Greenlight Kids & Teen Banking App Reviews

Greenlight Kids & Teen Banking App Description & Overview

What is greenlight kids & teen banking app? Greenlight is the family online banking app¹ where you learn to earn, save, and invest together. Join 6+ million parents & kids learning about money and navigating real-world money decisions with debit cards of their own.

FAMILY MONEY MANAGEMENT.

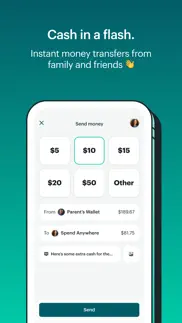

- Receive & send money instantly. Set up direct deposit for working teens

- Kids banking¹ & teen banking¹ with flexible parent controls

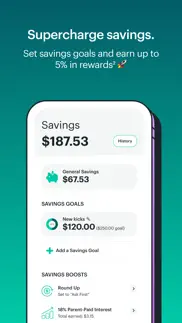

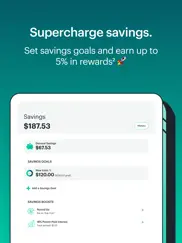

- Set savings goals & earn up to 5% in rewards²

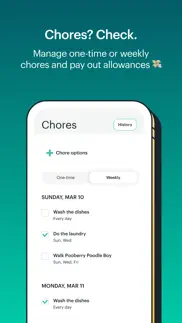

- Keep track of chores & pay automated allowances

- Kids and teens learn investing or invest directly with approval

- Get real-time spending notifications & set spending limits with Greenlight's debit card for kids & teens

- Play the Level UpTM money game to boost financial literacy

- Unlock purchase, identity theft, & cell phone protection³

- Keep your family safe with location sharing, SOS alerts, crash detection⁴, & more

TRUSTED BY:

- The New York Times: "Every conversation about money is a conversation about values waiting to happen, and these products can help inspire those discussions with your child."

- Parents Magazine: "Greenlight allows some independence for kids and teens to manage their money."

- CNBC: "The Greenlight Family Cash Card's up to 3% return on everyday purchases is extremely lucrative — whether you're a parent or not."

6+ MILLION KIDS & PARENTS SAY:

"My teen is learning to manage his own money. I wish Greenlight was around when I was a kid! I tell my friends & family about it all the time!" – Patricia A.

"I love Greenlight. As a mom of 4 kids, it makes paying allowances & spending money for trips so easy." – Samantha B.

"Traditional banks don't make it nearly as easy." – Shannon M.

PLANS FOR EVERY FAMILY.

Greenlight Core: Debit card and educational app for kids and teens to earn, save, spend, and give — plus 1% on savings² ($4.99/month)

Greenlight Max: All of Greenlight Core with 1% debit cash back, 2% on savings², protection plans³, and more ($9.98/month)

Greenlight Infinity: All of Greenlight Max with 5% on savings², location sharing, crash detection⁴, and more ($14.98/month)

FIND YOUR FAMILY'S PLAN: https://greenlight.com/plans

WE'RE HERE FOR YOU.

Get help & ask questions 24/7: https://help.greenlight.com

Your California Privacy Rights: https://greenlight.com/privacy/#your-california-privacy-rights

Do Not Sell My information: https://greenlight.com/data-request/Greenlight

(1) Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Community Federal Savings Bank, Member FDIC. The Greenlight card is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Mastercard International.

(2) To qualify, the Primary Account must be in Good Standing. See Greenlight Terms of Service for details. Subject to change at any time.

(3) Provided by Virginia Surety Company, Inc., cell phone protection is not available to residents of New York.

(4) Available on Greenlight Infinity. Requires mobile data or a WiFi connection, & access to sensory and motion data from cell phone to utilize family location sharing, SOS alerts & crash detection features. Messaging & data rates and other terms may apply.

© 2023 Greenlight Investment Advisors Investment Advisors, LLC, an SEC Registered Investment Advisor provides investment advisory services to its clients. Investing involves risk and may include the loss of capital. We only use the Value of Investment within the app store screen to show how the app works. It does not represent real customer investments or accounts.

Please wait! Greenlight Kids & Teen Banking app comments loading...

Greenlight Kids & Teen Banking 6.0.0 Tips, Tricks, Cheats and Rules

What do you think of the Greenlight Kids & Teen Banking app? Can you share your complaints, experiences, or thoughts about the application with Greenlight Financial Technology, Inc. and other users?

Greenlight Kids & Teen Banking 6.0.0 Apps Screenshots & Images

Greenlight Kids & Teen Banking iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 6.0.0 |

| Play Store | com.greenlight |

| Compatibility | iOS 14.0 or later |

Greenlight Kids & Teen Banking (Versiyon 6.0.0) Install & Download

The application Greenlight Kids & Teen Banking was published in the category Finance on 14 December 2016, Wednesday and was developed by Greenlight Financial Technology, Inc. [Developer ID: 1049340701]. This program file size is 481.37 MB. This app has been rated by 385,997 users and has a rating of 4.8 out of 5. Greenlight Kids & Teen Banking - Finance app posted on 06 April 2024, Saturday current version is 6.0.0 and works well on iOS 14.0 and higher versions. Google Play ID: com.greenlight. Languages supported by the app:

EN Download & Install Now!| App Name | Score | Comments | Price |

Dreaming of a family vacation? You’ll love this. Planning just got easier for you — and your budget. Parents can find member deals on theme parks, travel, events, and local attractions right in your Greenlight app.

| App Name | Released |

| SoFi - Banking and Investing | 10 April 2017 |

| Credit One Bank Mobile | 21 September 2016 |

| Venmo | 02 April 2010 |

| Klover - Instant Cash Advance | 30 July 2019 |

| Fidelity Investments | 22 February 2010 |

Find on this site the customer service details of Greenlight Kids & Teen Banking. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| Receipts Pro | 04 December 2013 |

| Accounts 3 Checkbook | 20 August 2022 |

| US Debt Clock .org | 22 October 2014 |

| DataMan - Data Usage Widget | 17 January 2013 |

| CalcTape Paper Tape Calculator | 16 May 2012 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Gmail - Email by Google | 02 November 2011 |

| X | 09 October 2009 |

| Messenger | 09 August 2011 |

| WhatsApp Messenger | 03 May 2009 |

| Microsoft Outlook | 28 January 2015 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Procreate Pocket | 17 December 2014 |

| Stardew Valley | 24 October 2018 |

| Geometry Dash | 13 August 2013 |

| Bloons TD 5 | 15 November 2012 |

| Bloons TD 6 | 14 June 2018 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

Greenlight Kids & Teen Banking Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

Overall Great, Still Hoping for a Couple Tweaks. I love the quick responsiveness moving money between accounts. I love being informed as soon as one of my children makes a purchase. What I still wish for is an easier user interface for ALL tasks. Some features, like allowing or disallowing a child to move money from their savings to spending, I still struggle to find again, although I have used them in the past. I wish it were set up like my credit union app. There are times I need to move money out of a child's account back to the parent's so they can pay me back for something and that sometimes is trickier for me to find. Finally, I LOVE the jobs option, but I would like it to be something I can set to daily or once a week without having to reset/retype it in each time the child completes it. I use this for jobs that the child is not necessarily required to do, but if they complete it without being told, they earn money. The hope is to instill in them an independence in helping with household chores.

