Honeydue: Couples Finance App Reviews

Honeydue: Couples Finance App Description & Overview

What is honeydue: couples finance app? Featured by Apple, Forbes as "New Apps We Love", "Finance for Happy Couples", "Inspiring Stories & "Best Tech Apps To Help You Save & Invest", Honeydue is the best personal finance app for couples. Track your balances, budgets and bills together - and engage in meaningful conversations about your habits and goals.

WHY HONEYDUE?

• Choose how much you share with your partner.

• See all of your bank account balances in one place, neatly organized.

• Set monthly household spending limits on each category, and get notified when you and your partner are nearing it.

• Add your own custom categories.

• Get reminded you when it's time to pay your bills.

• Send a thumbs up to encourage your partner's spending habits, or choose from 18 other emojis.

• Ask your partner about that mysterious purchase.

• Divvy up expenses, and square up with your partner when the time is right.

• Automatic categorization of all your spending, or setup custom categories.

• Support most banks in the US.

• Bank level security for your peace of mind: Your data is encrypted in storage and in transit.

• SSL/TLS, passcode & TouchID, and multi-factor authentication.

• See the big picture and argue less about the little things.

• Free up your time from financial chores and go enjoy your day!

• It's FREE!

Privacy Policy: https://www.honeydue.com/terms

Terms of Use: https://www.honeydue.com/privacy

Any questions or feedback? Reach out to us at support@honeydue.com.

Please wait! Honeydue: Couples Finance app comments loading...

Honeydue: Couples Finance 2.66 Tips, Tricks, Cheats and Rules

What do you think of the Honeydue: Couples Finance app? Can you share your complaints, experiences, or thoughts about the application with WalletIQ, Inc. and other users?

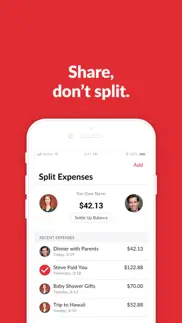

Honeydue: Couples Finance 2.66 Apps Screenshots & Images

Honeydue: Couples Finance iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 2.66 |

| Play Store | co.walletiq.WalletIQ |

| Compatibility | iOS 13.0 or later |

Honeydue: Couples Finance (Versiyon 2.66) Install & Download

The application Honeydue: Couples Finance was published in the category Finance on 17 December 2016, Saturday and was developed by WalletIQ, Inc. [Developer ID: 1157633944]. This program file size is 116.33 MB. This app has been rated by 8,481 users and has a rating of 4.4 out of 5. Honeydue: Couples Finance - Finance app posted on 12 January 2024, Friday current version is 2.66 and works well on iOS 13.0 and higher versions. Google Play ID: co.walletiq.WalletIQ. Languages supported by the app:

EN FR HI ES Download & Install Now!| App Name | Score | Comments | Price |

* Improvements and bug fixes for connecting to your bank

| App Name | Released |

| Intuit Credit Karma | 18 July 2012 |

| Progressive | 11 January 2010 |

| DasherDirect By Payfare | 12 October 2020 |

| Wells Fargo Mobile | 18 May 2009 |

| Discover Mobile | 17 November 2009 |

Find on this site the customer service details of Honeydue: Couples Finance. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Quick Checkbook Pro | 02 January 2013 |

| Currenzy | 31 October 2013 |

| Voice Recorder Pro . | 24 November 2013 |

| Debt Zero | 16 September 2020 |

| Easy Stock Profit Calculator | 11 December 2017 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Ralph Lauren | 08 November 2021 |

| 05 February 2019 | |

| DoorDash - Food Delivery | 10 October 2013 |

| TikTok | 02 April 2014 |

| 09 October 2009 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Bloons TD 5 | 15 November 2012 |

| The Wonder Weeks | 30 May 2012 |

| Pou | 26 November 2012 |

| Plague Inc. | 25 May 2012 |

| Terraria | 28 August 2013 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Honeydue: Couples Finance Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Great idea....but. I was going to set everything up and then roll it out to my partner and she what she thought. I linked the first two accounts just fine. But then when I got to accounts that have two factor authentication (2FA) on, it won’t link. 2FA is doing what it is designed to do, but there has to be a way link our accounts without lowering our security standards. Until we can link ALL accounts this does us no good to add another bill tracker to monitor. This needs to replace those not add to the number we are using. For people getting locked out of your accounts....this is probably due to too many failed attempts or an unrecognized IP address. The account providers are protecting your information correctly by doing this.

So So Close.... This really could very well be the best Couples budgeting app out there. My fiancé and I gave this a shot as we normally use YNAB (You Need A Budget), and we were looking for a cheaper alternative. We were totally willing to tip regularly, as long as it was a little less than the $10 YNAB costs. However, the reason why we use YNAB is because it has always seemed to be the only app that could authenticate and STAY authenticated with our bank (USAA). When we set up the app, the interface and the transaction import was remarkably promising, but now that a couple of days have passed, only the balance updates (not the transactions/deposits). It’s an outstanding concept, and you seriously contended with our present budgeting tool (we love how simple this is to use), but with this hiccup, we cannot commit to making the move to Honeydue just yet!

This App Lacks. I really want to like this app because it allows my partner and I to sync spending. It has really helped us to physically see where our money is going and how to better manage it. That being said, I have several gripes about this app: 1. I have been trying to add two separate credit accounts to the app (Target and Nordstrom) daily for the past two weeks, and the app crashes at login. I’ve contacted customer service twice (Dec 2, Dec 15) and have yet to be responded to. This creates a problem because not all of our accounts are accounted for. 2. Balances and transactions are not up-to-date. This also problematic when charting out your budget for the month. I have to keep a “notes” tab on my phone for all my spending which is tedious, and often times forgotten. Please fix this to be real-time so that budgets are able to be managed real-time. 3. Categorization is kind of a joke. I check this app several times a week and have to recategorize almost every transaction. It’s kind of fun, but mostly annoying and time consuming. Please fix. Overall, I know this is a newly developed app, and I hope that as time goes on and they acquire more users their technology will advance.

Terrible. I liked this app at first. I received my first two paychecks one day early at midnight, but now my Paycheck still says pending, and my boyfriend and I are stranded without gas in the cities. I contacted customer support, and they said it must be on my employer's end...that's interesting; why did I get my last checks early, if that's the case? The woman kept saying 2-3 days to post....oh really, why is that? It was posted the last two times immediately. Don't try to message customer support because you will get zero response. I've already been waiting over two weeks. PayPal worked last week, and now this week, it's not supporting my honeydue card. I don't know who's end it's on exactly, but be prepared if you use Paypal, not to use it anymore! Of course, I inquired days ago, and someone was going to look into it further, and I've heard nothing. As soon as my check clears, I will be pulling my money out and putting it somewhere else. So thanks, honeydue, for leaving us stranded without gas 😡

Great concept; annoying bugs. My fiancé and I started using Honeydue to track our spending and stay on budget. The app’s functions are great - really helpful to see all the accounts laid out, all transactions, and track our spending by category. However, this app can be incredibly buggy, which makes it very annoying to work with. A great feature of the app is being able to create new budget categories (for example, Wedding or Pets) and move items into this categories to track spending. So, it’s incredibly frustrating that the app can never seem to figure out recategorizing items! I had to recategorize a Whole Foods charge three separate times - I’d make the change, see that it was moved to the correct category, and then log in later and see that it had reverted to the original (wrong) categorization. Other problems - sometimes the Transactions tab won’t load at all and changes you make do not show up automatically (you have the force quit the app and reopen). So much potential here if they just fix all the glitches!

