T-Mobile MONEY: Better Banking App Reviews

T-Mobile MONEY: Better Banking App Description & Overview

What is t-mobile money: better banking app? T-Mobile MONEY is the banking service that puts you & your money first! Save with no account or overdraft fees. Take your dollars further with industry-leading interest & exclusive partner offers. Get your paycheck early with direct deposit⁺, make payments without fees, & withdraw cash at 55k+ no-fee Allpoint® ATMs.^ Download the app & start banking better today!

• No credit checks. No account or overdraft fees. No minimum balances.

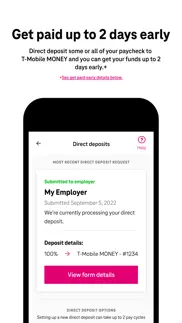

• Set up direct deposit to receive your paycheck up to 2 days sooner⁺

• Earn industry-leading interest on checking & savings balances

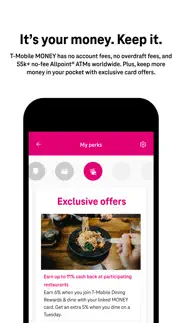

• Enjoy exclusive offers on dining, select travel, & more!

• Send instant payments to other MONEY customers without fees

• Withdraw cash at 55k no-fee AllPoint® ATMs^

• Make purchases with a personalized debit card, or enable Apple Pay (not available in all markets) for mobile payments

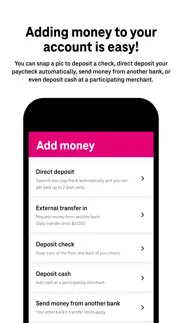

• Deposit checks on your phone or add cash at select merchants (third-party fees may apply)

• Pay bills: pay by check or set up recurring transfers

• Talk to T-Mobile MONEY specialists every day of the year. Y ayuda también disponible en español.

• T-Mobile wireless customers can save $5 per eligible line with AutoPay. Plus, all payments made to T-Mobile count towards perks qualifying transactions.

T-Mobile MONEY is a banking service powered by BMTX. Accounts provided by Customers Bank, Member FDIC. All Rights Reserved.

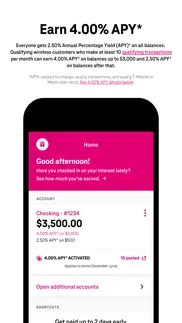

YOUR MONEY WORKS HARDER

Everyone earns 2.50% Annual Percentage Yield (APY)* on all checking & savings account balances. Plus, qualifying customers who register for perks & make at least 10 qualifying transactions per month can earn 4.00% APY* on checking account balances up to $3,000 & 2.50% APY after that.

SAFE & SECURE

Stay connected to your money with transaction & balance notifications. Easily transfer money to & from external accounts. Temporarily disable your debit card from your phone or browser if lost or stolen. Prevent unauthorized account access with multi-factor authentication & with biometric login. Deposits are FDIC-insured up to $250,000. Plus, with Zero Liability Protection from Mastercard® you’re protected if fraud occurs.

^The location, availability, & hours of operation of Allpoint® ATMs may vary by merchant & is subject to change.

⁺Subject to description & timing of the employer payroll-based direct deposit.

*How APY works: Checking account customers earn 4.00% annual percentage yield (APY) on balances up to & including $3,000 in your Checking account per month when: 1) you are enrolled in a qualifying T-Mobile or Metro plan; 2) you have registered for perks with your T-Mobile ID; & 3) at least 10 qualifying transactions have posted to your Checking account before the last business day of the month. Qualifying transactions posting on/after the last business day of the month count toward the next month’s qualifying transactions. The first time you fund your account, as an added value, you’ll receive 4.00% APY on balances up to/including $3,000 in the statement cycle in which you make your first deposit of greater than $1, as well as in the cycle that follows that deposit provided all other requirements are met. These added value benefits are subject to change. Balances above $3,000 in the Checking account earn 2.50% APY. The APY for this tier will range from 4.00% to 3.40% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 2.50% APY on all Checking account balances for any month(s) in which they don’t meet the requirements listed above. Savings/Shared Savings account customers earn 2.50% APY on all account balances per month. You must have a T-Mobile MONEY Checking account that is in good standing & funded to open any type of Savings account. APYs are accurate as of 12/01/22 but may change at any time at our discretion. Fees may reduce earnings.

For details & more on qualifying transactions, see Terms & Conditions or FAQs.

Please wait! T-Mobile MONEY: Better Banking app comments loading...

T-Mobile MONEY: Better Banking 3.1.1 Tips, Tricks, Cheats and Rules

What do you think of the T-Mobile MONEY: Better Banking app? Can you share your complaints, experiences, or thoughts about the application with T-Mobile and other users?

T-Mobile MONEY: Better Banking 3.1.1 Apps Screenshots & Images

T-Mobile MONEY: Better Banking iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 3.1.1 |

| Play Store | com.tmobile.money |

| Compatibility | iOS 13.0 or later |

T-Mobile MONEY: Better Banking (Versiyon 3.1.1) Install & Download

The application T-Mobile MONEY: Better Banking was published in the category Finance on 29 November 2018, Thursday and was developed by T-Mobile [Developer ID: 525560781]. This program file size is 155.79 MB. This app has been rated by 37,651 users and has a rating of 4.8 out of 5. T-Mobile MONEY: Better Banking - Finance app posted on 07 November 2023, Tuesday current version is 3.1.1 and works well on iOS 13.0 and higher versions. Google Play ID: com.tmobile.money. Languages supported by the app:

Download & Install Now!| App Name | Score | Comments | Price |

| SyncUP KIDS Reviews | 4.8 | 30,539 | Free |

| T-Mobile FamilyMode Reviews | 4.4 | 11,518 | Free |

| DevEdge IoT Reviews | 3.5 | 11 | Free |

| T-Mobile Internet Reviews | 4.3 | 81,652 | Free |

| T-Mobile Prepaid eSIM Reviews | 4.8 | 10,844 | Free |

Minor bug fixes and performance improvements. To give you the best experience, we're constantly improving our app. Keep auto-updates turned on to make sure you have the latest version.

| App Name | Released |

| IRS2Go | 20 January 2011 |

| Discover Mobile | 17 November 2009 |

| Fidelity Investments | 22 February 2010 |

| Venmo | 02 April 2010 |

| Bank of America Mobile Banking | 01 February 2019 |

Find on this site the customer service details of T-Mobile MONEY: Better Banking. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| My Currency Converter Pro | 16 September 2015 |

| Loan Calculator Pro | 11 February 2009 |

| Debt To Income Calculator | 06 December 2018 |

| Debt Free - Pay Off your Debt | 14 December 2010 |

| My Financial Independence | 30 September 2021 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| DoorDash - Food Delivery | 10 October 2013 |

| Telegram Messenger | 14 August 2013 |

| Amazon Prime Video | 31 July 2012 |

| ChatGPT | 18 May 2023 |

| Gmail - Email by Google | 02 November 2011 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Suika Game-Aladdin X | 06 March 2024 |

| 75 Hard | 19 June 2020 |

| AnkiMobile Flashcards | 26 May 2010 |

| Plague Inc. | 25 May 2012 |

| Poppy Playtime Chapter 1 | 08 March 2022 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

T-Mobile MONEY: Better Banking Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

A banking experience for millennials. Banking with t-mobile money feels very different from one of these old traditional banks like JPMorgan Chase or Bank of America. When using t-mobile money, you feel like the whole app experience is very informal, yet precisely engineered to be gratifying. This is in stark contrast to the more established banks, where everything feels more subdued and nuanced. It's like the difference between the extravagant and catchy nouveau riche and the reserved old money. Whether or not this is a good thing or not is entirely a matter of personal preference; the best short way to summarize it is perhaps that t-mobile money has a more millennial feel.

