Rocket Money - Bills & Budgets App Reviews

Rocket Money - Bills & Budgets App Description & Overview

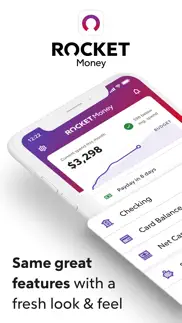

What is rocket money - bills & budgets app? Join over 5 million members who trust Rocket Money to save more, spend less & see everything in the #1, all-in-one personal finance app.

Forbes: *"This App Will Save You Hundreds"*

**KEY FEATURES**

- Track and grow your net worth (New!)

- Manage and cancel unwanted subscriptions

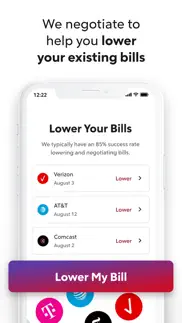

- Lower your bills and let Rocket Money negotiate on your behalf

- Keep track of your monthly bills and avoid overdrafts

- Create unlimited custom budgets (e.g. side projects, NFTs, etc.)

- Monitor your credit score

- Put your savings goals on autopilot

- Bank-level security and privacy

Save more, spend less, see everything, and take back control of your financial life.

**YOUR ALL-IN-ONE FINANCE APP**

Rocket Money (formerly Truebill) is your primary financial control center. The app automatically tracks different accounts and helps you navigate your finances each month in order to provide a clear picture of your income and expenses. Rocket Money finds recurring subscriptions and cancels them for you. It tracks all your bills and notifies you when they're soon to be due. Rocket Money can even negotiate bills on your behalf to get you much lower rates.

Use Rocket Money as a spending tracker to see where your money goes and how your net worth changes. Connect your investment and retirement accounts to view how your holdings have grown. Use Rocket Money to monitor your credit score and credit report to start thinking about long-term financial goals. The app tracks all your bank, credit, and investment accounts so you don’t have to – just link them once and let the app handle the rest.

**MANAGE YOUR SUBSCRIPTIONS ALL IN ONE PLACE**

Managing your subscriptions has never been easier. Rocket Money gives you a clear picture of all recurring services, including forgotten subscriptions. Actively and easily monitor, manage and cancel ongoing subscriptions from one hub. Rocket Money will notify you when an existing subscription goes up in price and remind you when free trials are about to end. Rocket Money can sometimes get you a refund for subscriptions retroactively. Stop spending on subscriptions you no longer use and start tracking your money today.

**LOWER YOUR BILLS AND SPEND LESS EACH MONTH**

Stop overpaying and start saving for what truly matters. Let Rocket Money lower your bills. Easily connect your bill by logging in or snapping a photo of it. Our expert negotiators get to work and lower your bills by either negotiating a better rate, or by getting 1-time credits applied to your account.

**TRACK YOUR NET WORTH (NEW!)**

Are you interested in discovering your net worth? Now you can easily monitor your assets and debt with Rocket Money. Simply select your assets—like NFTs, jewelry, fine art, cars, and homes—and let the app calculate the rest. Whether you need a pulse on your financial health for a loan or you’re just curious, figuring out your net worth has never been easier.

https://www.rocketmoney.com/privacy

https://www.rocketmoney.com/terms

8455 Colesville Rd,

Silver Spring,

Maryland 20910, US

Please wait! Rocket Money - Bills & Budgets app comments loading...

Rocket Money - Bills & Budgets 6.24.3 Tips, Tricks, Cheats and Rules

What do you think of the Rocket Money - Bills & Budgets app? Can you share your complaints, experiences, or thoughts about the application with Rocket Money and other users?

Rocket Money - Bills & Budgets 6.24.3 Apps Screenshots & Images

Rocket Money - Bills & Budgets iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 6.24.3 |

| Play Store | com.truebill.truebillnative |

| Compatibility | iOS 14.0 or later |

Rocket Money - Bills & Budgets (Versiyon 6.24.3) Install & Download

The application Rocket Money - Bills & Budgets was published in the category Finance on 05 July 2016, Tuesday and was developed by Rocket Money [Developer ID: 1130616674]. This program file size is 158.13 MB. This app has been rated by 63,104 users and has a rating of 4.2 out of 5. Rocket Money - Bills & Budgets - Finance app posted on 16 April 2024, Tuesday current version is 6.24.3 and works well on iOS 14.0 and higher versions. Google Play ID: com.truebill.truebillnative. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

Bug fixes and improvements.

| App Name | Released |

| Splitwise | 24 August 2011 |

| Money Network Mobile App | 25 March 2013 |

| DasherDirect By Payfare | 12 October 2020 |

| SoFi - Banking and Investing | 10 April 2017 |

| PayPal - Send, Shop, Manage | 03 February 2019 |

Find on this site the customer service details of Rocket Money - Bills & Budgets. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Adding Machine 10Key iPhone | 22 September 2010 |

| My Currency Converter Pro | 16 September 2015 |

| Penny Stocks Pro - screener | 02 June 2020 |

| HomeBudget with Sync | 26 February 2009 |

| WealthPlus Net Worth | 21 December 2014 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| BigFuture School | 28 September 2023 |

| Microsoft Authenticator | 30 May 2015 |

| Telegram Messenger | 14 August 2013 |

| DoorDash - Food Delivery | 10 October 2013 |

| Google Maps | 12 December 2012 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Procreate Pocket | 17 December 2014 |

| Earn to Die 2 | 20 November 2014 |

| Poppy Playtime Chapter 2 | 15 August 2022 |

| Muse Dash | 14 June 2018 |

| Bloons TD 5 | 15 November 2012 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Rocket Money - Bills & Budgets Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

No Apple Card Support. I was looking for an alternate application to Mint, which I thoroughly appreciate and enjoy, but at the time, it didn’t offer support for a few of my cards, including my Apple Card. So I was on the search for something that would. Enter Truebill. Although I prefer the interface over that of Mint’s, Truebill still doesn’t offer support for the Apple Card, only manual statements. Now Mint does, so I’m back with Mint. And you can’t beat the fact that Mint is free with all that it offers. I think the reason I give four stars is because it’s not really an above and beyond kind of app. When you have a competitor such as Mint, it’s critical to offer what they offer and then some, especially if there’s going to be a subscription attached to it. If they offered more features and support for the Apple Card, I would definitely use this app over Mint. It has a cleaner user experience and I love the simplistic, elegant look of the interface. I most note that I do realize that their lack of Apple Card support may not be their fault. But I hope this is something they can fix expeditiously.

Rocket Money: A Comprehensive and User-Friendly Financial Platform for Everyone. Rocket Money is a great financial platform that makes managing money easy and stress-free. What caught my attention first was how user-friendly the site is. It's simple to navigate and makes organizing my finances a breeze. What's awesome about Rocket Money is that it offers a wide range of financial services, including savings accounts, credit cards, personal loans, and investment options. Whether you're saving for a new car or looking to invest in your future, Rocket Money has something for everyone. One thing I appreciate about Rocket Money is the excellent customer support team. Whenever I've had a question, they've been quick to respond and helpful in their advice. They take the time to understand my specific financial situation and provide tailored advice that works for me. Security and data privacy are also top-notch on Rocket Money. I feel confident that my personal and financial information is safe thanks to their multi-factor authentication and encryption protocols. In conclusion, Rocket Money is a fantastic financial platform that offers a variety of services and exceptional customer support. If you're looking for an easy-to-use platform to manage your money, Rocket Money is definitely worth checking out.

