EveryDollar: Budget Your Money App Reviews

EveryDollar: Budget Your Money App Description & Overview

What is everydollar: budget your money app? EveryDollar: Personal Budget

Track Expenses, Plan Finances

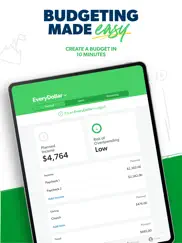

EveryDollar is your personal budget app. Create custom budgets, track your expenses, plan your spending, set—and reach—your goals, and keep up with your finances. Every single dollar. Every single day. Get started today—for free!

KEEP TRACK OF YOUR MONEY WITH EASE

Your personal budget should fit in your back pocket. It should be simple to set up and keep up with.

That’s EveryDollar.

Create your first budget in minutes. Track your monthly spending quickly, easily and accurately. Adjust your numbers anytime, anywhere. And know at a glance what’s left to spend—so you don’t overspend.

SEE ALL YOUR ACCOUNTS—ALL IN ONE PLACE

With EveryDollar, you can see your budget and all your financial accounts all in one place—from checking and savings to retirement and debt. Because you shouldn’t have to check a ton of apps to be in the know about your finances.

SAVE MORE MONEY EVERY MONTH

When you start budgeting, you’ll feel like you got a raise. In fact, budgeters find an average of $395 and cut their monthly expenses by 9% in their first month using EveryDollar.

SPEND YOUR MONEY GUILT-FREE

An EveryDollar budget helps you know where your money’s going—so you can make a plan for it. Then you can spend without the guilt. Finally. That’s the power of creating monthly budgets with EveryDollar.

FIND HIDDEN EXPENSES

Wondering if you’ve got hidden subscriptions? They can’t hide when you budget. Set up automatic transactions so your expenses stream straight into EveryDollar. You’ll clearly see all your spending and can decide to cut anything you don’t need or use!

MAKE THE MOST OF THE MONEY YOU’VE GOT

You have bills to pay and life to live. An EveryDollar budget helps you know you can cover it all. From monthly budgets to future savings, you’ll feel confident you’ve got the money for today’s groceries and that next vacation.

EVERY GOAL STARTS WITH A BUDGET

For all the big, small and in-between goals in your life—EveryDollar helps you budget your way to making those dreams a reality!

Create sinking funds to save up for big purchases. Set big-picture goals and see a timeline of when you’ll hit them with the financial roadmap feature. And all those goals that aren’t about money (but cost money)—make sure they’re covered. Every month!

And it’s free to get started. Right now:

• Create monthly budgets

• Access your budget on your computer, phone or tablet

• Customize budget categories and lines for all your monthly expenses

• Create unlimited budget categories and lines

• Set aside money for big purchases and goals with the fund feature

• Share your household budget with others

• Split transactions across multiple budget lines

• Set due dates for bills

• Talk to a live human being for customer support

Or upgrade your budgeting experience and get all those features, plus:

• Automatically stream your transactions into your budget

• Get notified when you have expenses ready to track

• Connect to multiple financial accounts in one app

• Track your spending and income trends with custom budget reports

• Export transaction data to Excel

• Get personalized recommendations for expense tracking

• Set due date reminders for your bills

• Calculate your current and projected net worth

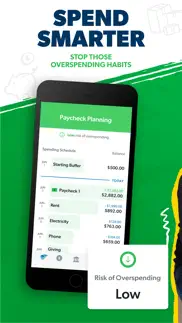

• Plan your spending based on when you get paid and when things are due with paycheck planning

• Set big-picture goals and see a timeline of when you’ll hit them with financial roadmap

• Join live Q&A sessions with professional financial coaches

Hey, you spend on the go—you should be able to budget that way too! Download EveryDollar for free and stay on top of your finances. One monthly budget at a time.

Privacy Policy: https://www.ramseysolutions.com/company/policies/privacy-policy

Terms of Use: https://www.ramseysolutions.com/company/policies/terms-of-use

Please wait! EveryDollar: Budget Your Money app comments loading...

EveryDollar: Budget Your Money 2024.02.29 Tips, Tricks, Cheats and Rules

What do you think of the EveryDollar: Budget Your Money app? Can you share your complaints, experiences, or thoughts about the application with The Lampo Group Incorporated and other users?

EveryDollar: Budget Your Money 2024.02.29 Apps Screenshots & Images

EveryDollar: Budget Your Money iphone, ipad, apple watch and apple tv screenshot images, pictures.

| Language | English |

| Price | Free |

| Adult Rating | 4+ years and older |

| Current Version | 2024.02.29 |

| Play Store | com.everydollar.EveryDollar |

| Compatibility | iOS 12.0 or later |

EveryDollar: Budget Your Money (Versiyon 2024.02.29) Install & Download

The application EveryDollar: Budget Your Money was published in the category Finance on 28 February 2015, Saturday and was developed by The Lampo Group Incorporated [Developer ID: 380709890]. This program file size is 122.73 MB. This app has been rated by 62,707 users and has a rating of 4.7 out of 5. EveryDollar: Budget Your Money - Finance app posted on 04 March 2024, Monday current version is 2024.02.29 and works well on iOS 12.0 and higher versions. Google Play ID: com.everydollar.EveryDollar. Languages supported by the app:

Download & Install Now!| App Name | Score | Comments | Price |

| Ramsey Audiobooks Reviews | 2.4 | 41 | Free |

| Ramsey Network Reviews | 4.9 | 25,256 | Free |

| EntreLeadership Events Reviews | 5 | 4 | Free |

| Ramsey Stickers Reviews | 4.8 | 41 | Free |

Minor bug fixes.

| App Name | Released |

| DasherDirect By Payfare | 12 October 2020 |

| Money Network Mobile App | 25 March 2013 |

| Credit One Bank Mobile | 21 September 2016 |

| Venmo | 02 April 2010 |

| Crypto.com Buy BTC, ETH | 31 August 2017 |

Find on this site the customer service details of EveryDollar: Budget Your Money. Besides contact details, the page also offers a brief overview of the digital toy company.

| App Name | Released |

| HomeBudget with Sync | 26 February 2009 |

| WealthPlus Net Worth | 21 December 2014 |

| Financial Calculator - Pro | 27 February 2022 |

| Debt Free - Pay Off your Debt | 14 December 2010 |

| Debt 2 Income Calculator | 15 July 2022 |

Discover how specific cryptocurrencies work — and get a bit of each crypto to try out for yourself. Coinbase is the easiest place to buy and sell cryptocurrency. Sign up and get started today.

| App Name | Released |

| Microsoft Teams | 02 November 2016 |

| Spotify - Music and Podcasts | 14 July 2011 |

| Telegram Messenger | 14 August 2013 |

| Google Meet | 01 September 2016 |

| Microsoft Authenticator | 30 May 2015 |

Looking for comprehensive training in Google Analytics 4? We've compiled the top paid and free GA4 courses available in 2024.

| App Name | Released |

| Bloons TD 5 | 15 November 2012 |

| MONOPOLY | 04 December 2019 |

| Earn to Die 2 | 20 November 2014 |

| The Wonder Weeks | 30 May 2012 |

| Plague Inc. | 25 May 2012 |

Each capsule is packed with pure, high-potency nootropic nutrients. No pointless additives. Just 100% natural brainpower. Third-party tested and validated by the Clean Label Project.

Adsterra is the most preferred ad network for those looking for an alternative to AdSense. Adsterra is the ideal choice for new sites with low daily traffic. In order to advertise on the site in Adsterra, like other ad networks, a certain traffic limit, domain age, etc. is required. There are no strict rules.

The easy, affordable way to create your professional portfolio website, store, blog & client galleries. No coding needed. Try free now.