Would definitely recommend. For cellphone service, too!. Everyone I’ve spoken with has been very nice, understanding (with the current COVID-19 pandemic), and helpful. I had an identity theft scare and T-Mobile Money was fast to secure my account so that my money was protected, as well as my identity & SSN. I received my new debit card in about 5 days. One of the cool perks is if you meet the requirements, you get 4% interest on your balance, as well as the bank having your back -$50. If you have a rough two weeks, and need a few groceries before next payday, T-Mobile has your back...no overdraft fees, and no interest stacked on it. If you’re looking for a back that truly cares, give this one a try.

Why choose T-Money?. Do you like your bank, or at the very least, tolerate them? Especially with their novel size book of fees, high interest rates and very little return on YOUR money that they use to make windfall profits... Well, I’m here to give you some examples of my experience with T-Money. $50 protection overcharge security with no penalty! My other bank charged $35 for an overdraft and the customer service was far less than stellar. I also receive the 4% return on my account up to $4000. And when I had a mixup with one of my mobile deposits, the staff was kind, courteous and genuinely helpful in resolving it. These are just but a few perks I’ve received and appreciated since switching over. Because of the attentiveness they provided, I tell my family and friends every chance I get to switch over and enjoy their money instead of their fee/interest hungry banks that they currently do business with. Keep up the great work T-Money...

“Time Will Tell”. I’ve had 2 bank accounts at 2 different banks for about 8 months now! I’m having issues with both of them! I recently switched from MetroPCS to T-Mobile!!! (I know they are owned by the same entity-company) T-Mobile has some perks that Metro didn’t! So I checked them out and low and behold they have a bank of there own! So I started yet another account with a 3rd bank! I received my card in about a week and have not had one issue in 6 months! I love your commitment to your customers with little to no interaction! I love your company’s efficiency & excellence of satisfaction! Now my peace-of-mind and life runs smoothly again! Thank you!

T-Mobile Money Customer Service is TERRIBLE. Customer service gives what seems like completely automated responses and you can never get through to someone that will actually help you out (especially via messaging in the app). Also, T-Mobile claims to give you 4% interest back on $3k, but they don’t tell you that they will not only change the requirements for getting that 4%, but also cut off the date you have to make the minimum transactions by several days before the end of the month and the transactions won’t post for 2 days or more, so you likely won’t be getting 4% interest back on your $3k if you cut it close by any means. And there is NO tolerance or forgiveness for this. They don’t care about you as a customer at all, I’ve talked to many reps and only talked to people in Taiwan or similar that will give you a pre-written message to just about every concern.

Inconvenienced. I’m enjoying the fact that I do not have to go to a bank. I used to have Direct Deposit but after personal issues, i was not going to work , therefore I didn’t get paid so I wouldn’t get direct deposit so they closed my account. Now I’m too busy raising my 3 grand babies who have ADHD (All 3 of them). There is no way I will go into a bank with all 3 and I have minimal help. With that being said, there should be the option to deposit money at the ATMs that we can use to withdraw money or after depositing 1 or 2 checks (via mobile picture) we should not have to wait 3 days. We have bills and mortgage/rent to pay and they are not going to wait for your hold. But mostly my 4 stars are because of no deposit over ATM.

Customer service is hot garbage. I started using T-Mobile Money as soon as it came out. It was okay. Being a fintech user with superior fintech banks, it wasn’t anything super excited but it was better than most brick & mortar banks. Customer service was great at the time as T-Mobile used to be. Now, it seems that customer service via the secure messaging is done by a really bad AI bot. The fact that the messages are never signed by anyone is already a red flag. They chronically don’t seem to understand what I’m asking and give me incorrect responses to questions I didn’t ask. Like literally what I’m writing isn’t being read. Functionally, as time has gone on, transfers take longer, the verification deposits for external bank accounts never come through, and it’s just overall useless to me at this point. I was using it as my main bank because my regular one shut down. But now I’m part of Envelope Money which is a far superior fintech bank with easy budgeting tools and an envelope system. T-Mobile was being used as a backup bank but with the horrible customer service, I’m honestly about to close my account. Highly disappointing, especially as a long time T-Mobile user. This is not at all what I’ve come to expect from T-Mobile. Do better or shut it down.

If it sounds too good to be true…Avoid T Mobile!!. I had mediocre hopes here. I never believe anyone that claims I will be paid up to 2 days early. Frankly, I don’t care to be paid early. What I do care about is being paid on time. Yet here I am, up at 4am (5 hours later than normal) now trying to figure out where my money is. So not only is the 2 days early a lie, but being paid on time is also a lie. Read the fine print here, and understand that the “365” service is a total lie! I now have to wait until 8am to speak to anyone that can help me. All the while, all of my auto payments will now bounce and have fines. After confirming with my company’s HR & payroll, the pay delay is 100% on T Mobile. While half my pay was in my Region account shortly after midnight, no one yet can seem to explain the missing check. So warning for all, if you actually need your check on pay day, go elsewhere. It’s not only not coming early here, but it is coming late. I will not only be closing the bank account, but I will now also be taking all 3 of my lines to AT&T. T Mobile is a scam of a company!

Easy and simple process so far. It was easy to sign up as the info in my T-Mobile account is basically moved over so I really didn’t have to enter much. Just make sure you update your address with T-Mobile before you start, if it’s not correct. There’s a waiting period before your account is actually active. After signing up I waited about four hours or so then got an email that I was able to login and finish setting up my account. Took about 10 minutes to finish setting up and it does look like TouchID/FaceID can be enabled but I haven’t been able to use it yet. During setup the app became very sluggish and my phone started to heat up. I had to quit the app and reopen and it seems to be fine now. Logging in uses your T-Mobile credentials which is a bit of a security concern. If you’re sharing your password for some reason, might want to change your password and stop sharing. Linking to another account is easy and takes 2–3 days to complete since you have to confirm the amount of two small deposits to confirm you have access to the account before you start transferring money from it. One issue I had was my bank couldn’t find/confirm the routing number for T-Mobile Money. Later I’ll update with: When I get my card and how easy it is to activate How long it takes to transfer money to or from Address any issues or bugs

Totally Terrific T-Mobile Money!!. It comes down to a simple matter of math: Where else in the country can you get 4% interest on balances less than $3,001? Answer? No where that I’m aware of! So TMM is a great place to park extra cash and arguably a great place to also use as your main account to pay bills - since while your money sits it’s earning a great interest rate as long as your discipline yourself to perform ten debit card transactions. That’s easy, in today’s no cash world. Since May of 2020? I’ve earned over a hundred bucks in interest. For most other interest earning accounts I would have earned very close to diddly squat!!! It’s my favorite “banking” account!

Surprising and Enjoyable. I’ll be honest, when I first saw T-Mobile Money, I just thought it was suspicious to have an account that offered interest like a money market account with no withdrawal limits, no service fees, no minimum balance, and generally deposits ACH’s 2 days early? It all sounded too good to be true, but after dedicating to it and transferring over the bulk of my funds from other banks, I’ve thoroughly enjoyed this account and heavily recommend it to people! Yes it’s a shame there’s no proper physical location for quick deposits and withdrawals, but I haven’t had any issues thus far using the alternative deposit methods.

Closing my account!. I’ve used T-Mobile money for a couple of years now, however, recently, they let 2 transactions for the exact same amount to process within minutes of each other. As soon as I noticed it, I contacted them and opened a dispute. Seven days later, and I haven’t received my provisional credit! Per their guidelines, they have up to 10 days to issue it, but they had no problem in giving my money to an obviously fraudulent transaction ! As soon as this is cleared up, I am closing this account. It makes no sense to me WHY their fraud software did not pick up on it. These were not small transactions. I’ve had quicker results disputing Cash App transactions than I’m having with this so called bank! I do not recommend this place to anyone! Unless you have money to just throw away!

