PocketGuard・Money&Bill Tracker App Reviews

PocketGuard・Money&Bill Tracker App Description & Overview

What is pocketguard・money&bill tracker app? PocketGuard is a budgeting app for people who want to be on top of their money. Personal finance is made simple by smart algorithms, which means budgeting with PocketGuard is so easy that you don't have to spend your entire life crunching numbers. We take care of all the routines like expense tracking and bill monitoring so you can clearly focus on money management operations.

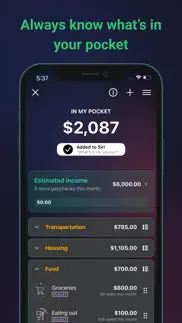

Always know what's in your pocket!

A budget is a difference between income and expenses. If it's positive - you're doing well. In any other case, the budget is unbalanced and needs attention. This is where the "IN MY POCKET" feature takes action. How much disposable income do you have after paying your bills, saving for your goals, and setting aside enough money for needs and wants? The PocketGuard budgeting app does those calculations for you! Always know the actual safe-to-spend amount so you can fit your monthly budget.

Comprehensive analytics!

Budget and expense tracking are just a part of the story. If you wanna do money management the right way you need to learn from the data you track. PocketGuard's budgeting app provides you with various reports to let you see personal finances from different angles. Learn about your spending habits, make necessary adjustments, and optimize your monthly budget.

Bill tracker and subscription manager!

You can use PocketGuard as a bill organizer. Once you connect bank accounts the app starts working as a finance tracker. All your bills and subscriptions will be identified automatically and included in your monthly budget. The bill organizer will help you never miss the due date again.

PocketGuard bill organizer gives you an easy way to negotiate better rates with your provider. So you can optimize your budget by cutting costs on services you use. PocketGuard subscription manager will help you to find subscriptions you might have forgotten about. This is another money management trick - stop paying for services you no longer need.

Set and reach your financial goals!

Goals are a key concept of budgeting. As was mentioned before, expense tracking is just a part of the story. Personal finance is made of goals. Let's say you want to spend less on shopping or save more for vacation. These are financial goals. The PocketGuard budget app gives you all the necessary tools to set them properly.

Set up your debt-payoff plan!

Nobody's perfect and almost anyone has debt to pay off. The question is: do you have a plan? Connect all your credit and loan accounts and we'll show you the way to a debt-free future. Our smart algorithm calculates the most profitable debt repayment strategy so you'll save hundreds or even thousands by paying less in interest!

BANK-LEVEL SECURITY

We use the same 256-bit SSL encryption as all major banks to ensure your sensitive information is safe and sound. The PocketGuard app also uses PIN codes and biometrics, like Touch ID & Face ID, as an additional security layer.

PocketGuard connects to U.S. and Canadian financial institutions only.

PocketGuard offers a premium subscription - PocketGuard Plus - which gives you access to additional features and is not required to use PocketGuard.

PocketGuard Plus subscription lengths and prices:

Monthly - $12.99* / month

Annual - $74.99* / year

Prices are in U.S. dollars, may vary in countries other than the U.S., and are subject to change without notice.

If you choose to purchase PocketGuard Plus, payment will be charged to your iTunes account. Subscription automatically renews unless auto-renewal is turned off at least 24 hours before the end of the current period. Auto-renewal may be turned off at any time by going to your settings in the iTunes Store after purchase. Any unused portion of a free trial period will be forfeited if you purchase a different subscription plan.

Privacy Policy: https://pocketguard.com/privacy/

Terms of Use: https://pocketguard.com/terms/

Please wait! PocketGuard・Money&Bill Tracker app comments loading...

PocketGuard・Money&Bill Tracker 5.4.6 Tips, Tricks, Cheats and Rules

What do you think of the PocketGuard・Money&Bill Tracker app? Can you share your complaints, experiences, or thoughts about the application with PocketGuard, Inc. and other users?

PocketGuard・Money&Bill Tracker 5.4.6 Apps Screenshots & Images

PocketGuard・Money&Bill Tracker iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 5.4.6 |

| Play Store | com.realme.pocketguardapp |

| Compatibility | iOS 14.0 or later |

PocketGuard・Money&Bill Tracker (Versiyon 5.4.6) Install & Download

The application PocketGuard・Money&Bill Tracker was published in the category Finance on 07 January 2015, Wednesday and was developed by PocketGuard, Inc. [Developer ID: 1435880178]. This program file size is 101.87 MB. This app has been rated by 6,923 users and has a rating of 4.6 out of 5. PocketGuard・Money&Bill Tracker - Finance app posted on 27 March 2024, Wednesday current version is 5.4.6 and works well on iOS 14.0 and higher versions. Google Play ID: com.realme.pocketguardapp. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

Bug fixes and performance improvements.

| App Name | Released |

| Western Union Send Money Now | 09 May 2011 |

| SoFi - Banking and Investing | 10 April 2017 |

| Splitwise | 24 August 2011 |

| Schwab Mobile | 14 December 2010 |

| Amex | 31 March 2010 |

Find on this site the customer service details of PocketGuard・Money&Bill Tracker. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Simple Budget Envelopes | 02 February 2018 |

| Best Budget Pro | 21 December 2011 |

| Military Retirement | 25 September 2012 |

| Military Reserve Retirement | 14 September 2013 |

| My Financial Independence | 30 September 2021 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| YouTube TV | 05 April 2017 |

| Amazon Shopping | 03 December 2008 |

| Google Maps | 12 December 2012 |

| Hive Social | 18 October 2019 |

| Gas | 27 August 2022 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| HotSchedules | 30 October 2008 |

| 75 Hard | 19 June 2020 |

| Geometry Dash | 13 August 2013 |

| TV Cast Pro for LG webOS | 23 June 2016 |

| Bloons TD 5 | 15 November 2012 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

PocketGuard・Money&Bill Tracker Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Quick and easy option to track finances. Highly recommend this app. It is amazing for keeping track of your money and how it’s spent. I liked it enough I took advantage of the 4th of July special for the upgraded version. I have multiple sclerosis and my cognitive functions are sometimes impacted, so being able to see and track everything in one app is a great tool. I had connection issues for one of my accounts, emailed support when it didn’t correct after some time and the customer service took a day or so after my email (I think?)

Big fan!. I’ve used mint and every dollar. Every dollar is very clean looking, PocketGuard takes some getting used to. BUT, I’ve got to tell you, after taking a few days or so to get my feet wet to truly understand this app and learn how to navigate my way through it, I love it! My favorite features: – upcoming bills. It’s a feature that I have sorely been missing,Knowing what bills are coming up and when is key for making sure I’ve got enough money in the bank to avoid overdraft payments. Super easy the way I have it set up, on the overview page I have a section that includes all my fixed costs for the month, easy to see and easy to categorize. Makes it super easy to budget what I have left over. - hashtags.I love the hashtags, never been easier to see how much I spent on back to school stuff , on my recent vacation, etc. -Love the easy comparison from one month to the next to see if I spent more than less than the previous month in a particular category. There’s more, but suffice it to say that I found the app that works for me. My only qualm is that I wish you could customize the color scheme. I’d like a lighter color scheme.