EveryDollar: Budget Your Money Comments & Reviews 2024

We transfer money over €4 billion every month. We enable individual and business accounts to save 4 million Euros on bank transfer fees. Want to send free money abroad or transfer money abroad for free? Free international money transfer!

This is just what I wanted. This app is wonderful. The layout is very simplistic which is great for easily seeing where I’m at in terms of my spending. Believe it or not the function that sold me on this app was the ability to not only name my budget lines, but the budget categories as well. There were a few apps I tried where you were locked into the names they used. I truly felt like I got to completely customize my budget. Bill reminders and linking your bank account are locked behind the paid version, which is fine, the developers made a great product and should be compensated as such. If you’re not willing to penny up and get the paid version, the free version is still marvelous. I cannot tell you how many times the thought of “I should make a budget” has crossed my mind, If you’re in a similar position, stop reading this review and download it already! You’ll be glad you did. I am about to pay off my second credit card and am almost ready to tackle my auto loan. I’m never looking back.

App that is solid for Day to Day. This (Free Version) app works well for everyday use. If you are looking to input data manually and track your expenses this works great. However I like to use my IPad for most of my mobile financing and this is where it is weak. The app doesn't have the ability to stretch to the full size of the screen and it doesn't rotate for portrait to landscape. Unfortunately when my wife and I sit down for the end of month budget review we have to log in online to look at all the features why? Also their are so many features that aren't available online not available on the app. The baby steps tracker is a screen that would be great to look at on the app my wife looks at that screen twice a week as a way to motivate and focus her on our long term goals. The fund categories are great for saving money up for special things however to set them up in the app is difficult. It would be great if the debt categories had a tab that showed our balance what we paid and what we are saving by putting extra payments in. As well as a time counter of the expected payoff date. Also if we have a fund and the need comes that we use some of that money it then is calculated in the spent total and the remaining budget total. Understand why it shows up in the spent total however at our end of the month meetings we have to go back hand calculate what our remaining monthly budget is so we can apply the savings to our debt. This is frustrating.

This app is by far the best budgeting tool out there.. This app and corresponding desktop interface is by far the best out there. It’s very customizable. I’ve never been good at budgeting because I get paid bi-weekly and I have a variable income. I also travel unexpectedly for my job which throws off my budget by adding reimbursable expenses throughout the month. Through the help and suggestions of the everydollar support staff, I know now how to work this app as an effective tool with all those budgeting variables. You work your current month budget with the paychecks from the previous month. Then I keep a “hill and vallley” account with just enough to cover any short months where my checks may not cover expenses. So far I haven’t had to use that account. For the travel expenses, I created an expense and income category of reimbursable expenses. I know how much I get per day for meals while traveling and I simply add that to the reimbursable lines as the month/travel has gone on. This has been a huge money saver for me. I’m controlling every aspect of my finances by budgeting. It’s the foundation for everything I’m doing with my money. And I highly recommend spending the $120 for financial peace university which as of now includes everydollar plus for a year. Worth. Every. Penny. (And no I don’t work for Dave Ramsey but it’s a great program for getting out of debt)

Would give it 5 if it wasn’t for FUNDS. I love everything about this app EXCEPT saving funds! If you are following the Dave Ramsey principles for financial peace university you should be saving for things like tires and annual insurances throughout the year. This is the idea behind funds however they are not intuitive at all. What happens to the money when you withdraw from the funds in relation to the overall budget? When you withdraw from the funds and you look at your remaining balance, the numbers don’t make sense and don’t add up. Tutorials are not helpful at all. They are very basic and show you how to put money in and barely how to take money out but do not explain the overall impact on the budget as a whole as seen in the app. What does remaining mean in relation to the funds. Does remaining include the overall amount in the funds? Or remaining amount for that months budget? It seems when you withdraw from the funds it screws everything up and the remaining balance is off by thousands if you’ve made a big purchase. Incredibly frustrating! I’m about ready to throw in the towel and go back to a good old fashion Excel spreadsheet.

BE AWARE- Bank disconnection issues and deleting manual amounts. I had high hopes for this app and love all of the features it offered. But after using it for 2 months and constantly having to disconnect and reconnect my bank(2-3 times a day), glitches when using the paycheck planning, incorrect amounts, deleting transactions that I manually entered and getting no help from 4 emails back and forth to their customer support line, I’m giving up!!! From the beginning I’ve had bank connection issues. So I emailed their customer service. They told me to enter it manually until they figure it out(but I paid for a premium subscription with the bank connection, so that was frustrating). A week or two would go by with no resolve. So then after they told me my bank connection probably won’t be fixed anytime soon, I asked for a refund of the cost of the premium every dollar plan. She told me I can only get a refund within 30 days. This really made me mad!!! I had been emailing her for a month and because it took them that long to figure it out, now I’m past the 30 days. This doesn’t make any sense. It should go by the first day I contacted them for support. I gave this app many tries, I guess pen and paper will be the way to go until something changes.

Used to love it!. I have used this app for years and love how it has helped me budget better. However, over the last year or so, updates have occurred that have left two very frustrating elements: first, it now takes FOREVER to load! My goal from the beginning has been to log every purchase I make, as I make it (isn’t that best for budgeting purposes?). This used to be easy to do, but now it will take anywhere from 10-15 seconds to open. That may seem like a small amount, but when you’re trying to enter a purchase in the app while standing at the cash register, it is very annoying to have to wait for the app to load. The second problem that has popped up recently, is how often it makes me sign in! Seriously, the most annoying thing! I’m using the app on my phone, so I’ve already gone through facial recognition on the phone, but now I have to take the time to login? As I said above, my goal is to log each purchase as I make it, but having to re-login every time is about enough to make me jump ship and find another app to use. It is completely cumbersome and not user friendly at all when I have to do that. Please fix these issues so the app goes back to being the wonderful, user-friendly budgeting tool that it used to be!

Like always, they keep changing the UI. I’ve used EveryDollar for years now, long enough to hit the historical data limit a few times over. I’ve embraced and relied upon it for a large part of my professional life now. My big area of opportunity for the Ramsey+ team is to stop modifying the way the app works. Modern software product and deb teams can’t seem to wrap their heads around the “if it ain’t broke” principle. Multiple times now they’ve made updates to the UI to make it more modern and visually striking, and they keep either breaking functionality or introducing a new process to those of us with muscle memory. Currently, I can’t tell if it’s a bug or a feature, but I can no longer see the progress bar on spending categories as I go. I also get an auto capitalization on the second word when hitting the space bar in a business name without that representing to me graphically. I can’t tell you how annoying that is that the app knows I’ve got a space and the next letter will be a cap but I the user don’t know that. Things like that have plagued this app over the last year or two. I’m starting to wonder at what point they’ll just hate the whole thing behind the monthly fee. You gotta make money, I get it; but honestly you could have just left the rest of us the version from 2 years ago with no further updates released and we’d all be fine.

Finally Nerds and Free Spirits Unite!!. I am a major nerd. I was a long time spreadsheet budgeter who painfully dragged my free spirit to the budget meeting table once a month. She hated it and was checked out by the time we were done each time. We eventually switched to using Mint for its automation. The ads and lack of cash flow planning drove me crazy so I still did a monthly cash flow plan on a big desk calendar. It always felt like my spouse and I had two separate budgets which always caused me to have spending anxiety. Finally with EveryDollar we have the best of both worlds in one place. My wife and I can get through the budget in a few minutes together (finally without her falling asleep before we’re finished) then I go through afterwards and do the paycheck planning for the month. We can both see how much is available in real-time in each category. We can both track transactions in one place. Finally it feels like we have one budget instead of a budget theory that I’m always worried is going to get blown up by that one poorly timed EFT. THANKS RAMSEY TEAM!! Keep up the good work.