I would not recommend!!!. I deposited a $475 check on November 28th, received an email on the 30th it had been accepted. Today in Dec 2nd I get a secure message stating that my check is being held to till the 9th because they have confidential information that the check will not be paid. I proceeded to then call the customer service number listed and I was assisted or attempted to be assisted by Edwin. All Edwin kept doing was reading the same response to me “I’m sorry our secure team currently has an investigation and this is part of the process,This doesn’t happen all the time but it does happen from sometimes, thank you for using Tmobile”. I then asked to speak to a manager. I has then helped by a cold woman by the name of Lisa. I explained to her how important it was for me to get that money for rent as father of four, especially during a pandemic as were getting ready to go down into another quarantine. My rent is due in three days I was depending on that money and now I have to pay additional charges for each day I do not have rent after the fifth and I will not have that money until the ninth. She also gave the I’m sorry, there is nothing we can do, l with a fake smile response. So all in all I now have to wait 13 days to receive my money and I spoke with the person who wrote me the check and they said the funds have already been taken out of their account.... Thank T-mobile, MERRY CHRISTMAS!!!

So much is wrong. First of all, there should most definitely be an actual specialist that can actually handle, get in touch with those that handle checks for deposits. I’m on my 5th time submitting a money order , the cash amount is coming in too light and I’ve tried everything. (For the life of me I don’t see why they can just use the money order number to verify the actual amount) The bright camera light should be optional, if you have a bright light against a white image it just might come out light. You should be able to at least email those handling the checks instead of them sending the same automated message over and over. And if you had problems with a certain brand of money orders. Display that so people aren’t going out wasting time and money. The customer service is nice, calling them specialist is REALLY pushing it. They can’t do anything 😒 I don’t know wth else I can do. This is beyond frustrating

Fussy App and recent Infinite Loading Screens. The app has always been convenient for pulling up account information and keeping track of purchases, especially with the recent adding of push notifications. However, since yesterday or for a few days now, I keep encountering errors that force log me out—something along the lines of “object that relates to object can’t be found”—and I’ll lose my place in the app. That’s separate to simply switching to another app and then coming back, which I understand also has a very quick timeout compared to other banking apps. Today’s error is fatal tho, I cannot even access my account after logging in because the loading wheel spins forever with no change after at least 2 minutes. I still cannot access my account which is incredibly inconvenient given it’s the beginning of a new month and I have to keep track of this months bills I need to pay.

Pretty Sure There’s Been a Data Breach. T-Mobile Money is a great app that’s easy to use, with lots of benefits. The only shortcoming I can think of is that it has potentially allowed my personal information to be gathered by hackers. I’m on week two of usage, with a considerable (for me) balance in my accounts, and I received multiple unprompted login codes for the app, followed almost immediately by a notification from the credit bureaus that my phone number has been found on the dark web. Naturally, I’ve changed the password, but it’s rather disappointing that it has seemingly taken no time at all to be hacked while using this service, the only thing that I have changed regarding sensitive info recently. Hoping this isn’t the case, but if it is… I hope that T-Mobile’s cybersecurity gets a solid retooling.

Where is the accessibility???. I don't understand for the life of me why when developers make apps they do not turn on or think about people who are visually impaired, etc.! You would think these days that will be one of the first implementations of making an app in the App Store… SMH! I've heard a lot of good things about this app but I cannot access it because the voiceover accessibility functionality is not totally supported! Please fix this issue ASAP because I would like to utilize the service as well as countless others were like myself! And if you are another developer reading this post please do the same for your apps to because it makes no sense nowadays for this to not be a functionality that should be Implemented on all apps and even games as well as Services!

great service and app. their benefits are great! There’s no hidden fees and the interest-rate is great! I have both a savings and checking account with them and the interface of the app is easy to transfer between both. Their customer support is superior and I’ve always been helped with what I needed in a timely manner. Like I said the layout of the app is great, everything is user-friendly and organized well. They have lots of free ATMs around the country and this is a hassle and stress free banking service. I use this for almost all the financial parts of my life. couldn’t recommend more!

Highly recommend this account!!!. Was a little skeptical when I first signed up but this account is awesome! The 4% APY is AWESOME, and it’s really easy to obtain! You get 4% on any money in your checking account up to $3,000 and 2.5% on any money above the $3,000 after 10 qualifying purchases for the month! I use my card like I would any normal debit card, for gas, lunch, coffee, Gatorade’s at the convenient store, etc., and I usually qualify for the 4% APY within 4-5 days, and get 4% on my money for the rest of the month! The good news is if I for some reason don’t reach the 10 qualifying purchases within the month (which has never happened), i still get the 2.5 % APY on all my money! Savings is a flat and constant 2.5% APY so that’s really awesome! I was also worried about having access to ATM’s that wouldn’t charge me for making a withdrawal and when I say there are ATM’s everywhere, there are ATM’s EVERYWHERE! It’s also fairly easy to deposit cash into your account if you don’t mind getting out of your car, which I don’t mind tracking those extra steps in my fitness app on my phone and watch 😂! Overall this is a great account to have! Tons of perks! Everything is made to be as convenient as possible, and I love earning money on the money that I worked so hard to earn!

Use this as a savings account. If you plan on using this like a regular debit card I do not recommend it. Again I DO NOT recommend! Depositing money into the account is a pain. So far it is taken almost 2 weeks for the money to transfer in from my other bank account. The worst part is that while it is transferring you do not have access to this money in either account! I am so glad I didn’t directly deposit my paycheck who knows how long that would have taken. Two weeks without access to my funds is ridiculous but if you’re trying to save money it’s actually a good thing. Just a warning for anybody who was thinking of using this as a second checking account like I was. They also give you an option to deposit money at stores like CVS and 7 eleven which might be faster (I’m not taking my chances though) but they charge a $4 convenience fee. So far using this card has been challenging however if you don’t need to use the card often just use it to save money this is a great option.

Not a good investment. Great at getting you hooked with the 4% return, after all the banks don’t even give you a 1% return on your money. It takes way too much time for transactions to show making it hard to keep track of things. I used the card to pay for a bill, they never sent the money causing a late fee which they obviously didn’t pay for. The rep from the customer service line said there was no such transaction although I kept telling her I could see the transaction on my mobile app. She said there was nothing that she could do and then I was more than welcome to send a screenshot via the text customer service option from the T-Mobile money app. How ridiculous! I pulled out all my money closed the account. Warning your money can go missing and they will not be of any service!

This app is terrible and CSRs have no clue.. I tried to deposit a check with the mobile check deposit and it was declined immediately. Stated “ Deposit Declined.” This was the first time I tried to deposit this check. Called customer service and they were not helpful at all. All they could tell me was that the deposit was under review. I was asked to give them until the next morning to finish the check review. I waited until 11:00am to check my account. Still no money. Called customer service again. I was told that the check was still under review. CSR asked me to reinstall the app and deposit the check again. Still same problem. CSR told me that I would have to wait until the check was out of review. Couldn’t even tell me how long that was going to take. I have bills to pay and I can’t even get money into my account. I have just closed my account and I’m going back to PayPal for my banking needs. At least they can give me my money immediately without my check going through a review.