Visually helpful. So, if you’re like me and end up writing out a budget monthly because you hate spread sheet then this is it. I love the month view, to see my expenses and paydays laid out in a calendar has been a game changer. It tied to my bank account super duper easy and that is magic because it takes me almost 2 minutes to log into that app vs Truebill just using my thumbprint. I struggle with organization, and if I were single that’s fine with me, but with 4 mouths to feed and a wife to retire and adventure with I’m 100% sold on this. I appreciated the sliding scale for cost because it helped me feel like I was giving as well as getting a good deal. Especially with how every dollar is accounted for, I needed a little flex. The credit score being built in, the lower my bills and THE CANCEL MY SUBSCRIPTIONS THAT I DIDN’T KNOW EXISTED STILL is worth every penny. I tried mint. Meh. I tried some others…meh. I’ve tried Dave Ramsey and his wonky envelopes. Ugh. Give this a try and if you’re a digital world lover, this is legit and so helpful. No regerts y’all. ✌🏼😉

They Figured It Out. I have had an endless number of budget apps throughout my years and everytime I download one it is just missing something that would make it perfect. Rocket Money is the first app I’ve used that gets everything right. I can split purchases, make my own categories, share with my husband, ignore transactions, get spending reports, create a budget that shows my savings, and tracks my subscriptions. Not to mention their customer service is fantastic. They’re always quick to respond and happy to help. I paid for this app last year and ended up cancelling only because I was stressed and practically deleted everything on my phone. When I got back into the swing of things and started paying attention to our budget again, I immediately thought of Rocket Money. Seriously, the app makes my life so easy. I have used the lower my bill option and it worked great. I prefer to cancel subscriptions on my own but the fact that that’s an option is really fantastic. When I first downloaded the app last year I found like $50 a month going towards subscriptions I thought I’d canceled. Getting rid of those felt like a little pay raise. Thanks for getting it right Rocket Money.

Subscription finder… thats all.. I’ve used mint for years, but feel it works better as a web app, which is frustrating as mostly do bills and budgeting on my phone. So I decided to try Rocket Money. The bill negotiation is bad. All the guy did was go and find a promotion that was on the front page of comcast. And they charge you a percentage of overall savings. So on a two year contract I “saved” hundreds but their cut is due upfront. Never works out well, and sounds much better on paper. The actual interface looks very nice and modern, but is very buggy. Constantly crashes, or gets frozen loading. It also tries to guess vendors for each transaction, and is frequently wrong. It thought my wife’s therapy bill was a charitable donation to an abortion clinic. It also splits up cash separately from savings which isn’t helpful because I want to know how liquid I am without a bunch of math. The saving grace of this app is the subscription tracker. I always thought that idea was dumb, how could you lose track of your subscriptions… get a wife and you will find out. Saved close to 100$ a month cutting out subscriptions. On a whole. It looks really pretty, but has a long way to go before it can compete with Mint. And charging for services in the app that Mint gives away for free was upsetting and left a bad taste in my mouth.

The Best Budgeting App. This app is, without a doubt, the best budgeting app available. I’ve used other apps, quite a few actually, but each at my views has features I like but lacks other features that I need or want. Is everything I want and more. I love that I can connect my account so when I spend money on my debit card I don’t have to remember to manually add my purchase so it makes my budgeting more accurate and easy. Plus you can attach more than one account so my boyfriend and I both have our accounts linked so now he doesn’t have to try to remember to tell me every little purchase he made so our budget stays accurate. The layout is simple and it’s so easy to find your way around everything. You can also view your credit score in the app which is cool. In my opinion, the best feature is the ability to cancel subscriptions within the app. There were so many subscriptions I signed up for using a free trial that I had forgot about and was either being charged or they were still attempting to try to charge my card and you can just click cancel subscription for me and they’ll cancel it for you! It’s awesome and saves me so much time and money. They also will negotiate your bill with the provider to lower your bill which is freaking awesome!!

So far 👍🏻👍🏻👍🏻👍🏻👍🏻. I only just got it but 1) it’s the easiest to use for these apps I’ve ever tried and 2) it’s the most *inuitive* of these apps I’ve ever tried, meaning that the app itself is intuitive…it correctly understands my accounts and my purchases, in a way that just always seems is ahead of me needing to instruct it how to interpret my expenses, bills, etc. it has a really clean, friendly, and welcome design that puts my current month’s spending on a line graph as it heads toward my budget. This is SO clear and well placed in the app so that I don’t need to seek it out. This is EXACTLY the thing anyone wants when it comes to a budgeting app; finally an app that could do it cleanly and make it be the first thing I see when I open it up. Not to mention all of the other features u haven’t even explored yet, i.e. their savings tools, categorizing expenses and marking them as deductibles, eliminating unwanted subscriptions. Heck, they gave me a credit report too? I’ve never had an app be able to do that before. Best app for budgeting and tracking expenses.

Stay away from bill negotiation. UPDATE: there’s no response from Truebill team even after sending email to negotiations@truebill as mentioned in the reply below. Here’s the story. I signed up for Truebill’s bill negotiation service after the app mentioned that i could save 15$ on the 75$ month that I’m paying for my Internet connection. Coincidentally my contract with Internet company was ending the month after I signed up for this. Truebill’s bill negotiation team intelligently waited for this to end and so they could claim a higher negotiation benefit. My next month’s out of contract bill came out to be 108$ at which point they contacted my Internet company and just put me into another yearly contract with monthly charges 70$. They claimed that they helped me save 458$ On my yearly rate whereas that amount was only 60$ savings compared to what I was paying before. There was no negotiation involved here since they just extended my contract to get savings after waiting for the contract to end. The customer service agent at Truebill doesn’t understand this but just keeps copy pasting same messages showing incorrect calculation. Even after Multiple email exchanges (since they don’t have a simple phone support) the issue is still unresolved. Do yourself a big favor and stay away from this shady bill negotiation support.

Terrible app!. First of all the app kept loosing its connection with my bank account. I tried to get the app and my account rekindled several times. After loosing the link between the two a 5th time. I just removed the rest of my accounts that were linked...or so I thought. This month I received a notification from truebill that they negotiated with Verizon on my behalf and saved me $75. That was great! But, I thought they had no access to my account because I’d deleted it. Plus, how could they pay themselves $30 from my account if it was no longer linked! Not only that, after speaking with Verizon they negotiated a new contract on a phone that has had suspended service since December 2017. This renogitiated a new contract on a phone I had lost and didn’t replace, but still had a balance that I was paying on because I owed for the purchase of the new phone. On top of that, this phone was paid off and totally deactivated/removed from my account in Nov 3018. Both TRUEBILL & VERIZON are at fault! At this point TRUEBILL COST ME MONEY rather than saved by adding a contract to a line no longer viable to the tune of at the end of the one year contract on a deactivated phone of around $240. I’m responsible to pay on a contract for a deactivated phone, PLUS THE $30 they paid themselves. So, now I’m out of pocket $270! Will Truebill return my $30 for the fiasco I’ve had to clean up! Stay tuned!

it's aight. I was mostly wanting to use this app to cancel subscriptions I forgot about. They make it seem so easy in the ads, like it's just 'one button.' No, it's a lot of buttons. You have to give your login and password for the account subscription you want to cancel. If I knew my login info then I could just cancel it myself? If I can't cancel it myself because I can't access the account or their service's business model doesn't allow for it, I just contact my bank and have them block the up-coming charges. Banks provide this service completely free of charge! This app's 'hassle-free cancellation' feature is click-bait. If I'm going to go through the process of resetting my password (because I forgot!!) to provide to the app then I will just take the one extra step to cancel the subscription myself. Some of these reviews seem like they are written by people who fail to check their bank account statements regularly or baby boomers who don't know how to utilize bank notifications. Get a grip, man. This app is basic. If you want basic features with nothing-special functionality then this app is perfect for you!

