Qapital: Set & Forget Finances App Reviews

Qapital: Set & Forget Finances App Description & Overview

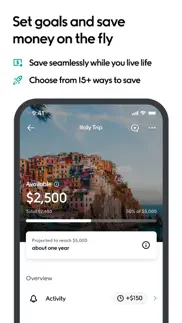

What is qapital: set & forget finances app? Your goals, our scientific approach to helping you take charge of your finances… it’s a winning combination that’s already helped more than 2 million people start their journey toward money happiness.

Using behavioral science, we’ve developed a smarter money app that helps you reach your financial goals without changing the way you live. The best part – our approach works just as well for couples as individuals.

And because we know just how hard (and boring) it is to stick to saving and budgeting plans, Qapital’s checking, saving and investing tools do the heavy lifting for you – automatically.

*****

Qapital is built on the idea that money happiness is personal. That’s why Qapital puts your Goals front and center, then helps you plan your spending, saving and investing around them. And you don’t need to give up your existing bank account.

1. Stop budgeting, start Qapitalizing

Let’s face it, traditional budgeting simply doesn’t work for most people. Life gets in the way, or we see something we suddenly can’t live without – we’ve all been there. Qapital replaces spreadsheets with scientifically designed money tools that help you take charge of your entire financial universe.

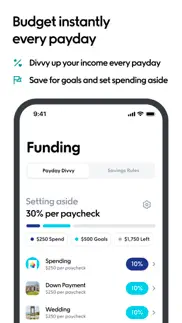

2. Pay yourself first with Payday DivvyTM

The Qapital effect starts the moment you get paid – Payday Divvy automatically divides up your paycheck between short- and long-term goals, bills and discretionary spending (don’t worry, your money is always available to cover unforeseen expenses).

3. Build successful money habits that last

Big picture in place, Qapital gets to work on the details. Spending Sweet Spot makes it easy to adjust your spending week by week while still helping you save automatically toward your Goals. And it all works by leveraging the habits you have – rather than expecting you to start new ones.

Smarter checking: Our FDIC-insured checking account gives you instant access to savings balances, instant free transfers from savings Goals, a Visa® debit card that works with Apple Pay & Google Pay, direct deposit with early access to your paycheck, and bill pay. All without any of the hidden fees regular banks saddle you with.

Smarter spending: Our smart money manager will help you make sense of your weekly spending habits. Discover how you spend, and you'll learn where to save.

Smarter saving: Set your savings Goals then use our smart Rules to save toward them automatically. And use our integration with the Apple Health app to save money toward your Goals when you reach your target for Walk or Run Distance, Steps, or Workouts. You can also customize your own Rules with our IFTTT integration (we have a few to get you started). All FDIC-insured up to $250,000.

Smarter shared finances: Designed for the way couples manage money together today, Qapital Dream TeamTM lets you save toward shared Goals and see one another’s transactions without giving up your individual accounts.

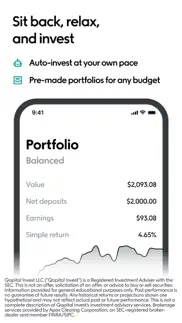

Smarter investing: Qapital Invest is investing for people who like the idea of investing but don’t really know where to start. Set your Goals, pick a portfolio and a timeline, and then leave the nitty gritty to us. Smart.

QAPITAL, QAPITAL INVEST and the QAPITAL and Q logos are registered trademarks of Qapital, LLC. Copyright © 2023 Qapital, LLC. All Rights Reserved. Qapital is not a bank. Banking services provided by Lincoln Savings Bank, Member FDIC and other partner banks. Qapital Visa® Debit Card issued by Lincoln Savings Bank, Member FDIC.

Qapital Invest LLC (“Qapital Invest”) is an SEC Registered Investment Adviser. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Investing involves risk; you may lose money, including loss of principal. Brokerage services provided to Qapital Invest clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC. Investments are not FDIC insured but protected by SIPC.

Please wait! Qapital: Set & Forget Finances app comments loading...

Qapital: Set & Forget Finances 2.301.0 Tips, Tricks, Cheats and Rules

What do you think of the Qapital: Set & Forget Finances app? Can you share your complaints, experiences, or thoughts about the application with Qapital, LLC and other users?

Qapital: Set & Forget Finances 2.301.0 Apps Screenshots & Images

Qapital: Set & Forget Finances iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 2.301.0 |

| Play Store | com.qapital.qapital |

| Compatibility | iOS 15.0 or later |

Qapital: Set & Forget Finances (Versiyon 2.301.0) Install & Download

The application Qapital: Set & Forget Finances was published in the category Finance on 14 March 2015, Saturday and was developed by Qapital, LLC [Developer ID: 969977668]. This program file size is 473.63 MB. This app has been rated by 83,565 users and has a rating of 4.8 out of 5. Qapital: Set & Forget Finances - Finance app posted on 14 February 2024, Wednesday current version is 2.301.0 and works well on iOS 15.0 and higher versions. Google Play ID: com.qapital.qapital. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

Now you can set up direct deposit to your Qapital Spending account in seconds, right in the app. Plus, you can use that account as a funding source for Payday Divvy. That all adds up to faster money movement. This release also includes improvements to Dream Team, our shared finances feature, just in time for Valentine’s Day.

| App Name | Released |

| Progressive | 11 January 2010 |

| Money Network Mobile App | 25 March 2013 |

| MySynchrony | 03 October 2017 |

| Amex | 31 March 2010 |

| PayPal - Send, Shop, Manage | 03 February 2019 |

Find on this site the customer service details of Qapital: Set & Forget Finances. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Family Money | 06 August 2020 |

| Simple Budget- Track spendings | 30 May 2012 |

| Best Budget Pro | 21 December 2011 |

| Adding Machine 10Key iPhone | 22 September 2010 |

| Debt 2 Income Calculator | 15 July 2022 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Netflix | 01 April 2010 |

| TikTok | 02 April 2014 |

| Amazon Shopping | 03 December 2008 |

| CapCut - Video Editor | 14 April 2020 |

| Cash App | 16 October 2013 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Stardew Valley | 24 October 2018 |

| Muse Dash | 14 June 2018 |

| AutoSleep Track Sleep on Watch | 19 December 2016 |

| Poppy Playtime Chapter 2 | 15 August 2022 |

| Poppy Playtime Chapter 1 | 08 March 2022 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Qapital: Set & Forget Finances Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Great app poor performance. The app itself is great. The features the interface even the investing aspect is all very good. But it’s too buggy for me to trust placing my money into it. I’ve used it off and on for about 2 years now. I always kept some money in my account but I will be looking for another alternative now. The time it takes for transfers to initiate, actually transfer, and then become available in your account is upwards of 4 business days. Since it is a savings app. Would typically look past that, but that along with my bank account randomly disconnecting with no ability to reconnect for a certain time, the app randomly crashing, and now being unable to open the app at all. I’m fault of my own a large amount was taken from my bank account and placed into qapital. I do need this money too so I figure okay I’ll just transfer it back, wait a few days no big deal. But the app will not open at all now. I’ve deleted and redownloaded the app and still nothing. I’ve been dealing with similar bugs for 2 years but this was the icing on the cake. As soon as I am able I’ll be withdrawing my funds from If you’re already a customer I won’t try to convince you otherwise. But until these bugs are fixed I cannot recommend this to anyone.