Simple to use but with some drawbacks. Very simple to use. However using the account does have a few drawbacks. They don't bother me since I'm using it as a place to hold money I plan on saving/investing. First drawback, transfers from external accounts take 4-5 days to process. For example, a transfer I did over the weekend will take till Wednesday/Thursday to process while a transfer in today won't post until the 18th/19th. In banking terms, that's essentially week. Why is it so hard to transfer cash from one account to another? Second, there isn't an option to deposit cash into the account at any of its ATMs. You can only withdraw money but never put money in. Perhaps that'll be a feature they add later. Let's hope so.

Love my T-mobile money... so far .. I started my account with T-mobile money a little over a 1 week ago with $3000. I got $3.22 on interest today, 02-01. This is wayyyyy more of what I get with my other checking account that I have with my other bank. T-mobile money is paying 1% on the $3.22 interest I got today 😱!! . I am planning on keep depositing $200 each month, so I can meet that requirements and keep getting my 4% on my $3000, and 1% on anything over it. I know everybody’s situation is different, but this works well for us. This is money that I don’t really need, so I am no going to use it. There are banks out there that will give you bonuses for opening checking account with them. Some require a direct deposit, a minimum per month to avoid paying maintenance fees, and the account need to stay open for some time or you will have to pay a penalty for closing your account early. There are many ways to make extra money, but you need to do your homework and do some research first.

Fatal flaw not fixed. They have not even tested their own app functions before releasing them on unsuspecting account holders to which they have fiduciary duty. I just now attempted 40 times to set an automatic recurring house payment where each date was rejected for being a weekend whether I changed the year, month, or day. They need to test the app and lighten up on the validation—make sure they have thought about each possible situation before blocking a transaction setting. A banking app is not allowed to have a fatal flaw, because it affects your finances and your life. The app warns you to deposit money the same day to bring your balance over $0, and asks if you are doing it now, but then provides no function to do that. All deposit methods given take several days to post. Good things: Smooth processes otherwise. Nice to have your banking in an app without having to register separately. $10 per month interest if you have T-Mobile service and keep $3000 deposited. T-Mobile also lets you have freebies in the T-Mobile Tuesday’s program. 0% interest on phones. And flat-rate unlimited data plans. A great Invitation to have a buffer. Not only do you get charged no over-draft fees, but also you rarely overdraft at all, because when you accept the invitation to have a buffer (or reservoir, or reserve), and keep $3000 in the account (or any smaller or larger amount), then you rarely have any accidental overdrafts.

Really buggy, approach with caution. I’m a dedicated t-mobile service user, I was really amazed with the interest rate offering, but of course the rate is Actually based on transaction quotas and other caveats. Not likely that you will get the interest rate advertised. Also, doing a cash deposit required almost 4 dollars in fees. Do not base expectations on the marketing, you will be let down. When I tried to open the account neither the website nor app would work, repeated error messages of “try again later”, so I went to a brick-and-mortar and even then the agent said he was powerless to make the software work. Then, randomly, I received an email 2 days later that the account had actually opened and an ATM card sent out. That’s downright scary. I’ve tested the account now with small transfers, both have posted to my originating accounts and both have posted to the t-mobile account, but days have elapsed and the balance still appears as 0. Scary. Also, the service is not compatible with Zelle for digital transfers. The company does not appear to have a banking product that’s actually ready for public use. I’ve been on the phone with customer support more than a few times, which is of course offshore in the Philippines and getting competent and knowledgeable support has been very hit-or-miss. In summary: I expected the product to be better and more functional, I’m experimenting with several app based banking services, this one ranks unequivocally as the worst.

Why was I hesitant? If you can get this interest why would you not??. Discovered this and thought only the Mr. could get the accounts because the cell accounts are in his name. But with my T-Mobile family plan number I too was qualified for the higher interest offer. Even just the 1% interest is crazy - why would anyone with a T-Mobile cell leave their money in a traditional bank to rot away for .01%?? I don’t know why but I hesitated and stuck with my Wells Fargo and chase accounts. But WF started charging because my new employer only lets me have one direct deposit. After the first fee I immediately opened the T-Mobile and closed the WF. Now chase charged me for not have $325 in my savings (it’s all in T-Mobile getting actual interest) so I closed that garbage account too. I send money out of my T-Mobile accounts via the zelle app no problem (I did have to first remove my cell number from being associated with my Chase zelle, I just swapped it for my email as the chase zelle contact). I easily get 10 debits per month. If T-Mobile decides to get rid of this interest rate, I’ll probably bounce again. But for now I don’t know why I even hesitated as long as I did.

It’s a decent bank. Like honestly I’ve had issues with some banks like Chase is not that great so Wells Fargo sucked so I decided to try the T-Mobile money one being affected I have my T-Mobile account in order to be able to even do it I like the fact that it’s all digital like there’s no like real bank to do stuff at and the app works really well like their prompt there courteous their customer service is always been extremely helpful accidentally locked my Account and within the same day they were able to help me get back into it and everything is cool they’re very helpful they’re extremely friendly and I seriously can’t say more like I don’t think I’ll deal with any other bank as long as they’re a bank like they rock 4% interest on any amount in your account if you hit a certain amount of transactions to get your perk overdraft protection up to 50 bucks with no fee as long as you fix it by the end of that calendar month it’s awesome it’s so much better than everybody else

Great benefits but lack of support. T-Mobile Money has amazing benefits for an online bank. Even without the added benefits for being a T-Mobile customer you still get 1% on a checking account which is amazing. And if you are a T-Mobile customer you get 4% on the first 3k which is by far the best interest I’ve seen in any checking/savings account. The main issue I have with this account is that nowadays most services for budget tracking require access to your accounts and these services use a third party service like Plaid. The issue with the T-Mobile Money account is that it does not support Plaid. All other online banks have implemented Plaid support but this account still hasn’t done so since it released a few years ago. This is a needed feature that will make this account perfect, but until then it’s hard to convince people to make this one of their main accounts.

Early 2 day deposit, but need to put alerts on activities.. I’m a T Mobile wireless customer, since the inception of T-Mobile Money I opened an account because of the convenience to use to pay my wireless bill, it didn’t offer early direct deposit until recently which I didn’t used frequently. So, I decided to switch my Varo account for almost 2 years to my T-Mobile Money as my primary account over the summer to give a chance of the experience the early direct deposit which I got it yesterday, but it would be helpful to put alerts on every activity and transactions to better enhance the service.

Great needs some work. I love the card and the perks. Customer service that needs some work. The people are the most knowledgeable or they just don’t understand what you are asking. It took them about 45mins for the one guy to understand that I needed my pin reset because it was locked out. He had me rerouted to two different people trying to reset the pin to into my T-Mobile account..another time I asked how long does it take for a paper check to get deposited if I take a picture of it. She kept telling me about direct deposit... when I first got it the automated system was hard to understand but that has been fixed. So I do believe that these issues will get resolved. I do recommend this card people I know who have T-Mobile accounts. I love the overdraft protection it definitely has saved me a few times.. and I have never earned interest on anything so that is always really nice to see.. I have been with T-Mobile for almost 6 years and I have to say they do keep getting better and better, they have help me so much.. thank you T-Mobile for being a great company

Only the best app out there.. I aggressively invest most of my money, and my ticket combo is to have my this earning the 4% APY (paid out monthly based on average daily) on my uninvested balances, (the checking account that this app provides) which I never have more than $3000 uninvested. Combined with Apple Card giving me great cash back on purchases means I’m earning on money I spend AND money I don’t. Customer support and ease of use is stellar, the card can be remotely locked and unlocked quickly and simply; tap of a button. I need this as a frequent wallet misplacer. I have yet to see anything close to this amount of APY on any balance anywhere for a checking or savings account. No annual fee. This app really is unparalleled.