Love it - just one thing missing to make it 5 stars. Love this app - tell everyone about it and I love all the added features with the new update. We have one request, can you please add the ability to search/sort deposits within each child’s individual section. Currently you can search (each child’s account individually) and sort transactions by date and store however there isn’t a way to do the same for “deposits” (unless I’m overlooking it somewhere). I know we can view funding history for the parents wallet but this requires the user to literally go line by line to view each and without any sorting options to select either by child or date we have to write down and keep tally when needed. I believe most users would find it most helpful if you could add options to search for this information. We’d like to be able to go into an individual child’s “account” and for example also be able to search/view all deposits/money added from parents wallet for a given time period and just for the individual child. I hope I’ve made clear what the is missing and requested. Please let me know if not. Thanks!

No Regrets. Great card!. In the two weeks my son has been using his Greenlight card for his allowance, I have seen a drastic change in the way he views and appreciates money. I switched all of his video game related expenses over to his Greenlight account. Between me and other family members, he would sometimes ask for $100 in add-ons for games over the course of a week! Now that it’s his own money, he’ll spend it, but not at the rate he was spending mine! I hesitated doing this for a long time. I didn’t know if he would be responsible with the card, wasn’t sure if he would really understand the purpose, thought it may be a big fight about his new limitations, and didn’t know if I wanted to pay the small monthly fee. But literally none of that has been an issue. I have explained to him with each step of the process how it works and he is stepping up to the responsibility. I like that I can go in anytime and add or remove the tasks that he gets allowance for. I can also do one time giftings for special tasks or special occasions. We both have the app on our phones, so we can both see how much he earns every day, how much he spends and where the money goes. And I have also set the round-up feature so the change left after purchases automatically moves over to the savings account. I love this card! If you are considering doing this with your kid, I highly recommend it and recommend it early! It is actually saving me money and teaching him some valuable life lessons.

Scammers. I really wish I could give you guys a 0 star rating but I will settle for the 1 star. I got this card for my kids and it was fine at first until they started receiving gifts from their grandparents. My dad tried to load money to the card for my child but it didn’t go through on our end even though they took the money out of his account, he did receive a refund after threatening to report them. They ended up locking my kids out of their account and said that I must repay every deposit my kids received from their relatives(even though nobody disputed the transaction) all because we didn’t load the money on the card the correct way. I finally got through to customer service and they told me that they locked the card’s because we didn’t load it money on the card as a gift. They told me in order for me to get their cards unlocked I have to repay them over $300 which is what my kids received in all from their grandparents during their time using this card. Why should I have to pay you to unlock my kids accounts for money that was never disputed, by any bank?? Don’t make any sense to me and customer service didn’t make the situation better. I will be reporting you guys because I still have money in my wallet in the account and I can’t access it and my child do as well. Horrible company and I do not recommend anyone use them either. Get it together Greenlight.

Company can’t be bothered to explain anything. Update: I have been advised that the hold is because I linked a bank account, instead of a debit card. I am very frustrated because the app strongly encourages linking a bank account—there is no indication that a debit card is necessary (or even preferred). At a bank, I can read disclosures to avoid situations like this. Because Greenlight is not a bank, the only way to find out their rules and preferences is by blindly triggering a hold that takes 1 week to resolve. My wife and kids like the app, so I’ll give it one more chance. I expect that we will not maintain the service for more than a few weeks, considering the poor quality thus far. Still keeping the 1-star rating because the company staff are very unconcerned about any of this—it’s like they have heard these complaints already. 👎👎👎 Company locked kids’ cards because I (the parent account owner) manually transferred money to the wallet. No notification about the lock until a card was declined several hours later. Then a phone call resulted in no explanation, and a vague promise to send an an explanatory email within 4 business days. Company says they’re available to assist 24/7, but they won’t provide any additional information for me. Unless they have a VERY good explanation, I’ll be closing account. I strongly recommend avoiding this awful company and its lack of concern for providing a usable service.

Love the App. Greenlight is great. We have 3 kids. The ability to manage allowance and set which parts of the allowance go where (savings, spending, investing) is top notch. The integrated investing is great and does well to explain it as well. Although if you’re an adult I would use other investing apps as I takes a bit long to get your money when you sell stock, I invested $500 to show my kids how it works and it took about a week to get it back, you have to fill out a request to refund back onto your debit card. Parent paid interest is also another great incentive to save and teach responsible spending. Overall the app is great, we also got a line of credit and got additional credit cards for all 3 children. The only thing I can gripe about is the location sharing, we have and still use Life360 for that, the location of my kids did not update quickly and in real time so we just disabled it.

Better off giving your kid a debit card. The only way to manage your account is thru this useless app which even the most basic options are a struggle to use. No web portal option. Trying to find the record of funding activities into my kid’s account - can’t find it. It only allows to view history of Spending, Giving or Saving. No options to view when they received money. Trying to setup funding was as painful as can be. I setup two sources, checking and debit card. Every time I try to fund from Checking it gives me an immediate error saying that I maxed my daily limit. But I haven’t transferred any money today?? I still don’t understand what the point is of having gone thru the hassle of linking a checking account if I can only move funds from a debit card. What I also don’t understand is why does tell me that I maxed my Daily amount regardless of the amount entered. In one occasion I moved money into my daughter’s account and when she tried using her card it declined. I never received any notification. I had to call support to find out it’s a safety mechanism for fraud prevention and spend 5-10 minutes answering questions to unlock it. Save yourself time and hassle and give your kid a debit card. Much easier to use and manage with mature fraud prevention mechanisms if they use it as a credit card.

SCAM!!!. This is not as advertised. You can not allow or block transactions based on merchant or categories until someone has been there or placed order which is basically useless unless you want to block everything. On top of that, during use, the cards were frozen because of fraud alert AND we had funded them with account tied to one of cardholders which support said was fine. It turned out they wanted us to pay them back $100s of dollars that they would then refund back to that account and then we could find it from the person listed as the parent on account and they couldn’t lift fraud alert until that was done. More or less, everything support told us to get us to sign up when we choosing which service to use, turned out to be false. Their website lies as well. We were told there was also no way to get remaining money off account but oddly enough when I was about to file a complaint, the very last time I contacted support to get details on account, they told me to verify some info and they would close account and they could credit money back to card on file. All the sudden I had funds back to checking account within a day. DO NOT USE.

card declined 3 times in two days for no reason. This app is horrible. It takes forever to load and will randomly buffer and then log out meaning if I’m trying to quickly check my balance it ends up taking at least five minutes. That was fine until it became useless as a way to buy things. My parents put $40 on my card (to be spent anywhere), and the card declined on a $12, $5 and $22 charge at 3 separate locations and stores. the first two times, where it said I had the wrong PIN, were fine because I could live without what I was buying, but I’m now stuck at a bus station because I can’t get cash out to pay for fare, as the ATM is saying I have insufficient funds. My dad reset my PIN yesterday, it didn’t work. I reset my PIN yesterday, it didn’t work. We called the number for Greenlight and they “fixed” it; but clearly they didn’t because I have $40 and can’t pull $20 out of an ATM. This kind of malfunction is unacceptable for a service designed for children and minors. It will put minors in danger, with no way to get home or buy food. This service is altogether inconvenient and not dependable and my family cannot keep using it with how many issues we’ve had with it.