Works as expected. Been using it for a month now. Stuff really does add up but you definitely do see the money leaving your account. But I also have it set to take $20 out of my account every week as well as have the 52 week rule where it starts off with $1 on first week and increases by a dollar every week after that. I guess if I only had it on roundup I might not notice the money leaving my account. It’s nice if you want to save for small things up to like $500. But if you want to save for big things like international trips it will take a long time before you get to your goal if you’re just gonna use the round up rule. Unless you’re using your card like 15 times a day and round every purchase up to the nearest 5. Which I doubt many people do. It’s fun nonetheless to see your money add up with the satisfaction of eventually being able to pay for something. I think I like it because I don’t have strict discipline so it’s nice because the money leaves my account so I’m less likely to spend it but if you are good about saving your money I don’t think you will get much out of this app.

Very helpful. I really wish my bank offered some kind of “round up” program. Qapital has been SUPER helpful for me. I’m not the kind of person that can manually transfer money into my savings. And having it done with direct deposit seems to make it easier to transfer right back into my checking account for usage because it’s such a large amount at one time. Like, if I put $500 in savings from my check, it takes such a huge chunk out of my checking account. Qapital takes little bits at a time. I have my “round up” rule set to $5. I also have an auto transfer of $25 every week, AND 5% of each deposit made into my checking account. This may sound like a lot, and I guess it is. But with these rules, I’ve been saving between $700-$900 a month (usually $800). And I hardly even notice. Absolutely loving Qapital. Highly recommended. I also have the card. Never had any issues. I have $50 going in there a week for random nice dinners or nights out and such. Oh! And I love the cute little milestone celebrations when you get closer to reaching your goal :)

Make saving a game. Saving money always felt like taking something away from my present self to give to my future self, so I rarely did it. But with Qapital, I find myself jealously guarding my savings, and trying to find more reasons to save. It's a wonderful concept, and it works great. Plus, if you get their debit card, they pay interest on all savings; better interest than many other banks offer. And now they offer automatic and commission-free (which is not to say without charge) investing. I've looked over their fund picks; they're good ones. They've got an interesting approach to diversifying your investments that I like. By far the biggest flaw is the lack of a free tier. Having a savings account—even a spiffy one like this—shouldn't cost $6/mo. Remember, they make money off your savings. Paying for investing—and even checking—is okay, but the basic features should be free. I find it hard to recommend this app to friends without a free option. The only other real flaw is that you can't exclude some transactions from the Rules. There are tons of possible options for saving, but I only use the Payday rule, saving 10% of every paycheck (split between various savings and investment accounts), and Set and Forget to build up savings for my next car. I do wish they had a more aggressive portfolio, something like an S&P 500 Index, getting ~10% returns.

Cherylb61. I started using the Qapital App right after it's inception. I am in my mid fifties and have a great career but have had difficulty truly saving money like I should. When I came across the Qaptial App and did what research at that time was available I knew this was a good tool for me. Since then the Qaptail app has really exploded and grown in popularity. Since adding their latest addition with the Qaptal Debit Visa (which I just received) and am excited to start using! I cannot say enough great things about Qapital and how it has helped me save money like never before! Of course there has been some kinks and bugs along the way, as with anything new, but there CS Dept. has pretty much always been very responsive to assist me when needed. I was a little bit leary at first since Qapital only offered online assistance and no phone number, but again when needed they always have responded quickly (CS) when I has questions/issues. I know this is a very long review but I felt it was worth the time!! I highly recommend Qapital App to everyone!

This app is broken!. So supposedly my bank account got unlinked but when I try to transfer my money from my Qapital savings to my checking account it shows that my checking account is non-existing, and the app tells me to link my bank account and when I do it shows my checking account. I click on my checking account and press the button “select funding account” and the button is blue and loads for about 1 second then turns blue as if I never pressed the button. I’ve tried resetting my app, logging out and back in, deleting the app, and selecting the button 100+ times and nothing is working ! I have no way of accessing the $100 in my Qapital savings account and if you don’t know, IT IS IMPOSSIBLE TO GET AHOLD OF THE QAPITAL SUPPORT TEAM. If you’re dealing with someone’s money, there should be an easy way to contact you if something isn’t right. UPDATE EDIT: So after 2 weeks the developers finally fixed my account, apparently it was frozen now I can say the app is a cool way to save money but just be aware of something happens you’ll have to wait about a week to get a response and for them to fix it!

AVOID this app and company. My wife and I opened accounts with Qapital and began saving through rounding up transactions from our funding account, which is a personal checking account that is not part of Qapital. We didn’t like how it worked, so we cancelled/deleted the rules within Qapital which created those automatic withdrawals, but the withdrawals from Qapital continued. Then we closed our Qapital accounts completely. More than three weeks later, after confirmation that our accounts were closed, Qapital continues withdrawing money almost daily from our checking account — which they call a funding account. We have asked Qapital repeatedly, no less than five times in writing, to stop taking money from our account, and to refund the funds they’ve fraudulently withdrawn from our account. In writing is the only option you have — they refuse to provide phone customer service and won’t even provide a phone number to call. Each time, they’ve done nothing to stop the withdrawals. We are reporting their transactions as fraudulent, as we have no other choice — they will neither acknowledge the withdrawals, or refund the money they are taking from us. Avoid this company! There are too many good banks and financial institution options out there, but Qapital is not one of them.

So far so good. Update: At this point I’ve used Qapital for almost 2 years and have saved for major life goals with the help of Qapital. I highly recommend this app for helping to make sure that you’re actually saving substantial parts of your income and investing over the long term. My investment accounts with Qapital perform better than any of my IRA or 401k accounts. I wish I could switch my investments and move them into Qapital. I’ve been using Qapital for about a month, and while I heard of the app years ago before they had a US banking partner, the service so far has been everything I expected. Qapital allows me to keep things really simple - I just want to round up all my purchases and save - and Qapital does just that. They don’t try to add or pitch me on investment products or portfolio management or continued cross-app integrations. I really like that aspect as well and it stands out from other apps in that regard. The only thing I haven’t done is save a substantial amount in accounts managed or connected to Qapital. I have some security and stability concerns. Would love to hear if anyone has over 5k or 10k being saved or invested in accounts associated with Qapital.

I love love love this app. I’ve been using this app for quite a while and it’s one of my favorites I am notoriously bad at saving money but this app makes it easy and even a bit fun! If I had to share a criticism though it is that Qapital is not the most easy to understand in terms of checking my bank account. For example: Ot checked my bank account 10am yesterday I had about 126$ in my account. I got paid yesterday some money in the evening and afternoon. I asked Qapital to put away 50$ into my savings and today around 7am received a notification that my account was on hold for overdraft protection. That’s fine Qapital will eventually check and notice I have over 500$ in my account now but at the same time I don’t know exactly when because obviously they didn’t check today at 7am. It’s not a huge deal just means my deposits are on hold for a couple days but still I wish I could force Qapital to refresh my bank account or get an approximate time as to when checks are performed as we are just told Monday through Thursday but not when and like I said obviously Qapital hasn’t checked any time today or they’d see my bank account is fine. Still fantastic app though!