Pretty close to useless. So, if you don’t have a banking app, maybe you would find this useful. But really, probably not. My bank TEXTS me within minutes whenever I make a purchase. Truebill starts emailing me about my habits immediately upon downloading, as if they’ve studied my spending for years. So for the first month, every purchase is an alert! How exciting ! So they send you a bunch of emails about your spending. Then make an “unusually large” purchase at the Secretary of State around your birthday (now why would anyone do that??) and Truebill will alert you several days later, multiple times, about your spendthrift ways. If I could charge them $5 for every useless email, I would be making out, even with the $7 a month I pay for their “service”. But don’t worry, Truebill can cancel subscriptions and save you $$$$. Yes, as long as you know the email and password and all the other info you would need to cancel the subscription with the subscriber. So, if you think Truebill is going to save you from the Netflix bill that someone signed up for and then died without writing down the password, NOPE, just cancel your bank card, it’s way easier and maybe it’ll knock out the truebill subscription too!

Best thing I’ve done financially. I’ve literally never felt so secure. Literally. I don’t have a numbers brain and I’ve been struggling since my twenties to learn how to budget or understand where my money is going and how to get ahead. This app has my back at all times and I’m glad I found it. I used to use my banking app transaction record to gauge where I was at but I felt like I was always going into overdraft and I could never figure out on my own how to neatly organize when my bills were coming…this app has a calendar that shows you and tells you exactly when your bills are due to be withdrawn and that ALONE has helped with my anxiety surrounding finance. You can link every financial account you have to it (I actually am having trouble linking one but I think it’s more to do with the account I’m trying to link thank with Rocket Money) and see right where you stand. It shows you exactly where your money is going and you can categorize your spending with dozens of preset spending categories or make your own. I haven’t even delved into how much this program can do and I’m so excited to see where I can get with it. The $48 I spent for premium access has probably already saved me just as much. If you’re someone who feels lost and hopeless and down all the time when it comes to your finances, I would totally recommend.

Wonderful App and Support Team. I really love this app. It has a wide variety of features and it's incredibly easy to use. The free version is pretty good, but the premium version is amazing. When you subscribe they ask you to post what you think is fair; from $3 up to $12. I had been using the premium version for quite a while. I went in to unsubscribe because, and only because, I'm not able to work right now and I could no longer afford it. I had already went down to the $3 minimum for premium... When I continued to cancel the app asked me why. They gave me a free month of premium for leaving written feedback. Now, I'm not tech-savvy in the slightest and have a really difficult time with numbers. I was able to add all of my financial accounts into this app and see it all in one place. And it may seem like a silly thing to cry over for the average person... but having learning disabilities and being financially crushed by the pandemic made a free month of premium service overwhelming. I can't thank the people who created, run, and constantly work to improve this app enough. I fully intend to re-subscribe and pay the maximum $12 when I can afford to. Because that's what I think is fair.

Misleading Savings. I downloaded the app and signed up for the negotiations just to see what it would be like. They negotiated with my cable company and got me a lower rate and I thought it was great, BUT they stated I would save $308 on that contract for the year and charged me the 40% ($120ish). About 3-4 months later my cable company starts charging me more saying the promotions negotiated expired. At the end of the day I paid my cable company what I would have if not more because of the deal they made plus I paid this app the savings I never got. I reached out through email after they automatically renegotiated a year later (I missed the email they sent as a remind like a week before they renegotiated, (which is not a reasonable amount of time to give a warning as most companies send an email 1 month in advance for renewals) and I told them before I was charged that I wanted a refund for the prior year. They emailed me back saying to send my statement so they could see the proof of how much I was paying and I did. Then they never responded back and charged me another like $90 for this years “savings” that I highly doubt will be savings. In theory this was a great idea, but unfortunately the application was performed improperly causing a misleading “savings” and a cost to me instead of a savings for me. I highly recommend doing negotiations on your own.

I have a problem/suggestion. I’ve had rocket money for a few months now. I really do like it. Connecting it to your bank is pretty easy for the most part. But i do kinda hate the “system” you could say for how it recognizes subscriptions and bills. So i first had to manually enter in my apple subs. Because they are all the same title on my bank, and i can’t change them there. But later it had noticed that they were recurring. It kinda just added one by itself. But since they’re the same title it thought that the subscription was being raised/lowered. And it had grouped them all together somehow. Like it right now says that they’re “grouped/bundled into one”, but then why does it think that it’s been raised/lowered when every new individual one gets paid. Ideally i’d like for them to all be separated. Why doesn’t it allow me to separate them? Or add them manually and recognize that they’re different through my bank, and it can see its recurring basically? Is that even an option i really don’t know. Because it couldn’t see on my bank the different payments, were separate when i had first manually added them. I think that lowkey really annoying. Is it just that way because they’re apple subscriptions. Idk i’m just confused.

Might be too early for five stars but…. Full disclosure: I have had Rocket Money for maybe a week? I just started the free trial today. I can’t speak to the premium services or customer support.. BUT this company is so obviously one that can be trusted. For one, they offer a sliding scale for premium services! I have never seen this done. I’ll be sure to increase my monthly price if month after month I’m finding this app to be a staple in my life. Just using the free services might be enough for you though! Since starting Rocket Money I’ve been alerted when my account was getting dangerously low and was able to rectify the situation before there were consequences and I’ve also been notified that a large bill was due to come in case I may need to make preparations for it. I can now easily count the amount of bills I have from now until payday and that includes all the pesky subscriptions I forgot about. There’s so much to be said about this app from just a first impression point of view. I normally never rate this early but hey even if I find some flaws… this app is a keeper!!!! (Remember everything I’ve listed here is FREE… I’m not even sure what to expect if the premium stuff but if it’s anything like the free stuff I’m sure I’ll love it too!)

Worth it for me!. At first I didn’t get the point of paying an extra $5/mo for a service that touts cutting your unnecessary subscriptions down, but this has already saved me more than I’ve paid for it! I just had an issue where an ex-leasing office tried to charge me again (when I shouldn’t have been since my lease was already over), & because I didn’t have the amount in my account it got returned by my bank. I’ve never had a return like that before, so I wasn’t aware I was going to be charged $30 for it, but Truebill notified me of it! I likely wouldn’t have even noticed it because I didn’t expect it, but because Truebill told me I was able to contact my bank to not only get that fee charge reversed, but stop payments in the future so the leasing office & my bank can’t keep charging me $30 every time it inevitably fails. In moments that I wonder if it’s worth it, something like this helps me know it is. Having notifications about my budgets (before I go over) really helps too, & reminds me to tighten my belt to make my $ last so I’m no longer living month to month. If you have the extra $5/mo to spend, I highly recommend it!