Kid approved. My kids love this program and are asking for like 50% interest on their money to help motivate them to save. When I was a kid my Step Dad would match me dollar for dollar on everything I deposited into the bank up until I was old enough to buy my own car at 17. This app can work the same way if you set the interest high and it would be fun for them to watch their money grow faster. Granted it’s not realistic because I don’t even get more than a percent at my local bank but for 8-13 year-olds it’s extremely motivating. I hope I can encourage a saving mindset doing this until they turn 18 and see how it goes from there. Great way to get ready to build credit carefully with credit cards and opening up their their own FIRST cell phone service plan. I am also going to put the babysitter/tutor on one of these cards to get her paid and offer incentives. I don’t mind bribing my kids with money to get A’s. So it takes my B student a lot of extra work to earn the big bucks A’s come with. This is a great way to reward them and this app makes it so easy. I love Greenlight as much as they do.

They stole my money. This company is fraudulent and a scam. Please be aware they will steal your money. They also have very uneducated employees who will lie and tell you different things just to get you off the phone. I sent $2000 from my bank account to fund my parent account when it did not show up a week later and was taken out of my bank account. I was very concerned. The first person that I spoke to told me that my bank account was not linked. Therefore, that was the problem. This was not the case, since my bank account was linked, and the money was transferred out. my bank confirmed it. The next person that I spoke to told me that the debit limit was too high and that’s why the money never showed up in Greenlight but that in 10 days it would go back into my bank account. This also was not true. She tried to hang up on me, but I asked to speak to her superior, after an hour hold. I finally spoke with someone who said she was the highest level. She told me she did not know what was happening, but thanks maybe the money will show up in a few days. This is very scary and this company appears to be fraudulent. Please do not use this account.

Do not do it!. This company has fraudulently charged my bank every week with unidentifiable charges in 20$. After removing my card from the app. It still charged money from my account and then calling the costumer help line which is in India they were unable to help get my money back. I shut Down The account and got a confirmation number of my deleted account and it still pulled money from my bank. I then had to call and report my card has lost with fraudulent charges they still try to pull out $20 after I canceled my card. After being on the phone with a fraudulent Department of my bank for an hour coming over the charges we found over 220 fraudulent charges that green light had stolen from us. Do yourself a favor don’t even bother. You will get no assistance if you need it you will have no way of getting your money back or even knowing where your money went through this terrible awful horrible money stealing app if I could give it zero stars I would. After sending an email to the company address still hearing nothing back I know they will never fess up to the fraudulent charges thank God my bank was able to get it all back. good luck to you and your fight and getting your money back.

Almost there but could use a couple of added features. I absolutely LOVE the idea of this app and the card to go with it. We’re super excited to start using it. BUT here are the things that could give it a 5 star rating.... 1. Add the ability for 2 parent wallets for the kids cards. With the world today and the divorce rate, there are so many split households so having the ability for each family to have access to the kids cards would be amazing! I even think you could double your profit by charging $5 per parent wallet. 2. Having the ability to require a chore to be completed for the kids to get paid their allowance. I chose to go with this app because of the debit card feature but a friend of mine has a different app where he can assign chores which are “required for allowance”. If those chores are not completed, they don’t get their allowance. He can then also assign chores which are assigned extra money and can be redeemed as well (which I know is also a feature of Greenlight). 3. Last, I think there should be a parent approval process so the kids can be held accountable for what they are saying they completed before the allowance goes out. Those are the things that would really help our family and I’m sure other families out there. Hopefully these things can be implemented soon so we can use the app to the fullest. Thank you for your consideration!

Update looks great but less user friendly. We’ve been Greenlight customers for about a year. We feel the fee is worth the value and convenience it provides us with 3 kids. My frustration is with the app update. It absolutely looks gorgeous, honestly my compliments to the designers, but I think this is a case where design lost sight of what’s important to customers. Before, I could easily see all information I wanted on the dashboard (the balance of each bucket of money for each kid). I’m now having to click 2 or 3 screens deep to see that information. It took me some effort to even find where the “giving” bucket went which is hidden at the bottom of the kids screen. What frustrates me is the lack of customization. Each kid is different. For example, we use “savings” as college savings (and transfer out to 529s every year, a process that has to involve customer service because transfer OUT is conveniently not a feature that was prioritized to build) and “spend” is our kids money. They have goals they want to save their “spend” money for but you can only set a goal in the “savings” bucket. I feel bad saying it because I can tell they must have spent a lot of time and effort on this redesign, but this update is pushing me away as a customer wondering if I can figure out how to do this on my own again.

Everything was fine in the beginning. Until my funding source (debit card) expired So I ordered a new debit card shortly after with the same card number and same name but it had a different ccv and expiry date. (A NEW DEBIT CARD) this app won’t accept it and Im not giving Greenlight my bank account number or a credit card number. Your app doesn’t recognize that my card is new and valid so your app says I have to contact customer service. Your app is broken. Also last month I tried to cancel my account. I “signed the form” and after a few days a customer service rep emailed me back saying that I had to add a funding source to the app so that they could refund my remaining money back to me ~$4. I couldn’t enter in my debit card and I didn’t want to go through the hassle of entering in my bank account for four dollars. (idk why they couldn’t just cut me a check?) PLUS you have to add $20 or more to reload, which I didn’t have at the time so I did not respond and they emailed me saying that “this issue has been resolved or ticket closed” so I’m like cool account closed…NO now they charged me my monthly fee instead of canceling and I assume they will just keep doing that until I owe them big time. Guess I gotta give them my bank info so they can STOP CHARGING ME A FEE AND CLOSE MY ACCOUNT Don’t do Greenlight - BROKEN APP/HASSLE TO CANCEL/FEES.

How this app is so good. I like this app because it’s for kids and grown-ups or teenagers and it shows how much money you have. It’s really cool because you can choose your savings and what you want to save up to and I think it’s just really cool because you should get the app. It is really cool. You can save up to gas stations and even grocery stores and it comes with a card if you set up your greenlight account it’s a really cool app so if you want to have a really cool card, you should allows you to put in your savings like do you want an iPhone you can get an iPhone if you want to TV you can get anything you want when you save up to I think you should get this app because it is really really really really really really cool and it works out good with kids, teenagers and even grown-ups if you are a kid, your parent can manage your account It should be so cool if you’re a kid you’re a parent can manage your account and it’s really fun because it can automatically add money. You should get the app if you don’t already have it. It is one of the best apps you should get it by it for free and the kids can also request you for money. Have fun and enjoy getting money. And don’t forget. Stay tuned for my other reviews.

Wanna love it 100%… but don’t. The concept of these cards are amazing. My kids love having their own debit cards. They customized their cards, and love being able to spend their own money without needing cash. However, a constant reoccurring problem is that Greenlight will not take money out right away. You can’t see pending transactions, and if it takes a few days to update, the days in between you can still spend the same amount of money. For example, my daughter had $10 on her card, she spent $5 one day, a couple days later she checks her account and has $10, so she buys something for $6. Now she’s overdrawn, but it doesn’t take that money out. You can keep “spending” that remaining $5 until it updates. These accounts won’t ever technically allow your child to go negative, which is great until your kid spends money they thought they had then suddenly the parent owes. Very frustrating to deal with. I’ve also had to deal with my son adding money from my bank account to his own card, there are no passwords, no codes, nothing to keep my children, or anyone else for that matter, from moving money. It’s also not a simple return and put it back on my bank card unless you call. All in all, great idea, there’s great features, I just wish it was closer to an actual bank card.