Hyphybae. I was the worst saver before Qapital-aimless spending, no goal management. Qapital has allowed me to stay goal focused and make a dent into savings for things like an emergency fund, a downpayment and a fancy tent for burning man. While it took some getting used to, automating savings was what I needed and changes how I live-I see my bank account and I think I’m broke-but really Qapital is putting my money where my mouth is. I’m no longer talking about my wants but going after them and that feels good. Setting up rules based on my spending behavior makes me think twice before swiping at the register. Every time I make a gas purchase, I put a little more into my car maintenance fund just in case I might need it down the line. The best part is when you get settled with Qapital and see your savings stack- it’s addicting! You can actually visualize your goals-manifestation baby. If I had some critiques of the app it would be that it isn’t a high yield savings account and your money isn’t growing based on the any interest earned on the account itself-just your hard work. Now that I’m approaching 10k I need to start looking into a more permanent solution but Qapital showed me that I have what it takes to actually save.

They always gotta ruin the good things... ****** UPDATE——- so utterly disappointed in the new changes of starting to charge $8 a month, qapital used to be a SAVINGS app which Im sure most people didn’t touch the money in the account, but if you start taking $8 a month out... your savings will most likely slowly disappear. So I found this app the beginning of this year- and set the round up rule and actually forgot completely about it one day lookin thru my apps seen it and in 3 months already had $40 saved up and that's just the extra pennies from purchase to round up to nearest $1. They have all sorts of different options for saving how you like, started doing $50 a week transfers and got up to $600+ saved I've used a lot of finance apps that say they'll save you money but this one really works for us and I'm greatful to have come across it! Their one and only downfall I'd say is they do take a couple days for your linked bank to be updated and transfers to be complete so hopefully one day it can be synced faster or immediate. And the qapital spending card has really saved my but a couple times! OH and I can't forget to mention how amazing their customer service is, 💯Give qapital a shot, you won't be disappointed!!

Very helpful. I’ve been using Qapital for years now and I have found it so helpful. Admittedly, I’m not naturally the best with money. For most of my adult life I’ve settled for living paycheck to paycheck with no cushion. However, with Qapital, I’ve been able to save significant amounts of cash, by creating realistic, achievable goals. The app itself is pretty simple and intuitive, and improving from time to time. The concept itself, while also simple, is very effective. Having goals helps to create a savings target, and putting money towards each goal gives you a sense of momentum. Instead of just saving aimlessly, or saving some huge number for, say, a down payment on a house, smaller goals create that momentum and encourage my savings habits. Lastly, and this isn’t really so much about the app as it is about saving in general — money doesn’t buy happiness, but it does provide you with peace of mind and freedom. Peace of mind knowing the last dollar in your checking account isn’t the last dollar to your name. And freedom to enjoy life without the stress or pressure of feeling like you’re always just “getting by.” I can’t recommend getting into that mindset enough, and I can genuinely say that Qapital has been so very helpful for me, in that regard.

Nice way to start emergency fund. I love using this app. Very easy to use. I just wish the deposits were more frequent. I use the set and forget rule added with round up rule. Picked to have $2 dollars a day, because who would notice just few dollars a day? Except, it builds up and then by the time it does come out it’s a big enough amount that I notice (at times over $60) I recommend getting the debit card. Otherwise, you’ll need to wait a few days for the money to be put back in your account, which is a pain if this is your emergency fund. Update: I have still been loving this app. I don’t really use it for savings. I take what I’ve earned each week from round up rule and transfer it to my debit card. Then that’s what I use for the week for lunch at work. The only thing I’ve seen change since I started using Qapital, was they now charge monthly fee. Not sure of the prices, I started using this so long ago that I was grandfathered in on the account type I was using. They still only deposit money in your account on certain days. But I did discover that if it’s starting to get higher then you really could afford, that you can go in and cancel pending deposits individually until you get down to the amount you’re wanting. And if your primary account gets down to a certain amount,(believe $150) then they will pause withdrawing from that account. Only reason for not giving 5 stars is because of their deposit schedule. Otherwise I love this app

Love this app. I *LOVE* this app. Easy to use, no fees (except ATM (use cash back, parentheses-ception!) and international), friendly UI, and the best is that any spending from the Qapital Spendings account (the Visa card Qapital issues you if you signed up for a checking, aka spending, account with them) is reflected INSTANTLY in the Qapital app, allowing me to track my spending as they’re happening. This prevents me from overdraft fees as well as better helps me budget. An exception I’ve noticed is when I’m electronically transferring funds from Qapital Spending to credit card company’s to pay my credit card dues. Still, that’s way better than my old account, which posted transactions 2-3 business days after they’ve occurred. Even if you don’t sign up for the Qapital Spending, it’s a great app to help you save without realizing it. Just gotta link your main bank account, and pick some rules that’ll go into effect, like “Round Up” which will round up any purchases and save the change, or “Set & Forget” which saves a certain amount in a set time interval. Give it a try!!

Just started using Qapital. Just recently started using Qapital after some online research and reading user reviews. So far I really like the app and have saved over $50 in a couple of weeks. I am using this app along with Acorns and Digit so I have a few side savings spread across those apps. I started off with "set it and forget" sum and the "rounding up" feature, just to test how much I could save with just my spare change. You'd be surprised at how much you can rack up. I have a specific saving account set in Qapital for a trip my boyfriend and I are planning. Once we go on that trip I'll set up a new saving account in the app. I also like that the app gives you notifications on your savings. You can also see a more detailed breakdown within the app. I really like this app because I can be very hard to save when you have a lot of expenses. This is a nice way to set up a savings that does the work for you. And honestly you don't even notice or miss the change the app puts away for you. Definitely worth trying this app if you want to save money, even if it's just using the round up feature. this app proves that anyone can save some money on the side no matter your income.

All you need is qapital. This is essentially a savings account but a more rewarding one. Daily updates and notifications (that are not annoying, more like exciting). Setting silly goals, for serious money. I was unaware of how much money I could really save until about 3 months in to using this app. Though there is a lot of other competition, qapital wins every time because they have the ability to support my account that stands with a small local bank, as other apps do not. Every review must have a down side or a flaw.. the only minor problem for me is that transferring money back into my normal account, while it states it'll be there in 2 business days, for me takes 3 to 4 days on average .. may be a small problem or wake up call for a procrastinator user. I highly recommend this to all my friends and it's very user friendly. Every time you sell this idea to your friends or family and get them to download it, qapital will pay you 5 whole dollars per person... that is a Starbucks frapp babbyyy. Ive treated myself to 3 free Starbucks drinks so far... my future is looking bright.

Budgeting made easier. I’ve grown grateful for Qapital. I’m the sort of person who feels money burning through my pocket. So when my checking account says I have money, I get excited and I spend it. Qapital gives me the ability to see what I actually have for spending money and set different goals for future purchases or monthly expenditures like rent. For example, I get a paycheck eve try two weeks. So half of my rent needs to come from each paycheck. I set up a rule that every time I get a paycheck, a percentage of it (half of my rent) gets saved to my “Rent” goal. At the end of the month I put the money from the rent goal into my spending account and my autopay will pull the money on the first. I can do that with future expenses too, like I’m going on vacation. So I figured out how much money I wanted to have accessible by the time I was on vacation, figured out how many paychecks until that date, and set up a rule to save the money from each paycheck to get me to the total spendable money for my vacation. This helps me not spend the money that has a future use. I can see when I’ve overspent a previous month because my spending account will be lower than I like. So if you’re like me and need to see the actual amount of money that you can use, this app is for you!