Don’t opt for the discounted bill service they offer!. I set up my account with them and requested to have my bill lowered through their service and it was all a lie. They told me they would lower my monthly bill while keeping my same phone service quality but they in fact lowered my phone service quality to achieve my lowered monthly bill and then charged me for doing so. After I fixed the mess they did, I asked them for a refund and they said they couldn’t do so because they had done their part of the service. I got in contact with an AT&T representative who told me that all true bill did was lower my phone quality to achieve a lower phone bill and when I contacted their support team about it, no one responded to me for months. When i finally got a response they told me I was wrong and that there was nothing they could do. I had to send them screenshots of my AT&T phone bill and statements from my AT&T phone bill showing exactly what they had done and how it affected my service until they finally gave me my refund. It wasn’t the money, it was the principal. They promised something and when they didn’t fall through with their promise they denied it. The amount of the refund wasn’t the problem. The problem was that they were shady and untrue to their word. If you haven’t downloaded the app yet, please don’t. Save your time.

This app an an essential. I was skeptical at first- i thought there would be some usability issues or that it wouldn’t be worth paying for- or that it would be something that I would look at then realize I don’t need, BUT… This app is awesome. I have been so impressed with it. I had two bills lowered and I synced all my payment accounts to keep track of them easier. I get reminders for like each payment, and the app identifies all of your charges to trace them back to any unwanted subscriptions, and it is so easy to cancel them because Truebill will do it for you.. I’ve also had them cancel something for me which was super convenient. I use the smart savings feature which is also super beneficial- it just pulls micro deposits out where it’s able to, and it can be withdrawn if needed at any time. I have recommended this app to everyone. If you’re concerned with cost, you can choose how much to pay for the app. It is definitely worth trying at the very least. I’m absolutely blown away by this app and I hope they continue to find new ways to make personal financial management easier!

Was very hesitant....and then it transformed our financial stress to understanding.. I looked into using TrueBill a while ago and initially decided against it. Wasn’t sure how legit or helpful it would be. Months later I spent about 40+ hours making spread sheets, combing through every single expenditure between my husband and myself. It was grueling, agonizing, and my head was spinning constantly. I ended up losing those spreadsheets in a computer crash the same week I was supposed to do our taxes. I decided then and there that it was time to take off my comfy pants and change into my comfy-comfy pants, drink a bottle of wine, cry, buy something online, and download TrueBill. The only mistake I made was not using it in the first place, months back. It’s very user friendly, incredibly comprehensive, saves me an absurd amount of time, and best yet, has finally got me on track of understanding our expenses. I can’t believe everything is all in one place. Every single card, every account between myself and my hubby, every App that we’ve bought and forgot about, every subscription etc, our credit score.....its a no brainer! I could continue my praises but I’m hungry now....

Simple and easy for my life. My life is stressful as it is. And money can definitely take over majority of that feeling. It seems every time I look in my account I have no money for my life style, because I have unknown subscriptions, bills and payment plans to pay for that come out of nowhere. I feel like I don’t even have enough money to put toward my future plans too like buy a car or get a new phone, save for a house etc. I was terrible with my money choices and even worse when it comes to remembering how much money I had to pay for my subscriptions and extra reoccurring transactions. but now with rocket money, after being with them for a few months now I feel so organized! I just simply sign in, check my balance and I feel like I don’t even need to do anything! Not only can I keep track of my subscriptions and future payment plans, it tells me when my next payment is due. Which gives me plenty of time to set some money to the side for rainy day or my favorite, treat myself. It’s just perfect for my busy lifestyle. So far no complaints here!

Literally changed my life. I have a lot of anxiety about money, and it always made looking hard at my account and budgeting something I would avoid. Rocket takes the sting out and does the organization for me, giving me all kinds of metrics to help me analyze my spending better. First Rocket helped me cancel unneeded subscriptions, even reaching out on my behalf to cancel them. So that was $300 a month right there. Then the way the app categorized my spending, I have been able to focus on problematic areas one at a time. For example, seeing just how much I was spending on groceries empowered me to come up with new ways to save there. I was surprised that getting takeout meals *saved* us money on our food budget. I like being able to see what bills are coming up and when we are getting paid. I’m probably saving a thousand a month at this point, and planning on saving another thousand within a few months. Highly recommend this to anyone who struggles with money and has anxiety about it.

Do not trust them with your money!!!. I don’t typically write reviews on apps but I had to on this. Basically, you are giving very very sensitive details on your bank account to people you don’t know - that alone should stop you! I was unpleasantly misguided into doing this myself. I set up a “smart savings” account thinking it was just going to transfer funds to my own savings account. But no, it is not explained to you when you do this but those funds get transferred to another bank that you do not have access to! Not only that but it takes days for transactions to go through, so withdrawing or cancelling the account is nearly impossible. Their customer service is very terrible. The “Chat with us” window comes up blank and they make it nearly impossible for you to get ahold of anyone. If I were you, I wouldn’t make my same mistake. This is your money. If something happens to the company your money you invested with them will go away - specifically because they do not give you any insight on what account this is. I will not entrust another third party person with my money ever again. It is much safer to just keep up with your spending/budget/savings with your own bank or through a system you have control over!

Caught a fraudster my bank missed!. Every month I have a small payment for cloud storage. This month, as usual my storage went through but the same day another payment SEVEN times my normal payment went through. I noticed it immediately and called my bank. There wasn’t any information such as a phone number associated with it and even they were perplexed but said they’d send a form to fill out. My daughter suggested I try Truebill to see if there was any other information. When I added Truebill a phone number popped up with the charge. Googling the disconnected phone number I found a confirmed fraudulent account with many of the same charges like mine so I sent to my bank. The charge was eventually reversed and I had my money back. I never thought I would need an app like Truebill but it’s much more than just keeping track of what you spend or how much you save. And I hope more people try it out to see for themselves how easy it is to use and how beneficial it is for so many areas of life. Thank you, Truebill!!!

The BEST financial management app and service. I have tried a multitude of apps and services to manage my personal finances. Truebill is by far the best designed, most considerate, most reliable, easiest, most comprehensive, and with impeccable customer service. I have wasted hundreds of dollars and days of my life inputting data, being frustrated by broken UX and UI experiences and generally disappointed with the lack of insight provided to me by other financial management apps and services. Truebill is unquestionably the best app and service commercially available to consumers. The ability to easily cancel subscriptions is just a bonus. Thank you Truebill for the effort you’ve put into the management of your company and quality of your product. Everything about this product and service shines. I’m sure it won’t be too long before Truebill is acquired by some major corporation or financial institution. And although that acquisition will be great for everyone working there or investing - it will undoubtedly ruin the product. But until then — look no further Truebill rocks.

LIFE CHANGING!. First and foremost I never or rarely ever write reviews but I was asked and I simply had to. This app is absolutely phenomenal and truly life changing the way it organizes my expenses my bills my subscriptions and allows me to see it all in one place, simply in-genious. Been waiting for something like this and it definitely beats setting up all my bills on my notes app and setting up reminders for when my bills are due. The ease and use of the app is awesome, and the fact that everything is specifically categorized and labeled properly helps so much and then it also gives you the option to set up your own categories. You can easily cancel any subscriptions you don’t want or use and they help with lowering bills and lastly you get a good look at your credit score as well in the app completely free. AND THE FACT THEY LET YOU CHOOSE THE AMOUNT TO PAY FOR USING THE APP IS AMAZING ! I Legit I have nothing but great things to say about this app it’s simply a GAME CHANGER!! Definitely earned its spot on my home screen of my phone and one of my most important apps right now with helping me organize my finances and life ! Thanks TrueBill!