Love the simplicity of this app!. I really am thankful for this app! I started using it in January, 2019 and have been faithfully budgeting since then. I have such a good picture of exactly where I spend my money, and can hold myself accountable for expenses. I use the free version, and love it. It’s not difficult for me to sit down every 1-2 weeks and make sure all my expenses are up to date. The app makes it really easy to delineate different things that I am saving for, which I LOVE! I’m always planning vacations, so it works it out great for that. My paychecks are not always exactly the same, and it is really simple for me to update my budget throughout the month with each new paycheck, but you could also plan ahead and not have to do that if your paycheck is consistent. I’ve tried mint, ynab, pocketgaurd, and other apps. This by far has been the simplest, and easiest for me to use... which means I actually use it. Great app! Thank you!

Feels outdated. Needs more features.. I just finished the total money make over book recently and this has been one of the better apps available, good budgeting app but could be better, there are other apps out there where this app could take a few pages from, features that are not available in this budgeting app. My only complaint is that it doesn't have a calculator built into the app to factor in cash expenses and income. I always find myself leaving the app to use my iphones calculator and having to reopen the app again to put the numbers in to each budgeted item. It would be easier and faster to be able to paste the results in each item. It would also be nice to swipe in between the planned, spent and remaining pages instead having to tap it. not worth the monthly asking price unless it improves. On the plus side the drag and drop feature is awesome if connected to your bank account, I will continue to use the free version for now.

I Use This App All The Time. I have been using every dollar since it launched. It replaced the other two or three budgeting apps that I had previously used and there has been no going back. It’s updated very regularly and is produced by a good-sized company where their whole focus is helping people get control of their finances, so the regular updates are always going to be the case. I usually set up the budget for the month on my computer and then do updates throughout the month on my phone while I am on the go. I have set up new budgets on the phone and it works great too, I am just on a computer all day every day for work so it is habit I guess. The app is very intuitive and easy to use. There is an extra feature called EveryDollar Plus that is available for a fee each month to integrate your bank data and the expenses that your bank sees so that you can quickly categorize them with a few taps into the correct budget categories so that you don’t have to manually enter each transaction. I did a trial of EveryDollar Plus when the app first launched and decided not to use it. So I have been using the free version for the last year and a half or two years since the app launched. It’s probably about time I give every dollar plus another try since it’s probably going to be a bit different since all of the updates that they have done since I used it last. Great app that I use all the time! This is one app that I could not do without on my iPhone.

The Best App Period. This app was created by Dave Ramsey and his team who help people with building wealth. The people behind this product are A+ and it shows in how intuitive this app is. I paid for the pro version that connects to my bank. Everything gets updated automatically and I literally just drag and drop the transaction into whatever section of the budget I need to. It is a little pricey but I will continue to pay it in a heartbeat because this is a must have tool for my wife and I to continue to work off the same budget simultaneously. It takes about 3 months to really start to put a solid budget together after some trial and error. Do yourself a favor and take financial piece university while your at it. They teach you everything you need to know about finances and how to build wealth. I’ll be debt free this year, and continue using this app for building wealth 🤙🏼 Thanks to Dave and his team for providing these great tools

Spend your money on a better app. This app was sufficient at one point. I was using Mint and actually found out months ago through Dave Ramsey that Mint was shutting down, and since I had already done DRs financial peace class, I started using this app again. Just as I got my budgeting down, I was asked to update to latest version - what a mistake. Now I either have to manually input purchases, or pay for the premium to connect to my accounts which was free before. Extremely disappointed in Dave Ramsey taking advantage of everyone because Mint shut down, especially when I’ve already paid for the class and this came free with it. Not to mention the yearly premium price is outrageous especially when I never felt the user interface was that smooth and I am constantly having to (re)categorize every transaction because the app isn’t smart enough to learn where reoccurring transactions should be placed. Thankfully I found another budgeting app that does all of this while also tracking my investments; although it is a little more expensive it is worth it with more insights, better design, has an option for tracking cash, and a much nicer and easier user interface. I’m already in love with my new ‘flying assistant’ budgeting app. Not to mention since the update I can’t delete or disconnect my accounts - frustrating! Therefore bye bye Everydollar.

Nice App. I’ve realized that the more you use the app the more you get into it and you really do see where your money has been going and you can redirect it to the right place. Only reason it is not 5 star review is because you can’t absolutely do everything on the app that you can on the website on a Mac or PC so that can be inconvenient (minor). I had an issue with my income being incorrect and the glitch was fixed within a couple days. You just have to use the help feature. The $10 is worth every penny for the benefit of money you save from using this budgeting tool and to me is not a factor in the grand scheme of things when trying to fix your financial situation even with a tight budget. Once you get a hang of it nobody says if you find a way to maintain your budget another way that you can’t cancel the subscription. You will still have most of the features you need with the free version. I feel like to expect this to all be free and not have to pay for this convenience that this gives you would be a bit a sense of entitlement. Not a good trait. Pay the 10 bucks and use the heck out of it.

Former Quicken Budget User. Since 2004, I’ve used Quicken for our personal financial management. As far as the budget goes, this app blows Quicken’s budgeting tool out of the water. Every Dollar is so user friendly, and the zero dollar concept is much more effective than Quicken’s how much you make- how much you spend method. I love that Every Dollar makes you assign every incoming dollar. If your like me, and tend to overspend in certain categories, you’ll have to take from another category to balance out to zero. Knowing this has helped me re-think impulse buys. I also love that my husband and I both can see and use the app from our cell phones. This means that I don’t have to call him and ask what was the charge or that charge. He can go in and assign it to the appropriate category himself very easily and quickly. I’ve only just started but already I think it’s going to be a great tool for my husband and I to complete all the baby steps.

Confusing and misleading if you take them up on an offer to resubscribe.. We had utilized the EveryDollar app a few years ago, but due to extreme circumstances, we cancelled all subscriptions for a time. Now, we are in a position to get life back in order, and EveryDollar is one way we knew to go about that. When I downloaded the app, I was asked if I would like to subscribe, and the app stated we would have a seven day trial. I didn’t really need a trial, but I followed the prompts to resubscribe. I couldn’t find the monthly option, so I hit subscribe, believing I would be given that option in a later step. I wasn’t. I was charged $129. When I called Apple support to change it, I was told that that option isn’t given to folks who are resubscribing. That’s a little harsh and misleading. Customers should be told UP FRONT that, due to having previously subscribed, they are not eligible for a monthly payment plan. Those of us that are getting back on our feet and really need this should be able to purchase the app. That’s a big hunk of money at one time for some folks. Please, consider changing the process for those of us who would like to resubscribe.

Perfect in every way EXECPT no way to allocate. I love this app and the user friendliness of it over the other highly rated apps in it field. My only complaint is that there is no way to set up your allocations on the app so a written form is still necessary for those that get paid multiple times a month. I think for almost $10 a month that there should be all of the tools that Dave Ramsey has in printable form on his website on the app as well. MAKE THE ALLOCATIONS AN OPTION ON THE APP! All the other things like lump sum payments can be set up using the “Fund” feature, break down of savings, and irregular income planning by setting up as many categories as you desire BUT it is lacking this and this is a huge part of being successful. PLEASE MAKE THE ALLOCATIONS AN OPTION ON THE APP and I will gladly give this five stars! Also as a side note but not a deal breaker or loose of any stars is that it doesn’t like to stay connected to my PayPal account/credit card so I have to re-login when I want it to up day per my paying off that debt and any online purchases I do through PayPal not very many for me so not a big deal. Thank you!