Great app!. Great idea but I do not like paying $60 a year to use this. Took 1 star away for cost and 1 away because I can’t access the money in the parent wallet or transfer it back to my account. This has been great so far for my 3 boys who make money doing their chores. It’s much better than cash and they are learning how to save for specific things and not just spend money so freely. They feel very proud and excited when using their debit cards! Their ages are 12, 11, and 7! We have an account for my 4 year old daughter just to have a place to save birthday money she has and such. It’s easy on us too. They are more willing to do their chores knowing they will be paid for sure a specific amount each Friday! We had no system before this and kept losing track of how much we owed them or how much they spent on something. The only downfall is the $5 charge monthly. $60 a year and I still have to pay the interest on my children’s savings myself. If I only had 1 child I would not pay $5 a month. I also don’t like that I can’t transfer the parent wallet money back to my bank account. There should be a card like Venmo or PayPal for the parent wallet. If Venmo and PayPal can be free, this should be free as well. As soon as I find a different free version of this elsewhere I will go with that! When I first signed up I wasn’t aware that it was only free for 30 days. I found that out when the cards arrived. I’ve never seen the monthly fee advertised so I felt mislead.

Don’t get this unless your extremely controlling. This is one of the worst kid cards by far, It may look cute and helpful but it isn’t. The way it’s set up it’s supposed to help the kid get ready to use a real debit card but it’s completely parental dictatorship. The kid can’t really do anything, the parents do EVERYTHING. On the app you have little areas where the money can go, shop anywhere, shop at the store, any atm, and so on. It’s supposed to help you (the kid) manage your money. But instead of the parents just depositing money into the account and the kids decide or at least have an opinion to decide where the money go they can’t. The parents do and there’s no way the kid can transfer 5$ from the spend anywhere area tab to the use at the store tab because the child has no control of there own money. You would be more in luck just keeping your child’s money in a piggy bank than this. Unless you want your child consistently requesting money as they can’t put money into it at a atm or them asking you if you can stop putting money in the shop anywhere tab and to put half of it into any atm slot. And you have no problem controlling the whole car for them and getting a notification for every time they buy a 5$ fortnight card than go a head. Do you

Best tool for my teen to manage his money!. As the world around us changes, so must we. Gone are the days of weekly tangible allowances and chore boards. My tech savvy son was excited to have a credit card and ready to earn some ‘spending’ money. The app is very user friendly allowing me to designate chores, as well as chore days and frequency. I like the ability to break up the allowance given between ‘spend, save, and charity’ and the ability to pause the allowance (if needed) or transfer extra money onto his card if he earns it. Through the app my son can see the amount of money he’s earned and has already put his earnings into a special category, he created, as a way to focus on maintaining his goal. He feels more in control of his allowance money/spending (but you can restrict places they spend money on if it gets out of hand-like video games) and we as a family have an easy way to keep track of his ‘chores’ and financial progress.

Rude. Hi me and my mom and sister Trying to get this app and like we installed it right and so then him he told us to sign and we were signing in and then it says verification that you live there. That means that I am legal because I am Mexican and he they said that I couldn’t do it because I’m not illegally from here so they can’t give me money and then I was like super sad because I didn’t even get to try the app and so I said I was like this is so rude. Why would it not let how do they not know that people immigrants live near USA and they don’t have papers? I’m about to get my papers, but still like can you be a little fair to you know Hispanic people cause it’s funny people would love to give their money you know that Sunday is that when you give your child money but these days it’s mostly debit card you know not in credit not money or cash. Nothing of that so they should definitely add some thing about Hispanics you know to like let them be in this, even though they’re not from here because they still try to do their best with their family please update it. I will change my review once you fixed it because I really would’ve loved to try this app. Thank you for reading and I hope y’all answer me. Can y’all still like change it

Technical problems leave kids stranded. The technical glitches with this app outweigh its benefits. The bank information saved to the parent account to fund the kids’ accounts has to be re-entered nearly every time I try to fund the card. I’ve tried to transfer money for a kid out-of-town and been unable to do so because the funding won’t work. The bank info is there - you can see a portion of it, but the “help” response is to delete it and re-enter it. Unless you walk around with your bank account number memorized, this isn’t a fix. The kid is stranded and you’re stuck fussing with the account numbers late at night when you get to where you have them saved. Just save yourself the time and money and give them a debit card tied to your checking account. As a follow-up - I called the customer service line in the developer’s response and was told someone would call me back with a fix. Also received an email from Tristan asking if he could call me. I said yes, if he could provide a fix for having to re-enter account information every time I want to transfer money, if I have to re-enter each time I would need to cancel. I did. It get a call, but Five minutes later, my kids’ cards were canceled! I guess that speaks to the app’s abilities and customer service.

Overall good app but needs better app functionality. I love greenlight. But they added new updates where it was harder to see the reason for transactions, which might bot sound that big, but when you need to add money into savings each time you earn money (not gift money), it got really annoying having to click on each and every transaction to see what the transfer of money was for. Usually when you swipe from the left corner in most apps, you can go back, but in Greenlight you have to press the back button on the top left corner. Just little things that make me a little more frustrated. Theres also the fact that when you create a profile photo you have to resize their face in a rectangle box. It even SOUNDS weird. Oh well, I’ll still be using greenlight. But if you're seeing this Greenlight, please make this app more polished 💚

Not super impressed. I downloaded this for my grandchildren and great grandchildren, and I think the concept is great but Im not impressed because I began having issues right away with the first two cards I ordered. Of course, its the weekend so no one is around to assist me. The first two cards I received were crossed somehow. I entered the info on the back of the card and it linked the wrong child, then when I tried to put in the next child's info it wouldn’t accept it. The monthly charge was also unexpected since it doesn’t explain it clearly anywhere when openly the accounts. Customer service was kind the one time I reached them but they didn’t fix the issues with the cards that had already been glitching in their system prior to me receiving them. I would look at the app and the childrens names would be switched and then I’d go back in and they would be fixed. I told them I didn’t want any issues with the cards because of this and they assured me it would be okay once we received the cards but it obviously was not. I will continue with this until I find a free service. This is like paying a yearly fee for a credit card the company is already making money from. This is not a good way to start your children off learning about good financial choices.

It’s awesome. 6 months in and our 11 year old and 9 year old are 100% on board. My 11 year had a couple crisp 100 dollar bills he’s been saving for a long time now. He asked me to move 100 into green light. We made a choice to pay 5% interest so our kids can learn.. a couple days later my kid says, “Dad, I want to move my the rest of money into Greenlight because it’s not doing anything in the safe, at greenlight I’ll make interest on it.” Awesome lessons to experience at such an early age. Our kids hated the old school savings account deal. They would get money from gma or family, we would give them the old line about putting it in savings, then they would never see the money again. Sure they had savings accounts, but they were not learning anything about money and saving. With greenlight, it’s all interactive at a level they understand - with serious parental control that makes me feel comfortable. Our kids also use the earn function a lot.. if they want something we have them put in at least some work for it. We started out with 100 dollars in the parents account just to see how it would go. Now that we’re more comfortable with how it works, etc. we’re all in. Highly recommend this! Only drawback I can see right now is that my 9 year old doesn’t have a phone. She can still participate and have a debit card, but can’t experience the kid app side of this. Honestly it’s fine though because we can show her what’s going on with her account and explain it in real time.