Changes made to earning 4%. I’m a T Mobile customer and decided I would open the account for the 4% interest rate. At the time that I signed up you only needed to have a qualifying T-Mobile account, register your account and deposit $200 a month into the account to qualify for the 4%. In a matter of weeks they changed how to qualify for the 4%. Now you have to have 10 qualifying debit purchases each month instead of the $200 of direct deposit to get the 4%. I’m using this account a savings account and not as a checking account, so this is useless to me. It also takes almost a week for an external transfer to be added to the balance in the account. Because of these reasons I will be closing my account and moving my money somewhere else.

Average but 1% interest is good. I signed up for the 4% interest offer, which they’ve changed to only apply if you use the Debit card (previously it was based simply on depositing funds each month): irritatingly, they keep promoting this change as if they’ve done You the favor. No, it’s not a favor. I have no interest in using the debit card, it was very easy to earn the 4% before by simply making a deposit each month. Also, I wouldn’t trust them to cash checks - it’s best if you use your main checking account for that (for example, Chase, Bank of America, or whatever). I mobile banked a check from my other checking account and it was rejected for some odd reason. I noticed another reviewer specifying problems with check deposits too. Still, the 1% interest rate is good so I use it like a savings account instead of Marcus by Goldman Sachs which, at the time writing, is now paying 0.5% interest.

Really good (almost great) checking account. A fantastic interest rate, light requirements for earning said interest rate and easy integration with Apple Pay/Google Wallet all serve to make this a really solid mobile banking service. I just wish that they could integrate with Mint (the budgeting app/website from Intuit). I use Mint to track every other of my bank accounts and credit cards and I have never failed to connect any of them before T-mobile. Apparently they used to be able to connect to Mint, but some update about a year ago ended that. If they could fix that issue I would easily bump this up to 5 stars.

Terrible experience. I was sold on the higher APR and opened a T-Mobile Money account online and deposited 3 checks from my employer during the enrollment process. Funds weren’t initially available given that I had just opened the account and I’m aware common banking process requires that they hold funds until the checks have cleared. A week later, still no funds and I receive an email that my account is under investigation. The following week, my account is closed with NO explanation. I’m told by their rep that my funds will be returned to me in the form of a check within 7-10 days. 2 weeks later, still no check. I’m then told that the funds were returned and I could deposit the original checks. I head over to the issuing bank to verify I’m able to deposit the checks and they indicate the funds were withdrawn by T-Mobile. Ugh! This all started in Oct 2019 and it’s now Feb 2020 and I still have yet to receive my funds. I highly suggest you go with a traditional bank, it’s not worth the hassle.

Great interest rate. I was very excited when T-mobile started this. Opening an account was very easy and I love earning 4% on my money. The problem is trying to deposit checks or money orders in your account. Its an absolute nightmare. When I first opened my account, I deposited 3 western union money orders with no problem. Now I have tried to deposit postal and western union money orders and they are always declined. I called customer service because this is very frustrating for someone who gets paid with money orders. They told me they are having a problem with their mobile check deposit system and that I should link my other checking account and just transfer the money. I do not want two checking accounts. What would be the sense of that? I then tried to link my Paypal account and that’s not working either! I’m almost ready to give up with this, the interest rate is not worth the aggravation.

App doesn’t work. I like the concept of TMobile money. After taking some time off after having my daughter I decided to go back to work 2 days a week. T mobile money was the only bank available to me that would not charge me a monthly fee (I have less than $500 coming in) for putting my money into a checking account. One downfall is depositing cash, but that’s not an Issue for me- I literally just needed a free way of making my employment checks usable “cash” and not be charged. The app in the other hand is horrible. These last few days it doesn’t load (I had my phone sit for 10 mins waiting for it to load and nothing) and you can’t access the website through a phone- it tells you the website doesn’t work with mobile devices. Very inconvenient to have to call and type in all my information to get my balance. Please fix and my rating would go up.

Great interest and no fees. I switched to T-Mobile money after my business had to bankrupt. The other banks wanted to start charging me for my checking account but T-Mobile had no problem with it and it turned out that their perks were better than Wells Fargo and Bank of America anyways. The only downside I’ve found so far is that if there is any abnormality on the check you’re depositing or it is difficult to read, they tend to reject it outright and it’s difficult to get someone to review it. But that’s pretty minor.

Great if you have direct deposit. I love almost everything about this account. The customer service is second to none, and the interest is incredible. Unfortunately my place of work does not do direct deposit, so I have to deposit through picture. Two paychecks in a row I have had to wait over a week to get my money. Being late on bills, having to pay late charges and returned payment charges is no fun. I’ve had to pay $200 in charges so far, and my current check still has not hit the account even though I deposited it Monday, so I’ll likely get another $50 late charge for my car payment, maybe another for the electric bill if the money doesn’t hit by the end of the day. If they would be better about depositing this way, like almost every other bank is, then it would easily be a 5 star account. Unfortunately it is far too unreliable for those without direct deposit, and can end up costing you far more than the interest is worth.

Too fussy over a mobile deposit. T-Mobile Money App from BankMobile rejected my check because while endorsing the back of a check I deposited I wrote “For Deposit Only” and left out “Mobile” out of the sentence, which according to them HAD TO BE SPELLED OUT “For Mobile Deposit Only”... c’mon people, I understand there have to be rules and regulations in place, and “a missing signature” would have been an understandable reason for rejection... but not the lack of the word “mobile”... I have been using Mobile Banking pretty much since it started allowing check deposits, and none of the banks I’ve dealt with ever rejected a check for not using specific wording. “For Deposit Only” of “For Electronic Deposit Only” or even leaving out the word “Only” has always worked... If it comes down to some logic... having an account in an online bank which promotes not needing brick and mortar locations it is implied that the deposits are “mobile” right? Leaving the word “Mobile” out of the endorsement of the check should not have been a reason for the bank to reject my deposit. SO, MY REVIEW: FIRST ATTEMPT TO MAKE A DEPOSIT WITH THIS PRODUCT: A TRAIN WRECK... A WASTE OF AN OTHERWISE PERFECTLY GOOD CHECK. /WN

Can’t log in.. The first time I download this app everything worked fine but it’s been downhill so far. It’s suppose to log me in with Face ID but that seems to never work. When it comes to sign in manually the floating keyboard doesn’t come up. I have to close and reopen the app over and over to get it to log me in and 9 out of 10 I still don’t get the floating keyboard popping up. I keep pressing the space to log in and it’s as though the screen is frozen just no response. However if I press the option for forget password and I don’t have a T-Mobile money account those options always work. This app is trash and as soon as it will allow me to log in I’ll probably take all my money out. The app is really bad. It’s by far the worst banking app I’ve ever used. What good is a mobile banking app if you’re unable to login to the account. Pathetic.

Great account with some issues. It’s a great account for saving and purchases. However, the main caveat being mobile check deposit. So 225 is available the 2cnd business after deposit. However the remainder is only available after another 5 like it’s still the pony express going to physically clear the check. This is a quite long in todays banking world. Otherwise no issues but if you do even a few mobile check deposits keep this in mind. Also the system is very sensitive where it will reject a check if even the slightest mark is made on it and not perfect handwriting. Customer service can’t do anything about it, override or help with that. So you need a whole new check

Thank you, TMobile Money!. So, my friend recommended me this app and the first time he got his first interest it convinced me to sign up & use Tmobile Money as well & since I keep cash at home and it’s just been sitting there without an interest, why not put in the bank, right? It didn’t take me that long to sign up & I have never had a problem with the app. The first transfer took a long time but I didn’t mind. If you transfer money, it will takes 4-5 business days. Don’t get this bank if you’re a very impatient person or if you need to use the money right away. Anyway, It’s only been 3 mos since I’ve signed up and I already earned almost $20 interest. How great is that? I’ve been with Wells Fargo for 5 yrs and I’ve only earned not even a $5 interest.