Needs to be more stable - bank account link. The app is great in that it is a logical way to budget. FPU has excellent information. The app keeps kicking my bank account out and requires me to use a lesser level of security. Given that I have to pay $100 a year for the luxury of connecting my bank account I think it should work seamlessly. I have not changed anything on my account in over a year; yet every two months or so I have to delete my bank info and put it back in and the sift through the double charges. I’m not using a small bank either, it’s one of the largest in the country so there is no reason EveryDollar shouldn’t support it perfectly. I don’t want to use a different app and I’ve even switched bank accounts when EveryDollar stopped supporting a credit union I was with - that was a pain. I hope Ramsey solutions puts some money behind the app to improve it. Especially if you are going to advertise in it and charge $100 a year for the premium feature.

A Must Have!!. If you’re serious about keeping tabs on your budget, this app is a must-have! The free version is nice. However, for $100 per year, you can link your bank and or credit card accounts to track your spending. The app reminds you to create a budget for an upcoming month two or three days before the new month starts! It automatically copies the previous month’s info which makes it easy to tweak budget items and amounts. The app is intuitive because you can create a fund (like a Christmas gift shopping fund, or a vacation fund) and tuck money away each month knowing that when it’s time to pay for that cruise, you can easily transfer the funds and pay without worry. The app also allows you to enter long-term payment accounts; car loan information for example, can be entered and you can more or less keep track of what is owed, on the app. This has made life so much easier for my family! I love Excel, but for $100 per year, I don’t have to spend hours each month tracking where the money went!! Thank you Mr. Ramsey!!

Cheaper than marriage counseling & lifesaving. This app is a great tool in so many ways. It works well, allows me to sync to our bank and categorize every transaction. It makes your money REAL. In my home where I’m on a different financial planet than my husband is, it has saved loads of arguing and playing “the blame game” about who spent what where. If one of us has spent over our allotted amounts it’s simple to see and stops the argument before it starts. We’ve sat in untold counseling sessions and money has always been a huge issue. This app has helped remedy more problems than any counseling ever did. When I can simply say “we are $400 over budget, spending needs to stop” and husband starts freaking out on me asking why; I get to reply “see line 9 where you bought truck parts and line 8 where you stopped at the gas station all week?” Then it spares me having to defend my $100 of budgeted “fun money” I put all our receipts into this app with a note attached to what the item was. Believe me when I say this has saved me so much stress and taken so much burden off of me being able to enjoy my little bit of “mad money” and not be made to feel guilty about it or have it thrown up in my face. After 32 years of arguing about money I have a tool to change the game. Worth every cent.

Great app with some room for improvement. First, I have to say my wife and I really enjoy using this app to track all of our expenses! I love having the ability to drag and drop new transactions into each category. I also like being able see when we go over our under or our projected expenses and having a visual representation of our remaining amounts per category. Having access to budgeting resources and financial peace university is also a huge plus! However, I would really like to have the ability to see which account the transaction came from on the transaction details screen. This would help tremendously in sorting transactions since my wife and I use several different accounts for different purposes. Additionally, I think it would be helpful to have access to a graph or chart that shows spending/saving trends per category over time. This would give users more insight into their spending habits and their ability to accurately project expenses each month. Overall, this a great app that is close to being the perfect budgeting tool!

New glitch?. I like this app a lot for budgeting. The only reason I’m writing is because there’s a new-ish glitch that I’ve noticed that has been frustrating. When I go to a specific category, let’s say groceries for example, click on ‘schedule’ and then go back to my budget, all the expenses that I’ve tracked throughout the month disappear so it looks like I’ve spent nothing and had no income. I then have to close the app and reopen to see my tracked expenses again. This happens every time I navigate back to my budget from the schedule for any category. It also happens sometimes when I navigate back from the paycheck planning. This app has been extremely helpful for my husband and I to stay on top of expenses and spending. But, especially for an app I’m paying for, I would prefer to not have to deal with this glitch every time I want to view or edit my schedule (especially since that is a big appeal of this app and budgeting method)

I use the free version!. I read all of the reviews before signing up a year ago and a lot of people were having trouble with their paid subscription accounts. So I went the free route .... All I say is take your time signing up because some boxes are actually checked for you. To include the automatic reoccurring subscription. **I have never tried the paid version** I downloaded the app because I watch Dave Ramsey videos online. Before this app I was doing a paper budget ... which I loved. So I just moved my paper notes to my phone. Another reason I went with the free version is because I’m used to having to make daily transactions deductions to my budget. It really does help me to stay on track ... forces me to actually check my checking account balance almost daily. Then inputting the amount into the app and placing it into the proper category allows me to see what, where, how much and how often I spending my money. Makes me feel as if I am using cash. It has become a habit for me to check my app for the available balance in a category before I go spending my money.

Definitely Not Worth $130!. I am an accountant, but my husband is not, so we decided on this budgeting app since it seemed a little more user friendly for those without a background in finance compared to a lot of other apps. We used this app for a whole year, and I was disappointed at how little information it can process, and how much effort it takes to maintain accurate info. My husband stopped using it altogether because of what a pain it is. One of my biggest complaints is that there is no “reports” section, so I could never see how well I was doing month to month, or notice any trends making it impossible to get a “big picture” idea of your finances. Categorizing expenses was a hassle too, especially when you are trying to categorize two months (ex. At the beginning of the month you have expenses from the past month as well as the present). The app was always having connection issues with my banks, so I never had real time information. I think I would have maybe let issues like these slide if it were a free app, but it is DEFINITELY NOT worth the $130 yearly subscription fee. I started to dread doing my finances because of how annoying this app is.

Bugs, Bugs, Bugs. I tried every single budgeting app available during a one month period. This hands down was the easiest and most flexible app available. However, it has so many bugs you basically need to call an exterminator. Transactions constantly disappear and then reappear sometimes doubling the entry. Due dates change repeatedly and often. The last straw was when I had 19 bills listed with correct due dates. They all changed to the wrong due dates three days in a row. I corrected them each time which was time consuming. The third day I fixed them all again and they changed again in the same day. Then some transactions that had already been assigned just disappeared knocking my balance off. I could never get the app balanced with my bank account. Each time I tried to reconcile it the app showed me off by a completely random and different amount. I was spending hours and never getting a good result so I deleted the app and rebuilt my good ole faithful excel spreadsheet. If the bugs in this app can ever be resolved it will be great. It is so catastrophically poor I do not see that happening anytime soon.

I like it but i have some ideas. I like this app so far! I think it’s really going to help my financial organization. The only thing missing is being able to share it with your partner! Maybe i missed that feature somehow, but being able to share with a spouse or significant other your finances also impact it would be nice to have separate budgets but be able to view both of them. Or even better, put in both incomes while being able to distribute that into both shared budgets and individual budgets. Ex: say my spouse and i both have a joint ‘giving’ budget being able to have both our spendings in the budget reflected would be nice. Meanwhile, we may have individual lifestyle budgets that could be viewed by both but no impacted by both of our spendings. And to go a step further each be able to assign accounts (credit/debit cards) to a person if you know only 1 of you use that card so it only shows up for them to assign the expenses to. Not sure how to turn this into an efficient reality but it’s a concept i’d love to see them try out in the app!

Great app, but some suggestions. Is there a phone number to call for help? I’m only on day 2 of my free two week trial. I have added my bank account. My big suggestion is please change it to a 30 day trial so people can actually understand and see the benefit of budgeting for the whole month. If people can see 30 days more people might be hooked Okay so on to the actual app, not going to lie I love it! I love that it sinks to my phone and bank account and I always have it with me. Unless some thing big happens I will for sure becoming a subscriber. Someone may look at this and think $130 a year is a lot but I say it’s worth keeping such great track of every dollar! This is something I so needed in my life. The 4 star is just because of the trial period length and not sure yet how easy it is to get help. I searched for a phone number to call and couldn’t find one. That could be hard for someone who is not tech savvy. Great app!!