Okay but could be much better. I’ve been using Honeydue for over a year now. The concept is great....the execution is okay. One of the major pain points is that your bank accounts don’t update in real time, so you don’t really have an accurate view of your finances at any given point. The other is that your banks often disconnect. When this happens, support will always tell you they’ll switch you to a more stable data aggregator, but it doesn’t always work and some of these integrations seem unstable. Lastly, the user experience could greatly be improved. I’ve gotten use to navigating around all the noise, but it seems like more efforts and resources should be dedicated to make sure the core product works correctly, rather than push out half baked ideas like the activity feed, bill splitter, or Visa card. I would happily pay for the app if it was more reliable.

Seemed amazing .... customer service lacking :(. This app seemed like everything I’ve been wanting and more for financial tracking! What a great concept! Unfortunately I needed my main bank account to be connected and it wasn’t working. Tried multiple times with it saying contact support, which I did. I got one response back after waiting a few days, no biggie. Said I put my credentials in wrong, which I didn’t. I tried again anyways, still same error message , contact support. I informed support a week ago that credentials were correct.... still have yet to hear anything back and still can’t link my bank account :( really wish I could’ve kept this app. Seems great, wish there was better customer support to help get me linked up.

Great app, terrible support. I’ll start with the good - this app does what it says. Link accounts, get a holistic view of your transactions, budgets, and net worth, and share those details with a partner. Great! The bad - support seems to be nonexistent. I have had issues connecting one of my banks. The first two times I reached out for support through the app, I received a canned response promising a fix (which didn’t work). I have since emailed their support directly as well as submitting additional requests through the app, with zero responses whatsoever. If you have any issues using the app, don’t count on getting any help from them. On balance I’ll still use it (and contribute a monthly tip) but I am quite frustrated with the lack of support.

Power User. Been using Honeydue for a little over two years now - SO valuable for my wife and I to manage our spending and budget. I tried all of the other apps and this one works best for us. Here’s how we use it: - we have all of our accounts linked, including some manually added accounts (like physical cash to keep track of) - we assign transactions to either spending or earnings, under one of the 20 categories we built out. Any cc bills or transfers between accounts are in the transfer sections. - here’s where we become power users (and why Honeydue is awesome): we are often netting out spending with earnings in one category, like covering dinner with friends and lumping the vemnos received in one category. Being able to do that, plus split the expense into multiple categories, is HUGE. what’s even better is editing transaction dates to match reimbursable expenses across different months. - once all transactions are properly accounted for, we upload the month’s data to an excel spreadsheet (since there are some limitations on history within the app, and sometimes the data gets refreshed and reorganized every 4-5 months). Not a huge deal to us, given price point and no other app doing what Honeydue can. -we don’t utilize the bills, activity, split expenses, or chat features By doing it this way we are able to track spending over years as well as make sure we are getting paid back on returns, cancellations, refunds, IOUs, etc. we love Honeydue for that!

Auto sorts?. Would be great if it would leave the transactions in the order that I enter them. We use it manually like a check book, and enter in upcoming auto payments etc... so we know what we have for spending after that weeks bills are covered. But when we enter a transaction, it just kinda randomly sticks it somewhere?! Sometimes I have to scroll down through to find it. I like to sit down each week and balance it out to make sure it matches our online balance - and it’s hard to find the transactions. They should be in the order I enter them, and have the option to manually sort them to keep uncleared items at the top till they clear the account? Also a reconciliation mark would be awesome. To show that it’s shown up on your account and cleared. Right now we use the thumbs up lol

The Customer service is fantastic. I had a problem with my cards and loan accounts connecting. One by one they were all having an issue with connecting to their respective bank. Contacted customer service for help and got a reply very quick. It was next day in the morning when I realized I had a team member on the case. I really like the projection maps and how my family credit card shows the total balance but only my charges show on my individual sheets so once it was all working I got set to budgeting. Super easy app to figure out. The set budgeting is extremely helpful and that’s exactly what I wanted but it also shows retirement accounts and now I can see my stocks and bonds too. Very very please with Honeydue.

Solid app, support unresponsive. This is a really solid app for couples. This allows my husband and I to share and manage our budget as we see fit. However, there are some key features missing that I know many others would like to see (rollover budgeting, ignoring certain transactions from its budget, as well as some bug fixes). I emailed support and was told they’d pass it along and get back to me. They didn’t. I followed up three weeks later, and again about two months after that, and haven’t heard anything at all. Doesn’t feel good to know they’re not interested in user feedback. We will continue to use because of the great reliability, but we’re looking around for an app that can meet our all our needs.

Great Experience So Far-Except One Thing..... I downloaded the app recently as I was needing something my husband and I could do together to track our finances and I am impressed with what I've seen thus far! It's ease of use and great layout makes it a pleasure to use the app. My one complaint at this time is that the add bank feature doesn't support Square Cash Card. I use this card for everything from transferring money to having my payroll direct deposited. I'd like to be able to track this account as well. Maybe y'all could add it to the list of banks. Overall, good experience.

Refuse to add option to change week start.. It would be an amazing app if they would just add the ability to change the week start /end from Sunday to Saturday to something custom. Most people get paid on Friday. I pay my bills weekly on Friday. Other people get paid on other days. I can’t use this app to see what’s due from Friday thru Thursday. I’ve sent multiple requests to the devs for this feature. They get ignored. It’s not a big ask, it makes sense. Therefore, I won’t be using this app until they make that change. I check in periodically to see if they added that feature but it’s been a year and no luck. My spreadsheet works better. So, 2 stars because it’s useless to me as a financial app, and poor developer response.

Helpful financial app for couples!. I really like this app but it definitely has some room to develop. If it does so it will be a great app. It is really nice how well it syncs between my wife and I without having to use Dropbox or some other service. It is also well designed with a clean look. One of my dislikes is that the navigation can be a little clunky. For example, if I tap “bills” navigation when I am already under the bills, but not on the main screen, somewhere further in a sub-area, the app does nothing. I would like the app to take me back to the main screen without having to tap “back.” Second, when I add a new budget item there is no place to put how much I want to budget. This seems like an oversight and should be corrected. Third, on the main budget screen, and on each budget category, I would like to see not just how much I have spent, but also how much I have remaining to spend. This app is on a great track and I hope it continues to develop!

Good idea... horrible execution. Newest update: Contacted support again and no reply. Balances still take about a week to update and no pending charges ever show up. Done with this worthless app and the horrible support. Update: I did get a response from the developer via this review and I emailed their support on December 1st 2018. No response from the email and nothing has changed. I sent another email... Let’s see what happens. App is a good idea but the bank balances and transactions update about 3-4 days after the actual transaction making it hard to keep up with the actual balances and keeping true to a budget. I would recommend a different app that updates transactions and balances better. I would give a no star rating if I could because there is no place to ask for support and the web page is junk.