I want to love this app but transactions are too slow. I reaallly want this app to be my go to budgeting tool. It has the best UI/UX of any app I’ve ever tried, it’s so great to use. But unfortunately it just doesn’t sync up with your card transactions very well. I have “pending transactions” from over a week ago that are definitely not pending anymore on my credit card. It also labels pending purchases with the incorrect vendor. I think PocketGuard has trouble with transactions that have tips? For example I went to a restaurant a week ago, but PocketGuard still says it’s pending and has the wrong merchant. It seems to mix up the merchant with previous purchases. Along with this, it’s missing some transactions from last week. Mint doesn’t have this issue, all my transactions are there, none of them are incorrectly labeled as pending, and all the vendors are accurate. There’s so many thing PocketGuard does right, but I can’t justify using it for budgeting when the transactions take forever to correct itself. I would gladly pay for a subscription if this wasn’t an issue. When it works, it works really well. Maybe I’ll try again in a couple of months and see if anything improves. I really hope it does!!

I live by this app. I have used every budgeting and spending app offered since 2003. By far, this is the most straightforward and user friendly app I’ve used. I hope it never goes away, I’ve paid for the premium version to get the absolute most out of the app. My 81 year old mother now uses the app, she also loves it. I reference the app multiple times a day, I can easily reference what bills are still outstanding without use of a calculator or downloading an excel file, although I can if needed. I can easily show my husband our spending trends and cash flow. I have gradually added more to the app and we are now tracking net worth. It is a breeze.

Wonderful. I was recommended to download this app three months ago but decided to leave a review only now. I didn't like the that categories are not totally customized at first, but then technical support gave me several hints on how to use their hashtags system. I wasn't sure it will work for me... But it did! I was able to create multiple spending reports with distinct categories without merging everything into one (#lifestyle report contained Sporting Goods + Gym + Food + Massage). Moreover, you can add multiple hashtags to one transaction and it will make the insights deeper and all-encompassing. they also have additional features related to savings or lowering the bills. I am completely satisfied and definitely will use it in the future.

Going on 2+ years: you will not regret. Let me tell you- all of the previous reviews are old. I’ve been on this app for the since 2019 & will honestly be here until I die. Hoping it lasts that long. 🙏🏽 I’ve been searching for a way to understand my spendings between categories, month over month & watching my budget. This is everything & more. I love the personalization that I can add my own catergories, mark a specific merchant as something once and never have to touch it again & even exclude things like transactions between my accounts. This is the app if you’re anal about how you spend your money & it even helps if I want to budget for let’s say shopping. I love it. Please note I am a premium user & to me it’s worth it. But I’m sure the free version is equally as good. The other apps mint, your bank, random ones only work if you have a goal. But for me, I want to know where, what & compare my spendings month over month so I can see how I’m doing. Or if I need to stop spending! Anyway highly recommend. And two last things- 1) they’re IT or support literally responds within 48 hours. You’re never left hanging and no question is stupid. 2) the app is constantly evolving. It’s not the same as it was two years ago, it’s better! If there’s a bug, report it! If you have a suggestion, suggest it! I love all the latest updates & it really helps me think of how I’m spending my money which was my ultimate goal. Thank you!!

Easy way to see past, present, and plan for the future. PocketGuard does what I need it to by bringing all my accounts into one place. The hashtag feature is great when I’m trying to track a specific thing that may be related to multiple budget categories like #VR stuff :) The notifications are a hot mess though and there is very limited controls. Also, I’m paying for a subscription here, can you please disable the ad notifications for your find savings section? It’s not helpful and I get no value from it at this time. What I’d like to see is individual control to enable and disable notifications as needed for bill reminders, late bills, large deposits (payday), going over budgets, etc.

Couldn’t Even Start Using It. I downloaded the app and tried to connect my account but it said it had a error and to try again in two hours. I didn’t think of it much at first so I waited a few hours and tried again. Same problem. I was slightly annoyed but I understand sometimes things like this happen. I submitted a request to support. Got a generic message saying please detail the issue. I replied back but still haven’t got an answer. I’ve been trying every day now and it’s still giving me the same issue and still no answer from customer service. Not even someone messaging back saying “we are working on this” or “sorry about that this connection going to be down for a while. We will let you know when it’s up and running”. This app had great reviews when I originally looked to download the app but the more recent ones have been bad. Needless to say I’m going to delete the app before I even got to use it. 😔

Old Mint User. I as addicted to Mint and leveraged it to help tackle debt and control spending. As a single mom with a house and two kids, my finances have to be right. This tool is phenomenal and the product team is very approachable and friendly. In My Pocket is an awesome feature. Only suggestions for me after a couple months of near daily use: ensure the tab icons can be tapped to autoscroll back up - by nature some tabs have long scrolls so a quick jump up is helpful. On the donut chart and line chart for current spending it would also be helpful to show the diff dollar amount against 1 month ago spending, not just the full total from last month end against today. Really well done folks.

So useful!. This app has made it so easy to see where our money has gone and is going to go. My new husband and I decided to share accounts and we were struggling to relax into that after independently controlling our finances for so long… this has made it so much easier! I had to contact customer support one time and they were incredibly prompt and helpful. I knocked off a star because I wish it was able to do the following (but would have only knocked off only half a star if it was an option): 1) I wish you could choose to carry over unspent budgets to the next month. ie If I underspend this month on ‘home’, the budget is bigger the following month to purchase a more expensive item. 2) I wish it could learn and adapt. We pay two bills to Banfield Pet Plan each month that come up as BP. When we buy gas from BP, it goes into bills because it think it’s the same. So a couple of times a month, I have to manuallly change names and categories - sometimes I have to re-enter the banfield bills and then, when they are paid, they don’t register as the ones planned. This is a niche and minor issue but slightly annoying nonetheless. 3) I wish it was a little more prompt in identifying new transactions. Sometimes the banking app will detail transactions as no longer pending and it’ll take a day or two for them to appear on PocketGuard. These are minor things that I’d like the developers to consider BUT overall I love this app!

Fantastic!. I absolutely love this app! I used to use the prism app but they started to have system issues and when I tried to address them, I would be waiting over a month to get a response. So I tried this app called Pocket Guard. I read a bunch of reviews on a what everyone considered “The best finance apps”. This one stuck out to me the most. They really thought about the user interface and how the consumer would have to use the app. I thoroughly enjoy discovering all the features and information this app provides. I don’t need to use any other app once I set everything up. The customization of categories is such a great feature that I opted to pay the annual subscription rate. Great job Pocket Guard! 👍🏻⭐️⭐️⭐️⭐️⭐️

Love this app!!. This app has been exactly what I’ve been looking for when it comes to budgeting. I love that I can see my spending patterns on a monthly basis too. I did decide to purchase the lifetime option, and love that I can change transaction dates (especially for end of the month transactions) creating my own categories, and being able to split my transactions. It gives me a much more clear and accurate view of my spending. The hashtags has been great too so if I’m paying via credit card I can know what that specific I transaction was for. All in all, I love this app!

Pretty Incredible, Could Use Improvement. App is well designed and extremely helpful, though there’s room for improvement. A number of banks are not able to sync (Apple card, Ellevest) which causes for inaccurate info, the desktop application is exceptionally slow preforming, and there are a few features that could use tweaking (like the ability to recognize transactions and associate them using ‘to’ and ‘from’). Still rating 5 star though, because it is the best money management app I’ve ever used and I find it very user-friendly.