Tracking your budget to freedom. I love this app. I decided to try it out because for the past two months, I’ve accumulated almost $1200 in overdraft fees after falling short on planning and managing my automatic payment withdrawals. This app has access to my spending and charges, let’s me know when I charge is about to post and allows me to get ahead of these payments in the event my balance is low. It’s unique in the sense that it takes all of my finances into account since I primarily use one checking account to pay bills and to spend. So, the app is able to detect if something is a recurring charge and it seems to increase in accuracy and functionality as I continue to categorize expenses. I was able to reschedule payments based and even negotiate some of my bills or close subscription accounts if I choose to do so. But I mainly appreciate this app because it’s allowing me to spend less time obsessing over balances. Now I’m more focused on managing expenses and taking control over them instead of reacting to them.

Great for single moms. As a as a newly single mom, I can say that this app has helped me with my finances, I work two jobs to make ends meet and it’s easy to forget things, when you have a lot of other worries going on in your life. It provides an overview of your bills, spending habits, what’s coming in and out of your account, how much your spending on a specific item. Also how to save. I was able to lower my car insurance by $53 dollars, by a recommendation I got from Truebill, which to most may not seem like a lot but for me, it was a big deal I cried, I have no help financially, it’s just my son and I, of course I got emotional, since I knew I was able to have an extra 53 the following month. You can pay how ever much you want for the app, as low as $1 a month. I had so many subscriptions for apps I had no clue of, and they cancelled it for me, I didn’t have to take time out of my day to cancel it, which helps since I work 1st job 9am-6:00 drive home To go to my next job at 7pm- 1am I have no time to call and it gave me piece of mind knowing I can actually rely on an app. Thank you for whoever thought of creating Truebill.

Game changer for our family’s spending habits!. Rocket Money has completely simplified our finances! It has made tracking what we spend, finding unused recurring transactions, staying on top of bills, and identifying where we need to cut back a breeze. You upload multiple accounts and credit cards and it does the rest for you. It even allows you to split transactions into multiple spending categories. I haven’t used this feature, but RM will negotiate lowering certain bills for you… hoping to look into this soon. My only request would be to be able to create sub categories under each main spending category. For example, I can see the total amount we spend “eating out” but would like to be able to break that down to see how much my husband, each child, and I spend individually on eating out. I used Quicken for years, and RM is easier and just as useful/helpful. I would 100% recommend paying the small monthly fee and letting this app help cut your overall spending and expenses!

I use it everyday!. Truebill (premium) has been life changing for me. I was once a reckless adult spending frivolously without tracking where my money was coming in and where it was leaving. Truebill has been the utmost game changer for me. I now have a clear picture and easy to understand reports of my spending habits and income and it has become so easy to categorize my transactions and receive an accurate visual of my expenses. My only con is that sometimes, some transactions that are recurring (I.e. weekly transfers from my checking account to my savings) aren’t recognized and I have to change it manually. It would be convenient if the transaction were to be automatically recognized. Other than this, Truebill has truly saved me and I thank the developers and staff for this godsend. I used to have Mint and I never liked the setup of the app, although I’ve heard good things about it; that app just wasn’t for me. Truebill, I feel, has a clearer organization to it and makes it easy to make custom categories or notes on transactions for your personal use. 100% recommend.

Loved it until Customer Service. Until my account link broke, this was the best thing I had ever done financially. One day the account link showed it wasn’t connecting and I needed to fix something on my bank side. I contacted my bank to see if there were security documents needed, signed, or some money expected expense that didn’t get paid or anything that could cause a hold. I then followed the instructions on rocket for the next step. I unlink my account which required, transferring everything I had saved to rocket back into my bank first, then, broke the link completely by deleting my bank from rocket. I cannot reconnect, because rocket says there’s a problem with my bank and my bank has no problem with me. Reaching out to customer service is message only. They advertise live messaging, but it takes up to a day according to them, which is not live. This is my money we are talking about. And they cannot even have a phone number available for me? I messaged the customer service and about six hours later was told it was being elevated to tech-support, and I should wait up to a day for them to contact me. When money is involved, this is less than desirable to me. All the reviews are reps and I’ll talk about low expense for this app but I paid $50 for a year. Get a phone number.

Not sure what to think. I’m not quite sure what to think about the app yet - on one hand, I really like the interface of the app and the features it has. The potential to add my various accounts and have a “quick look” at my upcoming bills is nice, other apps do this too but the layout within this app is one of the better ones. However... I don’t know if I’m doing something wrong or if there’s a glitch or what, but even after linking my Comcast account the app is displaying the incorrect amount for my next bill; I tried unlinking and relinking it but no change. Also, I can’t link my Verizon account! It comes up as letting me add it for the “bill negotiation” feature (which I have absolutely no interest in) but when I try to add it under the the regular account menu it doesn’t even come up in the search (the only Verizon item that comes up is “Verizon Benefit Connect”). I want to like this app and give it a go with the premium features but these things that should be simple fixes seem overly complicated and on top of that it seems that the customer service is non existent (I used the in-app chat and got a response that they would be back after 30 minutes but several hours and follow up messages later, still nothing). So - not impressed at this point.

Missing Two Things. I love this app, and it is VERY user friendly. I would recommend it to anyone who needs a reliable budgeting/bills app. There are two things that I think would set this app apart from other budgeting apps and really take it above and beyond: 1) Create your own category: The categories are great, but I would love if we could create and name our own categories, and then apply transaction rules to them just like every other category. I have some purchases that are odd-ball, and they kind of fit in one category and kind of work for another, but having my own that I can apply my expense cap to and work into my budget would make life so much easier. 2). Rollover budgeting: Oh how much better I would feel making a “bigger than my budget allows” purchase if I knew that I had THIS amount total I didn’t spend from my budget last month that can rollover to the next month and build and build and build. I know RocketMoney does a “Left for Savings” spot for income - expenses, but that doesn’t really me “you can take the remaining unused money from last month and use it for successive months.” Even if I do ultimately put that into savings, I would like to see a dedicated spot for a rollover budget.

Great app - one major issue. I wanted to use and love this app because I loved almost everything about it. The one feature it’s missing that kills the deal though is that there’s no way to turn off the default AI auto categorizing transactions. The reason this ruins it is because when nearly every transaction gets auto categorized, we, the user, lose track of our spending - because the AI is wrong a lot, and it will never be perfect. Here’s how I think it should work… Every transaction needs dealt with (have each new transaction be in the notification tab or something). But after you categorize a transaction for the first time, you can assign a rule (like it does currently) to always categorize it that way for future transactions, or don’t create a rule and it will need to be manually dealt with for similar future transactions. This would help users “own” their spending so much more and really allow them to feel in control of their finances, especially for those one off purchases that happen all the time that need to go into a specific category but get lost with the current auto AI categorizing.

Truebill is awesome!. I’m very into having apps and programs helping me with my banking. I’ve been using Quicken for personal and business since 1997. Truebill has been the easiest app to load all of my bank accounts and investments and it’s keeping track of my bills for me.. something I (along with most people who pay their bills!) am always worried about- is it getting paid on time? Am I paying more than I was? Do I have enough to cover upcoming bills? WHAT ARE my upcoming bills?? Reconciling through Quicken has always been (and I probably always will) a necessity for me. But Truebill has kept me from opening Quicken for over a week! I am getting all the info I need right now! They found extra charges I probably never would have known about. Transactions come through in one place, including my investment accounts. Truebill questions transactions I never would have noticed! I’ve already gotten back over $200 due to discrepancies THEY found and notified me about! And their customer service is awesome too.. thank you Malcolm! 😊 I am loving Truebill! Whether you’re into pouring hours of your time into your banking or you’re on a busy schedule but you want to keep track, Truebill is an awesome choice! Oh- one more thing- I pay $99 a year for Quicken.. Truebill is FREE! How can you love money and NOT LOVE THAT!!! Thanks Truebill.. You and your team are awesome! - Jessie K.