Great App, Budget-Breaking Bug, and No Support. My wife and I love the budget management capabilities Honeydue offers. The app is clean, organized, and makes connecting bank accounts simple. After we connected our accounts, we noticed some spending buckets were double what they should be. Refund transactions were counted as expense transactions even though they showed as positives in our accounts. For example, a purchase for $20 shows up correctly as -$20 in Honeydue and in our bank account. The refund for this amount shows up as -$20 in Honeydue but +$20 in our bank account. In total, Honeydue's transactions for these purchases are added up as $-40 but it should be zeroed out. This issue wasn't tied to a single account; it was on credit cards and bank accounts. I've emailed support multiple times, submitted my queries to their chatbot, and listed my email for a response. I've received anything back from them. I thought about reaching out on their socials but they haven't been active on Twitter or LinkedIn in years. If this one issue was fixed and support was actually a thing, I'd change this to 5 stars. Other than that, the app is great.

Good App, bugs appeared and not fixed. I am using Honeydue as my split expense app with my wife for some time now, and we're using it on our iPhone X. Recently, the app is so bugy and some main features are not working or not properly functioning. These are the issues we face currently: 1- The "Settle Up Balance" feature is not working AT ALL. Whenever we try to settle up the balance as paid, it just add it to the log but the balance stays the same without being zeroed down. I tried even to edit it after that to add the settlement expense manually but it doesn't allowing me to edit. 2- The dates of transactions in "Transaction" tab is not visible anymore, so it became a bit hard to track from the "Split Expenses" tab the dates of the transactions or splits done in the past. 3- Not able to add new categories for my transactions which I could do seamlessly at the beginning The app is updating automatically so I don't think it's update problem. We are currently searching for other apps to replace Honeydue since it became so frustrating to use it anymore. But since we're using it for some time, we don't want to change. So, this is our last chance with the app. If you couldn't provide us with solutions, we will change the app.

Worth Trying Out. I’m fairly new to this app. So far I’ve had mostly good experiences with it. I love the concept of being able to monitor various accounts involving both me and my spouse. I especially love that it’s free (at least for now). I do believe this can help any couple see where they can make financial improvements together, so it’s definitely worth trying out. I gave it only 4 stars instead of 5 because it seems to be very slow to update so our balances are rarely accurate. But then, we do our banking at a place that isn’t as common/popular as others; so I’m guessing that may have something to do with it. Also, I believe I have my notification preferences set up correctly and yet I never get any of the notifications I would like at all. Other than that room for improvement, I am enjoying the app and I look forward to what’s next.

Not trustworthy. I tried using this app with my spouse for 2 months. Nice features and easy to set up. It did not sync with my spouses Amex card and once they used a different data ag service it worked but we had to re-categorize everything. The same thing happened with my Amex. When I reached out the response came from “Emma Martin.” She asked what the problem was, then wrote me the solution. Not resolved. I reached out again, again “Emma Martin” replied. She asked what the problem was, wrote the same solution. Three hours later I got another email from “Emma Martin” asking what the problem was. Now I’m super sketched and withdrew all my info and cancelled my account. Not cool.

Great app. This app has been a lifesaver for us! I’m super into budgeting but my husband.... is not. This app lets us both set up our accounts separately but only one of us (hehe me) has to categorize the transactions into our shared budget. It’s a great tool for couples that share a budget but keep separate bank accounts and credit cards. It’s also free! What is not to love? We don’t use their visa or money sharing tools as we transfer directly from bank to bank when needed, so not sure about that functionality, but it can do that as well. The customer service is excellent. I’ve asked a few questions and they are always helpful and responsive.

Annoyed. I love this app! HOWEVER, I cannot have more than one custom category under the budget tab apparently. Because whenever I have two, click budget, and start to scroll the app closes. This is very annoying. Changed from two stars to one star because I have deleted ALL of my custom categories, hard reset my phone, uninstalled and reinstalled.....AND IT STILL CLOSES EVERY-TIME I TRY TO SCROLL DOWN UNDER THE BUDGET TAB. All of the other tabs work fine. I downloaded this app yesterday and it was working 100% fine. This is very annoying. Thank you very much for the response! I really do appreciate it. I love the way the app is set up. It really is the perfect app for budgeting. I even recommended it to my parents and friends. I am so happy that the issue was able to be resolved! 5 STARS!!!!!

Slow to update. The app is slow to update. My husband and I think it’s a great concept, but it causes distress in both of us. Just today my husband got a notification that I “spent $600” at a club downtown this weekend. In fact I spent $17 at the club, and the app grouped together my purchases from the last week and a half to let him know I spent $600. Of course he called me furious, and then once I told him to look into the transactions, everything was fine. The app starts fights because of miscommunicated information. Luckily my husband and I are “great at fighting” so it’s not like the app will break us up, it’s just that the timing of how it updates and sends notifications is very poor. It also doesn’t update for days. When I go to my bank account it may list 4 transactions from this last weekend. On honeydue, all of the transactions and balances won’t show up until they are processed. It’s misleading and slow.

Functional (50% of the time). It works half the time. The other half I spend countless hours back and forth with customer service just trying to log in to the app. It literally kicks me out of the app every other day and doesn’t let me log back in. It’s very difficult to trust this company with my finances when I can’t even log in to this app. On top of all of that, the reset password email links don’t work AND verifying my phone number doesn’t work. How in the world am I supposed to log in to my account? This incredibly small issue should not even be an issue! If I can’t even log into my app, we are going elsewhere for our needs.

great idea, developers checked out, no support. I wanted to love Honeydue, it is a great idea for couples to easily share finances without losing their identities. However, support is practically non-existent. I have tried contacting them multiple times and each time get a “we’ll look into it” and then get completely ignored. Updates are very few and far between. This makes me worry about their security. Is anyone in the drivers seat when a security issue comes up? Chances are slim. Plaid support responds within minutes and says an issue isn’t on their end, Honeydue support… they’ve moved on. Very sad as this app is very promising. Hope everything is ok over there and that someday you come back to this product, or pull it from the app store if you don’t have time for it.

Almost perfect, but not quite. So far we love this app as a way to split a joint credit card and easily track what should be a true split expense, or something individual. The only problem is that in the split expense screen, payments made to the card and credits from the merchants that are assigned to an individual show as an additional normal charge amount instead of a negative credit amount. This makes it looks like one person owes the other more for a payment, which doesn’t make sense. For example, a $350 payment would make it look like that person owes the other an additional $350. If that gets fixed, we could see this as being the answer to our shared expense app need!

Almost fun?. So I have to admit that I just got this app today but I love it. Categorizing my poor purchases is pretty fun! I love this transparency between my husband and I. Our before marriage counseling said it was fine to have separate accounts but that we should be open and save together, this seems right in line. Mostly I’m writing this review before I make my final verdict because I had a great experience with customer service. I emailed them this afternoon to ask about one of the features. I assumed it was user error but hubs couldn’t figure it out either so what the hey. I got an email back within an hour with a clear and thought out response. So amazing! I’m excited about combing though all the things this app can do!

Just started using the app. I feel like this is going to be great for my fiancé and I to use. Especially with the due dates feature so i don’t have to keep asking him when things are due for his bills. I’m not good with writing our budgets, but this will definitely help both of us see where the other one stands. A couple fixes, - for some reason the system keeps telling me that there is an error with adding my RED card. Something with the institution? But not really a decent explanation or seeming to get fixed at all. I don’t know if that’s a common issue or not. - when moving transactions between categories it does not update the amounts automatically. Which seems a bit silly bug to have. It also doesn’t move between months in any seemless manner.

