 100% of the time, I always leave happier after using it. The website is 4th on my internet browser bookmarks bar. After I finish this review I’m going to move it to first because it makes me that happy. Wow. Amazing. Thank you Mint, keep doing what you’re doing. I absolutely love it. Keep it up with the cute hashtags too. #MoveMints #EmpowerMint I set a net worth goal in January of this year and not only am I happy I reached it, I’m glad to have done it with the help of this app.

Needs Small Fixes - Otherwise a Great Product. I love nearly everything about this app. I love seeing all of my information displayed and the overall look and ease of the app. However, I wish they would fix some of the issues they have with the banks and credit unions. When I first connected with them I had no issues then it duplicated most of my accounts. Now I have a few credit union accounts that show all savings, checkings and loans twice. When I asked for assistance with customer service to resolve they advised me to delete the account then reload (but they were not promising this would fix the issue) or just “hide” the duplicate accounts so I do not see them and the app does not use the info. They also said if I deleted the account then I would lose all of my history it has collected. I opted to just hide my duplicate accounts since at that time I had several months of data I would lose and now I would have several years of data I would lose if I were to do it now. I am not satisfied by this and wish I did not have to have “hidden” accounts. Someday I hope they will have a fix where I do not lose all of my previous data the app has collected to get this fixed. It is frustrating but I can live with it if I must. Besides that I have no complaints. They constantly update and add new features which I love. I do refer the app to others.

Many things to like - still needs to improve. I love having all my accounts together, the budgeting features , and the ability to enter transactions I know are coming such as a bill I paid so that it is subtracted from my “available “balance. What needs to get better is the ability to change a transaction - currently if I see a mistake ( of account or date ) I have to delete the whole thing and can’t edit details. The available balance has a ‘glitch ‘ and doesn't always match transactions and subtract totals at the same time as the bank download so you have to be careful thinking you have money available because you might not. It can take some toggle in and out of the app to get it to trigger an update to the numbers and subtract your recent transactions. For now you have to mentally calculate what you know you spent and double check what it says is “ available”. Lastly it would be great if I could choose to match something or not. I would rather not have the auto matching. Often it tries to match a bill I entered that has the same dollar amount as one-that is downloaded and they are not the same transaction. I would rather have it ask me “ do these match? “ .

Incredibly difficult to use. I’m a huge fan of budgeting and create my own methods to do so, but life got too busy and I needed something that could handle my budgeting for me. This app worked ok for the first few days, but then my layout switched and it’s now a plain white background to scroll up and down on. Looks nothing like the side-to-side colorful page they advertise, and I can’t switch it back. I also try to categorize my purchases each week just so the app knows that my grocery store purchase was for home supplies and not food for example. But Mint conveniently forgets these categories each week. For a transaction to stay in the category I choose, I have to go in and change it at least twice before it actually sticks. Next, the calculations used to generate how much I’ve made and spent that month are confusing and pretty far off. I added up the money I spent according to the categories it gave me in both the pie chart and the cash flow, and neither came close to what Mint claims I spent this month. I have no idea where some of their numbers come from, even after reviewing everything in great detail and adding it all up. In theory this app is great but I don’t think I can continue to use it without it having more options to change the layout or see more details about how their calculations are made.

I love it. I’m a long-time user of the app and website as well. I believe the site and app are worthy of 5-stars, and I think everyone should be budgeting their money and giving themselves financial goals. There was a big update to the website/app, and the goals section changed. I have left a lot of feedback about it because some features went away, it used to give you a clear plan as to how to pay down your credit cards. It had access to your APRs, and it would tell you exactly what to pay to each card each month to pay them down the most efficiently. There were also sliders for BOTH money and time, if you want to pay less money per month, the time it would take to achieve your goal would change, and you could use the time slider to adjust the goal as well. Now it just asks, “How much money per month can you pay?” And then it spits out a timeline. That gives way less information than before. Overall the app is wonderful but I’d love to see those old features of the goal page return.

I’ve had SO many problems with this.. So to start off I couldn’t add one of my accounts and it took me about 3 hours on chat w customer service to finally fix it. Not to mention you have to do the chat there’s no way to talk to a person. Now my transactions take absolutely forever to update. Like several days. When they finally post they get automatically categorized in categories I don’t even have in my budget. Why would that make sense? Then when I recategorize them in my categories they automatically revert back and I have to redo them. Sometimes multiple times. When I got on the customer service chat to try to solve the problem the lady told me that if we got disconnected to reopen the chat and give my claim number so we could reconnect. When we did get disconnected I did exactly that and after waiting on hold for 30 minutes it disconnected again. They sent me an email saying they assume my problem is solved. Hah. Today I needed to delete a transaction and the only transaction I need to delete is apparently the only one that I’m some reason prohibited from deleting. The button just isn’t there like every other transaction. I also needed to split a transaction and the only transaction I needed to Split the button to split it just isn’t there. Every other transaction it’s there though.