Great App! Love it. Th app is great! I have been using it for more than 3 years. I have also have referred a lot of people to it. Unfortunately yesterday I received a notice that I had to update my app. Which I did but after I updated it I received a message that there is a $8 monthly service charge to use this app. Really!!! That is almost $100 a year. I could understand if I received interest from the money in my Qapital account. No interest, so Qapital is getting interest from my money and charging me $8 to hold it. But what really makes me upset is that I know someone who has been using the app as long as I have and Qapital sent them a message saying they are grandfathered in and don’t have to pay a monthly fee. I keep reaching out to customer service to ask why do I have to pay and they continue to send a stupid generic response. Really!!! This was a good idea until someone got greedy. Think about it, if people had an extra $100 to give away they wouldn’t be using this app.

Great app!. I love this app. I didn’t realize how easy it is to have a few hundred dollars saved in a month by using the round up rule. I haven’t been putting any money in my savings because I feel like I haven’t had any extra lately. This makes that possible. The only reason I gave this 4 stars is because this app doesn’t make small transactions throughout the week; rather, it adds it all up and takes out a big chunk at the end of the week. I would much rather see 35 mini transactions throughout the week vs. 1 large one. Having it all taken out at the end of the week just feels like another bill. And it’s harder on my bank account. Since I have several savings goals set up, and they all have different rules, and it’s hard to see how much will be taken out when they’re all added up. Sometimes it’s $30, sometimes it’s $150. I don’t like being surprised when I see $150 suddenly taken out of my bank account. I cut it pretty close to overdraft some weeks, and I feel like small transactions would prevent this, as I’d see it coming from farther away.

I love this app. This app has helped me so much and in so many ways. I am usually the type of person who wants to save money but have a hard time doing it on my own. I love the different features, especially the ones you can round up the dollar amount and fund it for specific accounts. Next year I have to attend three different weddings and a family reunion, which is a cruise. One of the wedding is my mother’s and the other is my own. I would have NEVER been able to save without this app helping me to be discipline. The one thing I also love is if I have an emergency (which I did, my ac went out this summer ☹️) I was able to borrow from here and not be charged a processing fee if I wait 24 hours. Plus, them money was safe and it was very helpful to complete this project without going to the bank and breaking my pockets to get the ac fixed. Plus the money was available only because I started saving with this app! Thank you to the creators of this wonderful app. I currently have not received my card in the mail, but I’m ok with that because it keeps me more disciplined without it and makes me double check my true intentions when it comes to spending unnecessary money.

So far so good.... All I can is so far so good. Saving isn’t really a strong suit of mine, so I saw this app and thought I would try it. I did a lot of reading on forums and just reviews of the app and was assured that it’s not a fake site since it is backed by Wells Fargo Bank. The first week I signed up I had my water heater go bad on me and I needed to replace it. I added the Lowe’s account as one of my guilty pleasures and then I started to save. I started to save by rounding up and also by charging myself $2 extra everytime I made a purchase. Needless to say I had to make a total of 3 trips to Lowe’s land a minimum of $6 I saved. That is not including the round up part. I use my debit card on just about everything, I very rarely carry cash. Soo everytime I make a purchase I save a little. Yes it does come out of your bank account, the app isn’t giving you the round up money, so make sure you keep a little more in the account to compensate for a little more being deducted when you make a purchase. The app is pretty cool... I also have their debit card that I can use to make purchases. Tells you where you saved and where you guilty pleasure was used. I would recommend it and have to a bunch of friends that have already signed up. I would have given the app a 5 but haven’t been using it long enough to get the full experience. I will do another review in a couple months.

Needs a new update. I’ve been using Qapital for 7 years and continue to use it religiously. It is a great tool to help save money not just for your own goals, but to team up with your friends to save towards a goal together (a trip, rent, apartment funds, etc). I got their debit card as well since it is super convenient when you travel internationally since there are no travel fees and it helps you to keep to your budget. With this, I stuck by them when they started charging membership fees (in order to keep the debit card), which was upsetting, but the cost was low enough that I let it slide. I even stuck by them when they started charging for same day withdrawal before 12 pm. However, call me crazy, the recent update is driving me nuts where you can’t see how much you and your partner have each contributed towards a joint goal. You have to go into the “transfer funds” window to see how much you have contributed. Additionally, it should be easier to transfer funds between you and your partner when you’re on a joint goal. This has always bothered me that you can’t do that. It takes way too long for me to withdraw funds from my Qapital account (which can take 1-2 days) and then wire it over to my friend in another third party app. There should just be a function for this in the app.

They took my money.. Opened this account a few years ago to save some money. Cool. Liked the app. Then, my bank changed their name. Routing and account number stayed the same. However, they disconnected my bank on the app. I tried so many times to reconnect my bank with no success. So they started taking the membership fee out of my savings on the app. At this point I’m a little annoyed and decide I want to take my money out of the app and close my account. I try once again to reconnect my bank, with no success. Even tried talking to an agent. Finally I decide that I’ll just let them take the money out of my app savings for the membership fee and once the savings runs out I assumed they’d close my account if the membership is no longer being paid. I had tried to delete my account at one point as well with no success. Now, few years later, the balance on my savings ran out. Lo and behold they have found a way to access my bank account to retrieve the membership fee. I honestly loved the concept of this app until they started playing stupid games that ended up costing me all the money I was trying to save. Wish I could give them negative stars. TL:DR they refused to connect my bank account when I wanted to withdraw my savings but as soon as they want me to pay the membership fee (years later) they find a way to access my account to withdraw the money.

This app can be great. I used this app for about a year. And it did serve it’s purpose for me and well! I hate to be the kind of person to leave a negative review but at this point I feel like I’m out of options. There is no phone number to contact them so you have to contact them through email only. I closed my regular bank account and opened with a credit union so I needed to change my funding account. So I filled everything out that I needed to fill out but no matter what I did I could not connect my bank on the app. Response time was extremely slow and honestly not helpful at all. I basically was just told to “try again” multiple times. Well it never worked so seeing as I can’t transfer money over to them I asked to close my account. It took a week for them to respond and no questions as to why or if I was unhappy with the app. The woman I spoke to didn’t even take the time to check my account to see what type of account I had that I wanted to close. When I confirmed I wanted to close my spending account she replied immediately that she closed it and sent the money to my bank. But since my bank never connected I don’t know what bank she actually means? The response time is just so slow and so frustrating. When you’re dealing with peoples money customer service is a big deal. But like I said this app is great for saving money and what it’s meant for. But if you have an issue that you need resolved good luck.

Saved enough to remodel my room & lease a car. I found this app about a year and some months ago and tested it out. It made a difference for me in my saving and in my spending. I got my boyfriend to download the app and we have saved over $6,000 since downloading. He was able to lease a car and I was able to remodel my room. As young adults in our early 20’s making minimum wage, saving before this app felt impossible. There were no consequences for constantly going out, we just wouldn’t save. This has made saving practical and harder to frivolously spend our money. Update: After I remodeled my room I had surgery so I was unable to work. So I didn’t really use qapital at all for more than half a year. I was checking emails when I got something from them, they were now going to start charging me. I cross checked with my boyfriend and he wasn’t being charged. We figured it was due to the fact that I had the debit card. This doesn’t render the app useless but there were so many benefits to having the card. I’m really disappointed.