Great app with a ton of potential!. This app is in the cusp of being the app I have been waiting for! When I first downloaded it, it didn’t have custom budget/spending categories which was a huge limitation and made it unusable for us. Once the custom categories came out, I immediately jumped back into the app and began to get it setup again. Unfortunately, I quickly realized that there is no way (that I have found) to do a rollover budget which is really important. If we have overspending or underspending in one category, I want the option to make that amount rollover so we can adjust in that category next month. Once that feature is in place, this app is a no brainer and will be next to perfect!

Almost Perfect!. I really want to give 5 stars but I can’t. There are so many pros to this app, the cons sound silly. Interface is clean and easy to use. Adding and editing custom categories is a breeze. Notifications are superb. BUT - the cons are such simple fixes that it’s even more annoying that they aren’t fixed. 1) The bank resync/update on balances is SEVERELY slower than any other budget app I’ve used. We’re talking 2-3 day lag on overall refreshes which is really unfortunate. 2) No search functionality within transactions. You can sort, but not search. 3) No ability to assign an account to the partner. If I add a bank account or other loan account, I should be able to assign it to my wife if it’s hers. Currently, you cannot. You can set to joint so the partner can see the account, but you can’t actually assign the account to the partner which is disappointing because the interface looks like you should be able to. #3 is a stretch, but #1 and #2 really need to be integrated. Other than that, pretty stellar app.

Well designed and exactly what we needed!!. Before we started using this app, my fiancée and I didn’t have a good way to split our expenses. We would try to alternate who bought groceries (sometimes they cost $20 sometimes over $100). One would take care of the phone bill, another would do power and gas. It was awkward reminding your partner to pay if they forgot. With this app, you can go through your bank transactions and mark the ones that need to be split. You can split them evenly or just share a portion of the cost. You can even add expenses manually Incase you paid by cash. I love this app. And it’s FREE!! No ads, the creators occasionally ask for a voluntary tip which I was happy to give for a wonderfully well designed app.

Good foundation, lacking upkeep, troubling signs. Started using in June 2022. UX and most features are well designed and easy to use. Able to add most major accounts via integration with Finicity, Plaid, etc. Default categories are a nice balance of comprehensive and simple. However, this app seems to be suffering from some back-end issues and a curious lack of user support that seems to be degrading over time. Even back when I first joined there were some outdated and stale websites for major banks and financial institutions that caused some account adding/syncing challenges. At first the support team was great about responding to issues and trying to resolve sync errors. But recent “updates” have removed features that would seem to be relatively critical (RIP Tip Jar and Support Chat). Even more worrying, in the last couple months the support team seems to have gone completely dark. Haven’t received any response to multiple messages to their support email, not even an auto-acknowledgement. As a former Honeyfi/Firstly user before they shut down their consumer app, Honeydue seems to be showing similar pre-shutdown signals. Hope I’m wrong, but won’t be surprised if this app goes away within the year. Sad and frustrating given the lack of communication or explanation for these ominous changes.

All Hype - Glitchy w/ No Tech Support. I was so excited for my husband and I to get all our accounts in one place so we could keep better track of spending by category. We just got married, we have some rental property, and he’s self-employed, so we have several different accounts at different institutions that serve different purposes. Seemed great for the first two days, and I was having a great time sorting historical expenses and customizing categories. Then it lost touch with our primary bank. I emailed support multiple times, got ambiguous answers, with the final one being, “This is impacting a lot of other users … Want me to contact you again when/if we get an update?” What?! Your app has access to all of our personal financial information, it’s had some sort of connectivity glitch for almost two full weeks, and you’ll “keep checking” to see if there’s ever a solution?? We also hadn’t been able to sync my husband’s auto loan account from the beginning, which is with a major financial institution that should’ve been available but was “currently unable to connect.” Maybe those are little bugs that can be worked out quickly, but it’s hard for me to trust a FinTech company that can’t figure out basic app functionality over the course of 10 full business days.

Good in theory, but.... A few issues. I frequently see it counting a pending transaction as well as when the transaction goes through. So essentially, it looks like we’re spending twice as much sometimes which is really misleading at a glance. Also, it’s really horrible at auto-categorizing. Ideally I would like to categorize transactions by myself so I can 1) notice what I’m spending and 2) make sure things are correctly categorized. I also really hate how you can’t delete the default categories. Not all are relevant/broken up the way I prefer, and it’s more junk to go through and re-categorize. I do, however, really appreciate how easy it is to sync accounts with your partner. If things worked right and they made it a little more thoughtful of the user. it would be perfect.

Getting Better!. Been using this app for about a year now, and it used to be pretty clunky, but it’s getting better! I LOVE the Pull Down to Refresh option now, vs having to go into the Bank Tab, into the Account, Options, then Refresh. I only really use it for a basic overview of my husband and my finances, and it gets the job done! The only other thing I wish they would improve on is if the app could better “remember” categories. Like I get my paycheck every 2 weeks, and change it to Salary every time, but it still autos to Miscellaneous Earnings the next time it comes in. I also love the little logos they do now for the bigger companies like McDonalds and Netflix, so cute! Edit: Everything I said still stands, but this app hasn’t updated bank balances in almost 2 weeks now, so I have no idea what our total balance is. Not good. Also I wish there was an option to Pull Down to refresh from the Balances overview page, so all your accounts will update at once.

Mint competition which is much better !!. I was looking for budgeting apps for couples and there are so few. I used to use mint and add my wife to it but notifications and alerts were sent only to me. When I saw the story of Honeydue on App Store I was hooked. Downloaded the app and updated my bank details and made a small purchase at petco and suddenly I saw a notification category under family and pets !!! So quick and intuitive and the best part is that the transaction merchants are mentioned in the subscripts so you don’t have to open each category to check. Please keep working on it folks this is really helping us. Happy savings

Doesn’t.... do anything. I was excited to use this app and connected all the accounts, but there were immediately weird issues. One of my bank accounts just shows that I have like 25% more in it than I actually do. It’s listing transactions from the 18th, but my balance was never even close to what it showed on that day, and the balance has never updated since. I was thinking I was going to be happy with this app on day one, but after having it a few days, it doesn’t seem to have loaded a single transaction from either my or my girlfriend’s accounts. Literally the only thing it has done since I checked it last night is unassign a few items I had assigned on the 18th. It was a nice way to categorize purchases I had made this month up till the 18th, but I suppose it will now be frozen in time, forever commemorating my finances up until - and no further than - June 2018. (This problem is across all accounts and my girlfriend’s is the same.)

This is a ten star app!. Honeydue is excellent. It’s well thought out and lets you see where you’re spending your money, set budgets, and give you real-time looks at expenditures vs. budget for each category. You can change the category that an expenditure is in and Honeydue will learn to put that expense into that category. You can split categories for expenditures. Let’s say that you go to Walmart and get household food, then you stop at the McDonalds’s inside for lunch, and then buy gasoline there. Honeydue will let you split that bill up into as many categories as you want. This is even though your debit card or credit card only has the one entry. I highly recommend Honeydue for the budget-conscious.