Good Budgeting App. I needed an app that would allow me to setup budget categories and monitor my spending (based on accounts I linked to it). It does that and it does it fairly well. I do have to constantly go in everyday to update the category for which it falls in, but I’m just very particular in how I want my expenditures categorized. I may try using the hashtag feature to simplify things. I also like how it notifies you when you get close to hitting your limits. Moreover it’s all free! There’s a paid version to unlock more features, but for me those aren’t necessary. The only downside I’ve noticed is that it doesn’t update or show your expenditures in real time. Meaning, I usually have to wait 2-3 days before an expense is posted which can be frustrating when needing to know where you stand at any given moment in terms of your budget... which is sort of the purpose of the app right?

Best budget app. While I’ve tried all other budget apps, this is by far the best out there. Very clean at reconciling and learning from past behaviors. I love that no matter what Harris Teeter grocery store I go to, it appears as Harris Teeter, not Harris Teeter store !785!, or whatever. The In My Pocket, which I wish they called, Left to Spend takes some time to learn, but it’s great once you do. Only ask is try update the UI. While I’m not a fan of Mint, it looks much more current like my bank app. If you could update the fonts, get rid of the grey and use white with dark screen at night, that would be great! Otherwise keep up the other updates. Five stars!

Could be better. Biggest complaint is the frustratingly long time it takes to update your accounts. It takes days for it to reflect past transactions whether they’re income or expenses. The app itself offers plenty of features but it’s not very user friendly. Adding some tutorials would be nice. Getting rid of the Find Savings tab would be nice as well. Overall this app just throws a lot of information at you and doesn’t really show you how any of it is connected very well for you to actually manage your budget properly. You’ll find yourself trying to go back and forth between tabs and various options just to do a simple task.

Not bad. I’m still getting used to this program. I’m not retirement age yet but have no debt so I wish I could hide the debt pay off section since it is irrelevant to me. Also, I wish I could export monthly transactions instead of the over 20,000 I imported from Mint. Have a date range to export would be helpful. I need to stop the pop-up asking for cash expenses, I use credit cards almost exclusively since I am a point collector through various credit cards. I see the point but again irrelevant to me. It would be nice if I could track my points and miles since the points at least have a cash value.

Best Financial App I’ve Used. I’ve tried 5 or 6 apps over the years. PocketGuard is the best. I like that I can just assess daily spending, not investments. It is easy enough to use that I do use it, and catching up is easy if I get behind. The team responds to questions quickly and have always answered my questions. There is one merchant that entries frequently default to, even when they are repeated expenditures that PocketGuard should have learned by now. I would like to see a yearly view of my spending categories in addition to monthly; hopefully that is planned. One small thing I would like is to see a number for total food (groceries and eating out combined) somewhere. I am always tracking that, as it’s the most important area to control. I really like the split transaction feature they added. Overall, PocketGuard has made a dramatic difference in understanding my spending and controlling it. I think I’ve used it for 4 years now and that’s a record for any financial app except Excel or a brokerage site.

Love the app but why it loads so slow?. Is the server somewhere else? I don’t know. So far I really like all the features of this app and it really helped me understand my monthly spend. But the problem is every time even the smallest adjustment like change one item to a different category take about 2-5 seconds load. And the in app mail like reminders also takes long time to dismiss. It wasn’t a problem at beginning but since I’ve using this app more often, aka everyday, the loading time seems really annoying. I thought it’s a membership thing so I made the subscription but it’s the same loading speed. It kinna worries me to think if the server of this app is somewhere outside US? If so does that mean my banking information may be at risk?

The BEST budgeting app out there. Can I just start off by saying I downloaded and tried using so many budgeting apps. I did lots of research to find the best rated apps and tried them all. I found this app and I will never look back! I needed a budgeting app that would track my spending, track my savings goals, and clearly show me where I was going over. This app does it all. I also do a lot of transferring money from one account to another, I’ve had trouble tracking this on other apps. PocketGuard let’s you easily hide transfers so they don’t confuse your budget. Same goes for credit card payments or other random charges I don’t want counted towards my spending or savings goals. The app also gives you a breakdown of your month with pie charts and statistics. It also lays out all the information I need in a clear way that makes it easy to understand. My husband and I both love this app and plan on using it for many years to come.

App needs some polish…. Plan page needs to have descriptions get a full line to themselves and the money should be below as a fraction of spent/budgeted: $122/$400. Also, the plan section lets you create a goal or budget at a section with Edit section, but then the new item appears at the bottom instead of in the section. There should be a way to shut off get out of debt for once you are out of debt or for those who do not want help. Great summaries and charts… but no way to dig into the data… clicking a chart portion should have a place where you can review transactions. It isn’t easy to see what account a transaction is coming from. Besides goals, there should be funds that float cash from previous months and have no date associated with them. The app is great about estimating the cost of something that changes over time, but if this month it’s $26 and next month it’s $30 I have to change my budget since it isn’t a fund (EveryDollar offers funds). Also it doesn’t support Landscape mode in a usable way.

Almost there just a few more. This app is by far one of the best. Love the goals and debit payoff. No other budget app has it. A few things tend to throw everything off tho. 1. Not being about to mark as and “early pay” for the next month. A lot of times my pay post early in my bank, so most of the time toward the end of the month. It post the income in the wrong month that it should be in. 2. Rollover option should be available especially when trying to save up for goals and budget caps. 3. A better 3rd party partner for small banks/connecting accounts. Most of my transactions come from a smaller bank doing everything manually kind of takes out the purpose of the app. These are the only things me from keeping my subscription. I’ll always check back and keep an eye on this app, though just to see if they have any good updates.

Great app but accounts don’t sync. As many people have said it that the app is very good. It logs for most parts of it accurately all the expenses better than other budgeting apps. However where it lags really behind is that they have not figured out a good partnership with the major banks and credit cards on how to get the synchronization perfected to be able to download the transactions seamlessly. I have problems with PNC and American Express. These are two bigger reputable institutions. I hope pocketguard really talks with those institutions and gets this fixed. If they can get it fixed which I don’t see why they can’t I will surely give them 5 stars. It’s like the restaurant has a very good atmosphere but if the food is bad somebody may not want to go back. Similarly the app is super good however if the synchronization keeps failing time to time people are going to have to decide and leave because without the transactions being able to be downloaded the app is no good which is so good in other ways. Please please fix. I am counting on PoxketGuard to come through it. Thanks

Almost perfect. I really like the idea of having an app that tells you how much is safe to spend without endangering your bills money. It does a pretty good job of categorizing automatically, the need to re-categorize is minimal. However, it’s detecting one of my savings accounts as checking and I have found no way of changing that. Adding such function would be great. Also, maybe allowing us to add an expense for the future would be nice. I added money to the cash account, which was reserved for a transaction a few days into the future. It didn’t let me add anything for the future. So I’ll have to come into the app when it happens in October and add it which doesn’t really make sense. Overall the apps is great, and it’s the closest I’ve found to what I want which is an app like Level Money which is now gone. There is still room for a few improvements.

Excellent app for budgeting - needs weekly budget option. Overall this app is the best I have found to budget and monitor spending in one account. Unlike others it does a really great job tagging things to the appropriate category, and even when it doesn’t it’s easy to fix. I love the spending limits feature but **wish there was a weekly option as well!** When you get paid bi-weekly monthly budgets are very difficult to plan because paychecks never hit on the same dates. The ability to monitor weekly spending and stay in my budgeting limits would be a game changer and I would definitely pay for a pro account if that was an option.