Complicated to Activate!. After 4 emails back and forth and 3 phone calls, we may finally have a working card. The app makes the process sound easy but it doesn’t tell you that if you and your spouse have a joint banking account, their information must be submitted when initially setting up the account or the account gets frozen with no notification to you. Your card arrives in the mail with simple instructions to activate it in the app. When you try to do so, you get an error message that makes no sense and doesn’t tell you that your account is frozen or why. I then had to email a picture of my husband’s ID, add him to the account, and he was to get a text linking him to the account. After 3 tries he still didn’t receive a text. I call customer support again, go through 10 security questions and the agent says she’s activated the account. Then she sees there’s a freeze on my account so I have to talk to a higher level. Ten more security questions and a long hold time with this person and now I MAY have a working card. Way too much hassle and all along I assume I’ve been paying $5 a month and the money I loaded from my bank account to my parent wallet on the app has been inaccessible to me. I hope it gets better from here!!!

Good, but could be better.. I do not want to draw this review out very long so I will get straight to the point. I do enjoy using the app and setting up each child account so they can spend money using a card but also practice on saving and giving money to local charities that they are familiar with too. The number one thing I DO NOT like is the cost. This app will cost you $60 a year to operate. I do understand it is unique and offer you some flexibility but I can see within a matter of a year another app will come out for free. But at the same time this is not a dealbreaker just know I will not hesitate to go with another business that offer the same thing for free or low cost. Secondly which is fairly a big deal to me is notifications. Yes you do receive notifications on when your child has spent money on something or their card has been declined because of insufficient funds. Once you view the notifications you are UNABLE to view them again. Vanish forever never to be seen again. I wish there was a way to review notifications similar to how you can review their account transaction history. Once again not a dealbreaker but, it seem like this was a no-brainer when it comes to practical uses for an app, especially when dealing with children spending money using a "real" debt card for the 1st time.

Love this app, could be better (specifically for trans youth). I am a teenager who uses greenlight every day. My parents got it two years ago and I have used it ever since. It works well for me as a high schooler who goes out often and it works well for my mom to be able to still manage my money in some way or another. I can’t speak for the parents that use greenlight but I will say there are some things on the kids end that could change especially when it comes to trans kids. I myself am trans and when I went to change my name in the app so people at coffee shops and fast food restaurants would stop calling out my deadname (as that is what comes up when i use my card) I couldn’t find an option to change my name in the app. I also recently had to get a new account and when doing this there were only two options for gender and as a non-binary person I did not feel seen. I completely understand this is not your main concern with the app right now but I can speak for all trans and non-binary youth who use your app when I say we would like to be seen and accounted for. Thank you for your consideration.

Best App for kids. GreenLight is a perfect example for getting kids ready for when they mature and get older now through their life there are gonna be times when they want to spend there money on something they don’t need so GreenLight helps with that if you were to add and allowance for your kids you can make them do chores for their weekly allowance so let’s say you give you child or your children a weekly allowance of $15 then $3 will go towards saving and they can save what up for whatever they want for example I'm saving up for a gaming chair I will save up till I get that chair and ask a parent to use there general savings account money for what they want, another account that there is is a giving account which once you click on the giving account it will give you a list of websites for you to donate or give to for examples don’t to Dog shelters or other things but if your weekly allowance was $15 then $2 would go towards giving and after a few months you will have what you want in no time! So GreenLight is definitely the best option and if you go on there site and do the following you will one ☝️ month FREE!

Great, but lacking the features we need. This app is amazing but there are a couple features that I would love to see added in the near future. First: Customizable buttons on the send money screen. It would be great to have the option of customizing the amounts. I never use any of the five preset options that are there on the screen and always end up clicking the “other” button and manually entering in the amount of money I want to send. Second: Saved/Reuseable chores. My son gets a certain amount of money per chore and doesn’t have set days to do them. He gets paid whenever he does it. For example he gets 50 cents when he helps us put the laundry in the washer (he’s 4 lol) so that can happen every day or every 3 days depending, so the weekly chores option doesn’t work for us. We have to use the one time chore option. But we have to manually add the same chores over and over again. It would be great to have chores that we can select/duplicate instead of manually filling in all the details every time.

Convenient & User Friendly. My kids LOVE having their own debit card. It is super convenient for me to pay them for chores with the app, instead of cash, because i don’t have to remember to go by the ATM and I can pay them in odd amounts instead of multiples of 20. It is super convenient for them because they can use the app to check their balance anytime, and they don’t have to carry around cash and coins. Compared to a prepaid debit card, which has tons of activation/balance inquiry/transaction fees, this is hands-down the best non-cash option that kids can use anywhere. Pros: -kids learn about money management -parent/child can check balance anytime -parent can view and control transactions -cool features like assigning chores and setting allowance -kids have a means to purchase online products with their own money (instead of me having to take their cash, make the purchase, and give back change, then deposit the money they spent into my own account) Cons: -getting their picture on the card is another $10 per card. This is a great way to add safety, so I am surprised it wasn’t included with the standard membership -there is not a way to turn off the function where kids can request money from the parent (my kids like to request absurd amounts of money often as a practical joke and it’s annoying) The monthly fee is really reasonable! I wish I had a Green Light card as a child. Very valuable tool for parents who want to teach their children good money habits!

Greenlight. This app is so amazing for kids or anyone! You can add money take away money and you can also make chores for your kids to do! Your kids can make a saving chart they can learn how to invest also! You and your kid can see where they spent their money and how much they spent you can also see how much money you added and how much you took away! Your kids can not add money they can only request! You can decline or except it! If you have more than one kid that has a Greenlight don’t worry you can make more than one account! You can change your kids profile picture and your kid can too. It’s literally exactly like a debit card but with all of the features I told you! Also, in order for your kid to have a Greenlight card the parent has to pay $4.99 a month! Your kid can buy anything with this card! But… you can add money to how much they can spend on video games or at a restaurant and more but you don’t have to! They can also use it for online shopping but I would be careful with that because if they get scammed they can’t get their money back because it’s not a bank account only cards that have money from a bank can get their money back so I would just buy it as a parent yourself and then have them pay you back! One last thing, you can design their card, you can put a picture on it or just have a plain greenish tealish color! That’s it, this card is amazing and hope you get your kid one!

Most helpful app ever. We don't do allowance in our house, but we do have jobs the kids (3 teenagers) can do for money. I was really struggling to manage the pay outs, as I always had to have lots of small bills on hand. Then the kids would turn around and give me the cash because they mostly buy things online. It was a total logistical nightmare. Enter Greenlight. It is the perfect balance between simplicity and features. I got the account setup in a few minutes, cards came a few days later. I have scheduled transfers setup for the kids job pay. I can also add additional money to their cards with three clicks if they do something extra. It's easy to take money away if I need to doc their pay for any reason. Everything in life should be this easy! I just had to replace a lost card. It took less then 5 minutes on the automated phone system. First lost card is free. So far, everything on this app is fast, easy, and works perfectly. This was a great idea for an app and implemented very, very well. It saves me a ton of headache every week. Thanks Greenlight!!