FINALLY !!!. Finally someone made the perfect app for couples wanting to get control of their budgets and spending. We had tried several different apps and many of them “glitched-out” while syncing with one another or just flat out didn’t perform or have the features we needed. But so far so good with this app!! We definitely enjoy the customization that we get and the fact that we don’t have to type in every single purchase but rather the app seamlessly imports our transactions from ALL of our accounts and allows us to customize which budget category to assign the expense to, is quite frankly a huge blessing!! 👍🏻🙂 In short...we love the app!! Keep up the good work!!

Bill mgmt. So far I’ve only used this app for bill mgmt with my spouse and it’s been a huge step up from sharing a note in my iPhone because we get reminders, we can message each other about specific bills in the app, and we can even put our pic next to the bills when we assign the reminder that way we know who’s bill is who. The two things I think can improve: Allow us to see not just the total for the week but the total for each individual Allow us to temporarily adjust a bill amount instead of permanently in case you have a payment arrangement going on. For ex I might want to pay 50 this time on a recurring bill but the usual 25 next month. Otherwise give us a note section where we can note that we are paying a temporary amount. For now I’ve just been pushing the bill to the next mo and creating a separate, non-recurring bill for the month being & it’s annoying. The app is def worth having and I plan to use the other features soon.

Wish I could Stay. I love this app and I can tell that it's made with care and thought put into it. However, it doesn't play nicely with some bank accounts, specifically with certain Credit Unions and JP Morgan/Chase. If we could get a version of Honeydue that talks to the bank apps that I already have on my phone to authenticate instead of going through fincity or whatever to login, that would be great. IMO, the onus is on the big banks to make my accounts more easily accessible, but unfortunately I am not going to change my bank accounts to work with my 3rd party financial consolidation app. I'm just going to find a different app. I love you honeydue, but it's just not going to work when you can't login to my accounts to verify balances. #stillfriends

Former YNAB User. Former YNAB 4 and YNAB cloud user. (Still currently use YNAB excel spreadsheet monthly). Due to the subscription cost of YNAB now and unable to continue to use YNAB 4 and associated YNAB classic iOS app, I needed a system to keep up with the household budget and spending between me and my spouse. We’ve been using Honeydue for the past two months combined with an old YNAB excel spreadsheet. Keeping high level categories in Honeydue along with manual expense tracking accounts for Groceries, etc reconciled with YNAB spreadsheet at month end has been a great alternative. I still have my sense of control over the budget to ensure every dollar is assigned and at work, as well as my spouse not only seeing the high level roll up, but being able to see our overall picture in our other financial accounts. Honeydue has been a wonderful experience thus far. We are also looking forward to being able to use the joint checking account in the future once some of the “upcoming” features are released and limits are adjusted.

Honeydue is what you thought Mint would be. Honeydue is the best finance tracking app I’ve seen yet. It is perfect for my situation because I share finances with my partner, but it also has the common sense features other finance apps lack. I love how easy it is to add cash purchases, split single purchases into multiple budget categories, and remove “purchases” that are actually just me moving money around. Honeydue is the only app I’ve ever used that actually gives me a clear overview of my finances, and it definitely performs its core mission of helping me and my partner split purchases.

*WASTE OF TIME & EFFORT. This couples budgeting app was the first app I’ve downloaded to try and keep track of our finances together. I decided on this app because I read good things about it online. But after the whole ordeal of setting up the app and trying to use it, I can honestly say, “DO *NOT* DOWNLOAD THIS APP!” The daily balances are *NEVER* up-to-date, so it makes it difficult to Really know what’s going on with your money as well as your partner’s. And if you want to transfer money from your bank into your joint account the processing time takes FOREVER. The *WORST* part of using the app was the **POOR** customer service you receive. It’s always the same person with the same response. They say they’ll have someone from their support team get back to you, but they Hardly ever do. Honestly, *DON’T WASTE YOUR TIME AND EFFORT* into trying to use this app.

Really like this app. Been using this app for maybe 3 months now. I really enjoy this app, much better than I did Mint though there were things I liked better in Mint. Those things are now included in the most recent update. I had problems with the reminder dates for bills here and there. Noticed that if you were to go in and modify a date, the date picker automatically went a year ahead of the date you are actually trying to change. No biggie. But now after the new update and the features I enjoyed about Mint came about, all of my due dates are messed up. Everything marked as paid for the last month are now showing as past due and they are also showing due on incorrect days. Things that are due today are showing due three days later. No clue what happened but now I have to go through all my accounts to figure out correct due dates again and reset the due dates for each one over again.

Meh at best. The idea of this app was intriguing. My spouse and I have our own bank accounts, but we always openly share how much money we have, what bills to pay, etc. this simplified it a little bit. It doesn’t seem to update balances very often so usually I would be seeing a balance that was from the day before. We decided to give that Honeydue Visa card a try. The cards came in the mail. I decided to deposit a small amount of money into the joint account just to see the time it took. We are almost to day 6 and the money still hasn’t cleared. It cleared the funding account quickly of course. They blamed it on the holiday...which was day 4. My bank clears money the next day, weekday or weekend. My paycheck clears almost as soon as HR posts them. The time it’s taking Honeydue to clear money that they’ve had for days is a huge turn off and I don’t foresee using this joint account anymore. I can’t imagine how long it would take if I moved my direct deposit to this account. I would be waiting a week for my paycheck. If the bank transfer is going to take this long then there should at least be an option to use a debit card to fund the account without the huge wait.

Support NOT RESPONDING on how to track balance in Venmo. So I have contacted them a long while ago because I desperately wanted to try their app but my main focus is going to be my balance in my Venmo account (& Venmo card) and cash app and tracking that spending and what it goes for etc. I contacted them and heard back that I could add an account and keep track of it manually but that they were working on an actual solution and one that doesn’t actually cost me more time. TheyThey responded to that email caramel although the three suggestions they made about tracking besides adding every transaction manually didn't work. So fast forward to a month ago, I emailed them again just to see about an update because I wanted (& still do) to be able to use their app or abandon ship. I’m tired of getting my hopes up or wasting my time up if it’s not gonna happen. I have emailed them two more times to get an update and not a single response about this...if it’s not going to happen then just say as such so I can start hunting again for the right app and not count on your finding a solution.

Read before downloading. This app does not seem to be maintained anymore. The articles on the app are out of date and customer service has not replied to a question that I asked a month ago. Additionally, it takes forever for funds to clear. I made a other deposit and the money he basically been in a digital black hole for at least five days. The first time, the app got disconnected from my bank somehow and the transfer never went through. It constantly loses connection to my account which is interesting given that it’s using Plaid. Finally, the account is limited to only 10,000 dollars for some reason. So after saving, you have to move funds elsewhere. I have the Visa card but haven’t yet used it. I’ll likely cancel this account and go with something like Ally instead.

Great but shortsighted. This would be our preferred budget app if it kept more than 6 months of data. I keep checking in hoping it will allow us to see a medium or long term view of our budget, but so far that isn’t an option. I would gladly buy a one time addition to the app that allowed for a longer duration of transactions to be kept (I don’t do subscriptions). For now I’m still using that app occasionally, but we had to move our primary focus for budgeting somewhere else. I just lost all of the data from January because I didn’t screenshot it in time (it was gone July 1st). No one should be keeping such a limited view of their budget. Moving the data to being stored on devices or allowing people to choose where their data is kept would also be nice. I’m a little uncomfortable with our data being stored on remote servers when I can very easily store it on my phone and back it up from there.