Unable to move my money to external accounts. I was really excited when I first open an account at T-Mobile. I have been using T-Mobile for a long time and don’t have any issue with them before. This is a totally different story… I moved some money from BoA to T-Mobile after I opened my account. After 2 months, I wanted to move the money back to my original BoA and it failed. I thought it was a one time issue but I was wrong. Every time I initiated the transfer, the record would disappear after a day like nothing happened. I called the customer services and it took them 3 weeks to investigate my case. After I followed up with them, they could not give me an answer and simply told me to remove the external account and add it back again. I did it and it was another nightmare. After I followed their instructions, I could not add my external account back. Tried multiple times…all failed so I called the customer service again. This time they asked me to uninstall and reinstall the app, even restart my phone. They also said that they saw a list of accounts under my external account section but I couldn’t see any of it. After trying all the methods they asked me to and nothing worked, the customer service said there is nothing they can do…they told me to use the ATM which I already told them that I don’t prefer this method to withdraw my money. I was so frustrated and it has been like this for months. I just want to transfer my money smoothly and safely.

Quick and seamless bank account opening. Recently opened a T-mobile Money bank account for the 4%APY interest rate and overdraft protection. The app was great, eye catching colors and very seamless to open my bank account in minutes, fastest I’ve ever experienced from the privacy of my own home and own time without having to visit a bank branch. I’m looking forward to receiving my debit card so I don’t have to pay the ridiculous ATM service charges, they really add up when on a budget! I’m excited to use the app and get to learn about all its bells and whistles. So far so good and haven’t experienced any bugs.

100% best bank I’ve ever used!. This bank is absolutely the best I’ve ever used. It gives me help when I need it most during a time of struggle by not charging me ridiculous fees for every single thing. Example, we’ve got your back benefits, allow you to spend $50 over what you have in your account, free of charge. So if I am struggling with $0 in my account, and I have no gas, but I also have a bill to pay for say, $35. I can pay that bill, & still go spend $15 at a gas station in two seperate overdraft charges and t-mobile won’t charge me a dime over that $50 when I get a deposit into my account. & I can do that over and over and they have my back every time with no hidden fees! It’s been a life saver during these uncertain times!

Don’t trust them to hold your money. They don’t even know where your money is!. I had disputed some unauthorized transactions on my account. The disputes were ruled in my favor. They credited my funds back to my account. Then, with no notice, they closed my accounts. They told me they mailed a paper check to the address on file. I could have easily moved my funds to another account. But, no warning. Money gone. It has now been 8 days. I’m still awaiting my paper check. No one knows anything. No one will give me any support. Do yourself a favor and do your banking with another company. These guys don’t even know who the actual bank is that holds their customers money. I could have had my money 8 days ago. Makes no sense. Digital banking app, … Paper check? 🤨

Pretty great—but options to unlock 4% would be better. I can’t complain about this account or service. I have used it since the beginning—when you needed a $200 monthly deposit to earn the top interest rate. I would rate this 5 stars if there was at least one more way to get the 4% bonus, preferably multiple ways. For example: 10 debit card transactions; OR $200 monthly increase in account balance; OR average daily balance of $5000; etc. As is I will keep using it, but there’s a bit of room for improvement while still giving the bank and t-mobile what they need to make this work.

Love this account!. I reluctantly decided to start using T-Mobile Money for my new checking account and I was impressed when they immediately offered me the 4.0% APR but then after using my card for just 10 transactions I also unlocked the $50 Got Your Back overdraft coverage feature and I thought that it honestly wouldn’t work since I haven’t been offered overdraft service due to my credit score in a very long time but it worked for me and now it’s unlocked permanently! I don’t have to continue to make 10 purchases with my card every month, it was just automatically unlocked after the first 10! I love the app, easy to use and seems very secure to me! I will be sticking with T-Mobile Money!

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Seriously this is how banking should be!!! Banking evolved and Laying the path for all big banks. Never saw this much interest that too on just a minimal deposit for a few days If you are still reading reading this review I would ask you to stop and first make a deposit and then see what crazy 4% tops would be like, your mind would be blown away and see what other banks are bargaining or providing you or sucking your money out of you

Not a bad banking option at all. So many banks these days are online and offer similar features. This app compares well to all the others. The T-Mobile Money banking service is a great option. I haven’t stepped foot in a traditional bank branch in years, so I enjoy the capabilities of virtual banks. This app has everything I need to manage my money and everyday purchases. Zero complaints about the app. Issues with the service: (1) the service fees to add cash to your account, and (2) the number of days for a check deposit to clear is far too many.

Amazing interest... I love T-Mobile Money. The interest is amazing. I’ve been using this bank for a year now and I’ve already earned $120 of the interest. Compare to my other bank that have more than 5k but only get 5 cents interest per month. I really recommend t-mobile money for everyone. 4 stars because the app keep logging me off and when I enter my pw it keeps saying wrong so I need to create a new password all over again and again

DO NOT USE. Do not use this bank at all. They restricted my account for absolutely no reason. When I asked to speak with the fraud department they tell me they don’t have an actual fraud department that I can speak with to unrestrict my account that they will send them an email. Like what??? How is that professional? Not once did they ask for me to verify my identity to get the restriction off. But want to give me the runaround. I just changed my direct deposit to my account and guess what? I can’t even use my funds. I would suggest not using this bank or wasting your time. I had to file a complaint with the BBB and the Federal Trade Commission.

A+ banking. The only banking app I actually use. $50 overdraft with no fees. I hit a rough patch and didn’t use my account for a year, they never closed it. You can deposit your check without having to py fees or go to the store to cash it. Direct deposit hits the day before it’s supposed to. Customer service through the chat is phenomenal. Still not a fan of banks in general. But if I HAVE to have one (which I do for work) it will always be this one!

The absolute worst, I’m sad to say. I’ve been waiting on my first deposit - a check from my Dependent Care FSA - to clear since 5/15 y’all. For a solid 3 days not only has the check not deposited, but I had a negative balance (didn’t even have the debit card yet - zero transactions on the account). I’ve got another external transfer heading inbound in limbo, too, for the past several days. I can’t believe I’m saying this but I would flat out not trust these people with my money. After the 3 day holiday weekend in which I imagine they’ll wring their hands some more over why the just can’t help me, I’m out. Customer service can’t or won’t help. Next best thing to closing this account would be never having had opened it.

Do NOT USE T-MOBILE MONEY. When my husband first started using t-mobile money it was ok. They had a few good perks, it’s free, it has $50 overdraft. So not as much as Chime and Varo. However if you run into any issues and need to dispute something, YOU WILL NOT GET YOUR MONEY BACK. The merchant has already issued the refund and showed us proof they issued the refund, and they still have not put the money back in his account. It’s been over a month. I’ve called the merchant several times, they keep telling me to call my bank. They won’t help at all. I don’t recommend using them at all. Their customer service is non-existent. Cell phone companies should not try and be a bank. Especially when they won’t protect your money and follow bank polices.

Decent mobile bank as long as you don’t get fraud charges. I was a pioneer and opened an account when this was launched. I have always been happy using them, that was until a week ago. My card info was breached and my card was used without my authorization. I received a text from the fraud dept thinking it would be a quick and easy process to get the money that was stolen back. Nope! I’m having to jump through hoops and red tape and deal with reps that seem disinterested in helping me. After years of using Tmo Money I’ve decided my money is no longer safe with them and will be opening a proper credit union account instead. I no longer trust them with my money.