Fantastic budgeting app. Been using this app for a few years and love it. Before then I had a complex spreadsheet I made for budgeting but when I married my wife that had to go. We love the ease of use for setup and and maintaining the budget. And with the cloud-based syncing of data, my wife and I can each stay current because we share the same account. There are a couple of quirks with the app. First, for unused funds in one category item to carry over from one month to the next that category needs to be setup as a Fund or else that money will “disappear” from the budget going into the new month. The app by default does not set a new category item as a fund; you have to change it yourself. Second, this app will not load the budget if you are not able to receive cellular data or connect to wifi. So if you are off the grid or traveling international without a data plan then good luck. Haven’t tried the Plus feature so I can’t speak to that. Thank you Dave Ramsey and team for blessing us and others with such a great service.

Times have changed. This was such a helpful app when I first started using it. As a young adult who’s still very new to budgeting this app quickly became my best friend. The app had its issues but for the most part was extremely useful especially considering it was a free budgeting tool. Then they started charging for it. And at a pretty exaggerated price point too. You can pay $60 for 3 months ($20 a month) or go up to $130 for a year (>$10 a month) which, for what your getting, you’d be better off going to a financial advisor once a year. The app is not worth the price point even if it was a flat $10 a month it’s still a half-baked app riddled with all kinds of errors that even after months of monetizing the app, still haven’t been fixed and probably won’t be anytime soon. Just because the frontman says things like “I want you to be financially free” it won’t be over him making a quick buck off of us. With that being said back to paper budgeting I go I wish everybody the best of luck creating their future don’t let these rich people manipulate you just because they do well for themselves.

An idea for improvement. I just downloaded this app recently so I am still in the process of figuring it out but it seems great so far! I used to use the app YNAB, which I really loved as it was so thorough, but I didn't want to spend the money for it after my free trial was up and they don’t even have a free version. EveryDollar is SO MUCH easier to understand, but of course the free version does not have all of the fancy features that the Plus version has or that YNAB has, which I completely understand and am okay with because I don’t want to pay anything. However, there is ONE THING that I wish EveryDollar had in general that I am really missing about YNAB so far. I see that there is an option for setting a due date for budgeting items, but you can only set a due date for that individual month and set it to repeat each month. I am new to this app so I am not sure how that works exactly, but I just like the savings options of YNAB better where you can set a due date months in advance and track your saving throughout. It also gives you a recommendation of how much you should be putting into that savings fund each month. This is helpful if you want to save for something like a trip next summer so you can set an amount and date that you would like to save that money by If EveryDollar could come up with something like this that would be amazing. I am still going to try it out for awhile though since it is free.

The right fit for me!. I have used just about every budgeting app on the App Store and they don’t seem to keep me coming back like Every dollar. - I love the simplicity of the tracking methods and the quick data each budget category provides from synced transactions. -With this app I find the more I use it, the more focused I become on where to save and structure my finances to reach certain financial goals. -The only improvement would be implementing auto-categorizing of the synced transaction and prompt for approval rather than sorting every single one AND giving a category every month. With automatically giving a category (from past saved transactions) but still listing the transaction for approval, you are still reviewing the transaction but not having to do the same leg work every month when you are syncing transactions to place into the budget. This makes only it mush faster and you can still change the category if needed for a change in a specific transaction. -Overall, this is the best app for me. I can easily track and update everything as well as see bank transactions and how my money is being spent every month.

Good app, but annoying repeat notification. I like this app for budgeting. There used to be an issue where if your bank account got disconnected in the middle of the month, then you’d have to recategorize all your transactions over again once the connection was restored. It was a pain. They seemed to have “fixed” that. I use quotes around “fixed” because the already-categorized transactions now stay where you had them, but the app reimports the duplicate transactions and notifies you that it deleted the duplicates—repeatedly. There is an orange dot in the Transactions tab that will not go away. You tap on the transactions tab, get the message letting you know the app deleted the duplicate transactions for you. Ok. Go back to your budget tab, and the orange dot appears again on the Transactions tab. Does not matter if I try to look at the duplicate transactions, it doesn’t help. There is also no way to permanently delete them. While the old way was annoying because you may have to redo your transaction categories, this is annoying because the notification won’t go away. Please fix!

Great budget tool. We started with the basic EveryDollar app 3 years ago and quickly upgraded to the premium because we couldn’t stay on top of loading our purchases. Game changer and worth every penny! My husband and I can both use the same account to make it easy to be on the same page. Easy to change budget amounts. Can’t change the line item name. Sometimes it logs me out but not a big deal since I remember my info. The emergency savings “goal” I haven’t quite figured out yet because you can put a goal amount but when you save the amount for the month and drag it into that line item, it still shows incompleted. The line items carry over from month to month but I wish there was an option to flag line items as quarterly, annually of every 2 months so I don’t have to remember. Overall a great app to use with your spouse and start telling your money where to go and start winning with your money!

Recent update preventing 5 stars. I love this app and recommend it to everyone!! I have really been able to get my family finances in order and have started saving a lot. If you’re looking for a budgeting app, your financial situation is most likely not great, just like mine before using the app. So here’s a money saving tip, you don’t need to pay for premium service. Enter everything yourself and be very hands on with all money coming in and going out and you will really start to see results. Good luck! One complaint only and I guess it’s minor. There was recently an update where retailer names will automatically be suggested when entering an expense. Please get rid of it. The local grocery store is not listed and many other places I shop are not listed either. Please go back to the way it was before. It was great. The only thing that would have made that better would be to save the names from my previous entries and then suggest those instead of what it suggests now. Thanks, love the app.

Really want to like it more. I really want to like it more. The User Interface is a plus for me. Conceptually I like this app way better than any of the others I have used. If you want to only use the free version and add all of your transactions it works great. My issues are with the paid version, and downloading transactions from my bank. I started using it and loved the app. After a couple of months I started to notice transactions missing. I started paying more attention, and compared it to a competitor who I still have my accounts linked to. The competitor shows all transactions, and EveryDollar does not. I put a request into support, and received feedback that they weren’t experiencing any issues with my bank. Was asked to update my login information with my bank to see if that would resolve the issue. I did this and went another couple of weeks having the same issue. I emailed again, and never received a response. I let it go for a little bit, and then emailed again. It has been more than two days, and still no response. My biggest issue is TRUST. If I can’t trust the transactions that are being downloaded, the app becomes useless, and doesn’t allow me to budget correctly. Again, I really want to like this app, but can’t if the version I paid for doesn’t work appropriately.

Missing Features. (1) The initial setup wizard needs to be available at any time, not just when you first start using the app. It’s easier to input information and figure things out with the help of the wizard, and if you quit the app without finishing the initial setup, it makes it difficult to figure out how to get all the right numbers in the right places. There should be an option to go back to the wizard at any time. (2) I also don’t see any information on how to budget for investments in the app. Nothing comes up when you type in “invest” or “investment” in the Help section, and I don’t see any Investments category on the app. (3) I want to be able to separate my budget by pay Period rather than by month. I get paid twice a month, and the app is making it unnecessarily complicated having to figure out how much of my 1st paycheck has been used for various categories and how much is left for those categories out of THIS paycheck. Since I won’t receive my next paycheck for a couple weeks, I do not yet have that money, but the app acts like I do.