Qapital destroyed my bank account in 24 hours. I downloaded Qapital as an attempt to save money and it’s been causing the complete opposite for my finances. Qapital caused my check to bounce because they took out funds with no prior notification, or “pending” status, which would have allowed me to deposit money into my account to avoid the negative balance. I was expecting money to be transferred per purchase or transaction into Qapital, but instead it just took out a lump sum of money 5 days later. When I contacted my bank I was told that because Qapital gains your bank information by account and routing number they don’t need to provide verification and can remove however much they want without your approval. When attempting to return the money in my checking account, the Qapital app stated that it will take up to 4 DAYS for me to be able to reach these funds again, and it’s basically being held in limbo within their app. When reaching out to Qapital customer service you receive a message from an automatic chat system that doesn’t understand most commands or responses and you are told that you will be contacted by a real person within the next day. I’m currently waiting for these funds to clear in Qapital so I can delete my account. I am unable to remove my bank information until their system releases my money. I’ve had the worst experience through this app.

Amazing savings. By far easier to use and better for savings than other apps. The rules thing is cool where you set how to save, I did round up every $2, the 52 week rule, set and forget $10 a month, and spend less at a couple fast food restaurants and I’m projected $3000 in 6 months. I’ve done it before so it’s all very accurate. I like that you can add a partner to it now like a spouse etc so you both can save into something. And I’ve also done the investment portion where you can take that savings acct or a different one and tell the app how aggressive to be for investments it’s all super legit and I tell everyone about it I can. There’s a delay of money transfer on purpose because the app tries to make sure your bank has the money. And if you ever see your next “transfer” saying something like $200 don’t freak out lol that’s just the money it’s accumulated but the transfer portions are smaller based on what was calculated per transfer period which seems to be every few days or so. I only know this because it scared me once because I wasn’t expecting to budget that heavy one week but then it only took like $30 and the rest was the next week. It also adds up quick if you don’t have the money in your bank so the transfer money can get high. You can let it ride like I do or what I’ve also done is cancel a transfer or some of the transfer and continue later

For the reluctant saver. It’s easy, fast, and has enough safeguards to keep me from going over. I joined when it was free, but did end up converting to the top membership option, due to the proof of what I was able to save in the first two years. Now I use it for investments as well as savings. It’s nice to actually be able to keep finances separate from my regular account that I use often. For the savings account, I have easy access, in case I need to make a withdrawal and I have had to do so. You also have the option of a spend account with its own card. My favorite feature are the options for the WAY it triggers savings: connect it to specific uses, like every time you get coffee or fast food, or even each time you use the card. The latter is what I did, starting with just a dollar for every swipe and it added up fast! Now I’ve worked up to $5 per use, since I monitor much better than before and am no longer worried about overdrafts.

Poor service. UPDATE: my address listed is an apartment complex in a city and state I’ve never lived in. Unknown when that change was made. Had some money in my account. It wouldn’t let me access it. When I asked when I could use it they said it was a glitch and I didn’t have any money. They said the glitch causes their app to sometimes not display the correct information. I had money taken out of my funding account and the app said it would be available August 2nd. On August 5th I asked when it would be available. I was told my funding account didn’t have the funds (although it is NOT in that account anymore) so I could cancel the transaction. That money is nowhere to be found. Although it shows on my Qapital statement that it was transferred. When I asked about the money transfer the rep said “if I recall you canceled that…” I don’t want someone to recall, I want them to look into what is going on and address my concerns about where my money went. A glitch that shows you have money when you do not and is something I should expect to happen, especially without anyone at Qapital noticing and advising me, should not happen. How many times has my account “glitched”. It should not be this difficult to speak to someone, get answers, or bank.

Great for budgeting. I’ve been using Qapital savings for several years now. I like it because I can set and forget my savings. I also like that these savings aren’t as easily accessible as a savings account with my primary bank, so there’s less temptation to transfer little bits to my checking account. I use Qapital’s spending account to keep my weekly spending on budget. I have a physical debit card for the account, so it’s better than trying to set aside cash or just remember how much I should be spending on recreation and random online purchases. I auto deposit a certain amount each week, and when I’ve spent it, Qapital notifies me I’ve hit the weekly spending goal. If I’m planning on making a bigger purchase I spend less in the weeks beforehand, so the extra funds are waiting in the spending account. I’ve also used the investing options to set up small accounts, investing a little bit each week just to get myself started. So I recommend Qapital to everyone basically. The service fees are negligible compared to big box banking. I think the fees have increased a little over the years, for new users mostly. Since I’ve been using the app so long it doesn’t really affect me so I can’t speak on that.

I would recommend this app!. Best app to help me save. I am trying to save for many different events in my life and I was having a difficult time trying to separate my money. The bank told me I had to open up different account for different goals and didn’t want to do that. So I googled and this app came up. For each goal I have I was able to make up my own type of “rule” for saving that worked for me. For example, I am saving for school. So I linked my checking account to the app. Every time the app seeing that I received money it applies my rule to it and transfers my money out of my checking and into the app. That way when I look at my checking I can see how much money I have to play with. There are no fees. Best thing about the app. It just takes a few days for the money to be moved in or out of the app. Last thing. You can have many goals with many different rules, when money comes into your checking account the app applies the rules for all your goals and divides it for you. Set and forget!!!

Great for budgeting and for the self-employed. I’ve had Qapital for 3 months now and I can safely say that this is the most useful app I have for my life. This is the first review I’ve ever made for an app, because it’s that good. I am self employed and have always been bad at putting money away for taxes, and started off using this app for just that. Now I use it to put money aside and budget for everything. I’ve never been this good with managing my money before. Since I automatically put a percentage or a dollar amount away for different bills or goals, it’s been way easier to be on top of things. I’ve managed to pay off a credit card I’ve been trying to pay off for two years, have all my tax money prepared for the year, have a rainy day fund and vacation fund set up. In just 3 months I’ve saved over $3000 towards my goals, without even thinking about it, AND paid off all the bills I needed to pay each month. I haven’t used their investment features yet, but for what I’ve been using it for so far it has been amazing.

Comes in Handy!. My husband and have a joint goal which does the 52 week rule and round up to the nearest $1 rule. It has helped us save up about $2500 collectively so far and it’s been about 10 months or so. Luckily we joined when it was free so no membership costs else I don’t know if we would still keep it. I love that it pauses the deposit when my bank account is close to $100. I think the average person can take advantage of this because I still live paycheck to paycheck, but I factor this in with bills so I can have savings. I do get paid every week though so it is a little easier to budget. This really helped when we had a fire and had to find a new place to live, we were thankful we had the money saved in Qapital, and we were easily able to pay $500 deposit on a New with with no worries. Now we plan on using some of the savings for our anniversary cruise in June! It’s nice to have money already saved and available and not have to worry about where we gonna get it from. 4 stars only because it does take some time for money to be deposited, but not everything is perfect.

Great Way to Save Without Noticing!. Have you ever been to the grocery store ans they say, would you like to round up for charity X? And you probably say, “Sure.” because it’s 17 cents so who cares. I always thought that was such an easy, inexpensive request that was hard probably hard to refuse and that got me thinking, is there an app for that? Well yes, there are: you can donate to charity or to an investment portfolio but Qapital is the only one I was able to find where you could save the money for yourself. All about charity and definitely donate to your favorite causes but if you also want to build up a cushion for yourself, this is the way to do it. You can set up goals, save towards multiple things and set rules for how often or how much is transferred with each transaction. Round up to the next dollar or two. You will be shocked how quickly that money builds up without noticing - every month or two I’ll check the account and be shocked! This is money you would have just spent anyway and, at a couple of cents or $1.99 from each transaction going to this account with nothing required from you, you don’t even notice it’s gone. I highly recommended!