Always Something. App often disconnects from my account. Has never reflected any transactions made on my credit card, but displays the account balance. Customer service takes forever to resolve issues and money management has to go back to manual entry until they figure it out. Although accurately tracking and organizing transactions, the account balances once stopped updating completely, (which would seem to be an easy fix with the refresh button) but it doesn’t work. After giving it a few more days and a new update, the accounts reflected the proper amounts in my account. But now it closes within 5 seconds of me opening the app. Great idea but it just doesn’t seem this company has the system figured out yet, I will be heading to Mint when my subscription expires. Which, btw, they ignored my request to cancel multiple times.

Great assistant in managing your finances. Every transaction is placed into a specific category (in 9/10 cases it's accurate) so you have a great insight on how much you have spent on coffee shops and books, on clothing and sports etc. Having the full picture will help you to understand how do your spending habits look like now and how do you need to change them. To be honest, it was difficult to stay on budget even after a couple of months of using the app. I was really shocked when having seen my 'in my pocket' negative a week before the next month starts. I couldn't believe I'd overspent with my credit card so much... PocketGuard won't change your life, only you can do it. But this app is a great assistant which definitely makes this change go easier.

Not as good as mint. This program is difficult to use. My wife and I both use it on our joint account, but our “in my pocket” amount rarely matches. It jumps around wildly over the course of the day as well so we literally never know how much we have. It’s difficult to figure out how to handle things like using your bonus from last month since finances reset every month. It’s also difficult to figure out how to handle periodic expenses. Mint tells you how much you have left and how many days remain, so while it doesn’t give you a “daily number” you can easily divide cash remaining by days remaining. Mints balance matches for my wife and I and doesn’t have wild swings throughout the day. We feel much more confident using that program which just very simple math without any weird issues. It’s easy to see where money is and where it went. I can not recommend this program.

Expected more. There are simpler ways to do about things that I had expected. Sort of give more options to the users who wants it. For one, there is no easy way to access any categories that I made without getting deep into each layer. I like to just categorize into whatever category I made but thats so so hard to access. Second, for each category, there is no ‘money in’ tabs and ‘money out’. So i dont know how much I received money on a particular category or so since there is no distinction. Third, I like to see my spending details by month. I selected January then I saw my self made category and clicked it and I was presented with all the items that are in that particular category up till this day. Fourth, if I don’t include a certain spending in any category, it will automatically put it into its own generated category (which is fine by me) but it is not shown in the ‘overview’ tabs which is very frustrating. I was giving this a try but now Im just contemplating into going back to just an excel sheet. I used Wallet by BudgetBakers before and I liked it except the fact that it can’t import csv pretty well w/o its own issues and some minor bugs. I just want more choices to those who wants better control of their finances instead of expecting the app to do it for them. Everyone is different.

Overall great app, a few snags that almost seem deceptive. The ease of use and simplicity are impeccable. The app has great promise, but there are a few things that are not helpful: Account management- cannot clearly tell if you’re in the trial period or if you actually have the premium service. If you have the premium tier you can’t tell if you’re monthly or annual. Bill name- cannot update the merchant name. I had to delete the bill and re- add it because I had a misspelled word. Budget planning- my monthly paycheck comes at the end of the month and I use it to plan the next month. I can’t tell if the app recognizes that. It looks like it wants to count my March paycheck for March bills but the month is over. Thank you.

Great app - with some bank issues. I think this app is great overall. Compared to other budgeting tools this is the best one I’ve used. I would even consider upgrading to the subscription, but I have serious problems with how it connects to my bank. My bank requires MFA to connect and so I am constantly needing to re-authorize in order to link the account. First, the notifications are annoying because I’m reminded of the issue multiple times a day. Second, I never had this issue when I was using Mint or another app for budgeting. I don’t know if this is a bug, but this is very frustrating because I like the app a lot in every other aspect. I think MFA is important, but I would rather have to do that to log into the app, and not have that be the cause of not syncing between the app and my bank.

Good but is missing some key elements. I like the concept of PocketGuard, but there are a few elements missing to really make it good- being able to split transactions into different categories (not all my grocery store trips are just for groceries), constant bank connecting issues, and you need to upgrade to categorize certain things (gas, coffee shops, etc). I also noticed I only got push notifications AFTER opening the app- that kinda defeats the purpose of saying “hey you’re close to your budget on ____ don’t overspend”. I do like that I could connect my main bank and see each account within in it including all of my different shares assigned to that account (checking, savings, trip savings, savings for Christmas, car loan, etc) and decide which to see every log in. The app is very esthetically pleasing and easy to navigate. I did google a few things to figure it how to do it.

Ok app not the best. Longtime Mint user here, given the circumstances of Mint shutting down I’ve been on the hunt for a new budgeting app that allows me to gain insights into my money. Here are top things I did not like about this app. 1. My account aren’t organized. I’d like to be able to see a collapsed view of my checking and savings amount but also be able to see them broken out. On the accounts view tab I would see a credit card then a savings account then a checking account from another bank- just no organization. 2. There were a few credit cards I was not able to link. Using the premium version to limit all of my credit cards is critical for me as it allows me to gain a complete view of my finances- especially with subscriptions on certain cards. 3. Cancelling the subscription is NOT the easiest. I was still within the 7 day trial period to cancel but I still have wasn’t sure if I wasn’t going to be changed since I signed up on the web

Awesome budget planner. I kept talking about keeping a budget for years but kept making excuses. I originally installed mint, but as pleasing to the eye as it is, it is not as simple and intuitive as I'd like and months passed without recording anything. So when I decided to finally start, I deleted the app and looked again and this Budget Planner was my first choice. I was surprised by how quick and easy it is to use, intuitive, with a customizable yet simple interface, and mostly, informative. Easily budget customizing, custom finance categories implemented, subscription-manager, expense tracker, the app works like a switherland clock. Pocketguard is an extremely good budget planner for everyday

Great tool - simple and easy to use. I love that it is customizable for categories, and whether or not a transaction should be counted. The budget is simple and easy to see where the money goes, and where you can make adjustments. The updates from bank accounts with merchant info and the ability to split the receipt into multiple categories. Just a well thought out and user friendly app. Only suggestion is to make it available to adjust a future budget, i.e. the coming month. That would make it easier to plan for certain expenses.

The bugs, slowness, and lack of reliability aren’t worth it. This app is a really cool idea and if it worked well I’d continue my paid subscription. However, there are a couple big issues: - It’s really slow - almost unusable. This seems newer. When I first started using it it wasn’t this slow. Just scrolling through transactions is so tedious because it freezes and then scrolls way further than you want - It doesn’t always catch when your accounts are out out of date or not updating. For example, I have one account that just won’t seem to update any transactions from the last 6 months but PocketGuard isn’t showing any errors with the connection. This type of ‘silent’ failure to update really takes away from the value because I can’t trust what I see in the app. -There also seems to be pretty frequent errors with accounts where I have to remove and re-add them or re-enter credentials. This is probably more related to the external accounts and their security but it’s still annoying. All in all, I find myself using the actual bank apps more than PocketGuard due to these issues even though I’d prefer to have it all in one place and use PocketGuard.

Great, but has a few issues. I love using PocketGuard for tracking my day to day spending and making sure I have enough to cover my bills. It’s fairly intuitive and is better for day to day tracking than things like personal capital. However, there are a couple things that don’t work quite right or as expected. Firstly, pending transaction are taken out of your “pocket” but can’t be modified or attributed to bills. It can take quite a while for some transactions to be marked as cleared, which means that often times my “pocket” is wildly inaccurate, since it’s counting large bills like my rent effectively twice. That kind of defeats the purpose of the tool. Secondly (and this may have more to do with the financial institution), but there are certain accounts that are listed as addable, but simple aren’t. My savings account, for example, hasn’t been able to sync for 6 months and the error is just a vague “something went wrong.” Mind you it syncs fine on other budgeting apps. So that’s disappointing.