It WAS a good app.... I’m annoyed by how ANY little message/offer/notification (includes pop-up or message center) from a creditor’s or service provider’s website will block this app from refreshing account info. Every time I’ve tried to check these “messages” it just takes me to the mint website in the Safari app, which after logging in will then direct me to the creditor’s website to log in again. Is that step really necessary?! Even then, there are often no unchecked messages/ notifications/ or special offers, so I still don’t know what the problem is. Mint is aware of such issues, but does nothing to correct these bugs. Currently this issue involves Spectrum and/or Time Warner Cable accounts that haven’t refreshed since September 2018. Two other issues I have is that you can’t manually add a fixed APR loan account for banks without a website account login. Not all banks have this feature available to customers who do not have a checking account with them. The second issue is the option to post date or backdate when payments were made is not possible on this app. Ultimately, I’m disappointed with how much this app has been going downhill over the last year. It was a good app before then, but it seems the developers have given up on regular updates for bug fixes. I’m just about ready to look for another app to replace it.

Decent budget app. Overall, Mint has been an okay budgeting app, but there is still plenty of room for improvement. For example, the two metrics “spending by category” and “Net income” are great, but the “spending over time” is ridiculous. For one, why is spending always considered red (negative)? The average person MUST buy groceries, food, pay rent, etc. Doesn’t the net income capture that? This metric should be improved to show normal (planned expenses) as neutral (grey rather than always red) and the bar graph should be in quadrant 1 ( with both positive numbers on the X and Y axes). Like I mentioned, planned expenses should be grey, but unplanned or unexpected expenses could be red, but the bar graph is still going up. Visually, I can’t stand the bar graph being in quadrant 4 (x positive and y negative) because no one is ever not going to spend on something during the month. All income is considered in the net income metric, so why not separate the two entirely so it doesn’t appear to show that average monthly expenses are frowned upon. Also, it takes several days for Mint to accurately reflect what is in my accounts and by then it’s already different. I don’t know how you’re going to fix that one but more accurate numbers for the accounts would be helpful. I hope these comments serve a purpose. Thank you!

Unresponsive to Requests for Improvemevt. UPDATE: I went to the article linked in the developer response, and it was totally inapplicable. It explained how to add a manual transaction to an existing account. That’s not what I asked about, or the feature I requested. If Mint has chosen not to support Apple Card, they should support off-line accounts that would have manually (or better, as I originally suggested, imported) transactions. Until mint allows me to capture a complete, accurate picture of my financial position, it’s worthless. I run a lot of spend through Apple Card and it’s not captured at all! Even the monthly payments to Apple Card aren’t recorded, making my monthly spend look artificially low. Intuit keeps investing in “redesigning” the app to add new features, yet they’ve been stubbornly unresponsive to requests to add major financial institutions and credit cards. For example, MetLife spun off BrightHouse Financial. Since Mint has always supported MetLife, you’d think support for BrightHouse Financial would be a no-brainer? Nope. Over two years and Mint still hasn’t heard of BrightHouse Financial. Another great example - Apple Card. Ok, I’ll buy that maybe Apple won’t let Mint connect to them. In fact, that might make me feel better. But Apple does allow downloading of transactions. Yet Mint hasn’t mastered the concept of manually importing transactions? How long has Intuit owned them? Maybe focus on the basics before trying to add flashy features.

Ad-free plan has ads. Mint has been a solid app for keeping an eye on our finances. Account refreshes still have issues, but are way more stable and reliable than they used to be. Given, the immense amount of personal data they collect about us, the financial insight features feel shallow but flashy. It’s easy to set goals then completely ignore them. The goals functionality itself is outdated. Investment data seems wrong with no way to add/edit/correct info about holdings in the portfolio. There’s no useful functionality around retirement planning (blogs don’t count). Biggest gripe is the Ad filled Ad-free plan. It’s just a buck a month, but the misleading description has soured my experience and trust for Intuit. If you subscribe, the marketplace page with all its third-party offers is still around and you will continue to have large portions of the home and notification pages dedicated to ads for Intuit’s other products like bill-negotiation (also a third party). Finally and most importantly, you will not be saved from full page pop-up ads upon logging in about Turbo Tax ‘offers’ that must be dismissed before you can use your ad-free app (Turbo Tax is a ripoff, btw). Mint is a fine app and I expected to have an even better experience after turning off ads, but that dollar per month doesn’t change much. Paying for Mint actually left me feeling tricked and less satisfied with the product.