Changed Our Lives!. I thought I wanted to stick to Dave Ramsey‘s paper budget printout. It seemed too much of a bother to get on the computer to do my budgeting but boy was I wrong! This app does all the adding, subtracting, re-adding, re-subtracting automatically for you! If I need to make a small adjustment to my budget I was having to re-calculate the whole month! What a hassle. Now I can make any adjustments so easily and this really keeps me on track. I prefer to do it on the large computer screen but it’s also so very handy to have the budgeting app on my phone for when I’m out I need to add in a transaction. Another thing I like to do is look at my bank screen on the computer, and use my phone for EveryDollar so I can add in the transactions. There are no advertisements or gimmicks. Since beginning Dave’s program in mid February we have paid off a total of $14,000 in debt and saved another $14,000 towards our emergency fund. This app was pivotal in helping me to organize our household budget. The best part is that my husband has been really impressed!

Love it!. I love using this app! The ease of it pulling over my transactions helps so much compared to trying to make sure I write everything down and doing math every time is so nice. However, the app does still have some negatives. I’m not a fan of everything having to have a “due date” or funds be available on certain dates. We set our budget as a monthly budget for a reason. So in the beginning when I set all of the dates based on our paychecks for the app to let me continue, it would should I was negative in money left for certain budget items even though that wasn’t the case. So I had to go in and change all of the “available” dates to the 1st day of the month just so I could follow my budget better. I’m using the app to track my spending and make sure I’m not spending too much shopping or eating out so that I can save each month. Not to make sure I don’t go negative in my bank account. That’s what my banking app is for. Just wish there was a little more flexibility with the app is all. Overall I love it though!

Could’ve Been Great. My husband and I purchased this app to help keep us both on the same page about our budget, after ready Dave Ramsey’s books. At first it was great, just set the budget and drag and drop. Then our bank had an outage on the app, three months later our bank still has an outage. I’ve spoken with technical support for the last three months and they have no idea how long it will take to get the bank back. All the while the Mint app is connected to our bank, which is free. So I keep asking and keep getting the same “ we hope to have it fixed soon” message. I finally got so fed up I contacted iTunes to get a refund, but of course, we had canceled the subscription to not renew at the year mark, we couldn’t get any sort of refund. Which we didn’t know, because we followed the instructions from the every dollar company on how to get a refund. So now we are out WAY too much money for an app that literally doesn’t work, and the company has stated there is nothing they can do for us because we purchased the subscription through iTunes and not online. My suggestion, don’t waste your money. Find a different budgeting app that is more reliable or at least cheaper, because if you bank loses connection you won’t see a dime back, which to me seems cruelly ironic.

I guess you need my money more than I do.. First of all being the fact that I signed up for a 14 day trial and then immediately was charged for it. How is that a trial if I’m paying for it right away? To make matters worse I paid through Apple. Everdollar says they can’t refund those types of payments. That’s convenient. Also they don’t give the option to choose the monthly subscription. “Want a 14 day trial? P.S. we’re going to charge you a full years subscription before you’re able to decide if any of this is what you want 😉”. On a lesser note but still irritating. I use a credit card for everything for security purposes so no place I make purchases can possibly have access to the accounts where my personal cash is located. Just in case a place of business gets hacked then I won’t be dealing with an empty account for up to three months. Everdollar of course advises against the use of a credit card even if in my case when it’s not accumulating debt, it’s just a security measure. So when I use the card it shows up in Everydollar as debt even though it’s not debt it’s normal spending that I will refund using my cash from a separate bank. So I can’t even use the app normally because it just thinks I’m constantly going deeper into debt.

Paid subscription stopped working. Concept is great, visually appealing, easy to understand and use, and there’s a nice free version where you manually input your transactions. This honestly WAS a great budgeting app I’ve used with my spouse for several years until the PAID version just stopped working with my bank account for a month with no fix. There’s also no customer support number to call (can only submit an online request for call back) and for nearly the cost of a Netflix subscription, I expected better. There’s nothing like trying to budget when your primary means to do so stops working for a month or longer :( **UPDATE** I’d sent some emails and after just over a month the issues with my bank seem to have been resolved and works as advertised again for the paid version. In the meantime we tried some other budget apps but will continue to use EveryDollar as long as it works. If the App Staff are reading this, thanks and PLEASE work with your third party company repairing bank issues to shorten problem repair time.

Not intuitive at all, frustrating to learn. I’ve used a number of budgeting apps over the last several years and figured I’d give Every Dollar a try. I figured with the good reviews it would be easy to use. Boy was I wrong. I’ve never struggled to figure out how to use a budgeting app before - until this one. I linked up my bank accounts and began setting up my budgets, easy enough. But I have several bills in my budget that are recurring every few months. I entered the total bill amounts and then attempted to change the frequency from the preset “monthly” to every 2-3 months. Doesn’t work, the option is grayed out. I tried a few different ways to change frequency with zero success. Managing recurring bills is a huge factor for me when budgeting so being able to set frequency is vital for me in a budgeting app. No idea why Every Dollar is set up to limit how you can budget but I’m over the app. I can’t even find an option within the app to find help or use a FAQ. Such a bizarre app to have no support and no ability to do basic budgeting tasks. Apparently this one isn’t for me. I was prepared to pay for the premium version if it worked for me but I can’t even get past 10 mins into using the app or even get support, so I suppose this one goes into my deleted apps now. Pretty disappointed.

If only I had start d using this App sooner. Since our retirement we really track our spending and this app is irreplaceable for doing that. The amounts shown in "remaining" however have never added up correctly. Even if I remove our budget line item for emergency fund. The total does not correspond when I manually add the remaining to spend. For us, it would be better if that ONLY remaining amount only included the amounts to spend. Since the latest update there is a glitch....when I enter in a line item for expenses, it used to show, via a green line, that the spend amount has been entered, it doesn't do that anymore on SOME of the items entered. Specifically on our recurring monthly expense items. I've recommended this app so many times, yes it takes a few months to become accustomed to using it, however...those few months are WELL worth it. Wish those people would start using it, because I can see the money being thrown out the window by those I have recommended this app to...😢 We are so happy to finally be in complete control of our finances.

Easy but incomplete and pricey. I love the design and ease of use to track transactions. But that’s where it ends… The math didn’t work out many times between “planned” expense, “spent” and “remaining”. No idea why. I was never able to connect to two of three banks I use. I love to run reports and see all of the transactions in a particular catagory, or merchant. This app does not do that, only the dollar amount. Finally, I like to see my transactions in a single account at one time. No can do. I did get a refund through Apple, thankfully on the 30th day after purchase. That’s the time limit. Not sure why it’s $80/yr, but I’d pay if it worked. Update: I received a developer response, addressing my concern about bank connectivity. Since I was forced to leave Mint and find another budgeting tool, I decided to use the recommendation from the app developer and try again. I went through their recommendations, and did everything suggested. When none of that worked, and I finally figured out how to send the developer an email in regards to my problem, I never received a response. As of today, there is still one bank I cannot connect to, and I’ve noticed more than one bug that makes using this app frustrating. The problem is, I don’t know what other tool to use that would replacement Mint. I would take a few ads in Mint over EveryDollar any day. Update 2: Moved to Monarch. Awesome app

Can’t sync my bank. I’ve had this app for about two years now. I used it very little at first, but it worked very well at the time: my bank connected and I tracked all my expenses very successfully. Unfortunately I stopped using the app, and my bank connection terminated automatically. This month I decided I am going to use the app religiously and went in to set up my budget and re-sync my checking account. No luck. According to the technical support at EveryDollar, my bank has changed their security protocol and additional information is required before they will allow me to link EveryDollar to my bank account. No indication what this additional information is or how to enter it. Tech-support has indicated that they will continue to try and get my bank to link but in the meantime, they suggested that I do the transaction deductions from my budget manually. In my mind, this defeats the entire purpose of the EveryDollar app. I want something that is done a with a few clicks not something that I have to do manually. With the enhanced security protocols that most banks have, I’m disappointed that Ramsey Solutions hasn’t anticipated this and put in place procedures to comply. But I can’t say that it’s entirely their fault. I have canceled my auto renew for the EveryDollar app. I’m looking for another app that will do the same thing, but will connect with my current bank. If I’m not successful, I guess I go back to the old envelope plan.