The Worst. The mobile deposit camera is far worse than what existed when the feature first came into existence a decade ago. Now that it’s a mainstream feature and works flawlessly everywhere, this bizarre bank introduces one that basically never works. You’ll find 90% of your deposits declined because they claim the check is unreadable. The rest they’ll decline claiming the endorsement isn’t valid (huh?) or other nonsense. There are all checks that work fine everywhere else. To add insult to injury, they can suspend your account at any time while they “review” it. You won’t find a more incompetent or uncaring bank anywhere. The mobile app even has spelling mistakes they have no interest in correcting. Amazingly bad.

Great Banking Account and Decent App. T-Mobile Money is a hidden gem in the online banking world. You don’t have to be a T-Mobile customer to have an account but you get better benefits if you are. The app is basic and straight forward. This is not a bad thing, it’s easy to get what you need done quick. I’ve been a customer for a little over a year and really appreciate the interest rates and convenience of the Mastercard debit card.

Great Checking Account… No fees. I’ve been a T-mobile Money customer for 5 years now and I must say this is my favorite digital online bank account. You can do everything with this account even receive wires transfer. Check writing for this account is also allowed. Please do yourself a favor and sign up for this fee free account.

T-Mobile shouldn’t be in the banking industry. If you have very simple requirements, and don’t ever have to deal with cash, maybe this is for you. Otherwise, beware. I was on the phone every week with customer service about one thing or another. Thankfully they are nice. I had a myriad of problems: balances are not updated on a regular basis, or sometimes not updated at all for days. I sent a check to a payee through the app, and 4 days later it still had not updated; a western union money order deposit declined; the app has to be deleted and reinstalled after an update because face recognition on the iPhone breaks; I could go on. In general they have super restrictive policies about a lot of things, I guess because they don’t have the resources of a large bank. The policies remind me of credit unions.

I love my account!!. If you are a T-Mobile customer then you definitely need to get a T-Mobile checking account!! It has the highest rate I have ever seen. It beats out every other checking account interest rates by a long shot. The app is also easy to use. I highly recommend this checking account. I’ve earned around 90 dollars in less than a year which is way more than any other account I earn interest on.

Can’t ever log into my account!. I have had TMobile Money app for 2 months. I have direct deposit from my employer every (bi-weekly) paycheck. I have only been able to login to see my balance twice in the 10 (I think) deposits. I’m not worried about the money, but would really like to be able to see how much I have in my account. I have to reset my password every time I want to see my balance. I totally get that I took a leap of faith getting into the program early, but this is very disappointing. I’m not sure why I thought that their money management would be better than their wireless service. Beware. I’m lucky that I wasn’t going to use Money as my primary banking service.

After a Year and some change. I’ve made a reoccurring deposit into my account. Got the new iPhone and proceeded to cancel the reoccurring deposit. A year later I’m just now noticing it never stopped and has been putting my money in the account for some time now. On top of the frustration already marinating with this app. If tried countless amounts of methods just to sing in. It continues to say I need to make a TMM account, but when in the process of doing so, it says I’ve already got one. I have all the passwords and account names of everything I’ve ever been on, written down. Yet, when trying online, they still praise this app.

Love T-Mobile Money. So far much more convenient and easier to use for paying bills. First time using it but so far so good After about one year of use, I am even more happy with T-mobile Money. The ease of use, especially when paying bills, is fantastic. Switching to it for my direct deposit was one of the best financial decisions I have made. Being able to pay all monthly bills in a matter of minutes without all kinds of fees is awesome.

WAS a Great Interest Checking Account. OK well it’s still a decent checking account, but as of the end of March they make it much more difficult two continue the 4% interest on your $3000. I was happy to deposit $200 a month. Now They change that requirement to spending money on 10 purchases a month. This is fine if it’s the only card you have but I prefer making payments with a different card with cash back And saving my money to this account for a reasonable interest at least up to $3k. Finding10 things to purchase every month as a hassle and trying to keep track of that is even more of a hassle. Why can’t they just leave good things alone?

Warning, there are hidden fees. I love T-Mobile cellphone serve, but extremely disappointed by their banking. You have to many hoops to jump through to get that high interest rate. Then it’s limited to a certain amount. The kicker is when you try to close the account, they add fees and hidden costs. You have no choice but to pay it because the details is hidden in the tons legal paperwork. So much for “No Hidden Fees”. What makes matters worse is that you have to pay those fees via a paper check through the U.S. Postal Service. It’s 2023, what happened to sending a digital payment? Oh, their customer service is horrible. Especially talking to their manager Irene. Recommend staying away from T-Mobile’s Money Bank.

Great so far. Works just as expected, and the 4% APY is much better than any traditional bank offers. I’d like to see T-Mobile find a way to allow us to deposit cash into the account instantly, or maybe allot a $50 or $100 credit upon making a transfer while waiting for pending transfers to clear; my only gripes would be the amount of time it takes to transfer money from an external account and inability to make cash deposits. Other than that, everything has worked flawlessly, and I’m hoping to ditch my current bank account with its service fees entirely and use T-Mobile’s service alone.

Change does not make sense. I was happy to see the 4% APY by adding the $200 per month, now they changed it, when I called a rep, said that they changed it because for some people depositing $200 was not convenient. Really??? I have never received a link for a survey on this...I don’t really use the card to make purchases but pay bills using the account... they should leave the deposit option as well, not completely remove it for those who prefer to deposit...

Customer Service need to improve. I am long life Tmobile customer and finally i decided to give T-mobile money a try, and today i called customer service number, right now when writing the review, i am still on the phone line waiting and this is the third call within 2 hours, even the auto machine said waiting should be 10 mins, the first call i was put on the line for 15 mins, second call for 25 and now the third one is about 15 mins already. How can I trust “ an online banking” with my money if I can not get in touch with customer service when I need the assistance

Solid place to stash cash for T-Mobile Users. I’m all about optimization, in this environment where interest rates are in the toilet for savings accounts. And it really looks like savers are losers this is a really nice option to stash that emergency fund. The 4% is pretty sweet. We don’t use the direct deposit feature with this account this is simply linked to our main bank account and we transfer money on a monthly basis. I cannot speak to any of the other features other than the 4% interest rate which I do see accruing.

Available Balance. Overall the account is fairly decent. The only issue I have is the available balance is not accurate at times. There has even been a point where I noticed that there was an extra $90 in my account and I wrote customer support because of this asking if the money in my account was correct, they assured me my account balance was correct and when I had spent the money I ended up going negative the amount that was extra in my account. They need to rewrite the program to where it shows exactly what your account has available to spend.

Banking Made Easy and RE-DEFINED. I have been using T-Mobile money for about 6 months now. It’s banking RE-DEFINED!! I love the way how the app was developed with the primary focus on most relevant/needed features elegantly laid out on the menu. No more fees for anything, yes you read it right not even the overdraft ones. One of the main reasons to switch was the ease of access and ofcourse I love the 4% APY 😀. I would definitely recommend giving this app a try.

Not great!. First it has been so difficult to open an account. If you have a T mobile account and open a T mobile money account they are linked. Since my husband pays the T-Mobile account his cell phone is the primary so it wouldn’t let me open an account unless I used his cell number. So I used his number, ended up locking the account because passwords are also linked. I called customer service and they were not very helpful or nice. They were able to unlock it but still was having issues and ended up closing the account before I even started. Very frustrating! I’m sure there are other apps like this, but already being a T mobile customer I thought I would give this a try. Disappointed!

Awful app currently. Unfortunately this app doesn’t work. I have one of the latest iPhones, and this app does not let you type your password in after about 2 weeks of not checking your account. I have had to change my password about 6 times in the last two months. I started noticing it was the app when I would try to use my actual password that the app said was wrong, for my new password. It would then say I cannot use my current password as my new password. Which makes no sense, because it would not let me log in with that password. Again, I am locked out of my account. Please fix or I am in fear your app is not secure and my information and money could be taken at any time.