Useful but Clunky. I’m a long time Mint user (over 5 years now). It is a VERY useful app, allowing me to do real time updates to my budget and keep a close track of my spending. The review of budget categories is easy while the goal keeping is very useful. The app does a good job keeping the various accounts linked. The clunkiness comes from categorization of each transaction. The app will auto categorize transactions, but this isn’t always accurate. It doesn’t “learn” common transactions, meaning a restaurant or store will continually cone up as a separate category which required a manual correction (on the website there is an “always categorize as” option, but that is missing in this app). I’d say only one out of four transactions are correctly categorized by the auto-feature. It also doesn’t allow one to ‘hide’ unused budget categories, meaning there is a lot of scrolling through extraneous items. Recently there has been a ‘glitch’ for the categorization of pending transactions, it’s been present for at least 2 weeks and no correction issued. So, I recommend the app for those wanting to have a useful means of tracking spending. But be ready for some frustration when trying to categorize transactions.

Love mint, suggestions for improvement. Longtime Mint user here. Mint is the best app I’ve found for tracking spending and managing our budget. A HUGE improvement would be to create a feature in the budget tool that allows you to specify that transactions from certain vendors should ALWAYS fall under a certain category in the budget. It seems like Mint eventually “learns” how to categorize some transactions, but it takes forever. Just give me a box to check that says “always categorize transactions from this vendor this way” or something. It gets wearisome having to individually recategorize transactions from the same vendor over and over. For the millionth time, NO, our favorite restaurant, Nose Dive, should not be categorized as “sporting goods” (who even had a sporting good line item in their budget?). And NO, purchases from Pet Supermarket should not be categorized as “groceries.” It would probably be helpful if you would also make it possible to delete budget categories we aren’t using. That might improve Mints ability to better guess where transactions should go. Another helpful tool would be being able to select multiple transactions and then categorize the whole batch. Then I could select all of my entertainment, shopping, or restaurant transactions and categorize them in one fell swoop. Come on, Mint! You have a great product, but some of these things seem like common sense.

Works for simple personal finances. This was a great personal finance tool for us in our first few years of building wealth. As our finances grew, Mints limits started to become much more apparent: one-time or changing budgets and projected expenditures can not be put into the system to plan for future one-time expenses, making the budgeting tool only good for retroactive reviews rather than planning ahead. Bills is definitely coming along well, but how and when to mark a bill as paid is very confusing. For example, if I pay a bill but schedule the payment to pull on or just before it’s due date, I need to be able to modify the “paid on” date. When a bill is marked as paid in mint by you the payment date is automatically set as the date you checked the box. That also doesn’t paint an accurate picture of managing bills, and leads back to the problem of not being able to project out money coming out of your checking account in the future. Without that ability, we still need a secondary tool to see how much money we have leftover after expenses at the end of the month for any expenses that haven’t yet hit our account. Mint is fantastic for seeing past trends and retroactively reviewing where your money went, but it is inadequate for budget planning and projections.

Used to be better. I have used this app since it was under a different name years ago (Pageonce, even before Check). It’s always been good about helping me keep up with my finances, but the new changes make it more difficult. I used to see on the first page what bills were due when, and available balances on all my checking and credit accounts. Now, I have to go digging for that info, and am instead inundated with ads to apply for various cards, personal loans, etc. I like the aesthetics of the new update, but I feel like functionality was forgone for ad revenue. It’s sad that advertisers have more power than consumers when it comes to app GUI design. I tried accessing the help page and App Support link, but they both direct to an FAQ that doesn’t tell me how to see my credit card balances on one screen. It shows percentage of utilization, but I have to go to each card account individually to see balance and available credit. Percentages are nice, if you readily recall what each number is a percentage of. Telling me I have 70% left means something completely different on a card with a $500 limit vs a card with a $7500 limit. I have a lot of respect for Intuit, but I think that they have lost touch with what a good app experience for the USER should be, rather than an advertiser.