Needs option to add accounts manually. I tried this app for a week, and in general, it has some very good features. However, once you have signed up for the “plus” account, it seems you can only add bank accounts that are electronically linked, and not all banks are supported. I have 3 accounts, all of which I access online regularly, that are not supported by EveryDollar. (They are, however, supported by other budgeting apps I have used.) I would have been okay with it if I had the option of adding and tracking the accounts manually. (They also proudly stated in their reply how there are over 200 banks supported, and to check the list, as if I was going to close out the accounts I had just so I could bank with one of the ones they actually supported. Talk about missing the point!) It can’t be that hard to add unlinked/offline accounts as an option. I’ve used both mvelopes and YNAB in the past, and both let me do this. I was hoping for a better budgeting app, but at a cost that is so much higher than the other apps out there, without even providing a way to track all of my accounts, it just seems like a huge waste of money. (I know part of the value of the subscription is supposed to be access to the other features, like FPU. But if all you need is budgeting, then those “extras” are pointless.)

Great App/Frustrating Issues. I’m a huge Dave fan. I follow his principles and it has served me quite well. I have used this app for years and 90% of it’s awesome. But at times it’s a big pain. It doesn’t recognize my bank account for some reason, so I have to remove it and then add it again but when I go to add it again it says “your financial institution isn’t currently supported and we’re not able to set up your account” even though I’ve had the account set up for years prior. This happens a couple times every year. I have to wait a couple days then it will recognize it and let me load it. The painful thing then is that it reloads every transaction from that month, so with it happening today (April 23) once it reloads I’m going to have over 100 transactions to go through. Kind of annoying. I wish it didn’t do it because when the app works I really love it.

Good tool, some flaws. I do like this app and it has helped me keep track of my spending much better than I had been. It also shows me how much I am really spending on items that I can cut back on, like eating out. Before, I really didn't realize how much we were spending and now I can see it add up as the month goes on. I like being able to split transactions into different categories to track each cost. But the help section is lacking and there was no real tutorial that I saw so I kind of had to learn as I went. The one thing I still can not get an answer to is the income. I can put in a planned amount but sometimes our income is more or less. When I put the actual received amount in as a transaction, it doesn't change my overall monthly amount. So it doesn't account for the over/under. This may be user error, but I've tried everything to get it to work properly and it won't. So I just change the planned amount to what we get paid. Which is fine, although the next month's budget shows the wrong amounts as planned income and I have to change, and it is not at all what the help section says should happen. It seems like the plus version would do it for me, but I am not paying $120 a year for an app to help me budget and save money. And honestly, I think that is shady of Dave Ramsey to even do that considering he preaches about cutting out unnecessary expenses. I'd give this app 4 stars but the lacking help section and fee for everydollar plus makes it lose at least 1 star.

Loving EveryDollar every day. Honestly, I can not say how much I truly love this app. It has helped me incredibly to plan for the future, separate my savings goals, and everything. I have the free app vs paying to connect to my bank account. I love the ability to add my purchases right away instead of waiting for them to go through on my bank acct. For 3 months straight I kept track of every transaction and all of my budgeting on PAPER and week-by-week because I have two sources of income that vary each paycheck. Now I am able to look ahead at the month, estimate (on my own) how much I will be getting paid, and then budget from there. There's so much more money I realized I can put into my different savings goals. Unfortunately the benefits aren't the same between the app and online, but I also love that I'm able to create 'funds' for my savings and it continues to track it month to month. THANK YOU for this app 🙏🏼🙏🏼

$130 to save money... right. I get that apps are designed to make money off of its users. But this just seems a little bit ridiculous. For a guy who tries really hard to sell that he cares about people learning how to budget their money, and having the best life for themselves, he is sure charging a lot for a super basic budgeting system. I don’t want all the extra classes and videos and everything else that comes with the app when you spend $130. All I wanted was to track my spending. I spent time plugging in the numbers for my planes spending, only to find out that there is no easy copy and paste feature for the actual spent tab, meant to help you track your budget. You have to retype everything a second time, even items that are consistent like car payments and mortgage and insurance/health insurance etc. Or, you can link your bank account. Obvious choice, you want to link your bank account. But in order to do that you have to buy the entire subscription for a year including all of the other things. Really frustrating. Guess I’m going to look for another app. There should at least have been an option to pay for only linking your bank account, for a lot less than 130.

Did you know that you can earn 25 USD from our site just by registering? Get $25 for free by joining Payoneer!

It’s brilliant and easy. I’m from overseas, have been using other famous budgeting tools. I have to say, this app is the one can make complicated thinks simple. I love this app so much! Easy to use and understand! You will never regret to have this app!!

Best Budget Tool. I could never budget well BUT then I found The Ramsay Show and met the crew who led me here. Best budget tool ever. It takes time and a little effort but it’s so worth it AND it’s free! Works great even if you are from Australia. Thank you !

Good but sad Aussie banks no longer support it. Nothing like it tbh Every easy to get used to too and figure out Had the premium version for 2 years was worth it Sadly due to some change they no longer can support Aussie banks annoyingly( hopefully a 3rd party service may be able to fix this or I can import bank statements) Have tried other budgeting apps since Aussie support dropped but just nothing else is easier for me to use 100% recommend hopefully they can support Aussie banks again one day

Two countries only!!. Pointless if you are from anywhere other than USA or Canada. No way to progress if neither of those are suitable.

Good budgeting app. It’s a great app but hampered by the lack of functionality outside the USA

No bank connection. Really upset that after paying the annual fee me bank won’t connect. Just error 102 over and over again even after following instructions on how to fix the issue. Major feature doesn’t work.

Does not support Australian Banks. Paid my $124 for full cersion in June 2023 found out feb 24 they no longer support Australian banks. No communication that this was happening just no updates in app. Now have to battle iTunes to get a credit. Was otherwise a great app. Very disappointed…

App stopped opening. Hi, App not opening beyond the front page.

BEST FREE BUDGETING APP. I appreciate the financial advice David gives and furthermore thankful for allowing the app to be free for users - it has made my financial planning easier.

Not US or Canada, don’t bother. For some reason this app is available but when I’m creating an account it asks which area you’re from, USA or Canada. Don’t bother if you’re from anywhere else

Other Countries. This is on the Australian App Store but can only select US or Canada as the country.

Outstanding App. Love this app for home budgeting - it transformed our home finances and helped us make steady progress in paying off debt and saving for our goals. Thank you!

US & CANADA ONLY. This is on the Australian App Store although you can only select USA or CANDA. ????

The best budgeting App Hands down!!. It’s organised and super easy to use!

AUSSIE LOVE. I love this app. It’s changed the game for me. Moving to a monthly budgeting tool means I’m no longer calculating payment based on my pay cycle or bill dates. I’m from Australia and this app is so customisable you’d never know it was US centric 👏🏻👏🏻👏🏻 *****App Improvement: FUNDS***** I really with if I could manually enter my transactions/transfers to savings rather than the app automatically doing it at the beginning of the months budget. It’s such a great feeling of accomplishment to add in a transaction that you’ve sent to your emergency fund/savings account but because that app does it for you automatically, I can’t match it against my bank statement and tick it off the “list”. Having the option to make the fund entries “manual” would be awesome. I would make all of my long term bills “funds” if I was able to manually enter the transactions.