Great idea, terrible customer focus, lacking functions, data privacy. For a younger kid this is ok though one could quibble about the monthly fee. But for older kids, I find this service frustrating especially as my 16 year old started to run errands for me. I quickly found there were unadvertised limits not only on his card, but what I could transfer from my own bank account. These were hard limits that couldn’t even be overcome with a call to customer service. Now, as my son is old enough for his own normal account with no fee, I went to close my GL account today. Again, functionality is lacking. I can’t cancel or close my account online. I have to submit a request via a form. This should be fundamental functionality and feels manipulative that it is not available. I am also unable to remove my bank account as a funding source from the system because it requires at least one. Why? This also feels manipulative to customers. This is a privacy nightmare and I have no idea when my “close/cancel request” is taken care of on their end if my bank account is unlinked or removed or what? The monthly subscription should be separate (with the ability to enter a debit/credit card/use Apple subscription) from my bank account as a funding source for use in the functionality of the system. I can change / get a new card easy, but its much more difficult for me to change my actual bank account. I don’t appreciate it being linked to this app without any control to remove it.

GREENLIGHT DEBIT CARD FOR KIDS IS THE BEST. I rate this app a 5 out of 5 star rating (five out of five star rating) because it is a a great app for kids like me. Greenlight Debit Card for Kids is also good for kids to learn about money. I recommend Greenlight Debit Card for Kids to you guys because it is a the best app for kids to learn about money, pay for things with a Master Card, and more with the Greenlight Debit Card for Kids app. There is only 1 bug (one bug) that I noticed and that is when I try to change my profile picture it does not work. I would be happy if the people who made this app will fix that bug. The parents or guardians and the kid will need the Greenlight Debit Card for Kids app on their devices for this to work. Please keep in mind that if you order your Greenlight Debit Card for Kids it will take a while like mine did. Download Greenlight Debit Card for Kids for free today on the Apple App Store or the Google Play Store. Also I think you can also set up Greenlight Debit Card for Kids on the website.

Incompetent. UPDATE: Was on the phone with them for almost 2 hours. Their call center finally transferred me to somebody in the states. They looked into our problem and found that there was some glitch in their system that was stopping my child’s card from being printed. They were able to fix the glitch and waived the $35 expedited shipping fee to get the card to us in two days. I’m glad we got it figured out. I’ll change my review if this ever gets resolved BUT this company is completely incompetent. I love the idea of this service and it has worked for one of my children BUT, I signed two of my kids up and over a month later have yet to receive a card for my second child. I received a card right away for one of them and over a month later and 4+ phone calls later have yet to receive a card for my other child. The first few times I called about it they said wait 7-10 business days for it to arrive. Nothing. Called again and demanded expedited shipping which they waived the fee for. Still NOTHING! How can you use a service if they make it impossible for you to use it? I either get this child’s card this week or I’m taking my business to a more competent competitor… :/

Lawsuit waiting to happen. I’m legally 18, still in high school but I no longer live with or have any contact with my parents due to an abusive situation with years of CPS records. Greenlight support can’t do anything to remove them as guardians on the account to give me control. I have emails of my pay stub proving that I earned all the money on the account and I was never given allowance so none of the money was from them. Greenlight is in no way responsible for my delt-hand in life however any credit union or bank I’ve talked to automatically hands controls over to a child as soon as they turn 18 if it’s in their name. I believe they should have someway to manage a situation like this the way any other bank would and for these reasons I have found it frustrating and unreliable. All the money I had so far scraped together to get myself through college to build a stable life for myself is now unaccessible. I have all the documentation I would need to take my parents to court but unfortunately no funds. There are many wonderful reliable parents out there and this app is great for them but there’s no insurance or help for anyone who is or has been in an unreliable environment. I am fortunate to even have a place to stay for now.

No way to change card in parent wallet?. I got this card for my daughter, and it was a great way to introduce her into responsible money management. However, my daughter last used her card in March 2020. At the start of lockdown for my area. A couple of months ago I got a message that my daughter’s account was negative $2.50, and that I needed to add money to her account. I can’t figure out why it’s a negative balance since she hasn’t used it in over a year, and Greenlight debits my account every month for the cost of the card. I have tried for 3 months to update my parent wallet with a new card, because I no longer use the card associated with the account. As of today her balance is negative $7.57, and I still can’t change my card to correct it. I guess Greenlight is going to have to go ahead and freeze her account. I will be opening a new account for her at my bank. Great concept, but not worth the cost when other accounts don’t charge monthly fees or hidden fees for lack of use.

Overrated & Bad Customer Service. The Greenlight card has a good idea behind it but compared to other teen banking apps it easily loses. I got the Greenlight card a few years ago and recently closed my account because even though it says you can withdraw money with an ATM it never let me do that, I have tried 3 different ATMs and none of them worked. There is also no way to deposit cash in to the account, and there is no way to send money with Apple Pay or Google Pay etc. you can only use Apple Pay or Google Pay to buy stuff, plus you can’t do any bank transfers or send money with Cash App, Venmo etc. Also I have to mention they have the worst customer service, when I closed my account I had money remaining in it so they said they would send the money back to the funding source linked within 7 bussiness days and they only sent $8 out of $148 so and I’m stilm trying to get a hold of them so I can get my money. If you want to get a debit card for teens I recommend Step Mobile which is actually free compared to the monthly fees of Greenlight and it has all the things that I mentioned that Greenlight doesn’t have.

Great ideas, great app!. My daughter is 11 (received her card at 10) and loves having her own debit card! The app is easy to use and functions well. I love that it reduces the likelihood of her losing cash. I do wish there were a kids version of the app she could have on her phone to keep track of her account balance without allowing the full level of access parents have to the accounts. But my biggest complaint right now is the time it takes for funds to deposit from a funding acct into the parent account. It used to be shorter and now it takes almost a full work week. We have definitely reduced use of the program for this reason as some spending decisions are made in a smaller time frame and there isn’t time to wait for the slow funding process. There have also been times when my child was on a field trip and did not have enough money for something, but I could not add money directly to her account unless it was already in my parents account. Funding it from my bank at that time to my parents account would’ve taken days when I only had minutes. In those situations she had to go without, because I was not present and the process takes too long. Please change this back to the immediate funds access you used to have.

Don’t Get Greenlight!. I’ve had this for several months. I want to say so many great things about this app, but a HUGE FATAL FLAW that touches on privacy and other issues is that any other adult you invite to contribute money can see your wallet and they can see yours. I invited my ex-wife, but recently when attempting to add funds, it tried to add them from her bank account. She was charged a bank fee that I’m now having to reimburse her for because I didn’t select my account from the wallet. I shouldn’t see any funding sources when I log in except for my own! I’m what other world or app would this be okay?!? I’ve sent a few requests that this be changed in the app. They continue to take my $4.99 a month and it’s a great app if you’re a single parent but not if others are involved. Greenlight should fix this immediately! I’m an app developer and understand what it takes and it really shouldn’t be difficult. If I’m the one adding a funding source under my login, those funding sources are the only options I should have and not the possibility of using my ex-wife’s bank account to fund the wallet. Very frustrating because it’s a great app and service but I’ll have to find a different solution now.