CANT EVEN LOGIN BECAUSE OF BLUR. This app, like most things that Intuit’s greasy fingers grace is unusable garbage. You won’t even be able to log in if you use the built in password manager in iOS or any other supported password manager. Once the autofill prompt pops up asking you if you’d like to use your saved password for mint/Intuit the display will blur all contents of mint and it will not in our no matter what you do. Likewise, if you try to switch between mint and any other app such as your 2FA authentication app of choice, the same blur will prevent you from continuing to log in to mint or doing anything with the app. Until you FORCE QUIT mint, it will not recover. This occurs after deleting and reinstalling the app. iOS 16.5.1(c) and iPhone 14 Pro Max. Not only do Intuits mobile developers have zero comprehension of how to properly develop an app for iOS. Their devs also have no idea how to make their application properly communicate with an API in order for users to be able to link their bank accounts to the mint application. It took countless attempts over multiple weeks in order to be able to link a Chase checking account to mint. And it was no problem of mine, Chases, or the methods or device I used to attempt to link the account. Good luck if you use this shoddy app. If you choose to, be aware that it may result in a heart condition from the endless frustration due to the incompetence of Intuits development team. Idiots.

Just okay. I’m not sure why the app has way less details and functions than the website, but I find the app a little pointless. If you want an overview of your spending in a pie chart...the app gives you that. Although not correctly because the categories are wonky. Even when I changed some of my purchases to a different category, it’s impossible to go through them all...because I find most are incorrect. I also have problems with the category making sense but the subcategory puts it with a different grouping, or vice versa. I can’t explain, but it seems some of the automatic subcategories don’t make sense within the category, so when it’s popping up in the pie chart, it doesn’t make sense with where it’s showing for the category. And sometime it’s lists the category and sometimes it lists the sub category...so I’m not comparing apples to apples....not seeing what I want to see. I just find the whole thing very clumsy. It’s not perfect by any means. And for the online website version which is a lot more comprehensive, I could use a class in the budgets and spending part! It just is not intuitive and isn’t working for me. But the app...just a snapshot of where it thinks you’ve spent money. Not great, because it has the transaction categories wrong part of the time.

Using for years and love it. Hi there - I have been using this app for budgeting and keeping track of my credit score for a couple or few years now. My score has grown over 50 points since I’ve been able to closely monitor it with this app. My favorite points to mention is the flexibility of this app - I’ve tried a few different budgeting “theories” or “systems” or whatever you want to call it and this app has always been there for me and I’ve been able to adapt the views and tracking to meet my needs. Also, when I get frustrated and just want a break from tracking finances this app is still in the background so when I come back to it I can hop right in and get a relatively accurate picture of my month or 2 I didn’t actively use it. There are ads, of course, and the syncing isn’t always *perfect* and has to be manually refreshed- but for a free app, I seriously have 0 complaints! Kudos to the Mint developers team. Keep up the good work. The other thing I will note is the app is not constantly changing with updates, however, bug fixes are solved quickly. That’s exactly the balance you want with a long term use app that most developers can’t get right. Some apps you have to completely re-learn after an update and it’s annoying and frustrating- but here I’ve never noticed large changes that make me change the way I use it. Thank you to the team for that.

The ugly. All the reviews across the web praise Mint but let’s talk about its glaring short comings. 1. You can’t share access with a spouse. They would have to make their own account, spend forever importing and tag all of the expenses all over again. 2. You can only import the last 90 days of transactions, that’s it. No other way to capture any other previous months. 3. Several accounts can’t be added- examples that came up for me. Apple savings, New York Life Investment account, student loan, bmw loan, college savings fund, and health savings account. 4. Can’t manually add house to the app. I’m sure there are more but I might be unwinding my work and try some other platform. They also suggest adding feedback to their website but guess what!? I deleted my account and they require an account to leave feedback. This might be why there are such huge gaps in the offering. It might be good for those who are just starting out on their budgeting journey with very few debt or savings accounts but unfortunately it just doesn’t work for all. Also check your bank and see if they offer an in-house budgeting tool. I had one through my bank I loved but they recently switched to one that isn’t as responsive which was why I decided to try Mint (again).

A gift to those of us who can’t keep track of our spending habits!. I’ve tried just about every free app for tracking finances and budgeting... Mint wins hands down. It’s simple to use and pleasant to look at, gives you options for setting goals and reminders, sends you notifications if you’ve spent too much or your any of your bank accounts have a low balance to keep you from accidentally going in the red, the app can track the status of your federal tax refund and alert you when it arrives, you can import any loans you have into the app and it will track your progress paying them off and will help you to set payment goals and send you reminders, also it gives you a break down of your spending on a chart that shows what percent of your funds goes to what category like food, rent, gas, miscellaneous, etc. Thanks to this app I realized I was spending way too much on beverages at gas stations. It adds up more than I realized! You can use it to create customized reminders for when it’s time to pay bills so you never forget. It’s just amazing. Highly recommend.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

They sell your information. I signed on applied my bank accounts 2 business days later I get repeated calls for outsourced telemarketers claiming to work on behalf of Scotia bank stay clear of this terrible app

Doesn’t work with TD bank. It stopped collecting the data from TD 2 weeks ago. Please fix it or tell me how to fix it.