After disrupting the cell phone business T-Mobile takes on mobile banking!. Convenient, secure, easy, and industry leading interest rates! I looked it up and this account has 3 to 20 times the interest the other checking accounts. I look forward to see how they continue to challenge the status quo and push the banking industry to be far more consumer friendly. Let’s go team magenta!

Boooo2 thumbs down. Takes 2 weeks or up to 21 days to get any money to reflect on your account and If you inquire as why it’s taking so long , be prepared to receive their petty attempts to retaliate in forms of losing track of your money and making your wait time quadruple , I should have known better. bottom line is if the real t Mobile chooses to clarify the fact that they do not partake in the views and make it clear that they are not associated with the bank should raise red flags . Bunch of scammers that are nickel and dimeing it.

Never sign up for stupidest card ever. Don’t make this kind of mistake like me. Such a stupid system. You have to pay money to put cash into your account. They put limit 500$ for withdrawal, you cannot purchase anything over 2500$. This is the highest limit. And it make take so many days till they process and till that moment you cannot use your card and even withdraw your money. They control your money. You are not a owner on your own money. Such a bad customer service they cannot do anything on their end. Such a disappointing and stressful thing you would ever deal in your life. Never ever. Don’t go though with what I did. Couldn’t use my own money. Such a terrible app

No fees but could be a 5. It’s good and I would recommend it because they truly have no fees. And they are a ACH account, unlike my chime I can use it for my stock broker account and use it to easily transfer money. It’s also my savings account as they give 0.4% yield, more than other bank Accts. Only reason I didn’t give 5 stars is bc you can tell their customer service are phone reps and they can’t always push a transaction or check but they're really nice 4 star reps.

T-Mobile money.. I open this T-Mobile account for direct deposit from my gig working. DoorDash, Lyft and Uber are my main source of income and I needed a bank that I could do stuff automated and through the app. So far this app has been perfect. It is a bit strange not to have to talk to people, however I’ve been able to get everything done I need it.

T-Mobile Money Member!. I have been with T-Mobile Money for years now, a friend of mine told me about this online banking. I have had a bank account before but this is so convenient when I get paid every week I just take a picture of my check and the money is in my account. Anytime I have a problem with my account they are right on the problem taking care of it. I recommend banking with T-Mobile Money.

Great Interest rate. I’ve been with different banks them as many years of I’ve been alive this is the first bank that I’ve gotten such a high inches ever I get more than even my husband and he’s in US Bank I would definitely recommend this bank to all my friends and family trying to get my husband to join because the interest rates are incredibly wonderful to see that you have an extra 12 $15 on the money you put in from working or whatever you do great job team mobile banking

Worst bank ever. People do not get a bank account with them it’s ridiculous your account compromiseThe turnaround time on resolving Their data breach is ridiculously outrageously long I’m going on a month with my money frozen my fraud claim still not finalized and I have to close my account but I still don’t have money I’m a single mom with two kids I can’t even buy them food because I’m waiting for my money to be sent out to me but the security of the resolution team hasn’t even begin fixing my information that was changed they can’t help me out a check until it gets approved ridiculous you guys go with another bank this week is horrible worst customer service ever

Impressed. I really hope everything with Tmobile stays stays the way it is now. I am really impressed with everything, beyond expectations. From the interest rate, to the ease of use of the app, to the ease of changing my pin, to how quick it is to reach a representative. Deposits are fast, transfers are fast. Everything is just so efficient, simple, and beneficial. And how convenient to be able to use so many ATMs!!!

Changed the 4% interest qualification. I just got notice that the 4% interest they give for a $200 deposit is being replaced with having to make 10 purchases from that account each month instead. I want the money to be deposited and I was not spending from the account. They claim it is to make it easier on all of us. But no, I would prefer a choice. We either deposit $200 or we have the 10 transactions. If this is changed I will just move the money. 1% is not that great and 4% is what made it worthwhile for the extra edge on some of the money. Disappointed this change was not made into a choice. The account has been okay, but they also caused me an issue where they accepted a check I wrote to myself from a joint account I have. That check went through no issue. I wrote another one from that joint account and it was declined causing me Issues with the other bank. They said they don’t take third party checks, yet they took the first one. I was recommending this bank to other T-Mobile users, but now I will stop. Just not worth it for the hassle and hoops they make me go through.

Like the interest, but there’s issues. I’ve never tried to deposit a check, but I hear that’s a nightmare. Also, it takes four business days to transfer money from her another checking or savings account, which is ridiculous. I edited this review to remove a big complaint I had, which they fixed. Overall I’m very happy with this bank.

No international transfers yet. They don’t do international transactions yet. Nor do they do business banking if you own an LLC... and if only they had a physical and so that I can deposit more than 3,000 dollars in one day. I enjoy t-mobile money... just dislike the limitations... especially when other banks provide certain things that it doesn’t... but love the interest rate.

Ughhhh. I rated one star because I changed my number and switched to prepaid service cause I left my family plan and on my old Number I had my tmobile money set up and tmobile id so I had to go though a whole process just to change my tmobile ID to my new number n then I have to recreate a new T money account soo now my tmobile ID app won’t let me sign in neither will my TMoney let me sign it’s always like oh we can’t find what your looking for smh now I regret changing my number🤦🏾♀️🤦🏾♀️🤦🏾♀️🤦🏾♀️

Missing notifications option in settings. Customer service is poor they don’t care to listen and secure messages I never get a response. I want to turn on push notifications when I select it on the app it tells me to go to settings and select T-Mobile money. When I do this there is NO option for notifications in the settings. FIX THIS ISSUE

Limits. This review is more about the bank service instead of the app itself. Maximum $3000/day deposits is a low limit. Also, any check above that has to be mailed in. I don’t like the idea of mailing a check that big. 4-5 business days for a deposit to process seems unnecessary too. It means you don’t have access to the funds at all for that time since it comes out of one account and isn’t available here for a week. Other than that, the APY is obviously fantastic and access to the ATMs is great. Well done!

Used to be a big fan; now, not so much. I really liked my T-Mobile MONEY account back when the qualification for the 4% APY was a monthly $200 deposit. They just changed it to having to use their debit card 10 times a month. I’m not sure why they couldn’t keep both options available for people who preferred one method over another. This account was mainly used as my emergency savings fund. Unless they re-add the monthly $200 deposit as an option, I will be moving my funds to a different account instead.

Bad Change. The switch from 4% APY earned from deposits to 10 qualifying purchases is very bad. Essentially, you have to spend more than you’ll ever earn. I mean, if you make 10 purchases every month anyways, you just have to use the card and you’ll earn some extra money. But the problem is for all those people, including myself, who are frugal and are trying to save as much as possible.

An official bank. This is an amazing service for mobile banking, insured by the FDC. In the past Tmobile offered a prepaid banking card and this is a much improved step up the 24/7 customer care availability is awesome, helpful and show extreme care and relatability with you. The ease of access to your funds without fees coupled with an extremely aggressive interest yield is simply the best icing on the cake. The only downside is there isn’t access to a physical branch for monetary deposits nor a credit line but all in all this is still a definite success.

Worst banking app. I mobile deposited my tax return only to be told they don’t think the bank that sent me the check has enough money clear the check… so I asked to speak with a manager an was told I couldn’t. I then told the lady (girly) let me speak to the manager or I’d report them to the BBB finally got to talk to the manager (gypsy) told me I would have to wait 9 days to receive my money. I asked to speak to someone over her an she proceeded to tell me she is the highest person at t mobile money an she had no boss. Needless to say after I get my money I will be closing this account an going to a local bank instead.