Very pleased with the platform.. Since being a user of Rocket Money for several months nearly to a year. The app and via Internet site is user friendly, easy to navigate, does well mapping out finances. More importantly it highlights on a lot of things that are hidden, or that the user/client might have forgotten about a subscription or a withdrawal of drafts. That way you’re able to see what is being taken out and no longer is needed in your life. Especially if it’s coming up on a yearly renewal, it helps to avoid something to go active again for another year if you’re not gonna need it. One of the best benefits and features is that it negotiate bills and cancels subscriptions. Another is the exposes hidden fees and drafts. To add with one more Rocket Money, will cancel what ever you choose is not needed in a timely manner. All in all; I love the app! Zero complaints. My only opinion is that it can improve on credit area with more, faster updates. But that is a minor thing. Caio! Loya

VERY Easy for New Budgeters, & Hesitant People. After a friend suggested Truebill, I downloaded the app and set it up. I was hesitant that it would be like all of the other financial apps: complicated, not worth the time/effort, not user-friendly, etc. I was wrong! Like most people, budgeting is not my favorite activity, yet Truebill takes away all of the stressful aspects so that it makes it a breeze! There are other aspects to the app that I have yet to utilize, but by simply categorizing my purchases, tracking my income, and seeing where/how my money is spent, has been a huge eye-opener. I just signed up for premium so that I was able to add notes to my purchases, however I am so happy with the ease and accessibility of the app, that I know the other premium benefits will only add to my appreciation for Truebill. As someone who loves to be very efficient with my time, this app will do most of the work for you, so that when your dragging your feet to start budgeting (like I was), it takes away the scary feeling of facing data, tracking expenses, creating a budget, and looking at financial weaknesses. I cannot express enough how much Truebill helped me face my fear of handling my finances, because of its ease of use.

Your personal accountant/ money management app. I love it, people say words cant describe certain emotions or things but this you can ! And heres why it tells you the details you need unlike banks just telling you info like this was spent there and have no idea what it was, was it gas? Groceries? This app explains it and puts it in statistics and organizes it for you and you can customize certain expenses. Helps you with savings with your monthly subscription for car insurance or wifi subscriptions and etc…, i have not yet tried it but i do once i have the time since it’s The end of the year. Anyway it is neat, user interface is friendly and easy to use and has an option to have an emergency savings plan?!?! What?!? Its Where technology will take small amounts of money and out it into a certain savings account and you can withdraw from it all you want unlike banks!! banks allow 3 withdrawals from saving accounts and them they charge 15-30$ per withdraw and that can be frustrating. where has this been all my life!!! Thank you rocket money for an app that will change lives and make day to day finances easier !

Rocket money. This app is great for ppl who’s trying to get their finances in order or if you’re trying to keep track of your finances of where your money is going or if you’re trying to make a huge purchase I recommend this app because it goes back years and you are able to see where you made a mistake with spending money you didn’t know you had this app has been amazing I’ve been able to keep track of my savings my spending my bills my extra money as well as the days I get paid or have extra money coming in. This app even track your credit score for you as well I mean think about it this is a life tracking finance app I pretty sure when you’re done with this app you’ll be on a budget plan so good that you’re not gonna even notice that you’re budgeting and you’re be-able to buy a house condo or the car that you want this app is amazing make sure you link your acct so it can show you what goes in and what goes out this app have change my life tremendously and I don’t even leave reviews but Chile get into it real quick

Service. Im a fairly cheap person not going to lie and do not like spending any extra money, but im also a visual person. This app helps me visually see all my bills an I can see all my accounts to easily see whats going on and when money comes in or out. It also helps me budget everything and gives me new ways to save money. It has been helping a lot especially because Im fairly young and just started building up bills and want to stay organized, but still keep track of my money. Its an easy way to balance everything without writing it down or trying to memorize it, but you can also add in or adjust bills as you please. If you are interested in upgrading its only $4 a month right now which im considering as its very helpful. They do also have a free trail an you can use the app without having to put any money towards it. Overall i have recommended this app to friends and family and think its easy to use, connect and beneficial. The only thing on your end is you just have to commit checking it every once in awhile to maintain the benefits of this app.

Love it!. I don’t usually write reviews, but I wanna give credit where credit is due. This app is honestly extremely user friendly. I love that I can exclude certain purchases from my budget (eg. if my brother sends me money to buy something for him, I can hide that from the spendings because it’s not part of my usual budget). I LOVE that they say you can pay them what you feel they deserve! (Min of $3/mo and above I think??). Another thing: this app has helped me build my savings!!!!! This is most important part and why I am writing this review!! I always thought for savings it had to be a huge chunk of money going in at once to make a difference but even $50-75/week is hardly noticeable on your bank statement (honestly money you’d probably spend on dumb stuff and/or fast food anyway), yet it packs such a punch on building it up. It’s so easy. I don’t have to think about it. It just gets taken out of my account, put into a secure place, and I can take it back out whenever I choose. I love this app. Sorry for the lengthy review, but honestly this is the most useful app on my phone 🤷♀️👍👍

Hands down BEST. Bill tracker available. Bar none. I’m taking control of my finances and actually paying down the debt now that I can accurately see and establish a budget with what’s realistically coming in and going out of my account. It’s so easy to get overwhelmed and think you’re just not bringing in enough money. For most of us that’s not actually true. This app will demystify your spending and help you turn a corner in your financial journey. Just use their easy hookup process to link your bank and credit cards. Some loans may be on there but mine isn’t yet. The app then does all the tedious work of actually tracking your spending for you automatically and spits out all the data in easy to understand graphs/charts. You can also easily see upcoming bills in a cool calendar view that shows EXACTLY which and how many bills you have before payday. Very very useful for those of us with hella subscriptions and a few credit cards. Literally could go on about this app forever. Experience it for yourself. Never going back 🙌

Wonderful all around budget/subscription/$$ saver. I just started on Rocket yesterday and I am already thoroughly impressed. For starters they let you choose what amount you want to pay per month. Whatever you think is fair. It goes as low as $3/month. Second they offer so many money saving possibilities. Like telling me about a recent bank fee for $25 from an uncleared check. Rocket told me most banks will reimburse this and they even provide a script of what to say while calling the bank. I was refunded from my bank!! They have a budget planner that seems pretty good. I need to mess around a bit more with it. They track my income and spending. The only thing I would say could be a bit better is that I don’t see all of my subscriptions and I was hoping they would all be pulled up because Rocket uses my bank account info to find all of subs and spending habits. Overall it has been helpful. It is telling me places I can use for better car insurance. They even can request that my bills be lowered from places like my cable company. I will just need to pay Rocket 10% of my savings. I say this app is going to be helpful

Amazing Service. TrueBill fully delivers with its services, and it's extremely useful when it comes to managing your finances. TrueBill lets you view a comprehensive report of your transactions across all of your accounts, set up automatic savings, plan multiple budgets, view your full credit report get your paycheck in advance, & even renegotiate your bills. Personally I only use few of these, but having a full transaction report dating back to the first transaction available, and being able to organise transactions into custom categories helps me put my spending into perspective. Unfortunately the "free" label on this app is misleading. Only about 20% of the features are available for free, while two of those features have restrictions for free users, & I honestly just find two of the premium features redundant. But I'm easily willing to pay 3 dollars a month for the ease and practicality of their services and highly recommend you download the free version to see if their services are worth your money.