Almost There. Like many others, I had to make the transition from Mint, which wasn’t perfect, but I loved and used religiously for years. I love the debt payoff feature, even though I have to “not count” a lot of transactions to get the balance I have available in my bank account only. The reason it’s not getting 5 stars is because I’m experiencing some bugs with my accounts. One account will not connect and sends regular emails with verification codes that don’t work (even when I’m not trying to connect the account), another one is a loan that reflects the borrowed amount, not the current balance, and the last one I can’t find (even through Plaid). The whole reason I use these apps is so I can see all of my finances in one place, particularly my balances. Once I can achieve that, it will be perfect!

App Itself Is Great, Bank Connectivity Could Be Improved. Love the functionality of the app itself. I love that I can characterize my transactions and track how much I’m spending in each category while creating budgets for areas I want to cut down in. I also love that this provides you an “In Pocket” number so I can be sure to not overspend by the end of the month. For reference I have the Pro version and it’s worth it! Edited: I used to have some issues with bank connectivity that caused my budgeting to be off by +\- $100 which was frustrating. However the PocketGuard team fixed the issue and I’m enjoying this app again with confidence my budgeting is accurate 🙂

Continuous 500 errors renders the app useless. Coming from Level App I have spent a long time testing out various finance apps that could replace it. PocketGuard is by far the best solution feature for feature however for whatever reasons my bank account needed to be reconnected but error’d our every time I tried to update. It also error’d out when I tried to delete the scout all together and re-ad. Finally I went to the website and update, which worked but error’d out on the app when I tried refreshing. As a last resort I deleted the app and reinstalled and now it errors out when I try to sign in! I don’t see a way to submit feedback via the support tool on the app so a review is the only place I can resort to. Please fix this so I can adjust my review appropriately! Thank you

Great app for budgeting. It works really well. Occasionally he glitches but they seem very responsive about fixing it. Some banks transactions clear much much quicker than others. I wish the Pending transactions allowed you to go ahead and update the category as well as add hashtags. One of my banks takes several days for transactions to clear so I’m always a week behind on updating categories. The reports are great. As a former long time user of Quicken, I only hung on for the reports but I haven’t used it since I moved to PocketGuard. The one change I would make is to add income to the budget page so for those of us on variable incomes you have an better idea of if bills will be covered.

The best budgeting app. I’ve literally never written a review for an app before, but I had to because I felt so strongly about the quality of this app. I used mint for a long time bc it was free and got the job done, but recently, Mint stopped supporting my bank (USAA). So, I was on the market for a new budgeting app and stumbled upon PocketGuard. I have to say, I’m extremely impressed. I love the ability to save for my goals without having to think about it. I love how it calculates my estimated monthly income so that I don’t have to do the mental math when it comes to budgeting. I love the notifications it gives me when I spend too much on a particular category. I love the customizable budget categories (not an option under Mint). This is truly the greatest budgeting app I’ve ever used, and I’ve been budgeting my money very persistently for about a decade now. Also, the customer service is probably the best I’ve ever come into contact with, across any business or platform. You have a question? Email them and you’ll get a response back within 24 hours. In fact I emailed them once with a question and received a response back within 30 minutes. Overall, this is a fantastic budgeting app and I couldn’t recommend it more.

Great app...but Always broken.. I love pocketguard, but too frequently there are errors that make it impossible to use. I get the same Error 940 "Puppetmaster" error all the time which prevents the app from connecting with my bank. It will sometimes work for a day or two then be in error again for week or so after. Customer support didn't really even respond to my e-mail, just an automated response asking for more details when I literally sent them a screen shot, and it's their own error message. I was considering buying pro, because when it works it's awesome and has literally helped me prevent overdrafts and stick to a budget but it doesn't really work very often. Aside from the broken bits, my recommendation would be the ability to select a date and see how much will be needed for bills in that time frame. It currently only shows end of month, but I always end up needing to bust out paper and pencil and manually (navigating away from the app logs out, so can't even use the calculator app at the same time) add figures to see what I need by next payday, as opposed to month.

Better than Mint. I came across PocketGuard when looking for a replacement budgeting app after finding out Mint was being shuttered. I had been using Mint for over 7 years and had got used to it. Although I was skeptical that I could get used to a brand new budgeting app I quickly found PG to not just be as good as Mint, but better in almost every way! I like that they offer a one-time lifetime purchase as I despise monthly subscriptions. The best feature in PG is the recurring income and bills. With Mint I often had problems remembering those quarterly or yearly bills and they’d throw off my whole budget. With PG I never have to worry about forgetting them because they’re always scheduled. It’s also helpful to be able to see next month’s estimated bills and income. Highly recommend PocketGuard to any fellow budgeters!

Good overall. Needs fine tuning. This app is great if you want something very basic to track your expenses. Bank accounts sync flawlessly, and it is easy to make a custom budget and track purchases. Where it needs work though is in the integration of the “Spending Limits” category into the rest of the app. For some reason they have 2 separate categories for “Bills” and “Spending Limits.” I am sure most people, like me, primarily use the “Spending Limits” portion which is not really used for any data integration in the rest of the app. I would like to see “Spending Limits” integrated into the “Overview” tab and future monthly income accounted for in the “Overview” space. It would also be nice to see some changes made in the “Insights” tab. Ideally, “Spending Limits” would be broken into macro categories and these macro categories would comprise the pieces of the pie chart under “Insights.”

Excellent app. Life hack. PocketGuard is an excellent budgeting app that helps users keep track of their finances and manage their money with ease. The app's interface is user-friendly, and it offers a variety of features to help users stay on top of their spending habits, such as tracking bills, setting spending limits, and monitoring savings goals. One of the standout features of PocketGuard is its exceptional customer service. The app's support team is highly responsive, friendly, and helpful. They provide prompt assistance to users who encounter issues or have questions about the app's features. Many users also rave about the app's reliability and accuracy. PocketGuard pulls in data from bank accounts and credit cards to give users a comprehensive view of their financial situation. The app updates in real-time, so users can see their spending habits and account balances as they happen. Overall, PocketGuard is a must-have app for anyone looking to get a better handle on their finances. It offers a range of features and tools to help users manage their money effectively, and its excellent customer service sets it apart from other budgeting apps on the market.

Phenomenal and Life Changing!. I’ve tried all the budgeting apps and felt that each one was missing a key feature that others had, but none had everything. I was just about to compromise and settle for one, but luckily I tried PocketGuard! If you took only the good features from all of the different budgeting apps and packaged them together perfectly, then you’d have PocketGuard! It has really helped me to see my spending habits, especially as a recovering “swipe now, worry later” kind of spender. Never trying anything else again and their prices are also much more affordable than other apps! One feature I’d love to see though is the option for credit card payment due amounts being included as a bill. That way I can budget for money leftover after bills + cc payments needed. I know this isn’t useful for those that don’t carry balances, but for those of us that do, this would make budgeting so much more accurate. Say you pull the minimum payment amount from each statement as they’re issued (since the amount can vary month to month) and it would show up as an Upcoming Bill and also deducted from In My Pocket. I’d also like to see the ability to mark smaller payments throughout the month as amounts towards the minimum payment amount so it shows the remaining. Thanks and excited to see future updates!