Best helper. I love Qapital it’s an amazing app that helps me save money. I’m learning how to use the application, lots of advantages come alone. You can set up a rounded amount to take out of how much you spend, you can set as many goals as you want. A great thing about the application is that when you account, or more specifically your bank account, is on a low balance, the app does not take out money from your account until you replenish or deposit more money and it will then take what ever you spent, which made your account low and then anything else. I also love that when I deposit a certain amount of money from a check I set up 11% of the money I transfer to be taken out to save. This number ranges to whatever you decide. It’s great! If you’re looking to take money out of Qapital you can then transfer the money from the app back into your account if you find you’re low on money or if you would like to withdraw the money and save it on the side in cash or if you decide to put the money into use, it’s free! Not a lot of free things are great but this one is, surprisingly so try it out if you get the chance to

Love the app but not for college kids. I love this app but something keeps getting on my nerves. I got the app because it looked great and easy and had great reviews and for the most part I agree. I have to say that when I can use it I have no issues and I love the customization, the issue is I can only sometimes use it. I’m in college so my debit card is usually working on around an $80 balance with some days right after a paycheck when I have over $100. The issue is Qapital has a mandatory, non-customizable overdraft protection. HUGE ISSUE. For college kids and some others who keep low balances on their debit cards Qapital wont let you save. My account is set up so I’m only saving in small amounts at a time (never more than $10 on a single transaction) so I don’t really need overdraft protection to kick in at $100. I love this app and I wish they would get rid of this feature or at least change it to automatically calculate the perfect protection for your savings type or let each person choose when they want it to kick in. I want to use the app more but right now I’m saving about once a month and it’s not doing much for me :(

I would really like to some day re-rate this app to 5 stars. I have been using this app for a little over a year now and I’ve had good experiences with it, I must say it has served its purpose. However at times very frustrating to someone like myself how is a little harder on control. First things first; the over draft amount... Qapital is set to $100 and if there isn’t- it will pause your transactions. As I agree it should have some kind of over draft restrictions to protect each user, I also think it should be up to each user what that amount might be!!! As I set the bank account up to work soli for Qapital & don’t want or need that extra $100 tied up for no good reason. Secondly; the transfer day. I have no issues on all the transactions happening on a particular day, I just don’t like that I don’t have the say as to what day that transfer actually takes place. Thirdly; wish there was an option for adding extra money whenever it’s available to ME to add to a savings goal. As you may have gathered- not the best at keeping money in my pocket. Just wish we had a little more say on what, where, and when MY money gets moved, taken, and how much is left behind.

It’s fun. This platform helps keep me on top of my savings. The rules are are straightforward however there is no way to set a date with the set and forget option. I’d like it to coordinate on my paydays but it comes several days after. No way to adjust as far as I can tell. There is a delay from when your rollover rule actually removes money from your bank account. This makes it hard to keep up with what’s coming out. I would like a freelance option of rules. Personally, whenever my work buys us lunch I rollover $5. It would be nice to create that rule myself. Maybe offering a weekly, monthly and annual spreadsheet I could see how much I’ve saved by my own rules. I also think as part of the application a beneficiary should be assigned before the account is open. I asked and received a lengthy explanation of how your heir would have to contact them and provide extensive proof they were indeed entitled to the money. A simple form at the front end could get your money into the hands of who you would intent it to go without hassle. I would hate to think this opportunity was overlooked on purpose. So far I like what I see, I’m still a bit skeptical to rollover much more than change and small amounts. But in two weeks I am $189 closer to Scotland!

First time I’ve successfully saved money!!!. This app has changed my life! I’ve never been able to save money. EVER. I have some credit card bills and some issues with my car that I’ve been meaning to pay off but I never save enough money to do so. I usually just spend whatever extra money I have on food or shopping! With this app I’m able to save without even thinking about it! It auto drafts $100 out of my account each month and now I have $400 saved up!!! One week I only had $200 in my account and the app wouldn’t take my $100 withdrawal out until I had more than $200 in my account (to prevent over draft fees) HOW COOL IS THAT?! I feel that the creators of this app truly care about people who have a difficult time saving money. Which is hard to find now in days. Most every company or app wants to charge you for their services but not these guys!!! I’ve told all my friends about this app and I hope they start using it and I hope you do too!! It’s customizable, easy to use, free and just flat out AMAZING! I’m so happy I found it. Thank you, thank you, thank you!!!

Excellent Savings App. Have been using Qapital for a very long time and happily saving for several trips and goals. It’s an incredibly simple and sleek app with visible, financial benefits. One improvement that I think would be easy to implement would be the ability to add a note to a transaction. One thing I use the app for is regular savings for things I’d like to be more responsible about spending on, such as clothing. That said, I have a recurring weekly deposit and when I do decide to spend money on clothing, I only withdrawal from this goal to fund my purchase. When I transfer money from this goal to my bank, I’d like to be able to make a note on the transaction; this way when I look at the Recent Activity for money movement, I can transparently see what I withdrew money for. Another thing I think would be neat would be within each goal, you could see how much money certain rules have saved you. I’ve always been curious how much money the “Round Up” rule has contributed to my savings!

Almost Perfect. This app automates saving to make it simple and painless. You have to put a little thought into your set up - once that is done, it works pretty much seamlessly. Using the app I've been able to save much, much more than with several other systems. The app is intuitive / UX is good. The linkages with other accounts break very rarely - much much less frequently than on any other savings/investment automation app I've used. (Which is most of them.) The only reason I'm holding back that fifth star is that (as previous reviewers have mentioned) customer service can be spotty. When you have people's money you have to provide customer service that works. Response times are several hours too slow for my taste, but I did get a same day fix for an issue that occurred on Christmas Eve, so not bad. Hopefully weekend support can be added in the near future - the addition of a spending debit card really requires this. All in all, a fantastic app. Improve your customer service and I'll add that fifth star in a heartbeat.

Natural saver *long post*. Read some reviews from ppl who aren’t typical savers so I figured I leave one from my natural saving perspective. I love this app because it’s exactly what I needed and very simple, user friendly. I love that you can set up your goals with a visual picture (similar to a vision board), really makes you want to save towards your goals more every time you open the app. I also love all the options at hand for HOW you want to save and how much. I have complete control over this which was very important to me because I know how important it is to save (no matter how little) when you can, especially when your finances fluctuate as much as mine do because I’m a student-veteran in college. Another thing is the transferring, I have an emergency fund I set up and it works as such, life throws lemons so I have my lemonade stashed in this app. The only CON/Downfall is that your money is not gaining interest while it’s sitting there. So if you just need an app to get you into the HABIT of saving again cause you’ve fallen off the consistency train, this is perfect but if you’re looking to save with some interest, stick to your bank and just get some discipline. I personally save my money through Qapital and then transfer the money to my accounts. Good luck and enjoy everyone!!

This app is great for people that aren’t so great at saving on their own. I have had Qapital for around two years now. I got in before they started charging for it, which I think is a total bummer and almost worth knocking a star. Almost. This app is a passive way of setting money aside where you don’t notice it leaving your bank account. Don’t use this app in place of things like your Roth or 401k, this has a different purpose. Setting roundup rules and “reward” rules will get you plenty set aside after a few weeks. That encourages you to set bigger rules, like automated garnishes from your biweekly/monthly paychecks. I set up a coffee shop rule and after 4 weeks of seeing how much I was spending on that, I quit coffee shops 100%. The amount of money I’ve saved using this would be worth the monthly fee they’re charging now. Luckily, I have not incurred those charges because I have had it for so long. I’m sure there are other apps doing the same thing. If there are any that have decent reviews and don’t charge a fee, maybe try that first.