From confusion, overwhelm, fear to clarity, progress, relief!. This app is amazing! I cannot recommend it enough! It took me from groping in the dark about my subscriptions and auto payments to being able to see clearly, not only the big picture and next steps, and upcoming automatic payments so I could prepare, but also, with just one click, all the pertinent details for each. But that’s not all! With just another click or two I have detailed instructions on all my options to cancel the subscription. And all of this with the free account! What would it do for me if I had a paid account! Wow! There is no way to calculate how much time this has already saved me! Now, instead of having to block out chunks of time to sit down and get a handle on my finances, and figure out what to tweak, I can easily make significant progress in just minutes, during a break at work, or when I am waiting for an appointment. There is no wasted time trying to remember where I was and what needs to be done next. Just open the app with my fingerprint, and it’s all right there! Exactly what is coming up in the next few days, in plenty of time to be ready for the payment or cancel if it is no longer pertinent! I vote this the most impactful personal finance app ever! Genius!

Don’t bother.. I decided to get this app because the reviews looked good and it sounded like a perfect way to trim unnecessary spending. Now I’m hoping to save someone else the bother. This app did not work AT ALL. It repeatedly asked me to add my bank account after I already had and it showed my bank account listed. The first day it showed an inaccurate account of the money I had in my bank account and it NEVER changed. Even after a pay day. Never showed any subscriptions. Never showed that I paid any bills….Nothing. Nothing showed. It just kept telling me it was gathering data. I thought “well maybe it would be better with premium. So I signed up for a paid subscription”. Nope, nothing changed. In fact the only thing that worked was the part where I signed up to pay them. Tried to cancel and it ran through 3 pages telling me that I’d miss out on all the services I hadn’t even received in the first place, just to finally tell me that since I signed up through Apple I would need to go there to cancel. I signed up on the app, I should be able to cancel through the app. Just one more hoop to jump through. Honestly the only thing I have felt good about in reference to this app is that I am now done with it. I’m not sure how anyone gives this good reviews. If I could zero to negative stars I would.

Perfect Financing App All-in-One. I got this app because I wanted to start tracking my spending. And let me tell you it does one hell of a job for that!! It sorts my spending in different categories and even compares my spending month to month. I’ve been trying to save up for a car (I’m a college student) so I really wanted to know where all my money has been going. This app makes it so simple and easy to track all of it in one place. It has a saving feature (you don’t have to use it) that takes money out of my account and puts it aside so I can save up without having to lift a finger. It tells me the amount and what kind of bills I have coming up, so if I need to cancel anything I know about it long before hand. My favorite part is TrueProtect. This feature allows them to help negotiate lower rates for your bills, get refunds for internet outages, lower your energy costs and even cancel unwanted subscriptions. If you don’t want to deal with those payments, they will even contact the company on your behalf! No more calling and waiting on hold for hours! On the home screen, the dashboard, it shows exactly how much money I have on hand, saved up, invested, my card balance and spending for the week/month/quarter whatever you choose. This really is an all in one when it comes to financing. This app is nothing like the rest!

This helps keeping me on tract!. I kept seeing the commercial and finally downloaded the app! After looking around it has a good dashboard to keep me on top of everything! We just bought a house and I felt like I was hemorrhaging money! It was getting kind of scary. But they started moving money from my saving to a saving account in small increments and it was like finding money from the tooth fairy! I am getting ready for retirement and this has been the smartest thing I could have engaged in lowering cost and paying off bills. I won’t even have a car loan, and my house will be almost paid off by the time we stop working. If you need to learn how banking works and budgets do work and you won’t feel deprived at all. Remember this Money gets more expensive the worse your credit is! And maybe you want to get that spiffy car that will impress the friends and family! Think of how impressed they will be when you can get 4% interest loan or lower! This where you go to accomplish these goals or learn what your goals should be!

love it! (Detailed/more than I expected). I was truly skeptical at first because there was yet another budget app out I saw the advertisement MIKE-CONTRACTOR casually spoke on it so I thought I’d check it outAfter watching the features and benefits in the App Store hearing his satisfaction with it and the commercial I thought I’d give it a try right away I was truly surprised at how the details or set up just how the system was set up an general I have been using the Mint app but since they upgraded it just didn’t feel right and a lot was missing I am pleasantly surprised with Truebill it has so much information I love the platform how is broken down the subscriptions area I just love everything about it I’m like wow the way they put it together and monitor everything it’s just wonderful makes it so much easier to budget I signed up as a premium customer right away I just knew I was in the right place I’m getting the field for everything now and getting all my finances and subscriptions together so I can personalize everything but I am looking forward to it paying off and really helping me

Best personal budget app. TL;DR: Truebill is smarter, easier to use, and more powerful than Mint and other budgeting apps I’ve tried. The primary pain point of other apps is their consistent inability to accurately and consistently categorize transactions, making their reporting features largely unusable ($8,500 on “uncategorized” last month? Really, Mint?). Truebill does not have this problem. I had a few regular non-payroll income events that I needed to help it understand, and a handful of transactions to assign to a category, but the vast majority of the heavy lifting was handled by the app. As a result, I have the most accurate view of my finances any app has been able to provide. It also offers some powerful planning, cost-cutting, and savings features. The interface is intuitive, and the feature profile is rich. I have banking and investment accounts across several institutions and it had no problem establishing reliable connections with any of them, including other app-based investment accounts. Recommended for anyone who wants to confidently put their personal budgeting on autopilot.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

You want to have a overall picture of you finance with just an app?. Definitely check this app out. For years I have been living paycheck to paycheck. Even going into the negative in my bank accounts. My spending was horrible and the list of hidden subscriptions were astronomical. Worst of all I was getting into loan debts because I could never have a full picture of what my financial situation truly was. Lastly I finally asked myself, why is it that when my career and pay upgrades my debt swallows everything. And the answer poor financial planning and financial goal setting. Download this app if your financial history is complicated. It definitely has tools to help you in anyway. And the app is easy to navigate. I have only had this app for about three paychecks now and so far I am slowing pulling out of the paycheck to paycheck living. I hope my review helps someone whose financial journey needs some help like I did.

Exactly what I’ve been looking for. Rocket Money is exactly what I’ve been looking for in an financial app. All of my institutions are able to link information (albeit some have issues linking regularly), Wells Fargo linkage works like a charm and even categories line items from my credit card in with my debit card which I LOVE. Loans like education and my mortgage link well and assets like my 401k and some stock options occasionally have issues linking but I’m able to manually add values… those sites often require multiple steps of verification so I suspect that is why I have issues with automatic linking. But the best part is the graphs and charts and history and trending reports I can view at any time. Before I started with Rocket Money I was attempting to get this level of detail by myself on excel but this is so much more accurate, automated and up to date. Rule setting for expenses is amazing also. I’m looking forward to my next step in this journey which is budget setting.

Really Helpful. For just $7-8 a month, it helps me a ton with my finances. It tells me how much I’ve spent on different categories of things (eg. Groceries, dining out, rent, etc.), how this compares to my budget, how it compares to other categories I’ve spent (in a pie chart), and how it compares to previous months of spending. I don’t have to do any of calculations to figure out what I’m spending too much money on, or to manage my subscriptions, or how much money I have left in my accounts. Rocket Money does it all. I think this app is a must have for anybody trying to budget expenses, manage subscriptions, and to make sense of all the numbers of individual transactions that often make it hard to see the forest for the trees. That said, it does cost money. Personally, I think it’s worth the expense to save all the counting. It’s been especially helpful for me when it helps me realize that this or that particular month I spent more than I earned. Definitely recommend it.