Beautiful look, but doesn't add up (literally). Maybe it's just me, but I'm having problems with this app. I wanted to like it, but it simply is not adding up budgets correctly for me. For example, it only counts venmo transactions towards a budget when I pay other people, but not when I'm paid (which creates problems when I pay the bill at dinner and others pay me back, it's artificially inflating my dining expenses when I am not overspending myself). Another example is that I made some returns to a store the other day, and I see the positive transaction categorized under "shopping", but it is not reducing the amount that I've spent on shopping by that amount, so it also is overstating what I've spent in that category. It makes no sense to me and is too many exceptions to keep track of, so I must say goodbye to this app.

Account syncing issues not fixed for weeks. I have been having intermittent sync issues with my accounts for months, and now my primary checking/savings accounts have not connected to the app at all for 6 weeks. I contacted support and was not given any information beyond basically ‘this is a known issue and we’re working on it.’ After several weeks with no updates, I reached out again and got essentially the same statement. This app is useless without the functionality of automatically tracking transactions. I was finding the app really useful before the constant syncing issues, but I’m highly disappointed by the lack of urgency and communication in getting my account back in working order.

Exactly what I need. Finally! An app that let’s me track my expenses real time…and accurately! I have tried 14 other budgeting apps in the last year and each one had something buggy about it, or the process flow didn’t make sense. I used to use Mint but there are too many problems with syncing transactions, etc. This app does all the things I expected the other apps to do and has other cute features (icons for each budget). I’m sticking with this one from now on. After playing with it for a few hours I bought the annual subscription which is reasonable compared to the other apps I’ve tried. My only request is that the Spending and Budgeting screen should be easier to get to once the app opens, since I use it daily to make sure I’m staying within each budget category.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Why insisting on linking bank accounts?. Why insisting on linking my banks account? And why forcing me to log in using a gmail account?

Worth it.. Costs a little, a little bit of work to set up. But then it just works, and it’s really easy, and really clear

Great, When it works (which is less these days). Worked great at the start, good customization, helped to replace Mint. I even payed for premium. But have had problems recently syncing with BMO and TD. Which makes the app useless. Hopefully these issues gets fixed soon, but not too confident they will, and from other reviews these issues seem to have existed for sometime now. Will be cancelling premium until I’m confident these issues dont pop up again.

Exactly what I needed. This app records my transactions , j is identifies my Bills and plan an estimate of what is to come. I can set-up saving objective. It just great and exactly what I needed.

Disappointing. I bought this to take over for mint being shut down and it’s such a disappointment. First one of my bank accounts just randomly stopped syncing, so I got told to add it in a different way, did that, now everything from those accounts is doubled. My whole budget is wrecked now and I can’t remove the account that won’t sync. Absolute waste of 100 dollars do not waste your time or money, this is not a good budget app.

Need More 4 Canadians. Only could connect one bank, no credit cards and stuff… also the “Add to Siri” button is not working.

Big bank centric. Some of my banks are supported; mostly the big ones. But the smaller or online banks are not. The app is pointless if you can’t link all of your accounts. Please offer linking to more credit unions and online savings banks.

Canadians don’t waste your time. I bank at RBC and TD, neither would connect accounts. I would get errors every time. Still searching for my new Mint.

Cannot Reccomend. So disappointed, one of my Canadian banks drops transactions, so the amounts are never correct. I have emailed twice and both times no replies. Other emails come but nada for my issues. I have synced and used Plaid to connect but just too many glitches to be of any value. There are very little help topics to help with learning how to use the software. Some FAQs but not nearly enough. I have asked for my Premium account to be refunded, still waiting to hear back about that.

Lacks some key features. Great app, sync works well mostly. However a feature that’s lacking is the ability to manually add transactions to accounts. This is only available for cash accounts.

Error 185. I keep getting the error 185 when trying to connect my card! Is it just taking my credentials and running with it?!

Has potential, but can’t see or change my payment information!!. Been trying to contact their support team but get no answers. There’s no way (as far as I can tell) to change my method of payment in my account. Extremely frustrating. The only thing they provide is a “refund me” button, and when clicked on it just says it’s submitted but received no other confirmation or email about any refund details. I don’t want a refund, I want a way to change my credit card on file before my trial expires. Also there is no way to cancel the trial immediately (refer to refund me button). It’s insane to not be able to access my own payment information and be at the mercy of their responsiveness to change or cancel my subscription. Keep in mind I signed up on the web app and not through iOS subscription which is what I should have done, now that I know I have no control over my payment details. Besides that, the overall intuitiveness and ease of use is good. I mainly use the web app. Most of my Canadian bank accounts link fine, but don’t show updated information which has been irritating. The refresh account button doesn’t refresh anything for some linked accounts, and the refresh timestamp doesn’t change. Edit: changed stars from 2 to 5. Received great ongoing support from the PocketGuard team to resolve my issues. I feel much more confident using their app and will continue to do so.

Customer Service is non existent. I had issues syncing my transactions and send 2 messages to customer service 5 days ago and have heard 0. It finally synced today but I am this close to switching apps because I don’t trust it and am constantly double checking everything. It will occasionally de sync from my accounts and I have to re input all of my info which is a pain. When the app is working it works GREAT.

Really like it. Have tried a few budget apps over the years before finding this one, YNAB, Mint etc. I like the simplicity of the options here, it gives me all the forward and backwards look I need to stay in control of my finances, without too many extra bells and whistles to cloud the message. Much more hands off than most I’ve tried, which is huge for me. It does occasionally have sync problems but they rectify themselves most of the time. Works fine with the 3 Canadian banks I’ve linked.

Got locked out of my account. My bank doesn’t use PAC anymore. Only for phone banking. As a result I got locked out and had to call my bank to fix it.

Can’t sync. Moving from mint to a new app. This one does not sync up for initial set up with 3 out of 5 big banks. Asks for 2FA every time but times out. Tried reaching out to customer support. No reply for over a week. Nothing in junk mail.

Needs work. This app has good potential but it lacks flexibility and still needs lots of work. For example when a recurring income is created you cannot change future income, so if your paycheque varies you cannot accurately predict your income for the month. Entering refunds is very cumbersome, budgeting system needs work also. Fir example a budget on a category cannot be set to $0 if you’re not planning on spending anything in that category for a month. Lots of other small annoyances, however if they are willing to work on them and fix them, this app has good potential.

want my money back. I paid for the “pro” which they offer at about 100+ and I still have problem with transactions loading to be accurate... if anything downloading the “best” version was the worst option for me. Looking to find a refund... don’t even know where to look.

Not useful without reliable synchronization. Can’t sync reliably with my bank (BMO). Asks for 2FA then timeout. No response from support. Spent too much time already.

Royal bank of Canada - ERROR Linking account. Hi support, I love the interface and the way the app looks. I was excited to find the app. (RBC is a fairly big bank in Canada) but it gives me “Aggregation error” “error 185”. I also noticed this app is being updated still so it tells me it’s a good app. Can you guys pls check this error and see if you can fix it? Again, I love the look of the app, it really stands out, I’d use it if it could link to my bank.