Great concept, but too many limitations. I heard great things about Greenlight from other moms. I was looking for an option where I could quickly transfer money to my kids, teach them how to be financially responsible, and allow them to have some freedom. However, I wish I had done more research. My kids are 15 & 17. The 17 year old has a job and his paycheck is direct deposited into Greenlight. BIG MISTAKE! He pays for half of his car payment & insurance (teaching financial responsibility, right!?), but I can’t get his monthly payment back to my finding source. Parents are limited to the amount of $ that can be transferred back to the parent funding source. I’m making the full payment and his money sits in my parent wallet. Absurd! You can’t attach Apple Cash or Venmo for a transfer. I was told “we can refund the money to you by check. This will take 2-3 weeks.” 2-3 weeks? Absurd. No one should have to wait weeks for their money. I was then told I could open a Greenlight Family Cash Card. No thanks. I have a credit card with fantastic benefits & rewards. Greenlight really needs to figure out a better plan for 16-17 year olds who have a job to have access to their money. Let parents decide what they can & can’t do using the restrictions they can turn on or off. Allow the teen to pay the parent and the parent can access the money however they wish. Parents are adults. There are other money management cards out there that have better options. Do your research!

Great except one major flaw. I love the Greenlight app for managing chores and allowance for my kids! I wish it was easier to set up chores once, then assign them to each kid. Instead I have to set up the same chores multiple times for each kid. For example, I want each child to put away their laundry every day, so I have to create a new identical chore for every kid instead of just creating the chore once, and selecting which kids I want to apply it to. Same thing for jobs. I have a list of about 20 extra jobs around the house to earn extra money, and I have to create each one duplicated for every child I have. I wish I could create the chore/job lists on the parent page, and just assign them out to one or multiple children so I only have to create them once. Or even if there was a ‘copy to’ button to copy a chore/job to another child’s list. Imagine a family with 6+ kids, the set up would take forever. I only have 2 kids and I’m annoyed I have to create each chore/job twice.

Almost perfect. While this is a great tool to teach kids how to use money, it is just missing some final touches to be a 5 star app. Everything in the app (and the card) works perfectly. What is missing is the ability to create savings goals under “spend” so that kids can learn how to save for reoccurring debts (like Minecraft or Roblox Club). While this can be done via the savings portion of the app, it also needs to be available under spend as well. We want our kids to realize that if you don’t save some of your available for a service it just won’t work. Since the goals are under savings only there is no easy way for the kids to feel how monthly bills can drain resources. Adding goals under spend would be a huge plus. Lastly I wish when my child signed in they did not need to refresh the screen to see their current balance. Our daughters sign in each time thinking they have more money than they do until we refresh it. Will move this to a 5 star app if these two items are addressed.

Best Youth Debit Card. I enthusiastically recommend Greenlight to every family looking for a debit card for their child. We have been using this card for several years and it is perfect. I have the ability to link my child’s card to funds that I transfer from my own account, and release the money to her as she needs it. The controls in the app allow you to monitor all activity on the child’s card and limit both the type and amount of approved expenditures. The card can be immediately disabled through parental controls. I receive notification of every expenditure, and the app will inform my child of deposits to her account. The card has a function that allows for automatic payment of allowances, if desired. There is also a savings and charitable donation feature. This is the perfect debit card solution for our family! The developers of this app thought of everything! Highest recommendation!

Great Customer Service. I just signed up for Greenlight however I confused it with another service that had feature I really thought would benefit my child. I am always nervous when canceling required a phone call, because it usually includes some really pushy attempts to make you stay. My husband was on the phone with one company over two hours trying to cancel. It’s scarred us for life! (Haha) So I braced myself and called Greenlight to cancel. After one man took my general information and then told me he was transferred me to the cancellation department, I automatically thought, oh great here we go. My defenses went up and I was ready to battle. Turns out Greenlight plans to add the feature I wanted in a couple months and was willing to give me discount in order to stay and have the opportunity to compare the two services. Being in defense mode, I wasn’t open to staying.... and I will say the guy on the phone was not remotely pushy and was super nice. The second I hung up I asked myself why I didn’t stay. I have had so many horrible customer service experiences, especially when trying to cancel a service it actually caught me off guard to have nice genuine customer service.

Great App. Fatal Flaw- no security.. I’ve been keeping track of my kids earning and spending with a spreadsheet on my phone, but you can imagine when life gets busy it can be weeks before I update things, and often I would forgot to add items. I was about to open a bunch of child checking accounts for our kids when a friend told me about Greenlight. I downloaded it and set it up and I really like it except for one MAJOR problem. Once you login to the app for the first time there is no password protection. Anyone who might be using your phone can see and move money in and out of you checking account. This is not okay. The chances of someone having my phone with ill intent is small but not zero. Maybe my teenager borrows my phone for something and is tempted to go in and move some money around. This app has direct access to my checking account and debit card, it NEEDS to be password protected. All of my other banking/financial apps use Face ID or a password for security every time I open the app. This app needs that kind of security. A banking app with no security? Otherwise I like everything about it. I hope they can add this feature otherwise I will have to close our account.

This app has issues along with customer service.. I actually have had this app for four months. The first time I used it was great. The card that I was using for funding was gone and canceled. I was unable to establish a new funding source through the app. Had to contact the company through an email and no help from them even if they created in a new slot for it. Then contacted the company about closureOf the account and I’ll refund theRemaining balance on the card. I was told that they do not do that and I had to go back through my bank to recover the amount owed to me. This app has a good theory of how to distribute and track spin alarm on a child’s account. But would not recommend it to other parents. There are bugs in the system and customer service is horrible. I was online for 10 minutes before answering and huge amount of noise in the background. Will not use again and will not recommend it to friends or family. Huge disappointment to my son who would’ve liked to use it. All I can say is this is a warning to those to read the comments closer and maybe the company should give a free trial before charging the price of the app.

Write up needs to change. I have used this card for my three kids for quite a while. For the most part, I like it. There is one area that is NOT true on the write up - as I search for a new card. The write up says “the kid can’t charge if they don’t have the money” - or something like that. NOT true. Just today, the kids account was overdrawn and pulled from the parents account. I don’t care about the $21, the money was there - it’s just teaching the kid it’s ok to spend more than what you have. I called customer service and they told me that if the spend anywhere is used, it will pull the overdraft from the parents account. If not enough there- it then pulls from the funding account on file. I want my kid to get denied and have to contact me if he needs more money. He needs to learn to budget. This card is not doing this AND the write up is WRONG. Don’t believe it if this is important to you. Customer service said I could set specific limits on different stores for spend anywhere;however, I want him to have the ability to spend his money wherever he wants - but only the amount he has available. Very frustrated and not hacked off that they didn’t keep to what they had stated. Normally I’d give a good star rating. Based on the aspect they don’t do as I thought and just confirmed in their write up, I lowered the rank quite a bit. Hate not being told how things are really handled.

Worst Customer Service ever! Look into other companies before signing up with Greenlight!. Greenlight would be the perfect way to help kids and teens control and save money as well as teach them to be responsible with money at the same time. We got Greenlight debit cards for our 15 and 11 year old boys to start preparing them for spending responsibly, saving and unexpected expenses , etc. I set up the allowance auto funding once a week only for completed chores which is awesome as well. My 11 yr old was at a friends house and went to the store and his card was declined and keep in mind we don’t have restrictions on his card! My son was really embarrassed and actually thought that I didn’t pay his allowance which really hurt me and some of his classmates teased him over the declined sale. This was 3 weeks ago and this issue has not been resolved yet I can’t seem to speak with anyone and no return calls. They state that they have 24/7 customer support! That’s not true at all. At this point I’m frustrated and jut want to close our accounts and be refunded . Greenlight you are wrong for the horrible customer service that you are so proud of!