The wife and I love the app!. We both love that under the “bill” tab we can now mark the bill reminder as “paid” rather than the reminder defaulting to next set reminder frequency after the set due date has passed. Sometimes it takes a few days to debit from the account. The only downside to the update is we wish we can still have the ability to see total amounts due for any given day on the calendar, and total bill amount due for “upcoming bills” again. For example - $300 total due on the 15th or $100 total due on the 21st and $700 due upcoming bills for example. Hopefully with the next update!! 🤞🏽

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Needs more features. I really liked the idea of the app but without more features it doesn’t work for us. I would like: 1. To be able to allocate expenses. For example, if I go to Walmart and spend $50, of which $30 is on groceries and $20 is on auto supplies, I want to be able to break that out. 2. I want to be able to budget on a more granular level and remove the default categories. I realize I can create my own granular categories, but with all the default categories remaining in the list, it will distract my partner and reduce the utility of the app for us. 3. I would like a third option for splitting expenses, which would be something like “reimburse the joint account.”

Good app and improved functions. Overall this app is very good - easy to navigate and easy to connect to your accounts and pull data from them. My biggest complaint was that the category options were limited but they’ve fixed that with custom categories. It would be nice to hide or rename their preset categories. I would like to export the data to a csv and be able to use it on an iPad or desktop. Overall I like the app and it’s very helpful and an excellent value.

Transparency and Maintaining Financial Literacy!. We are thoroughly enjoying this app so far! It was important to us to have some combined finances and keep some accounts separate in order to ensure that we were maintaining financial literacy together. This app is doing just that! The transparency between accounts is the best part. It’s so simple and straightforward. Four stars instead of five merely because the budgeting tool is a little too lightweight for our needs so it can’t replace a few other apps we use. That said, I would absolutely recommend this app to couples (and have already)!!

Best budget app I’ve found!. I’ve tried mint, EveryDollar and finally something that works. I’m really loving this app in so many ways; design is simple and clean, easy to use and customize. Today is the first day my spouse and I sat down to due bills, and there were no arguments, no surprises, we were both on the same page!! Thank you Honeydue❣️ So now I’m on the hunt for a personal budget app for young adult children, to help them budget new income, and college debt. So please honeydue, where can I find this in a personal budget app?

I LOVE this app, but.... I love this app, But the bill reminder needs fixing. It cycles off to the next bill after the day due, and so it can make you think you paid a bill when you did not. It should be set so that the reminder tells you the bill is still due (or past due as sometimes can happen) until you mark it as paid or skip it. Otherwise, this app is near perfect for us.

Leaving my review neutral for now..... I’m interested to know more about the security of this app? No ability to use a OTP from an Authenticator app such as Google Authenticator. Also, I didn’t set up a password for the account on this app. I suppose having FaceID and a pin is better than nothing, but I would expect to be able to set up a password at least. I know that it uses one time codes sent to email, but I’d really like to see the ability to create long, complex passwords as a means of logging in. As far as the app itself, just downloaded it so I’m going to give it a bit of use before I comment on that. Security is a top concern for now though.

Finally Trying. I have looked at and tried so many different apps/programs to replace my checkbook and help with budgeting. I am a manual entry person. My husband and I both work, and we are always on the go. I pay the bills, but I feel we should both know where the money goes so we can make better money decisions. I’m only giving 3 stars because I feel like I shouldn’t have to change the date for every transaction. If I am entering transactions for the same day, I shouldn’t have to enter the date on each transaction. I’m hoping this will be changed in a future update.

Can’t connect to main account. The majority of my and my spouse’s money and investments is in Schwab. Despite this being near the top of the list of supported banks in the app, upon trying to connect, I received an error message that says “a technical change may prevent you from linking your account to Plaid-supported apps. We are partnering with Schwab to restore your connection.” So, the app isn’t very useful to us when we can’t connect our main account. I have always used Mint, but got tired of the ads. But Mint has always been able to connect to whatever I throw at it. Guess I have to go back to Mint.

Key functionality doesn’t work, no support. Seemed great, but once my partner and I had finished syncing up our accounts we found that the Chase accounts for some reason weren’t syncing individual expenses. We refreshed, tried re-linking…nothing. Reached out to customer support multiple times and got crickets. We tried to go ahead and enter Chase expenses manually, but ended up with different totals to settle—my app wasn’t catching an expense that my partner had put in, and we had to go back through the entire list to figure out which one. We were super excited about the features the app offers, but at this point it’s not saving us time over our previous spreadsheet method.

Manual Bank Account. The app itself is very well done from a design standpoint but if you want to manually add a bank and manually add transactions it doesn’t update the balance. My wife’s debit card was recently cloned and used for 4 fraudulent transactions. If I did not keep a manual check register(with another app) and notice that the balance was off then I may have just overlooked it. Even though it’s tedious for us it’s the only way to make sure that the bank is correct. Trust me banks make mistakes on transactions and balances more than you think. If the balance update issue is fixed then 5 stars.

Almost there 😕. I really think this app could be useful but I really wish there was a way to add transactions manually. A lot of people are on debt free journeys with the Dave Ramsey program and use cash for groceries, fuel, etc! It would be soooo nice if that was an option. Please add this feature 🙏🏼 I also, knocked down another star for the transactions posted don’t match when they are posted at the bank even though it says the banks have been synced. The transactions sometimes don’t appear for 1-2 extra days. Kind of defeats the purpose. I could just use my bank app and a budget book.

Honeydue is what you thought Mint would be. Honeydue is the best finance tracking app I’ve seen yet. It is perfect for my situation because I share finances with my partner, but it also has the common sense features other finance apps lack. I love how easy it is to add cash purchases, split single purchases into multiple budget categories, and remove “purchases” that are actually just me moving money around. Honeydue is the only app I’ve ever used that actually gives me a clear overview of my finances, and it definitely performs its core mission of helping me and my partner split purchases.

Me and my Fiancé LOVE this app!!. This app is great for keeping track of bills and totals together and all in one place. It is so very easy to watch your budget and help plan stuff together while keeping an eye on all accounts. One other amazing thing about this app and its staff are when i emailed in to support later in the night not expecting a response for some time because of how late and if they were busy. I received a response in less than FIVE minutes! And then my problem was solved in 10 to boot! Over all a great service and idea, cheers to you all!

I can see where it can be useful. My significant other and I used this app for a few months. In the beginning I was excited to use it as I was switching from Mint. It didn’t take me long to figure it out however, it got really cumbersome to go in and allocate each transaction. The app does a poor job in categorizing. This is by far the most important thing to get right! I shouldn’t have to go in and re-arrange the categories. This is detrimental to ensuring our budget was correct. The app was aesthetically pleasing however the functionality needs some work.

Not great for tracking daily spending. I really appreciate this app. My husband and I can check on our spending instead of just assuming one or the other person is doing all the spending. The only issue I have with the app is that it does not update daily. I like to label purchases right when I’ve made them so I can put it in the appropriate category by looking at my receipt. Sometimes I buy non grocery items at Walmart or Aldis. Hopefully they can fix this speed issue. Other than that it’s a great app.

Great app, just a couple kinks to work out. Beautiful app, me and my girlfriend adore it. Notifications for bills, show you budget, where you're going wrong with spending. Split up expenses with your spouse so that there is no arguing about it. Kink is sometimes the budget is wrong, and how much you actually have in your accounts. But I alway just go check my real bank app. But as far as keeping track of bills and spending, this app is the truth.