Ok but not great. It’s ok but very disappointing. I wanted to try it for free first to ensure it was what I was looking for since mint is going away. Free version wasn’t much help as you are limited to 2 accounts so I had to upgrade to see the full potential of the app. It connected to my accounts but it’s constantly out of sync with my account and hitting “refresh” doesn’t do anything at all. It also doesn’t have the option to connect to all institutions like MBNA and WealthSimple isn’t available which is a bummer as that’s where all my investment accounts are. Overall it’s an ok app if you have 1 or 2 accounts at the major banks but if you’re like me with accounts and investments all over the place with smaller institutions, you’ll be very disappointed.

Impressive App!. Set up was easy! Reminders are appreciated. The entire set up is smart and relevant. Lots of categories to make a comprehensive budget for myself. Very happy with this product! Exceeded my expectations.

Not great if you’re Canadian. Can’t get any accounts to sync. It just loads forever. Bought premium because I loved the layout, and I managed to get ATB working properly. But no other bank I have will load. I wanted this app because it connects to account and I wouldn’t have to do things manually. Now I own premium for an app I can’t even use

Major Syncing issues. This app is great to use, however they have major syncing issues they need to sort out. Every time I log into the app, I’m asked to constantly sign into my online banking. If I close the app and sign in the same day, I’m still asked to log back in to my online banking. Huge waste of time, especially when I paid for almost a years worth of subscription. Great potential, poor execution.

Premium is Not Worth It. As a Canadian, not a single one of my accounts were able to connect with this app. I've waste a lot of time waiting for it to load and nothing. It doesn't matter what I try, it does not work. If it's one thing you take away from me record is to save yourself the time, money and disappointment. Premium is a waste of money and I would like a refund.

Really great but…. Everything with this app is exceptional, very in depth and I love everything about it, so many options very easy to use, not too expensive either BUT every time I use the app, it says there’s a sync problem and I need to verify my accounts. This is pretty tedious having to send myself verifying codes each time I want to use the app not to mention for each bank account. I’m not sure if it’s because I’m in Canada. This very well may be an American app. But nonetheless shouldn’t sign in verifying/authenticating accounts be maybe on a monthly basis? Might switch to something else. On the hunt for a new budgeting app since Mint is shutting down.

Idea is great but app isn’t sadly. I was really excited when I first downloaded this app as I currently use mint and was excited this app offered more options for budget the way I want to ie envelope money. The next day I opened the app see where I was at and my bank account won’t update. It’s still just the transactions from when I first linked my account. So, if I have to enter all my transactions manually then I think I’ll stick with mint. Also, not a fan of having to pay for premium to use certain features as the whole point of budgeting is to save money - not spend more.

Goodbudget is better. I hate this app and wish I’d never gotten premium. If you don’t care about linking your accounts and want an app to budget manually, don’t get PocketGuard. The interface is really attractive and I love the ability to create different categories with icons BUT you don’t have the option to budget weekly (only monthly) and contributing to savings categories is more complicated than necessary. Spending is also tracked by filling up to your budget limit which I prefer having a full bar that depletes as I spend in the category. If you want a good app for tracking budgets and savings week to week (and how much money you’re accumulating in budget categories), I’d recommend GoodBudget. At first it seems like you can’t create customs categories but there’s an add button if what you’re searching for doesn’t exist :)

Extremely helpful!. This app is a great way to force you to watch the money you spend and see where it’s all going. It makes cutting out unnecessary spending easy as well as saving that extra money. Very useful for building good financial habits especially as a young adult or as an adult just leaving home for school.

No customer support. Works ok but I need help on some features. Still waiting to hear back. Support seems nonexistent.

Great app. The best app for me, works with all of my cards in ontario(ScotiaBank, TD, Amex)

Issues with Scotia Bank in Canada. This app appears to be a good app but I’ve been trying for over a month to get my accounts with Scotia Bank connected with no luck and very frustrating.

Widgets. Really enjoying this please please add some widgets to this app though !!!

Very frustrating. To begin with, I selected my subscription as monthly and somehow it automatically changed to annually. The app doesn’t synchronize with my CIBC accounts, it gives me a sync error when I try to connect to my account. The app also doesn’t have a connection to MBNA credit cards, so I need to add all my credit card transactions manually. The app looks good, but didn’t work for me. Just requested my refund!

Great app-Canada. Evaluated for value all the top tier apps, PG stood out considering all the benefits vs value , the in my pocket feature is great. There will be a learning curve initially , but you’ll like it once you’ve established all the base elements, migration from Mint is good as well!

Good but no support anymore. Application is good, some stuff could be improved (subcategories, rules…). But my main issue is that I did not heard from support for weeks even with multiple requests sent. As a paying customer it is very disappointing…

Constructive feedback. App has undergone impressive changes lately, based on user feedback, which proves developers have improvement at heart. I’ve noticed a lot of issues revolve around cash and synced accounts. All features of cash accounts, creating recurring cash transactions, selecting the account to credit, are not available on synced accounts. PGs forte is background automation, and auto reconciling transactions between accounts that are synced, the biggest feature request I have is ability to treat synced accounts like cash accounts, where I can create transactions and these transactions will reconcile when their backend financial tools update those accounts. I plan on using PG going forward in the new year. Enabling these requested functions would go a long way to utilising the auto sync feature, as opposed to using cash accounts for all my accounts. I can do all my banking through PG if I’m willing to upload my FI CSV files per account. Tedious but worth it if I’m going to keep improving my financial standing. Manual is always less than ideal, but may be the only way forward if PG won’t support manual transactions within synced accounts.

Stopped working after 2 days. At first this app seemed great. I bought an annual subscription after trying it out for a day. My bank was a little whole to link and had to be manually verified once a day, but I could live with that. Now, my bank is not refreshing at all. The web app doesn’t work. It just spins when you login. I tried contacting support and got no reply.

Account Syncing is Garbage. Bank accounts either need to be resynced multiple times per day or, if using Plaid, won’t sync for days on end despite other apps being able to update regularly with Plaid. Support is not help at all. Don’t waste your time and certainly not your money.

Great app! One improvement suggestion. Great app. I’m loving it so far. I have one improvement suggestion: can we have an option to accumulate spending limit? Say I have a 200 eating out spending limit every month, and if I don’t use up all that budget, I can accumulate it to the next month where I can get some REAL NICE food.

Need MFA on my CIBC. Good work on bringing so many banks, love it. But just please can you add some support on CIBC? Why I need to do MFA login every time to sync the data?

App doesn’t sync with Canadian bank accounts. It really is a terrible product. Even when the app says it has sync’d, it hasn’t. Not at all comparable to Mint. A total waste of money!!!

Doesn’t want to connect to my bank. I used to be able to connect to my scotiabank account when I first downloaded the app but now it keeps telling me that there’s a temporary error. Unfortunately this “temporary” error has been going on for weeks now and I’m still not able to access my Scotia account.

Avoid if you're Canadian. Many issues with Canadian issuers.

Solid but misses the point. First off, this app is great! I love how well it syncs with my account. It easily captures what’s bills what’s expenses and shows me how to truly save. Although this app is designed to save you money, it still is trying to monetize off of you. I think that defeats the purpose of being an app designed to save you money not take your money. Allow the features to be free. The moral and ethical thing to do would be that as it is a budgeting tool. That’s my only complaint for the 3 stars but why it’s not 4 stars because the whole principal is to save, not to spend. Keep up the great work developers and I hope the app can eventually be free with all features!

Not ideal for Canadians. There’s a lot of banks and investment accounts that cannot be synced because they are Canadian accounts. Scotiabank, for instance, won’t sync an account from Canada and Sunlife investments can’t be synced by Canadians.