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules. Sign up!

Good until it wasn’t. My kids really enjoyed earning their allowance on their cards but recently the app was no longer able to connect to my bank account. I ended up having to cancel and deactivate greenlight. You have to make sure to deactivate and then call to request a refund. These are two separate processes that you have to complete and are not made aware of when you deactivate the account. Also, after I called to request a refund, I received an email that stated I will be receiving $0 back, which was not the amount discussed over the phone. I called back to ask for another email with the correct amount and they stated this could not be done. I just wanted a paper trail with the correct amount but this could not be completed by the customer service team. I will be waiting to receive my refund in the next 7-10 business days and hopefully I will receive the amount I am supposed to. I just felt that the customer service team could have handled the situation better.

Not For Blended or Non “Traditional” Families. App is okay but not for non traditional families . I foster an angel & one of her parents are still involved but they aren’t the other parent to my other children. The divorce rates are high as well and blended families exist . So not having the option for each child to have their own sets of parents is really unfortunate. Instead of assuming that every child within a household shares the same parents they should have the option to set their own parents .Not all parents coparent gracefully each parent should be able to have their own account & sync with the children accounts . Definitely made for a cookie “ cutter family “ all family styles should be welcomed . On top of that when I tried to cancel they told me I would get a receipt of my refund I never did I called back the next day they said well supervisor aren’t here call back later they couldn’t provide a recipe for my refund . Doesn’t show good integrity for a company hopefully I will receive my refund because it’s over 100 dollars .

Great way to deliver allowance!. My 12 year old son is like a lot of kids his age, meaning he always seems to lose cash when he’s out running around. We also never know how much he might need for any event, and we’re weary about giving him a lot of cash. Pairing the Greenlight app with his phone and Apple Pay, means he just keeps up with his phone for money (most places anyway). If he needs more money, I can easily transfer it over. It’s a MasterCard, so most places take this card too which is great. Allowance is another way Greenlight is perfect for us. I can set it up to auto-apply on a set day, and can even pause it if needed. Finally, if for some reason the card or number is compromised or stolen, it only has whatever is in his account available. We knew the balance pretty low, so if that happens it’s pretty easy to recover.

Best way to teach kids about money!!!. I’ve LOVED having Greenlight for my foster son!! My 15 year old foster son is obsessed with online gaming and is always wanting money to spend on his games. I do NOT want any of my personal cards saved to his account. This has given him his OWN card to use that has an allowance automatically added each month and that I can instantly load more money onto when he earns it. I get notified of every purchase he makes and every purchase he attempts to make that gets declined. And if he ever loses it, I can easily turn it off and request a replacement card. I also got a card for my 5 year old. He mostly likes to watch his monthly allowance add up and then use it to buy big packs of legos or video games. I HIGHLY recommend this to EVERY parent!!

Worst customer service ever. The app would not let me add a bank account to fund my children’s accounts. They told me I had to call the customer service number. After calling and been disconnected twice, verifying my identity to five different customer service agents, I was told that they didn’t know why my account would not allow me to add bank accounts, but when they tried to reset it, it removed the ability to ever use bank accounts to fund my account. I could only use debit card cards from here on out. We do not use debit cards, so I am unable to use my children’s accounts until I order a new debit card from my bank account and add it to my Greenlight account. This is absolutely absurd, and removed much of the functionality we were so excited to use. We are currently on vacation, on a shopping trip to use my children’s accounts for the first time. We were all so excited for this app, and have been incredibly disappointed in the way their customer service is handling this issue. Do not recommend.

Fantastic App!. Before coming across this app, purchases online for me were quite difficult. I would have the cash myself, but my parents either didn't have the time or didn't have the money in their bank account to make the purchase. This was disappointing at times especially when trying to buy an item on sale. Then we sparked the idea of individual bank accounts for my siblings and I and came across Greenlight. Greenlight is a fancy app that allows parents to allocate funds into child accounts. It allows me to purchase items online and in stores whenever I want, without the worry of my parents lack of time or money. Parents can also restrict where money is spent and add interest to a savings account. My siblings, parents, and I all agree that this has made giving us kids payment for work so much easier. I highly suggest this app to any who come across it.

Great app features when they work.. This app is very good and easy to navigate and manage. We love the app itself. Unfortunately, it takes literally 50+ minutes to get ahold of customer service. The customer service reps are very nice and helpful once you do get in touch with them. Also, every time I transfer money from my bank account to the parent wallet, I have to verify my account, over and over and over and over. Which causes my child’s debit card to be shut off. I like the safety feature but it’s either a glitch or a problem with their system. It says I successfully verified my bank information but keeps taking me back over and over many times to re verify it. Also the contact tab under the help tab which is suppose to be a direct message to a representative, never seems to get through. I have yet to receive a message back. Fix these issues Greenlight and I will give you 5 stars.

BEWARE!! Use at your own risk!!. While the concept is great and the app and account functions worked great with the kids!!! Here’s my experience, YOU ARE NOT PROTECTED!! they do not follow the same rules as banks. I had an unauthorized charge on my kids account. I called the same day to dispute the charge and the agent said it was just an authorization and it could fall off and advised I called back after so many days to make sure the charge goes through and then I can file a dispute. Well I did this and now my dispute has been denied multiple times and they won’t refund the money. Terrible customer service!! They could have stopped the charge from processing from the first day. This company will not protect you funds were taken out of my child account and they really don’t care it’s really not worth as much drama, when there are so many other companies out there that will look out for you I regret referring this company to my friends and family I will make sure to have them close their account before they lose money I still cannot believe what I have gone through with this mess!!! BEWARE!!

What a great idea!. My daughter turned 11 last weekend and I called my bank looking to open her a savings account but wanted a ATM card. My large bank told me no one gives any cards to minors. So I did some research and decided to give this a shot. My daughter has put her birthday money on here and is learning how to budget her spending. We have also ran with the idea of earning money for chores and I think every child could get with the idea of this app and card. My only complain is I swear I had put in correct info for my daughter. Her card cane with her first name but my last name? Maybe that’s a requirement or I can change this? It’s inconvenient because my daughter does not have my last name. It’s not technically correct. But I guess it’s not too big of a deal! She loves that she can pay for her Xbox games with this and order things offline! Thanks!

Such a joke. Don’t bother with this junk. You may think it is a bank, but it is far from it. It is clear that the way they make money is by charging $10 for a debit card and using the money you transfer to invest and make money themselves. I realize that all banks do this, but what makes green light different from them is that they have your money pending in your green light account for up to 3-4 days before you can access it. And that does not include the day or two it takes to leave your funding source. In short, they take you money and the hold onto it for up to 4 days before you can use it. If you want to teach your kids money management, maybe try a real bank. Green light is a joke!

Almost perfect - one problem with update. We’ve been using for a month and a half and this has been a fantastic move for us. Now that the kids control their own money, they want to spend less! Just downloaded the updated app and there is one point I don’t like. You can see a child’s spending history in their wallet, but have to go to mine to see what I added and when. It would be perfect if both were back in the kid’s wallet AND it looked like a regular check register - in other words, it showed deposit and debits and also kept a running balance like a register. We’ve had a situation where I let my daughter use her card for pumping gas, even though I was there, so she’d get experience. I then paid her back, but it’s not clear as to when it was charged and credited. A running register with balances would make it easy to see he balance transaction by transaction.