No customer support. Honeydue boasts a 1 day response time for customer service, but sends a stock answer of submitting to the team on day one then never responds. It’s been over 40 weeks since I asked a question and have received no info back. The app has bugs that make it hard to use and you can’t connect a large number of banks etc. making it unusable. It is unable to remember how you have sorted transactions in the past so you need to sort them every time. I was really looking forward to using this app as it was exactly what we needed but the functionality issues and lack of support have me questioning the safety of this app.

Free intuitive. We are using Honeydue for 3 years and it completely changed our couple budget control. no more surprises at the end of the month. My wife loves it ! Especially the multi currency account, very useful for our nomad life. I tried different budgeting apps, comparing Quality and features, Honeydue is the best and … free. Thanks a lot to HoneyDue team! P.S There is a little big with currency conversion since last week. But it should be solved quickly.

Function & Design. Hi, I’m a married man with several children. My wife and I both work, we have normal expenses for a family of six renting and saving to buy a home. This app allowed my wife and I to better review our overall financial picture on a month to month basis and in large grouped periods. It helped us identify gaps in our spending that other personal finance apps could not. We believe this is because HoneyDue is designed with couples and shared expenses in mind. It’s design actually fits the way we spend money. Very functional, I can’t wait to see what improvements might occur in the near future. I’m so ready to add that 5th star to my review.

Perfect. It’s so easy to add bills and your accounts to manage your money. It’s nice to have transparency with your significant other so they 1.) don’t spend extra money you didn’t plan and 2.) they can help save money for a bill that needs covered. We have our own separate accounts but we are able to contribute equally. This helps work together towards your wedding, that house you’ve always wanted, saving for house repairs, or for having a little family!

Love the concept, but needs some improvements. I love how this works however it would be nice to have the ability to change items after they are posted such as who’s bank account it is. Also would be nice if it was able to have a full screen on the iPad as well as horizontal layout. Looking forward to the future improvements, been using it about about a week and so far really enjoying it. If you can get me to use a banking/budget app for more than two days you are off to a good start.

Finally handling bills as a team!. It used to feel like I was the one always getting overwhelmed with having to remember when things are due, to pay it and whatnot and that if I asked my husband I’d be sounding naggy. But now with this app, we share the workload of remembering to pay bills, we even now sit down every week now to budget our week out since we can clearly see when things are due. This app has brought me such piece of mind and now finances is less of a stresser in our marriage!

Really great!. This app has done wonders for my wife and I. I still use everydollar too, as a way for me to figure the limits for each category. - one thing I’d love to see is along the lines of what both everydollar and pocket guard do. They track your predicted income and build your budget off that. -one thing that isn’t so good: Starting on Saturdays it doesn’t update from my bank very well until sometimes Sunday evening. Other than that I really love this app!

Bummer. Would be great if it worked properly.... I had high hopes for this app, but it has been a huge frustrating let down and it is going to be deleted off our devices... Very challenging to set up accounts because there are lots of missing institutions (i.e. Ally Auto, carious Comenity bank connected accounts or my bank’s business login portal) and several other accounts do not work (including Betterment and Freedom Mortgage) even when using the proper login credentials. There is no use for this app unless one can log into every account. Customer service has tried to help, but no solutions yet. I am disappointed because it seems like it could be useful.

What I've been wanting. I've tried other budgeting apps, and none worked as well as Honeydue. I especially love how seamlessly it works for couples. My husband and I are newlyweds in the process of merging some accounts, but also keeping other accounts separate. This app makes it so easy to keep track of all of that and helps us see where we are for spending and savings goals, both individually and jointly. I'm so glad I found this app and appreciate how easy it is to manage money for couples.

Great app for couple. I've been looking for an app for couple finance and this is finally what I chose. The idea of shared finance between a couple is great and the split expense is exactly what I was looking for :) But there can be several improvements: adding sorting and filtering functions based on merchant name and amount in the activity section will be very helpful. And the split expense can be improved by adding shortcuts like evenly split or split based on some ratio. Personally I also want to have a wallet for cash in the account settings.

Must Have for Couples. Honeydue is the app you wanted Mint to be; it seamlessly tracks joint and individual income and expenses for couples; allows you to manage and seek reimbursement for household expenses; and features privacy settings that provide as little or as much transparency into individual accounts and spending as various individuals desire—overcoming that problem where you don’t want you cloak your spending in secrecy so your wife doesn’t know how much you spending on video games each month. Truly a wonderful app. Has been a definite game changer in my household.

Unique app. I love the concept, the idea of having this around really is a lifesaver. The only thing I did not enjoy is the bank account linking, I get it an option as well as a sure way to balance out funds within each other it’s just I wish there was a way to just have a manual point to put in the amount you like & your partners & have the app itself manually come up with a budget without linking any personal info into this(I know it’s apparently safe but I rather not risk it) I appreciate the hard work developers and keep it up many people will enjoy this concept more than I.

If You Want to be Better Than Mint. This app is very good. It’s practically mint with a different UI and some extra features. There are two thing it should have that would put it over the top for me. It needs budgets that are calculated weekly. I track my gas and dating spending weekly. It should also total your bank accounts when in the all that. I like to know how much money my partner and I have without pulling out a calculator. There should be an overall total, a total for checking, a total for savings and a total for credit cards.

Finalized Divorcé Because of Overdraft Fees. App doesn’t reflect real time transactions from linked bank account. Parter nor myself were able to see true balances after daily use of multiple debits, leaving us unable to budget correctly. After months of yelling and tears over spending habits not logged immediately by this app…..partner and myself have decided to dissolve the marriage after 22 years. Current litigation in the discovery process, overdraft fees and who will pay..are pending. Do not recommend unless spending is minimal. App should update to show real time data. Other than that, the app was loved by both of u

Customer service is nonexistent. I’ve been using this app with my husband until our bank updated their online banking system. Since Honeydue has not made updates with Plaid, we are unable to reconnect with our bank. We attempted to contact customer support via email and through the chat messaging on the app multiple times and never received a resolution and response. The person “Lucas” who is assigned to my customer service app says he typically responds in a day but that is clearly not the case. Super unsatisfied with this customer service and will be looking for another budget app since this has not been resolved for over two months.

Easy to use but still flexible. I’ve just been using this app for a week so this is all preliminary. It’s really easy to use out of the box and has all the views I want to see built in, but also has flexibility with categories and what to include and exclude. The separate views for me and my wife are also great since we are looking at different aspects of our budget. Only downside is that linking to less important accounts, like my mortgage, has been challenging. But these links are just a nice-to-have.

Not good compared to other money management apps. I tried Honeydue out in earnest, but its buggy/flaky integrations with half of my accounts (including my main checking account with Schwab), renders this app pretty much unusable. I was also not able to get my partner connected. Couples are much better off sharing the login to the same Albert or even the same Mint account. In my experience of using these financial management apps for almost 10 years now, if you can't account for all of your income and spending in the app and you begin relying on the app, then you're more likely to overlook some potentially critical balances and transactions in your financial planning.