Horrible. The worst app ever. Not only do you have to give them your private information it is so much easier to cancel something that you are paying for than for them to do it. I tried it just to see what it was like and they kept asking me for more information about the account. It was an audible account but they kept asking for email addresses and what my name was. My suggestion is check your bank account once a month and see what is coming out. Worse case scenario call your bank and have them stop payment if you can’t get ahold of the company. As an addition, the company emailed me in response to this review. They stated that in order to cancel a subscription, as they state they can, they need my email address. The majority of the subscriptions I could cancel didn’t even give me the option of canceling them through their app. It simply gave me options of emailing, calling, or going to the website of the company. This is why I stated that it is just as easy and less expensive to check your account information monthly and do it yourself or call your bank and have them stop payment.

Best THING to happen to me financially other than winning the lottery!!. This app is simply amazing. It’s UI/UX (user interface and user experience) are brilliantly designed and well thought out. The app is easy for anyone to use and take advantage of everything they have to offer. They even canceled subscriptions for me after discovering ones I had no clue I was still paying for every month!! I’m saving money every month by utilizing this app and the best part is the app hardly costs anything monthly. So your monthly recurring payments don’t go up - It’s actually the exact opposite. The monthly subscriptions that we all sign up for (like that 30 day trial and forget to cancel it because the software/app in your trial was not what you needed) go down in price month after month after month! I’d recommend to any human that pays for anything monthly or annually for that matter. They even helped me lower my cost of my internet rates, and cell phone bill! So on top of everything I have already mentioned - This app is an absolute 150% must have for any business owner small or large. I’m a fairly small business owner and new to entrepreneurship and Truebill helps me to categorize all of my recurring expenses and itemize them to be ready quarterly, annually, and/or monthly. My accountant was even impressed this last go around with how prepared I was for filing my taxes. DO NOT WAIT AND GET THIS APP NOW PEOPLE!!!!

Amazing <3. I’m 18 and have started taking on the tasks of adulthood like rent, loan, entertainment (Netflix & peacock), and so much more! I first got this app because I had a reoccurring change of 30 dollars for 6 months straight and I didn’t find out till November :( I got on different sites trying to figure out what the charge was and how to cancel it but nothing helped! I had heard of this app through a lovely podcast called murder with my husband and decided if anyone could help they could and what do you know!! IT TOOK 10 SECONDS. So much money for future me and it helped me see other subscriptions that I didn’t think about! I have a hard time remembering what I do sometimes or 1 month trials I forget to cancel but this is a life saver I truly mean it. Also so sweet how they give you the option to pick how much you think you should pay at the beginning! Absolutely 1000% have never in my life trusted and loved an app more. Thank you!

Truebill Review. I just signed up for Truebill (even though I’ve had it downloaded to my phone for a little while). Everyone is always starting the New Year with resolutions but that’s not my reason for joining. I’m just sick and tired of paying for bills, subscriptions and everything else and not really knowing where my money went (because I’m broke) or if I’m over paying for something. THIS app takes all the guesswork out of my mind. I can finally see what I use and what I’m wasting my money on. Just in setting this up I was told that I’m paying a lot for my car insurance. Truebill told me that and then offered me two other insurance options at a lower price and with the same coverage (and they were, what I call, name brand insurance companies— like LibertyMutual or Farmers)!! As of just starting with this app, I AM VERY HAPPY with it. I’ll try and write another review in a few months (when I can see it in action/or not). I RECOMMEND THIS APP!! Happy so far!! Try it! You’ve got nothing to lose and MONEY TO GAIN!!!! Good Luck!!😃

I was shocked to see the name change but I like it!. One critique I hope they read is this: the app is great so far I’m on day one of my free trial b it I had truebill back in the day……seems like a lot has changed but with that being I think something that would increase retention is a quick app tour soon as someone finishes registering. When I went to add my second bank there were two options to “add account”, but one was add another checking to Your current bank and the other one was to add another bank altogether…..I’m fairly decent with tech so I figured it out but I know if I wasn’t tech savvy that might’ve made me think the app was “too complicated for me”…….great job though I hope this app goes far places 🙏💯 P.S. • where’s the incentive to share the app? There’s no button to share easily accessible somewhere? Also why isn’t their an algorithm to determine if the transaction is tax deductible? How is the average person supposed to know what is/is not eligible for tax deduction ? 🤔 💭….

Completely Customizable and It’s Amazing!. This app allows you to categorize any transaction you want into whatever category you choose. You can write notes for those transactions so that you’re aware of what that purchase was for. Sometimes I’ll make a purchase at the end of the month on my credit card, but the transaction won’t process until the month after. Rather than having that transaction for the current month, I can change the date myself even if it was processed on a different date! Really helps the consistency of budgeting! They have some amazing tools, and the constant notifications keep you updated on how much you’re spending based on previous reports and whether your over or under a certain budget! TrueBill is something I have been recommending to friends and coworkers. It’s THE BEST budgeting app I’ve ever used. The format is super user friendly and I have never needed to ask for help. They just get people! Love it!

Rocketmoney aka Truebill. I'm that person that never writes app reviews but this one I had to. So I'm a long time user of this app and it definitely has it's pros and cons. So first of all I must say that I'm much more of a fan of the old version (truebill) because I found everything to be simpler and more efficient. The app has helped me out a lot, it's the best for managing your budgets, most of the transactions automatically get sorted and it's a very efficient and convenient app for an overview of your spendings. However ever since the company changed and the app itself changed I just don't like it anymore. Idk but I lost that love for it. Also theres a glitch where one random bank account always gets disconnected and you have to reconnect it which sometimes takes up to 2-3 minutes and it gets annoying when you have to do it everyday. I have two other friends who also use this app and they experience the same exact problem. I feel like next to creditkarma and experian, truebill is simply not useful to me anymore. That's why I'm giving it 3 stars. Thank you for reading.

Great help. I recently went through a divorce and among all the stress of the divorce and taking over bills and household chores along with a demanding full time job, it was difficult to sit down and workout a budget to get things back on track. While working on bills one night a recommendation for Truebill came up. In my struggle to keep track of everything this sounded like something that could work really well for me. I work all day on a computer and at the end of the day I didn’t want to have to sit down and spend another couple of hours getting my finances in order. All I can say is Truebill has been amazing and has helped me stay on track and has kept me from sitting at a computer for hours working out my budget. Simply link your accounts to Truebill then do a little work quantifying what the expenses are and your done. If you struggle to do a budget this is the app for you, and it’s simple and easy to understand. If your struggling like I was, this is the app for you.

I don’t know it seems slightly terrible. So if you don’t have credit or bills, there is no other way to get help here besides creating your own plans chances are you are too lazy to because if you knew how to create your own plans effectively you wouldn’t need this app. So if you are too young for credit and bills and net worth but you plan on saving to buy a big achievement this helps in no way. Also they charged me 35 without notification and no clear indication that they could do that. I payed them 3 dollars a few days ago I go to work today and get off go to Dunkin donuts and see this 35 dollar charge. Idk for a money management app it’s terrible but it’s the only thing I have in this category and I can see some of my statements. SOME. It doesn’t even show all your card transactions and they probably don’t connect to your bank properly that’s why they miss information. It’s bad but slightly ok for it’s made for, but of course as an app that’s designed by I’m assuming millionaires it’s definitely horrible. How does this “Truebill” come across a team’s mind they should’ve snatched it and left it behind the barn and invested in crypto imo