Overall great app!. This app is really great for budgeting. One main feature is missing for me, and that is to be able to set budgets that roll over month to month and accumulate over time. This is a feature I am missing from switching over from Mint. I know I can enter it manually as a transaction but that’s another step that complicates my monthly budget. If it had this feature it would be 5 stars!

Good, but persistent syncing issues. I love that I can have my credit, debit, and savings accounts so easily accessible and see where my money is going across al three. It’s been a really useful tool to help me better manage my money and generally it works really well. However there are sync issues, and every few months it will stop linking to my bank and tells me I have to update my credentials. This wouldn’t be an issue except when I put in my information it tells me it is incorrect (I’ve checked and it is correct) and then I have to start all over to link my bank account. This is a bit tedious and makes me fall back on keeping track of my money. Otherwise, I really love PocketGuard!

Banking Stopped Syncing. My wife and I bough the year long package as mint is going out out of business. We had used mint for years with no issues. We used the free trial on pocket guard and it was all working for a little over a month then bought the program. Then we got a message saying our banking isn’t able to sync “Error 908” we’ve emailed 3 different times and gotten the response of “IT is looking in to it and will get back to you soon”. Now despite paying for the app, it has be completely nonfunctional for over a month. Not impressed. If it goes on for another week we’ll just use a different software. We were really wanting to take control of our money habits, but waiting months for IT to fix their issue isn’t working. *****Do not buy this program****

Seems useful but constant tech issues. The app seems good in theory but technical issues make it difficult to recommend (unless you are inputting all of your data manually). Even then I found that half the transactions I entered caused the app to freeze on a loading screen. Not sure if this is due to being in Canada but the app absolutely refuses to login to my bank and just stays on the leading screen forever. Also can’t seem to ever log in to the web browser version even though I’ve tried different computers, different browsers, clearing cookies, etc.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Recommend.. I would highly recommend this tool to everyone who has decided to change the way of spending. This app won't tell you where to spend and where don't, but it will show you what happens if you do this. Overspent this week? Try to cut the spending on everything you can in order to stay on track this month. Failed this month? Go and increase budgets for each category. Everything is pretty simple but you may need to have a good planning in the beginning and at the end of the month.

Cannot link AmEx High Yield Savings Accounts. I’m currently trialing a few finance/budgeting apps, and so far Pocket Guard is pretty good. It’s features and functions are easy and allows for a satisfying amount of customization (though I could use even more). Where it is falling very short for me is the inability to link my AmEx High Yield Savings Accounts. The bulk of my cash are in these accounts making it tough to reap the full benefit of the app. Other apps seem to have this same issue, which is odd given I had no issue linking my AmEx credit card. If I didn’t bank with AmEx, PG would be would be a no brainer for me to continue on with.

Pros and Cons. Pros: -graphs and pie charts showing spending, income , and what was spent on -easy to set up -dark mode with cool colors - let’s me adjust dates on transactions which is nice because my paycheck for a month sometimes comes in the next month which can mess up my data - auto savings as well as auto saving from each pay check - a lot of categories to choose from for transactions - merchant history which allows you to see past monthly spending on one category Other things these are the best for me CONS: - I don’t know why some transactions aren’t showing up and it really screws with my income vs spending graphs -can never connect to Sallie Mae - auto save isn’t consistent at taking out money as indicated Overall I love this app and for the past 2 months I’ve run into the problems stated in cons. I don’t know why it’s happening I contacted support and they’re taking a while to get back to me. If these things could be fixed this app is the best among the others in my opinion. But these flaws are defeating the purpose for why I even use it :/

Simply and easy. Love the app! It’s exactly what I needed with nothing too complicated. The plus allows for budgeting and it’s worth it. I’m able to keep an eye on everything and write notes on transactions. I would give it five stars if it wasn’t for its duplicate transactions. It keeps scaring me and then when I check my bank it’s only one transactions. It’s also easy to hide it but it’s really annoying. Everything is good then all of a sudden it’s calculates something twice. Please fix.

So simple, So good. This app has an In Your Pocket feature that is EXACTLY what I want from a budgeting app. You put in your income and expenses (with plenty of options to reflect the different types of both), and then you get to see what’s left “in your pocket.” If you want to know how much money you have to spend on ancillary purchases, that’s what this tells you. It’s the perfect thing to help you determine if a current purchase—for which an entire budget category doesn’t make sense—is reasonable or not. I highly recommend this app!

Was hoping this my last budgeting app. I came over from Rocket Money because many of my accounts were not able to connect to Rocket Money. The good news is that all of my accounts connect to Pocket Guard. The not so good news is how Pocket Guard shows monthly budgets. I’m currently renovating my house and I’ve been transferring and spending savings. Pocket Guard doesn’t have the level of automation that Rocket Money does and so it is treating transfers and withdrawals as expenses effectively double counting. Rocket Money does this for you, which is a time saver. I hope pocket guard enhances expense categorization. I paid for a lifetime membership and I’m starting to regret it.

My Favorite app. Best app ever! I'm not a disciplined person and that caused many troubles with manual budget apps because as soon as you stop tracking your spendings even for a few days, everything gets messed up. Gladly, Pocket Guard solved this problem for me. If I forget to visit the app for a few days, it still pulls my data, updates my accounts and so on. Thus, I don't have to worry about my budget, it's always there when I need it.

I'm on my way. It was my New Year resolution to start getting out of credit card debt and to improve my financial health. I installed this app as believed that it would help me to reach the goal and it really does. I've been using it only for 2 months so far but it already works great for me. I found out where I can save and set some spending limits for the categories of spendings. Besides, BillShark negotiated with my Interent and TV providers and they reduced my bills! So I am totally satisfied with Pocketguard

Credit Card Connection Issues. I see you’re create a bunch of new features but you main ones still doesn’t work properly. My credit card accounts don’t read the correct amount and haven’t for over a month now. Even after re-verifying it. I figured I’d wait until you release a new update but it’s still broken after your most recent one. Even paid for your “plus” program and it’s not worth it. Wanna try you cash? Just label the ATM transaction as what you actually bought. Then you don’t waste your 50 bucks.

Great, and could be greater. There are a few things I wish this app would do- like I want to apply just more than one goal in savings for my one savings account (ie: I’m using it to save an emergency fund AND a vacation- why can’t I split my amounts and track them?) There are some features that it’s says are “coming” but not available yet... like if I make an extra payment toward my personal loan, I’ll be able to apply which account I drew from to pay it (and not just “cash”). It’ll be a lot more helpful when these features are added. But I’m mainly happy it actually connects to all of my accounts. Other apps like YNAB don’t work with a lot of banking companies.

Just ok.. lots of syncing errors. I have an American Express card and recently it’s started to disconnect from pocket guard and is the biggest hassle to log back into. I also noticed that at least once a week my transactions are moved out of the “Budgets” I assigned them to previously, so I have to go back and do it again. It’s a good concept of an app but there are many bugs that make it frustrating. I’d also like the ability to see from month to month where I’m at versus just one single month… rename certain transactions differently.. several things like that that just don’t have the customization.

Good for my family. When you are single, budgeting doesn't seem as somthing must-have. However now as a married man with a toddler I know that it's crucial for my family to have not only a decent amount during the whole month, but also have a safety net fund. Pocket Guard was the app that helped me to start budgeting and change my spending habits. Besides, it's awesome that the app categories my purchases and it only takes me minutes to check what I am spending on this month.