5 stars!!!. I’ve always been awfully putting money away and saving it. I stumbled upon Qapital one day and decided to do some research. I love the idea of making up your own rules for saving money and now find myself excited every time I use my card and know the round up rule will take my change and store it away for me. I was skeptical as many are about giving my bank account info to anyone never mind an app. But after reading many online reviews and articles about the company, I decided to give it a shot. I’ve had nothing but an outstanding experience while using the app. I just ran into a snag over the past few days where the app was having trouble connecting with my bank. I opened a ticket to them and within minutes had an answer from SANDY asking me to try a few things. Within an hour or so everything was back up and running like nothing had happened! Great customer service! If you are looking to save for a wedding, a trip or even just to have extra money put away for emergencies this is the app! I can’t wait to get my Qapital Visa card in the mail and can’t wait for the Qapital Investing that is soon to come!

EASY PEASY LEMON SQUEEZE ! Cha Ching. As corny as that sounds, this app is absolutely fantastic. I always struggled to put money to the side because I didn't remember, I would push it off until my next paycheck or because I would spend it elsewhere. Qapital takes the hassle out of transferring money into a savings account and does it for you. It's absolutely rewarding when you see the savings just accumulate week after week. In a few months I was able to save over $1,000 which to me seemed impossible before Qapital. Trust me, this helps a lot. Need to save for a house, for vacation, for your family, for loans, or for those absolutely must have shoes?? This. Is. The. Way !!!! The rules are fantastic. I reward myself and save money by avoiding all the places I used to love going to, ahem, Starbucks! It's an incentive - what's more important, saving for that house or having that super delicious drink? I'll have to go with the house. TRUST ME. DOWNLOAD THE APP and see for yourself. Tell everyone you know as well !!!!

My 6 week experience with Qapital. I had been thinking about a way to be able to save money exactly this way I had really wished my bank did something like this but unfortunately they do not. So I came across Qapital and it sounded great. I was very skeptical bc this is my money we are talking about! I did a lot of research for a good year before I felt comfortable enough to finally download the app and give it a chance. I am really glad I did bc it’s been almost 6 weeks and I’ve already saved 363$! I started this savings for extra spending money for my upcoming anniversary trip to Las Vegas, at this rate by the time we go in a few weeks I should have at least 500$ extra to take with me! I am not good at saving at all so this has been awesome for me. I couldn’t of been able to save like this on my own so I’m very happy with the app so far! Only thing I would change but isn’t really a big deal is that they would take the money out at the time of transactions and not in batches a few times a week which like I said isn’t a big thing but I would change that if I could other than that I give it 5 stars so far! Hopefully that doesn’t change in the future but so far so good! 👍 Update: So I’ve been using Qapital for about 6 months now and I’m loving the app it has been a lifesaver for me!

Disappointed.. I’m very bummed. I’ve used this app for years and I realized I started getting charged for a membership. I reached out to customer support to understand what happened. In short, they told me they had sent out an email months ago that everyone was going to be upgraded automatically (to the highest cost membership) and I had two choices. I could just change my membership and lose the money I didn’t know I was paying for the past few months, or if I wanted a refund I would need to delete/close my account. I also went back to view the messages sent to me earlier in the day when I got home from work and they’re wiped. There’s no way to even view them. I was sad to leave the app I’ve been using for years and have recommended to many friends/family, but the messages made me feel like it didn’t matter. What made it worse was the reason I didn’t see the monthly charges in my bank account was because my bank started making you re-link your account periodically. Qapital just started taking the membership fee out of my goal’s savings so I didn’t see it in my usual bank statements. I appreciate how the app helped me over the years, but if I’m going to get an ultimatum from someone I turned to for help, I think it’s best to find something different. I guess don’t get too comfortable even if you’ve been using something like this for a long time.

App keeps disconnecting bank. UPDATE: I am still having the same issue. My bank is connected but none of the rules have been activated even though I have swiped the card it’s connected to. I keep getting the run around about my account. This is ridiculous the developer responses are generic and the email rarely resolves anything. Wellingston doesn’t do anything to help you. I’ve been using this app for over two years now but I’m starting to dislike it due to my bank constantly disconnecting and my rules haven’t activated. The issue is on qapitals end and even after reaching out to their customer service, the issue still wasn’t resolved. They keep saying it’s an issue with my bank connection but the issue is on their end. It shouldn’t be this difficult to fix an error. You should have IT people for your app for this very reason. My rules haven’t been activated for weeks because of this. I will be finding a new app to save since qapital doesn’t care about fixing issues for their customers. They have been sending me the same generic message saying that they are working on it but it has been an ongoing issue for months. I’m gonna find another app to use. My bank has new rules with allowing access to third parties and it’s very frustrating.

Out of Sight, Out Of Mind, In My Bank. Qapital is an easy way to save your money without you having todo anything. I’m pretty sure I’m like everyone else who does bank balance banking with their money, meaning whatever you see in your bank account is going to be spent on some thing(bills, student loans, overpriced coffee, you know who I’m talking about, etc.) instead of being saved. But I set my Qapital to take out small increments from each of my paychecks and I use their saving options/rule that I can set my savings account such as their 52 rule which through the course of a year, which is 52 weeks, the saving program will save the dollar amount of the numbered week that it’s saving in until it reaches week 52. At 52 weeks, you would have just over $1300, without you having to do anything but let the rule run. For someone like me who has a hard time saving money and struggles with the money I do get cough teacher salary cough. Qapital has really made it easy to save and I’m still able to manage the money I do have even with those small increments being withdrawn.

Great for learning to save money!. I’m a debit card baby so spending money has always been way too easy. If I have money in my bank account, I can spend it right? It was an awful habit! Money was just way too easy to move around on my banking app. So if I wanted to spend a little extra money this week, it was as simple as opening an app and transferring the money instantaneously from my savings to my checking account. Qapital helped me create new habits, and so easily. I just set my goals on Qapital, set my rules up and then every time I got paid money was going directly out of my bank account and towards my savings goals in Qapital based on the rules I had set. Because of this app, my now husband and I were able to save up enough money to buy a house and pay for a wedding at only 23 years old. The investing account makes investing easy and puts our money to work for us so it’s not just sitting there and losing out to inflation. I love Qapital and would highly recommend it to anyone looking to create healthy saving and spending habits.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

You would be a fool not to try this app!!!!!. Ok I’m not good at saving but this app does it for you seriously!!!!! Try try try. It is not complicated. Try try this app. If you have never been good at saving then this app is seriously for you especially if your married like me!!! Men like to deny that there wife basically control the money in the family because let’s face it most women are way better with money than us men!! But this saves for me and it’s money she can not TOUCH!!! So now I can save for all my silly hobbies she gives me 💩 about!! So far loving this app and I would have no problem paying a fee in the future if they put one in place! Yeah I forgot about that Quapital is FREE yes FREE So you def need to try. I do however wish they had a way to invest my savings in stocks and ETF-exchange traded funds?? If they had that feature then this app would be amazing and I would no longer need my other app for investing, I would be able to do it all in one. Maybe if they partnered with a brokerage firm like Vanguard?