Banks accounts disconnecting issue. Every time I go on the app, my balance is not updated. So I need to sync my bank each time I want to see new reports. That’s such a waste of time. Developers, answer this post when this will be fixed. In the mean time, I will just delete my account and see elsewhere.

Developer has given up on this app. It has been about a month and they have not fixed the sync problem with all accounts except Wealthsimple. Opened a ticket with Mint chat and the rep said they will open a case number and I received no number or response. Do not recommend app.

Accounts Don’t Update. This would be a great app if the accounts would update more frequently. My Tangerine, CIBC and TD accounts haven’t updated for days. For a budgeting app, I need to see how things are unfolding over the month. Until they improve connectivity with Canadian banks, I won’t be using this app.

Can not edit.. It tells me I overspend, which I already knew. What I don't like is that the trends pie chart is not accurate and I have no way to edit it. I have a budget for groceries and it likes to lump sum my groceries in with dining. I know I spend more on groceries, so I don't need to see this as the biggest chunk of the pie. I want to see how much a month I spend on dining out. You can't edit these charts so I will have to keep old school paper charts of these things. I already have an app for my online banking so mint is redundant. Will be deleting.

Connectivity issues and bugs abound. App crashes anytime it tries connecting to Scotiabank Canada, and it's been that way for over a year. Wealthsimple doesn't connect at all, from neither the app nor the website. Fix your app please, it's not of much use if we can't update our accounts!

New Update - App will not Open. I cannot open the App after the last update!?!?? It just continues to load??? Please fix this! The app is no longer good.

What a bad app from such a reputed company.. I installed this app and was starting to liking it and then the app update happened. They changed the interface and the bills option to edit all the bills I had created disappeared from the app interface. So I logged in to the app using my laptop and was able to make adjustments and then today even that disappeared and I get a stupid message “Uh-oh. Something went wrong. Please refresh”. Nothing worked. Opened a chat session, where I was suggested to use different browser. I used all, safari, IE, Edge, Chrome. Same result. Another chat session and this genius tells me that the Bills option is not available to Canadian customers. Hmm 🤔. The genius should be fired. If it was not available then how heck did I set up all my bills in the first place. I was not using it in Timbuktu. In summary utterly disappointed by this app and cannot fathom a reputed company like Intuit would roll out such a bad app, especially nowadays when knowledge of app development is mandatory for all developers. I know because I have a team of smart guys who do it on a daily basis. Uninstalled the app. Goodbye Mint.

App stopped auto updating for more than a month. And has become practically useless

Won’t connect to my second RBC account. I’ve had this app for years and not had issues. Now it’s not connecting to my second RBC account. It connects fine to my Scotiabank and first RBC accounts so I’m not sure what the issue is.

Stop getting update from MBNA. I enjoyed for few months. But after some time the app stopped pulling updates from MBNA credit card. I detached the card and attached again. Not worked. Eventually deleted the app.

Nice interface, seemed difficult to connect. The interface is nice and the features are promising. However, there doesn’t seem to be an ability to show all household accounts - ie: my partner’s credit card. As a household app it fails because of this.

Too glitchy to bother. The bank connection would crash every single time when I log in. I had to reconnect it to my banks every time. Not worth the struggle.

No longer working. The app worked great when I downloaded a few months ago. But for the past few weeks it’s been increasingly glitchy and now it doesn’t work at all, no longer connecting to my bank account to update in almost 10 days. Until this is fixed, this app holds no utility for me.

amex canada not updating. what is going on with your app? amex canada is always down? the website for amex works fine. stop saying the bank connection is down like it’s their fault. fix your app. been more than a couple of months where it doesn’t seem to update the account info at all and one has to delete and add the account back

All the useful feature from the website? Gone. I originally started using Mint because of their bill reminders and its consolidation of accounts/available cash. The app has none of this, just a nagging app that tells me I spend too much on coffee. I already have a wife, thank you.

Horrible. I don’t know how this is top of the list for budgeting apps. You cannot edit your categories or add more transactions once you put one in. Not user friendly at all

Does not update spending. Mint has not updated any of my spending information since the day I downloaded the app. I have tried updating the app, logging out and back in and re-installing and it still does not update. Very disappointed as I had high hopes for this app.