Finally available in Australia!. Thank you Ramsay Solutions team for making it available in Australia. It simple to use and there are heaps of videos on YouTube if your not 100% sure how to use it. I personally have been using the website EveryDollar for years however the app didn’t work here until now.

Bugs need to be fixed. I’ve been using this app for almost 2 years now and although it started off really helpful, for the past 3 months or so it only lets me log in maybe 1/3 of the time, and it gives me a “something went wrong” error the rest of the time. I’ve sent an email to their support team and never heard back. As someone who was using this almost every day recording every transaction I’ll need to look for another budgeting app because I’m only let in a few times a month now. Ads have also been recently added in between your transaction categories which means a lot more scrolling and wasting time - for an app meant to be easy and efficient I’d prefer it for ads to be at one set place in your screen and not something you have to scroll through to get past.

Imagine you at your best. All the time. Picture yourself at your sharpest and most productive. Your most alert and focused. Your most lucid, creative and confident. At work. At play. In every area of your life. Add Mind Lab Pro® v4.0 to your daily routine and uncap your true potential. Buy Now!

Second best thing that happened to my finances. This is the greatest app you can find for budgeting. The only thing I would recommend is not to use the “fund” option as it seems to have a glitch or something. However , it is not completely necessary for handling your finances. In addition, you can follow the Ramsey team to get momentum and boost your finances!

Bring this to CANADA!. Mint used to be my go to app for budgeting but now that it’s gone I’ve been on the hunt for a better solution. I love the resources available though the network but I’m so sad I can’t access this app from Canada. I’m currently using the online version on my computer but it takes so long to input everything manually. With a busy household (we are a small business owning, homeschooling, family with six kids), it is just sooo time consuming. Please make this accessible to your northern friends!

no option for recurring expenses?. can you pls add a recurring option for expenses so i dont have to keep typing it down monthly? also i cant change titles. instead of “lifestyle” i want to label it “work” instead. if u added it to premium i would buy it the rest are useless to me.

Love the facility of this app. It’s great but I’m fed up of subscriptions. I have no space to spend 168$a year. Or another 20$ a month. These subs are getting ridiculous.

Used to be the best. Now it sucks

Crash. Can use the app after the update.

Amazing App. Thank you so much for this app and all the work behind it. Would you please add an ability to use Dark Mode and some content on Font weight and size? I really appreciate all the work!

Cool but. I wish that you could set your own 30 day period so that there are some flexibility for those of us that use biweekly pay checks

Will not link to RBC. The whole point of a financial app is to monitor everything you spend by linking to your bank account. This app just keeps giving an error code “10000”. I opened a ticket with support and it’s been over two months. I email for an update every week and I keep getting the same reply that they’re working on it. I had high hopes because it’s a Ramsey product but I’m giving up and giving it the rating it deserves unless they solve the problem. Conclusion: RBC clients can not use it.

Awesome App!!. I love this app it is easy and fun to use!

Free version. Although this is the free version, and more work to manually keep it all up and together, let me tell you, I’ve only been using it for a few days and already feel like in more control of my finances ! I’ve paid a few debts off, putting aside money for charity and and keeping a close eye on my spending habits! Just wow I’m loving this feeling of being in control of every single dollar that we worked so hard for! Not sure where this will lead us but hopefully in a good place down the road!

Getting greedy. I’ve used this app for a number of years along with listening to Ramsay related content. The app used to offer upgrades once in a while, which was fine. Now every day I open it it’s asking me to upgrade for $25/month or $100 per year. It doesn’t bother me they offer that but shoving it in my face daily when I open the app is getting to be frustrating. Not to mention it contradicts Dave Ramsays advice for years to cut out everything non essential. “Live like no one else, so you can live like no one else”……except buy our subscription. Hypocritical now that it’s gotten to this point. I would have given it 5 stars had it not been for the daily pushy subscription money grab.

New update. App is great but recent update is garbage

Not happy. Subscription is a scam… all it seems to do after connecting your account is send your transactions to the app. You still have to do everything as if free version and trying to understand the transactions you are seeing is a big mess. I still need to log into my bank so I can properly put things into categories. Even after all that after only 3 days into the month it for some reason doesn’t add up. And I’m not even entering the values. The app is doing it for me. I’ve been trying to use this app for 3 months now and just can’t see the point of it. Subscription certainly doesn’t seem worth it. Big waste Why can’t connecting the app calculate everything for me? Why can’t the balance of my bank account be the same as on the app. For the amount they expect people to pay for a subscription it’s a joke

App won’t load after update. It won’t load, just a green screen

Better before the update. -new update got rid of the percentage breakdown on the app, and overall doesn’t look as good -also some minor bugs, transactions not showing on app but showing on browser

App is Crashing. 3 comments 1-in the last app refresh a large percentage of times i open the app the screen is just green and stays for over a minute then crashes. 2-i miss the percentage piecharts from last year…the visual was so helpful for me to interpret where my money was going to in a high level overview. 3-the categories should have a total at bottom or at top to show how much $$ is in each category

Naggy. The app is fine however the constant nagging to sign up for a subscription was getting old. I thought Apple had a limit on how many times per year an app could ask for a signup in app. Needless to say it’s annoying enough I’ve started using a spreadsheet again.

Please make available to Canadians. Would really like to use this app but it is i it available to those in the US. Please make it available to Canadians .

Keeps unlinking my accounts. It seems like a great app and a great way to start looking at all my overspending. But it seems I have to relink my accounts every single day, and this is getting quite frustrating, I may switch to a different app

Great app. I love the simplicity of this app compared to others. This is so much easier to use. Unfortunately the PLUS option doesn’t work with my Canadian bank. I used to have it but it stopped working. Now I have the ad to upgrade to PLUS showing 4 times on my budget screen. That’s sort of annoying as it used to never be there. Would like it if it would only show once.. and if there was a way to get them to connect to Canadian banks again.

Subscription price. $170 a year!?!?! Pull out a pen and paper you’re better off. Like holy shieeettttt son

Perfect tool to stay on track. This app is by far my favorite in terms of keeping my finances in order. With this tool I’m able to keep track of all my spending and create a realistic budget for all the different things that come up each month. It’s comprehensive and easy to use. If you have a goal to payoff debt and save for the future this app is exactly what you need. I love reviewing the « planned », « spent » and « remaining » features. This app holds you accountable for your spending and helps you live a more financial secure life. Good luck!

Great until it won’t let me sign in. I use this app daily to track my spending and stay on budget. But every few months, it suddenly won’t let me sign in. I change my password, reinstall the app, nothing. Very frustrating!

Don’t waste your money on the paid version. Paid for a year subscription so that my bank account syncs to the app and constantly logs me out of my bank. Then it takes several tries every time to sign back in. Out $100 and have to manually enter everything just like the free version

Too Many Bugs. This app is unreliable as transactions I’ve just added can disappear. Sometimes I notice and other times I don’t. It’s hard to budget this way. It’s too bad as I like the free version without these recent glitches.

Ramsey+ Features Not Available In Canada. Would have been nice to know before buying. And bank account connections have endless errors. App is not usable.

Ipad landscape mode?. App is great, but iPadOS version doesn’t flip to landscape mode when using, please fix and this would be 5 stars. Oh, and a search function would be great too.

Bring EveryDollar Plus to Canada!!. I like the Every Dollar app way more than Mint, but it takes so much time to put each transaction manually. I await the Plus version for Canada 🙋🏻♀️🤩

Removed Necessary Feature... This App was everything I needed, until the removal of the Percentage Ring.. Having the breakdown of each category is incredibly important. Otherwise any time you add or subtract an expense, you have to recalculate it… it’s time consuming and not user friendly. Bring back the Percentage Ring! (Without making it an additional cost..)