This app is great and here's why!. I was on Instagram and I saw the ad for this service, and I decided to try it out and I loved it! You don't have to pay for anything, ive had this for about a year now and now I have their Visa Debit card. You link your bank account to Qapital and you can send find from bank-to-Qapital and vice versa, though it is a 3 day wait but there are no fees for moving your money. They have these awesome rules that you set up for yourself and it could be anything from a round up rule which is it'll round up whatever number you have set in the rule, it'll round to that ammont and save it every time you use your card. Or you could set up a certain percentage to be saved from every pay check and I've set 20%. It's also a great "rainy day fund" because I've had to get money together when I was low and use the money I had saved on Qapital.

Highly recommend if you need to stay on budget and save up money. I’ve been using this app for a couple of month and it’s been great. The rules to save up/transfer money into categories/invest are really easy to set in place and modified/delete. I’ve been using Qapital to budget, save up money for upcoming projects, and invest. To budget, I made up different savings categories (heat/gas, water, Internet bill, phone bill, pets food+parasites), at the beginning of each month (when I get paid) money automatically gets transferred into these categories. When a bill is due I transfer the money to the spending account and pay it. It’s great because a few of my bills are at the end of the month and before I used Qapital I often didn’t have any money left and had to use my credit card. I also use the sweet spending spot for groceries and eating out. To save, I just created a few categories and set up the round up rule; however, since certain projects are sooner than others I only have two categories going at a time. Once one goal is reached, I delete the rule and move on to the next goal. And to invest, I am just automatically putting 5% of my pay in there at the beginning of the month. When I’ll make more money, I’ll up the percentage. As far as I’ve seen, it’s been going up slow and steady (it also goes down a bit from time to time but that’s normal). I’d recommend to everyone!

Longtime user, still giving a 5 star rating. I’ve been using Qapital since they first launched the app. It started with me using it to save up for Christmas presents, to me setting larger spending goals. I’ve saved so much money from this app, and it’s definitely come in handy for multiple occasions over the years. When I first started with it, I really only utilized the ‘rules’ because I thought you HAD to have a rule set to each goal. Recently, I actually deleted the app as I’ve started the Dave Ramsey cash envelope budgeting method and figured that it doesn’t fit in with my budgeting techniques anymore. However, after using cash for about a month now, although very satisfying to have physical paper, it’s very nerve-racking to keep on you, knowing someone could possibly steal it. It’s also kind of hard to keep track of, and very time consuming, when you’re doing large envelope stuffings. That’s when I realized what Qapital really was—digital cash envelopes. It’s also WAY more satisfying to have numbers being shown you instead of just feeling a thick envelope. And now that they’ve launched their card, which you’re able to sync seamlessly with each goal, it makes the cash envelope method even easier. I’m so happy I have this app. Cash is nice, but it’s definitely becoming a thing of the past. I’ll be utilizing my Qapital account a good amount now from here on out.

Fantastic system for splitting up your pay check! Although.... Been using this app for a while now for general savings and is now my primary bank. It’s great that you can set it up to divide your paycheck by percentages, and allows you to save better and maintain good spending habits without doing much work. It would be very nice however to have a “replenish” option for each payment you make from your spending account. Allowing you to transfer the exact amount from one of your savings accounts. So if I spend money on lunch and I want to maintain the amount in my spending account I can take the funds I put in my “food & groceries” saving account by holding down on the expense and selecting the saving account to “replenish” from. It’s not too hard to add and would greatly benefit the app. Would also help to keep things more organised and fluid for the user. But overall fantastic concept their developing and I’m excited to keep using as the app grows. Thanks Qapital!

So far, so good.. I came to Qapital after using Digit for about two years. Ran into some issues with Digit staying connected to my bank. After about 4 months of no connection I decided to look elsewhere. Digit was aware and did seem to be working on the issue but I had to make the change as this type of passive savings have worked well for me. I am only a few weeks into Qapital but so far I am enjoying it. There are many customizable ways to save and I have found that a combination of rules have really turbocharged my savings in a few short weeks. I have not made any withdrawals yet. I can only assume that will go as smoothly as the deposits. They also offer some other features similar to a regular bank such as a debit card for easy access to your money but I have not done that since it is the easy access of my regular bank savings account that makes it so hard to save. Self-discipline is not in my nature. I have recommended Qapital to friends and family and most have had positive responses.

Easiest way to save without saving. I signed up for Qapital a little over 2 years ago. I was newly engaged and knew I would have to buy a wedding band in the near future. I set a fund titled “wedding ring” set some rules and forgot about it for about 4 months. Sure enough when it came time to put money down on the ring, I had saved up enough with capital to pay for the entire thing. Never even had to budget for it. Next I figured I might as well start an account for my honeymoon. Set up a new goal and set some rules and voila. I just booked my honeymoon last week with money stashed away in Qapital that was quietly diverted without me even thinking about it. This app is great. I have not used the investing part of it and won’t as I have a good method for that already, but if you need a little help with saving money for special occasions then this definitely the best way to do it.

EASY PEASY LEMON SQUEEZE ! Cha Ching. As corny as that sounds, this app is absolutely fantastic. I always struggled to put money to the side because I didn't remember, I would push it off until my next paycheck or because I would spend it elsewhere. Qapital takes the hassle out of transferring money into a savings account and does it for you. It's absolutely rewarding when you see the savings just accumulate week after week. In a few months I was able to save over $1,000 which to me seemed impossible before Qapital. Trust me, this helps a lot. Need to save for a house, for vacation, for your family, for loans, or for those absolutely must have shoes?? This. Is. The. Way !!!! The rules are fantastic. I reward myself and save money by avoiding all the places I used to love going to, ahem, Starbucks! It's an incentive - what's more important, saving for that house or having that super delicious drink? I'll have to go with the house. TRUST ME. DOWNLOAD THE APP and see for yourself. Tell everyone you know as well !!!!

Wish I could rate lower. I’ve been using Qapital for almost a year and a half now and honestly I’ve loved the app. Using the round up rules, I started really saving some serious money from my debit card purchases. Usually the round up rule would take out no more than $2 at a time, if the purchase allowed for it. But one day, recently, $11 was taken from the account without warning, and without any trace of where, when, and what it was taken for. I’ve been trying now for over 5 days, starting on March 24th to get a hold of someone from customer service, and let me tell you—you’re better off sitting in a ditch and crying for help than you are attempting to get in touch with someone from this app. They “claim” their customer service is prompt and is open from 9-5 on the weekdays, but I think that’s utter trash, because I’ve yet to hear back from someone. It really upsets me, because I love this app and love what it does. But when it starts to take money that I didn’t authorize, and then I can’t get in touch with anyone to figure out why it was taken, or let alone REMOVE MY ONLY ACCOUNT FROM THE APP WITHOUT THEIR AUTHORIZATION, yeah this app deserves less than this rating.

Too slow to transfer. Literally takes forever to transfer money into Qapital. I can’t wait that long because I have other expenses that I need to attend to and by the time it starts to transfer my account balance becomes too low for Qapital to withdraw. The point is to withdraw the money so I don’t spend it. I save for groceries with my partner on this app but since it took SO long to transfer by the time it was grocery time I had the money pending in Qapital still so I had to pay from my original bank account. It’s like double spending. This morning it took over $500 out of my bank account leaving me with an overdraft. This particular withdrawal was not too slow. In general the app just lags way too much that it stresses me out thinking about how long it’ll take to actually take the money out. It’s sad because I like the concept and I know it would help me save but I am most likely going to delete this app. The worst part is now I need those funds back asap and it charges for a faster deposit and doesn’t allow the full amount to be returned since it takes 2 days to clear the full amount on Qapital. Too much.