Works okay, but uses Plaid so it’s not secure. Mostly works, but some banks require reauthorization every week so it’s not much better than logging in yourself. Security, however, is another story: you have to disable 2 factor authentication for many banks to work, and if that’s not bad enough, Plaid (the tech used by Honeydue to connect to your accounts) sends your passwords in PLAIN TEXT. If you ever logged in with Plaid, you now need to go change every password you have used. What’s worse, Plaid just settled a lawsuit for sharing your scraped financial data with third parties!! No thank you. That’s private information, and I trusted you with it Honeydue. Not cool.

Connectivity Problems. My husband & I have used this app for appx. one year. It was easy to use. In the last 3 months,though, it has been problem after problem syncing with banks. I’ve had to delete & add my bank 3 times, losing all previous entries. And it still is not syncing properly. Now my husband’s bank is not syncing with this app. Support has been responsive, but nothing they try seems to work for more than one week. If they could just fix these problems.

Great idea- doesn’t work. I got this app a few weeks ago after trying Honeyfi for about a year. For some reason they can’t connect to my credit card account even though I pass all the security checks and my bank says it’s sharing data. And this isn’t a podunk cc company: it’s Bank of America! I’ve reached out to support and got the same canned bot response several times in a row that it was fixed and to try again. Then totally ghosted for the past 2 weeks. What a joke. My spending is useless without my credit card. I’m still in the market for a good couples finance app but this ain’t it.

Great app for all kinds of couples/finances. Love this app. I’m sure it’s helpful for most that almost all expenses are automatically sorted into categories but I wish there were a way to setting to bypass that. I would prefer to sort on my own since the app and I don’t always agree on what category an expense belongs in. Other than that, this has been a great help with my fiancé and I since we have chosen to combine finances but aren’t great at tracking on our own. I’ve also recommended to my sister who has chosen to split finances with her husband. Great app for all!

Great App! Horrible Customer Support.. This app is wonderful, unless you have a problem. The “chat app” inside the app says the support team “usually responds within 24 hrs.” This is entirely false. They will look at your message and not respond. For days. Or not ever. I have transactions that have spontaneously deleted and the issue has not been addressed. I’ve asked them for help multiple times in the past and not received any helpful responses. Love the app, but customer support is very disappointing. It’s entirely a shame because they have the groundwork for an incredible application for financial and budgeting assistance and they have improved so many things in the years we have been using it. Hope to see a change soon.

Should have banks not just in USA. This app would be so useful if it could sync banks from around the world not just US. There are many people who do business in multiple countries. My husband and I teach in China for most of the year but still have student loans and a mortgage back in the US. It would be amazing if we could sync our accounts from China and the US all in one place. We do most of our small transactions in China but our big bills are in the US. And there are many people like us who have footholds in multiple countries. It’s a shame that all the apps that help you track your finances are country specific

Glitchy and no support. I like that I can see my partner and my money. However, it’s annoying to have to sort every transaction. It can’t tell what I’m doing even if I’ve sort it before. For example, my checks keep going into misc and though I’m sort it into salary and wages before. Also, one of my credit cards keeps not syncing. I get a message saying we haven’t been able to sync your credit card since x date. I’ve emailed customer support 5 times and have inky received one reply and when I responded to that email, no follow up. I’ve even tried deleted the card and readding it. It’ll work for a couple days then stop syncing. Again, I email and nothing.

Love the app, some suggestions. Love the app, it is very easy to use, and fast*. The reason for the * on fast is that some accounts takes a bit to query for transactions, like Bank of America. One suggestion i would like to give is to add the ability to reorder the accounts on the main page. Currently there is no way to put Credit Card as the first group of accounts on top of the main page. Also maybe give us the ability to add more “types” of accounts as well. Overall, good app so far.

The App is Broken/No Response from Customer Support. I really, really, really wanted to use this app but I could not get it functioning properly. My linked accounts kept saying “no recent activity” and the balances were incorrect. I wrote to the support chat on their website multiple times with no response. I uninstalled and reinstalled several times. Waited a couple of months and tried again. Still nothing. I unlinked my accounts and tried to set them up again. Now there are error messages trying to set up my accounts again. I’m so disappointed because the concept for this app was exactly what I was looking for. I’m wondering if this company has shut down?

Amazing app! Needs updates for glitches. My husband and I LOVE this app and it makes managing our finances so much easier. There are some glitches that can be frustrating - the app links up to my credit union accounts fine, but they don’t update my transactions so I need to keep linking and unlinking my bank. I reached out to Honeydue support about it and didn’t receive a response. Also, lately the app has been showing me error messages when I try to split a transaction among multiple different budget categories. I’d love to see these issues resolved

Glitchy. We have been using this app for the last month and have had a good amount of issues such as constantly having to sign into our banking application. Additionally, it is not very intuitive — for example, when you click on your budget diagram it won’t let you enter back into the individual transactions or even highlight which category it is. It also is pretty messy in categorizing transaction. It double counts transactions. App definitely has potential if you have the patience to deal w the glitches.

Refuse to add option to change week start.. It would be an amazing app if they would just add the ability to change the week start /end from Sunday to Saturday to something custom. Most people get paid on Friday. I pay my bills weekly on Friday. Other people get paid on other days. I can’t use this app to see what’s due from Friday thru Thursday. I’ve sent multiple requests to the devs for this feature. They get ignored. It’s not a big ask, it makes sense. Therefore, I won’t be using this app until they make that change. I check in periodically to see if they added that feature but it’s been a year and no luck. My spreadsheet works better. So, 2 stars because it’s useless to me as a financial app, and poor developer response.

Used to love this app. Update the below issue seemed to fix itself. Never got a reply to my email to support. I have added my bank which it says has been unresponsive in the app and to email support. I emailed them 24 hours ago and no reply yet and bank account still isn’t working correctly. I used this app all the time to keep track of my bills and to mark when they’re paid. Then all of a sudden allllll of my bills on the app are gone. I’ve contacted support but no response yet. I’ll update this review if this issue gets fixed. I’ll definitely be making a backup if this app ever works again. So be cautious using this app.

Generally great. This app has really helped my bf and I feel comfortable about sharing expenditures, especially since we live together. It's hard to feel cheated when all spend is listed right there. One annoying part: honeydue will list pending charges and will let you split them, then when the charge is no longer pending, the split will still be there, but the charge will show again in the transactions list as if you never split it.... This is a bug and should be fixed.

Great when it works. Was excited to start using this app for our household budget between my wife and I. We built all our own categories and it worked great for a week. But our transactions stopped updating ten days ago and I haven’t heard back from support despite multiple attempts to reach out. I tried their in app help and submitted a request via email but no response and the app still hasn’t updated across five different bank accounts and credit cards. Great functions don’t help if it doesn’t update constantly. Especially at the end of the month. I guess we’re going back to another budgeting app.

Excellent app....! Better than the rest. My wife and I had a great set up with a different app. When they changed a feature that prevented us from seeing our bills and when they were due and who paid it. This sent us on a months long search for a replacement. All of a sudden we found it. This app has all of the features we could want as a couple. So glad we found this amazing app! Look forward to staying here for the long haul!!!

Great customer service. I was going through the process of setting things up in the app and noticed my bank wasn’t listed. I emailed customer support and within the day had a response that said they were working on it. After a bit of troubleshooting we got it working smoothly. Not only that, but the app is tip based, so you pay what you can for it. Let me tell you after getting things set up it’s extraordinarily clean and user friendly and you will want to tip.